Global Markets Rise; U.S. Inflation Data Eyed, Gold, Oil Down

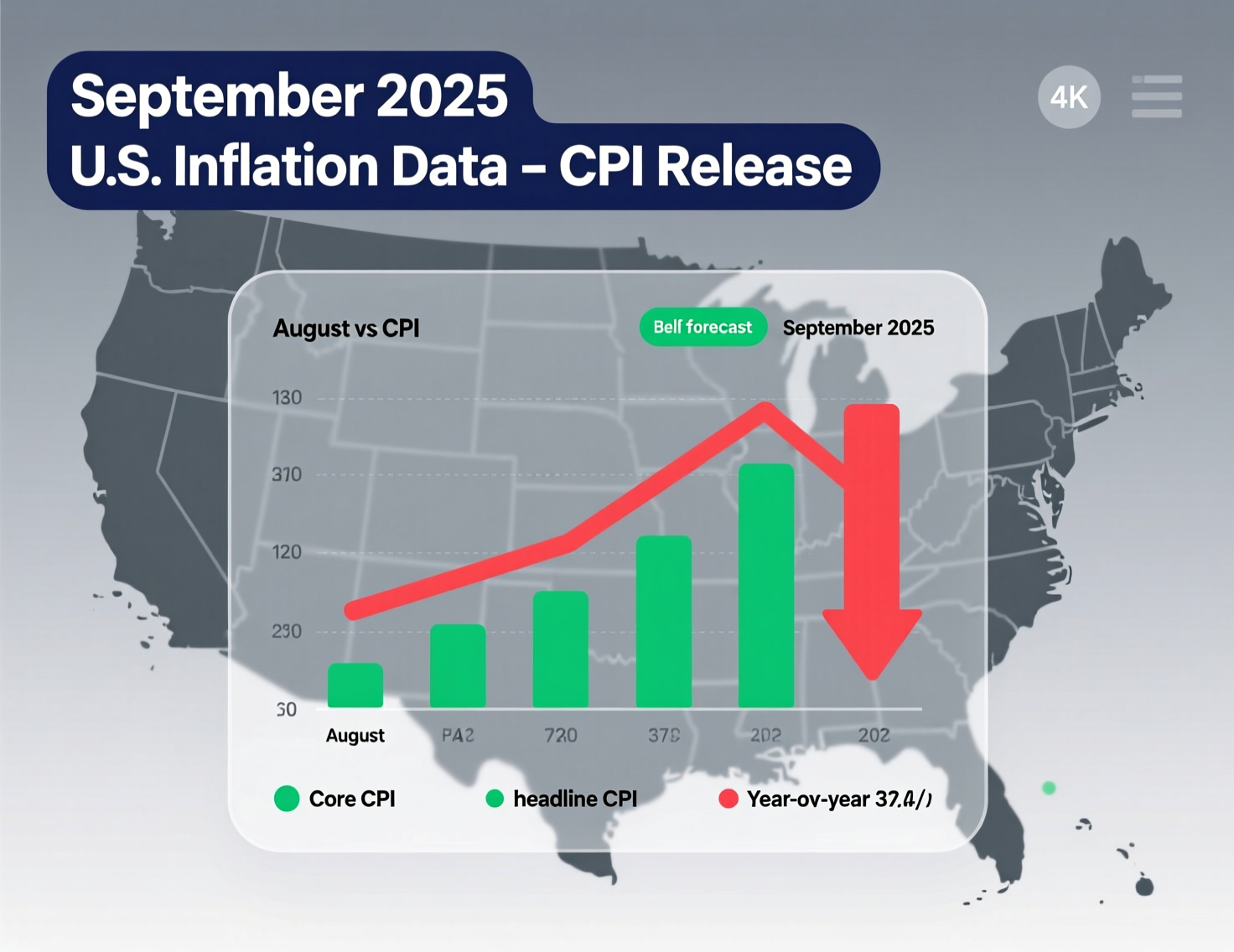

Global markets traded slightly higher on Friday as investors awaited the release of the September 2025 U.S. inflation report, now scheduled for 12:30 GMT (08:30 ET). The data is expected to offer fresh clues about the Federal Reserve’s next policy moves and the broader inflation outlook heading into year-end.

U.S. equity futures posted modest gains, while European markets showed a mixed performance amid cautious sentiment. Gold prices slipped, on track to end a multi-week winning streak, reflecting a pause in safe-haven demand. Meanwhile, oil prices eased after recent sharp swings, as traders reassessed supply dynamics and geopolitical risks.Bureau of Labor Statistics+2Reuters+2

Markets at a glance before September 2025 U.S. inflation data

Wall Street futures ticked up, with S&P 500 and Nasdaq contracts higher ahead of the CPI print, even as European equities slipped. The BLS confirmed the delayed release timing due to the government shutdown. Traders are watching whether a firmer CPI alters expectations for near-term Fed policy.

What economists expect from September 2025 U.S. inflation data

Economists surveyed by major outlets anticipate headline CPI rising to 3.1% YoY from 2.9% in August, with core inflation seen around 3.1% YoY. A 0.4% MoM headline increase is widely cited.

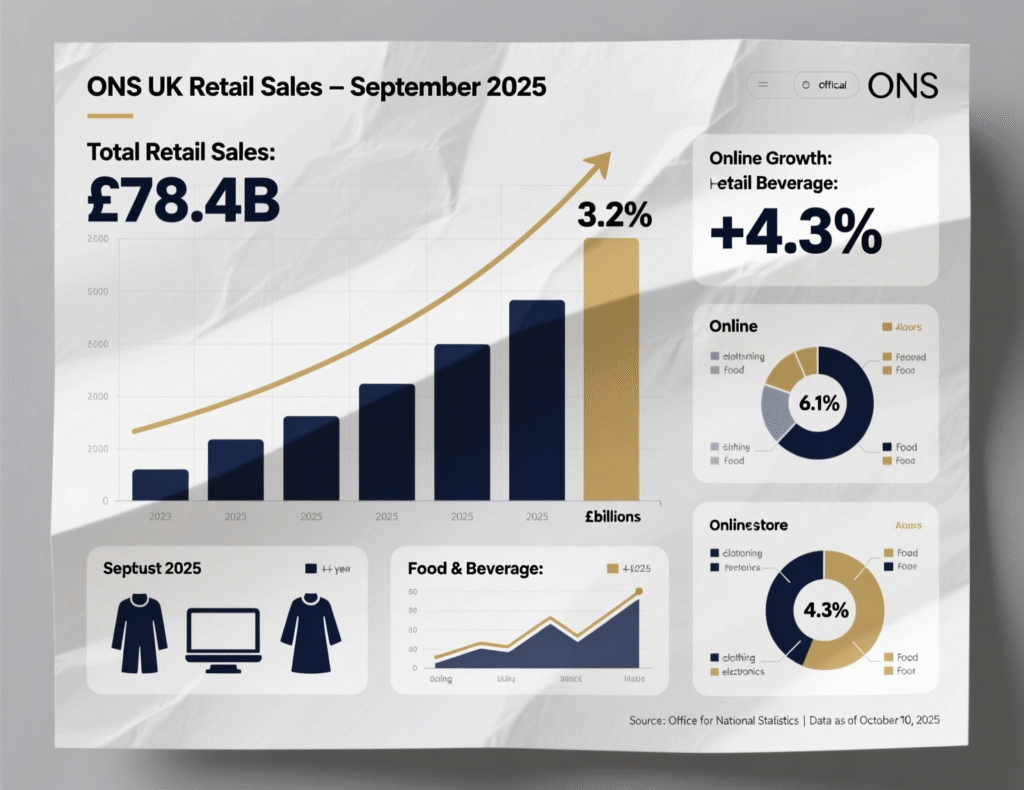

U.K. retail sales: fourth monthly rise

U.K. retail sales volumes rose 0.5% MoM in September, beating expectations. The ONS cited strength at tech retailers helped by new smartphone launches and robust demand for gold from online jewelers. August’s increase was revised up to 0.6%.

Commodities: gold slips, oil eases

Spot gold fell more than 1% and was on track for a weekly loss, with investors booking profits ahead of the CPI. Oil eased intraday after recent swings; prices remain sensitive to supply headlines and macro risk appetite.

Analysis

A modest upside surprise relative to the 3.1% consensus could reinforce “higher for longer” narratives, pressuring duration and non-profitable growth shares; a softer print would likely support risk assets near record highs. The concurrent rise in U.K. retail sales suggests resilient discretionary demand, though one-offs (new handsets, bullion buying) may not persist.

Conclusion

Markets approached the upcoming U.S. CPI report with cautious optimism on Friday. Equity futures held firmer, while gold softened and oil prices eased as traders positioned ahead of the key inflation release. The mood remained tentative, with investors balancing hopes of steady prices against the risk of renewed price pressures.

The next move for risk assets will largely depend on whether inflation shows signs of re-acceleration or steadies near 3.1% year-on-year. Attention will also center on how the Federal Reserve interprets the data and signals its outlook for potential rate cuts heading into the final months of 2025.

FAQs

Q : When is the September CPI released?

A : The BLS scheduled it for 12:30 GMT (08:30 ET) on Oct. 24, 2025.

Q : What is the consensus for headline CPI?

A : Around 3.1% YoY with 0.4% MoM; core CPI is seen near 3.1% YoY.

Q : How did markets trade before the print?

A : U.S. futures were modestly higher; Europe mixed.

Q : Why did U.K. retail sales rise?

A : Strength at tech retailers (new smartphone cycle) and demand for gold jewelry aided the 0.5% MoM gain.

Q : Is gold falling because of CPI?

A : Gold often softens when the dollar and yields firm ahead of key data; it was on track for a weekly loss.

Q : Did oil drop today?

A : Yes, intraday oil eased after recent swings; prices remain headline-sensitive.

Q : Does this article use the exact term “September 2025 U.S. inflation data”?

A : Yes the article covers markets ahead of September 2025 U.S. inflation data.

Facts

Event

Global markets firm ahead of U.S. CPI; gold down; oil eases; U.K. retail sales beat.Date/Time

2025-10-24T12:30:00+05:00 (coverage day; CPI due 12:30 GMT)Entities

U.S. Bureau of Labor Statistics (BLS); Office for National Statistics (ONS); S&P 500; Dow Jones Industrial Average; London Stock Exchange (LSE).Figures

U.K. retail sales +0.5% MoM (Sep); CPI consensus 3.1% YoY, 0.4% MoM; gold down ~1–1.5% intraday; oil marginally lower intraday. Reuters+5Office for National Statistics+5Reuters+5Quotes

“The CPI report…is expected to show core inflation having held at 3.1% in September.” Reuters market wrap. ReutersSources

ONS Retail Sales Sept. 2025 + URL; Reuters market wrap + URL (see Sources)