Gold rally implies $644K per Bitcoin in ‘equivalent value’ VanEck

Gold’s record-breaking surge has once again sparked the classic debate between Bitcoin and gold as the ultimate store of value. According to VanEck’s research head, Matthew Sigel, if Bitcoin captures around 50% of gold’s store-of-value market, its “gold-equivalent” valuation could soar to nearly $644,000 per BTC based on current gold prices.

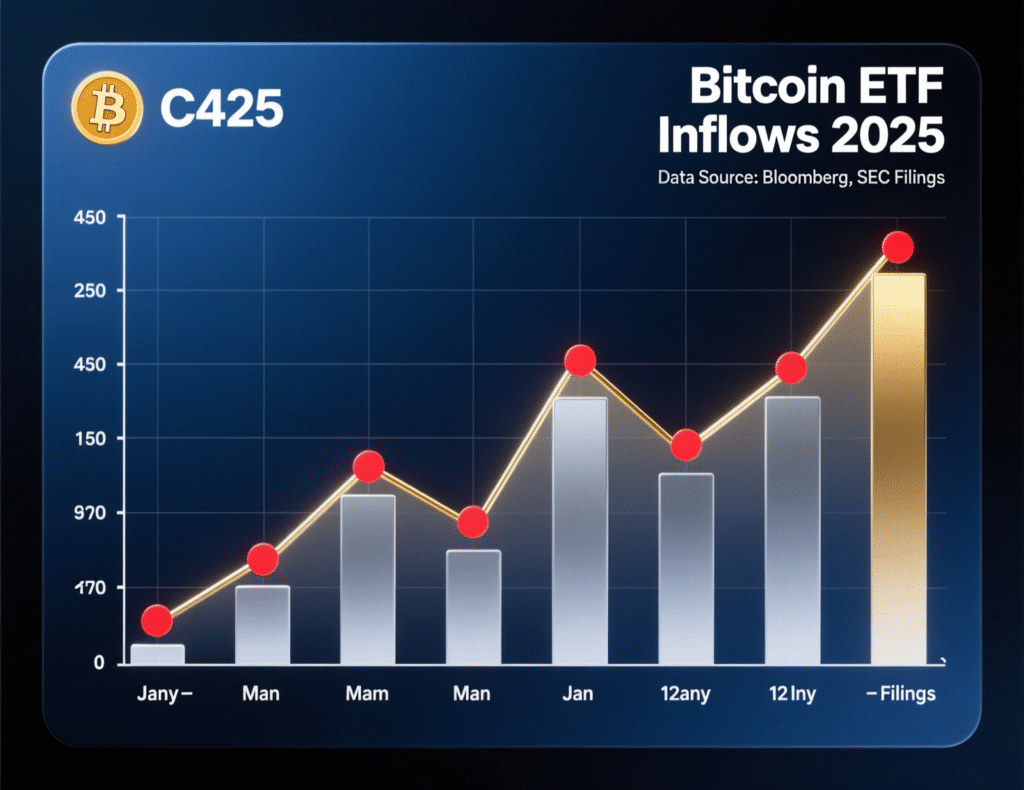

At the same time, Bitcoin has been on a remarkable rally of its own, hitting fresh all-time highs above $125,000, fueled by strong inflows into spot Bitcoin ETFs. This renewed momentum highlights growing investor confidence in BTC as a digital alternative to gold, signaling that the long-standing rivalry between the two assets is evolving into a new phase of market dynamics.

Gold sets the pace; BTC follows with fresh highs

Spot gold rose to new all-time highs around $3,970/oz in late Monday/early Tuesday trade, while U.S. futures peaked near $3,997/oz just shy of the psychological $4,000 mark—as safe-haven demand and rate-cut bets intensified.

Bitcoin rallied in tandem, notching a record above $125k–$126k as risk hedging and institutional demand persisted.

What is the Bitcoin gold equivalent value 644k claim?

VanEck’s Matthew Sigel argues roughly half of gold’s market value is tied to its store-of-value role, and that younger investors increasingly prefer BTC for that function. Mapping gold’s record levels onto Bitcoin at 50% of gold’s market cap yields an “equivalent value” near $644,000 per BTC, by VanEck’s math.

Assumptions behind Bitcoin gold equivalent value 644k

Gold’s price and market size remain elevated (near record levels).

BTC’s monetary adoption continues, with supply issuance cut via halvings. (Context per VanEck analysis.)

Preference shift among younger cohorts toward digital stores of value

Market voices: bulls, skeptics and technicians

Veteran trader Peter Brandt cautions gold may “go substantially higher before any meaningful correction,” warning FOMO buyers may need “deep pockets.”

Gold advocate Peter Schiff countered Bitcoin’s dollar ATH by noting BTC is still ~15% below its prior high in gold terms, saying BTC would need ~$148k to reclaim that ratio.

Liquidity pulse: ETFs and flows

U.S. spot Bitcoin ETFs logged about $3.24bn of net inflows last week second only to their record week in Nov. 2024 underscoring persistent institutional demand.

Policy backdrop and adoption

The U.S. GENIUS Act (stablecoins) became law on July 18, 2025, formalizing federal oversight for payment stablecoins; broader market-structure legislation (the CLARITY Act) has passed the House and awaits Senate action.

Ownership remains uneven: a National Cryptocurrency Association study found ~21% of U.S. adults hold some crypto; UAE tops global ownership tables at ~25.3%, per ApeX Protocol’s 2025 index. Business Wire+1

How to size BTC vs. gold (method guide)

<section id=”howto”> <h3>How to estimate BTC’s gold-equivalent valuation</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Find latest global gold market value (price × estimated above-ground stock or via reputable aggregates).</li> <li id=”step2″><strong>Step 2:</strong> Decide your “store-of-value share” assumption for gold (e.g., 50%).</li> <li id=”step3″><strong>Step 3:</strong> Apply your BTC target share of gold’s SoV value (e.g., 50%).</li> <li id=”step4″><strong>Step 4:</strong> Divide that figure by current/forecast BTC supply (circulating or fully diluted).</li> <li id=”step5″><strong>Step 5:</strong> Stress-test with scenarios (lower/higher gold price, SoV % and BTC share).</li> </ol> <p><em>Note: This is a heuristic, not investment advice. Inputs are judgment calls and will change with markets.</em></p> </section>

Context & Analysis

VanEck’s $644k “equivalent value” is a comparative yardstick, not a time-stamped forecast. It hinges on (1) gold sustaining record territory, (2) BTC continuing to monetize as digital collateral, and (3) policy clarity sustaining ETF-driven demand. Offsetting risks include macro reversals, regulatory shocks, or a rotation back into yield-bearing assets that could cap both gold and BTC.

Conclusion

Gold’s climb toward $4,000 per ounce has amplified Bitcoin’s position as a potential store of value. VanEck’s projection of a $644,000 “equivalent value” per BTC outlines a bullish upper limit if Bitcoin manages to capture half of gold’s monetary market share.

Currently, Bitcoin’s rally is supported by strong ETF inflows and a more favorable U.S. policy stance. However, this valuation outlook depends on assumptions that remain highly debatable, with future price dynamics likely shaped by global macroeconomic shifts and investor sentiment. The balance between optimism and caution continues to define Bitcoin’s evolving value narrative.

FAQs

Q : What does “Bitcoin gold equivalent value 644k” mean?

A : It’s a comparative estimate: if BTC captured ~half of gold’s store-of-value market at current gold prices, each coin would be worth about $644,000.

Q : Did gold actually cross $4,000?

A : Futures and spot hit fresh records near $3,970–$3,997, just shy of $4,000 intraday.

Q : Is BTC at a new all-time high?

A : YesBTC topped $125k–$126k this week, setting fresh records.

Q : What’s driving BTC now?

A : Institutional demand via U.S. spot ETFs; last week’s ~$3.24bn net inflows were the second-highest since launch.

Q : What’s the policy context?

A : The GENIUS Act for stablecoins is now law; a broader CLARITY Act has passed the House and awaits the Senate.

Q : Do younger investors really prefer BTC to gold?

A: Yes. VanEck’s thesis and surveys suggest a shift toward digital stores of value among younger cohorts.

Q : Is pricing BTC in gold a forecast?

A : No. It’s a framework to compare monetary assets; outcomes depend on adoption, policy, and macro conditions.