Gen Z Crypto Adoption Middle East: Stats, Hype, Reality

Gen Z crypto adoption in the Middle East is being driven by high smartphone use, economic pressure, and youth culture that lives on TikTok, X, and Telegram as much as in banks. For US, UK, and EU investors and policymakers, MENA’s young crypto users are an early glimpse of how mobile-native, globally connected investors behave when regulation is clear enough to let them experiment.

Introduction.

Scroll through TikTok or Snapchat in Dubai, Riyadh, or Istanbul and you’ll see the same loop: short videos about side hustles, meme coins, and “how I made $100 today trading BTC,” right next to lifestyle content and football clips. For many young Arabs, Gen Z crypto adoption Middle East isn’t a niche trend — it’s part of everyday digital culture layered on top of oil wealth, youth unemployment, and volatile local currencies.

This piece breaks down why Gen Z in MENA is embracing crypto, how they’re actually using Bitcoin and stablecoins, and what it all means for investors, founders, and regulators in New York, London, and Frankfurt. We lean on sources like Chainalysis, Henley & Partners, and regional regulators such as Dubai’s VARA and Abu Dhabi’s ADGM to separate stats from hype.

Gen Z Crypto Adoption Middle East.

In short, Gen Z crypto adoption in the Middle East is already significant and in some niches outpaces Western peers, powered by mobile-first finance, economic uncertainty, and easy access to global exchanges. MENA is no longer a fringe region in crypto; it’s a mid-sized market with youth-driven patterns that global firms quietly track.

Who Counts as Gen Z and What “Crypto Adoption” Means in MENA

For this article, Gen Z means roughly those born between 1997 and 2012 today’s 13–28-year-olds. In practice, crypto adoption is concentrated among 18–24 and 18–30 age bands: university students, recent graduates, junior employees, and gig workers.

“Crypto adoption” here covers.

Trading and holding Bitcoin, ETH, and altcoins

Using stablecoins like USDT/USDC as a dollar proxy

Crypto-powered remittances to and from the Gulf

NFTs, gaming tokens, and creator-economy payouts

When we say “Middle East / MENA,” we’re mainly talking about GCC (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman) plus Egypt, Jordan, Lebanon, and Türkiye corridors where smartphones, youth populations, and currency risk all overlap.

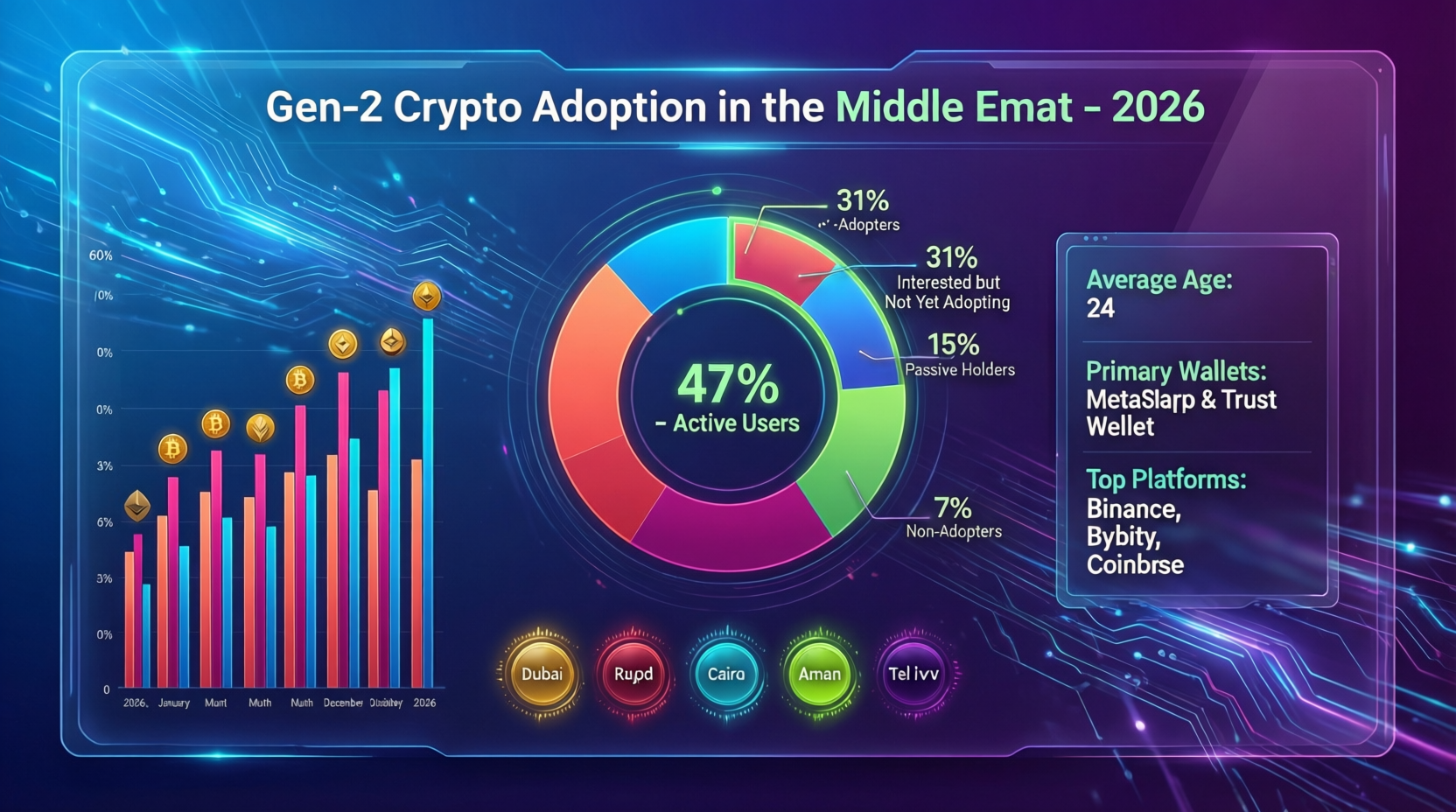

Middle East Gen Z Bitcoin and Crypto Statistics.

Chainalysis estimates that the MENA region received about $338.7 billion in on-chain value between July 2023 and June 2024, around 7.5% of global crypto transaction volume.

Earlier reports put MENA at roughly $389.8 billion (7.2% of global volume) in 2022–23 and about $566 billion in 2021–22, making it the fastest-growing region during that cycle.

Most of this flow isn’t purely Gen Z, but in countries like Saudi Arabia, where around 63% of citizens are under 30, youth are clearly over-represented among crypto users. UAE surveys indicate that around 1 in 10 residents aged 18–24 say crypto is their preferred investment, a remarkably strong signal compared with many Western markets.

How MENA’s Gen Z Crypto Adoption Compares with US, UK, and Germany

A 2025 Gemini study suggests that about 51% of Gen Z respondents globally have owned crypto, versus roughly 35% of the general adult population. In the US and UK, many of those young investors still rely on traditional banks and regulated brokerages as their main financial stack.

In MENA, smartphone penetration is comparable or higher, but trust in banks and local currencies is lower, especially in Egypt, Lebanon, and Türkiye where repeated devaluations have scarred savers. A Gen Z investor in New York or London might see crypto as a speculative asset class; their counterpart in Cairo or Istanbul may see it as emergency savings plus upside.

Regulation also shapes the gap. US Gen Z investors run into SEC enforcement headlines and tax complexity; UK and German youth face FCA and BaFin rules, plus incoming MiCA obligations for EU platforms. In contrast, parts of MENA still feel like a high-risk lab with UAE’s clear frameworks and more ambiguous environments elsewhere.

Summary

Gen Z in MENA uses crypto at least as enthusiastically as US/UK peers, but with more focus on currency risk, remittances, and regulatory “gray zones” than in most of Europe.

Why Middle Eastern Youth Are Investing in Crypto

Economic pressure, limited local investment options, always-on social media, and narratives of financial freedom make crypto feel like a rare, global, mobile-first opportunity for Middle Eastern Gen Z. Younger users are experimenting with Bitcoin and stablecoins far more than older age groups, not only to chase quick gains but to protect themselves against inflation and currency shocks.

Inflation, Unemployment, and Limited Local Investment Options

Youth in MENA are navigating one of the highest youth unemployment rates globally around 25% in 2024, nearly double the world average. Entry-level jobs are scarce, and traditional paths into property or blue-chip equities are often out of reach.

At the same time, countries like Egypt, Türkiye, and Lebanon have seen sharp currency depreciation, pushing young people to treat Bitcoin as “digital gold” and stablecoins as “dollars in your phone. When local stock markets feel shallow and capital controls restrict moving money abroad, buying small amounts of BTC or USDT via a global exchange looks like one of the few scalable alternatives.

Social Media, FOMO, and Youth Cryptocurrency Culture in UAE & Saudi

Social media-driven investing among Gen Z is a powerful driver. TikTok, Snapchat, and YouTube are saturated with short-form content about trading, side hustles, and “signals.” In the UAE, TikTok’s user base grew by over 30% in a single year to more than 10 million users, with Gen Z heavily represented.

In Dubai, Abu Dhabi, and Riyadh, youth cryptocurrency culture is shaped by.

Influencers streaming live trades and portfolio updates

Telegram and Discord groups sharing “alpha”

Micro-creators breaking down VARA announcements or new token listings

For many young professionals in Jeddah or Dubai Marina, crypto has become the new after-hours topic, sitting alongside esports, sneakers, and K-pop. “Social media and FOMO in Gen Z crypto investing UAE” isn’t just a search phrase it describes how friends pile into trades within hours of a viral clip.

Financial Freedom Narratives, Trust, and the Halal/Haram Debate

Gen Z across MENA talks openly about financial independence: not relying on unstable employers, slow public sectors, or family networks. Years of banking scandals and currency crises have chipped away at trust in legacy institutions, especially outside the GCC.

Into that space comes crypto marketed as borderless, censorship-resistant, and yours as long as you hold the keys. But young Muslims also wrestle with whether leveraged trading, staking, or yield farming is halal or haram.

Islamic scholars and Shariah boards disagree, creating a spectrum: some see spot Bitcoin as permissible but high-leverage derivatives as problematic; others are stricter. UK and EU Muslim diaspora communities, from London to Frankfurt, often watch MENA youth debates on Reddit and Quora-style platforms to guide their own choices.

Country Deep Dives.

AEO micro-answer What role do UAE and Saudi regulations play?

UAE’s clear licensing (VARA, ADGM) and Saudi’s more cautious but evolving rules create a semi-regulated sandbox where Gen Z can experiment on mainstream platforms instead of going fully underground.

UAE Gen Z Crypto Trends.

The UAE has positioned itself as a global crypto hub, with Dubai’s VARA and Abu Dhabi’s ADGM building detailed virtual-asset frameworks covering licensing, risk management, and market abuse. Exchanges like Binance have obtained VARA licences that allow them to serve retail clients, not just institutions.

For Gen Z founders and retail investors, that means:

Access to licensed exchanges and fintech apps in dirhams

Clarity on KYC/AML expectations

A sense that “this is allowed if I stay inside the rules”

These UAE/Saudi youth crypto trends interact with broader policies like the UAE’s push for a digital dirham and pro-startup visas, making Dubai and Abu Dhabi a magnet for Web3 builders from the US, UK, Germany, and beyond.

Saudi Youth Crypto Adoption Under Evolving Rules

Saudi Arabia is more cautious. Officially, SAMA and the Ministry of Finance warn that cryptocurrency trading is unauthorized and carries significant risk, and crypto is not treated as legal tender.

On the ground, though, Saudi youth still find ways in.

Using global exchanges via bank cards or P2P

Trading in riyal-denominated P2P markets

Joining DeFi protocols from Riyadh or Jeddah while tracking Vision 2030 narratives

Higher average salaries than many neighboring countries, combined with family and tribal support networks, mean that some Gen Z Saudis can take larger crypto risks than peers in Cairo or Amman but a legal gray zone remains.

Egypt, Jordan, Lebanon, Türkiye and Other MENA Cases

Outside the GCC, FX pressure, remittances, and political risk become the dominant themes.

In Egypt, crypto remittances are increasingly discussed as a way to route funds from UAE or Saudi employers back to families at home, especially when banking channels are slow or expensive.

In Lebanon, some Gen Z savers moved parts of their savings into Bitcoin or stablecoins after local banks limited withdrawals and devalued deposits.

In Türkiye, youth adoption is tied to the lira’s inflation and the popularity of local exchanges that market BTC and USDT as everyday hedges.

This broader crypto adoption in MENA region is less about hype and more about survival with UAE and Saudi acting as better-regulated “north stars” in an otherwise patchy regulatory map.

How Gen Z in the Middle East Uses Bitcoin and Crypto Day to Day.

AEO micro-answer How are they using Bitcoin and stablecoins?

Middle Eastern Gen Z investors mostly trade and save in Bitcoin and stablecoins, while a growing minority use crypto for remittances, online income, gaming, and creator-economy earnings.

Trading and Saving: Bitcoin as an Inflation Hedge for Young People

Across Dubai, Riyadh, Cairo, and Istanbul, Gen Z investors tend to split into two broad camps:

Short-term traders, chasing intraday moves in BTC, ETH, and meme coins

Long-term “HODLers”, stacking sats or stablecoins as a dollar proxy

With inflation and weak local currencies, Bitcoin as an inflation hedge for young people feels intuitive, even if the volatility risk is huge. Many build micro-portfolios mixing:

BTC as “digital gold”

ETH and blue-chip altcoins as longer-term tech bets

A small “casino” bucket of meme coins

This behaviour mirrors US Gen Z in cities like Austin or San Francisco, but the macro backdrop in MENA makes the hedge narrative more urgent.

Stablecoins and Crypto Remittances for Middle Eastern Gen Z

For many families, crypto remittances Middle East Gen Z are starting to sit alongside traditional money-transfer corridors. A Saudi or Emirati employer might pay Gen Z workers in riyals or dirhams, while they:

Convert part of their salary to stablecoins (USDT/USDC)

Send them to Pakistan, India, the Philippines, or Egypt via exchanges or P2P

Cash out locally or keep savings in dollar-backed assets

This Middle Eastern Gen Z stablecoin usage for remittances is watched closely by US and EU-regulated stablecoin issuers and banks because a spike in MENA flows can impact global liquidity and FX demand.

NFTs, Gaming, and Creator Economies in Arab Youth Culture

Not all usage is about hedging. In hubs like Dubai, Riyadh, and Istanbul, Gen Z gamers, musicians, and designers experiment with:

NFTs for music drops, digital art, and in-game assets

Gaming guilds that pay in tokens

Creator tokens and micro-DAO memberships

This sits inside broader youth cryptocurrency culture and sometimes clashes with religious and cultural concerns about speculation. For some, NFTs feel like a legitimate extension of gaming and art; for others, they are indistinguishable from gambling.

Platforms, Regulation, and Risk for Young Crypto Investors

Where Gen Z in UAE and Saudi Actually Buy Bitcoin

In practice, best bitcoin apps for youth in UAE and Saudi tend to fall into three buckets (without endorsing specific brands):

Global exchanges (e.g., Binance, Coinbase) with regional licences or strong on-ramps

Regional platforms headquartered in Dubai, Abu Dhabi, or Bahrain

P2P marketplaces and OTC groups, often coordinated via Telegram

VARA and ADGM licensing has started to move Gen Z users toward regulated venues, while Saudi youth still rely heavily on global apps where local banks tolerate card or bank-transfer top-ups a situation that could tighten quickly if regulators change course.

KYC/AML, Age Limits, and Access to Banking for Youth

KYC/AML rules and age limits are a real friction point:

Exchanges usually require government ID and often a minimum age of 18

Some Gulf banks restrict student accounts or flag crypto-linked transfers

Parents may control bank cards for teenagers, pushing them into informal P2P

Global standards like FATF’s virtual-asset guidelines, plus security frameworks such as PCI DSS and SOC 2, increasingly shape what’s considered “good enough” for compliance both for MENA exchanges and for US/UK/EU platforms serving Arab youth.

Volatility, Scams, and Financial Literacy Gaps

The risk side is obvious but under-taught:

High volatility can wipe out over-leveraged traders

Rug pulls, pump-and-dumps, and fake “halal” schemes target young users

Influencer promotions often skip basic risk warnings

Policymakers are slowly waking up to digital asset literacy in Arab youth as a new policy frontier, similar to earlier pushes on digital payments and financial inclusion.

Using regulated or well-audited venues

Limiting position size vs income

Avoiding leverage and “get rich quick” signal groups

Treating crypto as one risky asset class in a diversified portfolio not a substitute for stable income

What Gen Z Crypto Adoption in the Middle East Means for US, UK, and EU Stakeholders

AEO micro-answer What can US/EU learn?

MENA’s Gen Z shows how mobile-native, high-risk but highly engaged youth behave when regulation is clear enough to enable experimentation, offering a live case study for US and EU regulators and firms designing future crypto rules and products.

Signals for US and European Investors and Fintechs

For investors in New York, London, or Frankfurt, the impact of MENA Gen Z crypto adoption on global Bitcoin markets is still modest but rising: remittance-driven flows and speculative bursts can amplify liquidity and sentiment, especially during bull cycles.

For US/UK/EU fintechs, key opportunities include.

Building localized apps for Arabic/English bilingual Gen Z users

Partnering with UAE and Saudi platforms for compliant cross-border products

Offering analytics, custody, or compliance tooling into VARA/ADGM-licensed ecosystems

Ignoring MENA means ignoring one of the world’s youngest, most crypto-curious regions.

Regulatory Comparisons.

The EU’s MiCA framework (Regulation 2023/1114) creates harmonized rules for crypto-asset issuers and service providers, with full application by late 2024/2025.BaFin in Germany and the FCA in the UK are implementing or aligning with these standards, while the SEC pursues high-profile enforcement in the US.

By comparison.

UAE (VARA/ADGM) offers tailored virtual-asset regimes that many founders describe as clearer and more pragmatic

Saudi Arabia remains cautious, with warnings on retail trading but strong interest in blockchain and CBDC pilots.

For Western analysts, MENA is a living lab for the question: “What happens if you mix high youth adoption with relatively pro-innovation, sandbox-style regulation?”

How Western Platforms Can Serve MENA Gen Z Responsibly

For US, UK, and German fintechs looking at MENA.

Localize UX (Arabic and English), including Shariah advisory content where relevant

Embed strong KYC/AML aligned with FATF, plus data protection aligned with GDPR, DSGVO, and UK-GDPR

Leverage Open Banking rails in Europe and the UK to connect fiat and crypto more transparently

The winning playbook will combine:

Transparent fees

Education-first onboarding and in-app explainers

Local partners in Dubai, Abu Dhabi, Riyadh, and Doha

Scenarios, Risks, and Action Steps

Bull, Base, and Bear Scenarios for MENA Gen Z Crypto Adoption

By 2030, three broad scenarios are plausible:

Bull

VARA/ADGM-style frameworks spread; Saudi relaxes retail rules; CBDCs and regulated stablecoins coexist, and Gen Z integrates crypto into everyday banking.

Base

Regulation tightens but remains enabling; crypto is a significant but niche asset class alongside tokenized securities and FX.

Bear

Major scams or crises trigger blanket bans or severe restrictions, pushing activity back underground or into offshore venues.

CBDCs and tokenized assets will shape all three scenarios, changing how “crypto” even looks to a 25-year-old in Dubai or Berlin.(UN Trade and Development (UNCTAD))

What Policymakers and Regulators Should Watch Next

Key indicators for central banks and regulators in MENA, the US, UK, and EU include:

Youth indebtedness linked to leverage on crypto platforms

Scam and fraud prevalence targeting under-30s

Systemic risk from stablecoin and remittance dependence

Spillovers into housing, consumer credit, and FX markets

Signals from FATF, IMF, ESMA, BaFin, FCA, SEC, and regional central banks will guide how tight or loose the 2030 landscape looks.(ESMA)

Action Checklist for Investors, Founders, and Analysts

For US/UK/EU investors.

Treat MENA Gen Z as a signal for long-term digital-asset adoption curves

Monitor MENA flows in Chainalysis and exchange data alongside US/EU volumes

void over-concentrating exposure based purely on hype

For fintech and exchange founders.

Build education-first, Arabic-friendly onboarding flows

Plug into VARA/ADGM or equivalent regimes early, with strong PCI DSS/SOC 2 controls

Design remittance and savings products that respect local rules and religious sensitivities

For analysts and journalists.

Move beyond “crypto bros in Dubai” stereotypes

Track data on youth usage, scams, and literacy programs

Frame MENA not as an outlier but as an advanced case of mobile-native finance under stress

Key Takeaways

Gen Z in MENA is a leading indicator of how mobile-native investors behave when inflation, currency risk, and social media collide.

UAE and Saudi regulations (VARA, ADGM, Saudi guidance) are creating semi-regulated sandboxes that global exchanges and fintechs use to test youth-centric products.

Use cases go beyond trading: Bitcoin as a hedge, stablecoins for remittances, and NFTs/gaming for creator income.

Risk and literacy gaps are real, pushing regulators and schools (e.g., UAE’s youth investor programs) to build financial and digital asset literacy.

For US, UK, and EU stakeholders, MENA’s Gen Z is a live case study for MiCA-era product design, cross-border partnerships, and smarter regulation.

If you’re building or scaling fintech, Web3, or analytics products for US, UK, EU, or MENA markets, you’ll need data-driven insight into how Gen Z actually behaves not just headlines. The team at Mak It Solutions can help you prototype compliant, scalable platforms that serve young users from Dubai to London.

Explore our web development, mobile app, SEO, and business intelligence services and reach out for a scoped consultation tailored to your crypto or digital-finance roadmap.(Mak it Solutions)

For more context on youth, gig work, and digital opportunities in the region, you can also explore related insights in our blogs on freelance IT jobs in Saudi Arabia and IT brain drain in Arab countries, or browse the full Blogs archive before heading to our Contact page to start the conversation.( Click Here’s )

FAQs

Q : Is crypto considered halal or haram for Gen Z investors in different Middle Eastern countries?

A : There’s no single ruling across MENA. Some scholars argue that buying and holding Bitcoin or major crypto assets without interest or excessive speculation can be halal, while leveraged trading, margin, and highly speculative meme coins are closer to gambling and therefore haram. National fatwa councils and Shariah boards in places like Saudi Arabia, UAE, and Egypt can take different positions, and many young Muslims follow local scholars or certified “Shariah-screened” products. It’s wise for Gen Z investors to consult trusted scholars and avoid any structure they don’t fully understand.

Q : At what age do young people in the GCC typically start buying Bitcoin or other cryptocurrencies?

A : Most regulated exchanges in the GCC require users to be 18 or older and able to complete KYC using a national ID or passport. In practice, some teenagers get early exposure by watching parents, older siblings, or social media influencers and may experiment informally via P2P channels before 18 often borrowing accounts or using gift-card-style methods. From a risk and compliance perspective, starting after 18 on regulated platforms with clear educational content is far safer than experimenting in anonymous, unregulated spaces.

Q : Which Middle Eastern countries are currently the most friendly towards small retail crypto investors?

A : Within MENA, the UAE is widely seen as the most crypto-friendly for retail users, thanks to clear rules from VARA in Dubai and ADGM in Abu Dhabi plus a strong ecosystem of licensed exchanges and fintechs. Bahrain and some other GCC states have also issued digital-asset licences, though on a smaller scale. Saudi Arabia remains more cautious, with warnings around retail trading, while countries facing severe FX or banking crises may tolerate usage in practice but lack formal consumer protections.

Q : How risky is it for students in the Middle East to trade crypto on platforms they discover through social media?

A : Risk is high if platforms are chosen purely based on TikTok or Telegram hype. Students face three main dangers: losing money to volatility, falling for outright scams or rug pulls, and breaching local banking or KYC rules by using shady on-ramps. A safer approach is to treat social media as a starting point for research, then verify whether a platform is licensed (for example under VARA, ADGM, or other recognized regulators), read independent reviews, start with very small amounts, and never trade with borrowed money or funds needed for essentials like tuition or rent.

Q : Do Gen Z investors in the Middle East prefer Bitcoin or stablecoins when sending remittances to family abroad?

A : For remittances, stablecoins usually win. Bitcoin’s price can move 5–10% in a day, which is too risky when you’re sending part of your salary home to Pakistan, India, Egypt, or the Philippines. Stablecoins pegged to the US dollar (such as USDT or USDC) offer more predictable value during the transfer window, even if there’s platform and issuer risk. Many Gen Z users treat Bitcoin as a long-term, higher-risk holding, while using stablecoins as the short-term rail for cross-border payments and emergency savings.