GCC Crypto Regulations Explained for Global Firms

GCC crypto regulations can look like a maze from New York, London or Frankfurt. Bahrain runs a licensing-based, fintech-friendly crypto-asset regime. Oman is rolling out a virtual asset framework that will gradually catch most VASPs. Kuwait, meanwhile, has gone in the opposite direction with a broad ban on most crypto activities, including mining, leaving only passive holding tolerated in practice.

Recent estimates suggest that around 6.8% of the global population roughly 560+ million people owned digital assets in 2024. In Europe, around 9% of eurozone adults held crypto-assets in 2024, with Germany and other major markets steadily adopting Web3 and tokenisation. Against that backdrop, the Gulf is simply too important for serious crypto businesses to ignore.

This guide cuts through the noise for US, UK and EU firms and focuses on three questions for Bahrain, Oman and Kuwait: Is crypto legal? What licence or registration do we need? And where are the biggest red flags?

GCC crypto regulations are highly fragmented. Bahrain operates a detailed, licensing-based regime for crypto-asset service providers under the CBB’s Crypto-Assets Module. Oman is building out a Virtual Asset Regulatory Framework with mandatory registration and AML/CFT rules for VASPs already in force. Kuwait applies an “absolute prohibition” on most crypto activities, including mining and licensing, with only private holding of crypto tolerated in practice. Global firms usually treat Bahrain as a primary GCC hub, monitor Oman as it matures, and avoid onshore crypto operations in Kuwait.

GCC Crypto Regulations 2025.

Bahrain regulates and licenses crypto-asset services under the Central Bank of Bahrain (CBB) Crypto-Assets Module. Oman is in transition, gradually implementing a Virtual Asset Regulatory Framework with mandatory registration for VASPs. Kuwait, by contrast, enforces a comprehensive ban on most crypto activities, including payments, investments and mining, while still tolerating private holding without any regulated market infrastructure.

Crypto Laws in the GCC: Where Bahrain, Oman and Kuwait Fit

Within the GCC, Bahrain and Oman sit closer to the UAE’s “regulated but open” model, while Kuwait sits nearer Qatar’s restrictive stance. The UAE (through Dubai’s VARA and Abu Dhabi’s ADGM) and Bahrain have positioned themselves as regional hubs with dedicated frameworks for virtual asset service providers (VASPs). Saudi Arabia and Qatar remain more cautious, focusing on experimental pilots or excluding cryptocurrencies from newer digital asset regimes.

Across this GCC virtual asset regulatory spectrum, Bahrain is the most mature, Oman is mid-build, and Kuwait is the most prohibitive. That divergence matters when you are deciding where to base a GCC entity from New York, London, Frankfurt or Luxembourg.

Key Regulators and Source Documents

Bahrain

The key regulator is the Central Bank of Bahrain. Its Crypto-Assets Module (CRA) in Volume 6 of the Rulebook sets out licensing, capital, governance, custody, technology, cyber security and conduct rules for crypto-asset service providers.

Oman

The Financial Services Authority (FSA) (formerly the Capital Market Authority, CMA) leads the Virtual Asset Regulatory Framework. Decision No. E/35/2023 introduced Instructions for Registration of VASPs and AML/CFT obligations, requiring any VASP operating in Oman or targeting Omani users to register and implement robust AML controls.

Kuwait

The Capital Markets Authority (CMA), Central Bank of Kuwait, Insurance Regulatory Unit and Ministry of Commerce and Industry jointly issued 2023 circulars imposing an “absolute prohibition” on dealing in virtual currencies, including a ban on licensing and mining.

International law firms, FATF mutual evaluation reports and the Law Library of Congress all highlight how these documents translate into real-world constraints for investors and VASPs.

Quick Legality Matrix for Investors and VASPs

In one line.

Bahrain = regulated, licensing-based VASP regime

Oman = transitional, VASP registration and AML/CFT rules now; full framework still evolving

Kuwait = prohibitive, with a broad ban on regulated crypto activities and a clear mining crackdown

Bahrain Crypto Regulation.

Bahrain allows crypto-asset businesses to operate if they are licensed by the CBB under the Crypto-Assets Module and comply with strict AML/CFT, prudential and technology rules. For US, UK and EU firms comparing GCC crypto regulations, Bahrain often feels like the most “MiCA-style” jurisdiction in the region.

CBB Crypto-Assets Module and Scope of Regulation

The CBB’s CRA Module treats crypto-asset services as regulated capital markets activities. It covers.

Reception and transmission of orders

Trading as agent or principal

Investment advice and portfolio management

Custody services

Operating a crypto-asset exchange

Acting as a digital token advisor

Scope is both territorial and user-based. Any firm incorporated in Bahrain or marketing to Bahrain-based users must either obtain a crypto-asset licence or ensure its activities fall outside the defined services (for example, pure technology outsourcing with no client interface). Cross-border VASPs targeting Manama-based users from London or New York can be brought into scope, so “we’re offshore” is not a reliable defence.

Licence Types and Requirements for Exchanges and Custodians

A crypto exchange serving Bahrain must hold a CBB crypto-asset exchange licence, meet minimum capital requirements, appoint “approved persons” and demonstrate robust systems and controls over trading, custody and client assets.

For US or EU-facing platforms, the short compliance answer is: you typically need a CBB crypto-asset service licence (often as an exchange and/or custodian) plus your home-state permissions (for example, MiCA CASP authorisation, UK cryptoasset firm registration, or US money services / broker-dealer status) if you keep serving those markets.

The CRA module includes detailed expectations on.

Technology governance, cyber security and wallet key management (CRA-5)

Custody segregation, reconciliation and reporting (CRA-8)

Business conduct, marketing and client disclosures (CRA-4, CRA-12)

CBB does not literally require PCI DSS or SOC 2 certification, but its systems and controls standards are close enough that most serious exchanges implement PCI-style network segmentation and SOC-grade monitoring to keep regulators comfortable.

If your team needs to design that stack, partnering with a technical firm such as Mak It Solutions for business intelligence and secure architecture can help you build something that satisfies both CBB expectations and Western audit standards.

Cross-Border Angle: US, UK and EU Firms Using Bahrain as a Hub

A common pattern for SEC-registered, FCA-authorised or BaFin-regulated firms is to:

Incorporate a Bahrain entity in Manama.

Seek a CBB crypto-asset licence (exchange, brokerage, custody or advisory).

Use Bahrain as the GCC booking centre while keeping core EU/US risk and governance onshore.

You still need to reconcile Bahraini rules with MiCA, UK-GDPR, EU GDPR/DSGVO and US privacy / Bank Secrecy rules when handling client data from London, Frankfurt or New York. In practice, that means building data flows and consent journeys that would also look acceptable to regulators in Berlin or Dublin, not just in Manama. Guidance on data protection and certifications in pieces like Mak It Solutions’ cloud and certification overview can be useful here.

Oman Virtual Asset Regulation.

Oman is rolling out a Virtual Asset Regulatory Framework that will require virtual asset service providers to register or license with the FSA/CMA and comply with FATF-aligned AML/CFT requirements. Decisions issued in 2023 already require VASPs to register and implement AML/CFT controls, even while the full framework is still under consultation.

Oman’s Virtual Asset Regulatory Framework and FSA/CMA Circulars

In February 2023, Oman’s then-CMA announced plans for a comprehensive Virtual Assets Regulatory Framework covering crypto assets, tokens, exchanges and ICOs. ([The Library of Congress][5]) June 2023 Decision E/35/2023 introduced registration instructions for VASPs and AML/CFT implementation requirements.

A public consultation on the broader Virtual Assets Regulatory Framework followed in July 2023, aiming to define licence categories, supervisory expectations and timelines. As of late 2024, the Law Library of Congress notes that the full framework remains under review, but the VASP registration and AML/CFT obligations are in force.

Registration and Ongoing Obligations for Virtual Asset Service Providers

The registration instructions capture exchanges, brokers, wallet providers and other VASPs incorporated in Oman or operating from abroad but offering services “in Oman” to local users.

Core obligations include.

Customer due diligence, sanctions screening and ongoing KYC

Transaction monitoring and suspicious activity reporting to the FIU

Implementation of the FATF Travel Rule for qualifying transfers

Governance and risk management frameworks, including board oversight

Cybersecurity measures appropriate to the scale and complexity of operations

Existing operators were given a short transition window (around three months in early guidance) to regularise their status, reinforcing that this is not a “light touch” regime.

Implications for US, UK and German Crypto Firms Entering Oman

For a US exchange, London-based fintech or German VASP, Oman sits somewhere between Bahrain and the UAE: attractive medium-term, but still maturing. Oman’s rules echo EU MiCA’s emphasis on licensing CASPs and UK FCA expectations on AML and financial promotion, but without an EU-style passport.

In practice, “Oman virtual asset regulation for German VASPs” and “Oman VASP registration rules” type questions reduce to: be ready to form a Muscat-based entity, register with the FSA/CMA, and treat Oman as a separately supervised market rather than a bolt-on to your Luxembourg or Berlin structure. Data flows from EU users to Oman must still comply with GDPR/DSGVO, while UK users trigger UK-GDPR and FCA expectations on outsourcing and operational resilience.

If you plan to localise content and onboarding flows for Omani users, Mak It Solutions’ web and SEO services can help you structure regulatory explainers, FAQs and landing pages so they are both search-friendly and easy for local compliance teams to review.

Kuwait Cryptocurrency Ban and Mining Crackdown

Kuwait has introduced a broad ban on most cryptocurrency activities, including using crypto for payments, offering it as an investment product, licensing VASPs or operating mining farms. As of December 2024, official guidance still describes a comprehensive prohibition on crypto-related financial activities, although private holding remains in a legal grey area and is not actively licensed or supervised.

What Kuwait’s Crypto Ban Actually Prohibits

On 17 July 2023, multiple Kuwaiti regulators issued circulars imposing an “absolute prohibition” on dealing in virtual currencies. The circulars explicitly ban.

Use of virtual assets as a means of payment

Dealing in virtual assets as an investment or offering related services

Granting licences for virtual asset services

Conducting any cryptocurrency mining activities.

Securities and financial instruments already regulated by the Central Bank of Kuwait or CMA are excluded, but there is no carve-out for typical crypto tokens. Violations can trigger penalties under Kuwait’s AML/CFT Law No. 106 of 2013, including substantial fines, restrictions on business activities and potential licence revocation.

Cryptocurrency Mining Restrictions and Energy-Grid Concerns

Kuwait’s regulators explicitly ban crypto mining in the circulars, citing AML/CFT risks. On top of that, the government is increasingly concerned about energy subsidies and grid stability. A recent crackdown on suspected mining operations in Al-Wafrah reportedly cut local electricity consumption by around 55% in a single week, illustrating the scale of power usage.

Authorities frame unauthorised mining as an unlawful exploitation of heavily subsidised power and a threat to public safety. The clear message for US, UK and EU investors is that Kuwait is not a viable jurisdiction for data-intensive crypto mining or large-scale Web3 infrastructure under the current rules.

Risk for Foreign Investors and Expats in Kuwait

For foreign investors, expats in Kuwait City or remotely managed structures, the practical position is stark: there is no licensing path for exchanges, custodians, brokers or token issuers in Kuwait under current rules.

Most international law firm commentaries interpret the framework as allowing individuals to hold crypto offshore at their own risk, but not to promote, intermediate, mine or otherwise run a crypto business from Kuwait. In other words, “Kuwait crypto mining illegal” and “Kuwait cryptocurrency ban risk for foreign investors” are not edge-case questions they largely resolve to one conclusion: do not structure active crypto operations there unless and until the ban changes, and always seek local counsel before taking any risk.

Comparing Bahrain, Oman and Kuwait for US, UK and EU Firms

For regulated Western firms, Bahrain is currently the most viable GCC hub, Oman is a medium-term opportunity, and Kuwait is effectively a no-go for active crypto businesses. That high-level answer holds whether you sit in New York, London, Berlin or Luxembourg.

How Each Jurisdiction Treats Virtual Asset Service Providers (VASPs)

Bahrain

Full licensing framework for crypto-asset service providers (exchanges, custodians, brokers, token advisers) with clear rules on capital, governance, technology and AML/CFT.

Oman

Transitional: VASP registration and AML/CFT instructions in force, with a wider Virtual Asset Regulatory Framework under consultation and expected to evolve further.

Kuwait

Prohibitive: absolute ban on VASPs, no licences granted and explicit prohibition on granting licences in future under current circulars.

That directly answers the question “How do Bahrain, Oman and Kuwait differ in their treatment of VASPs?” for most investors and compliance teams.

GCC vs MiCA, FCA, BaFin and SEC Expectations

MiCA, fully applicable in the EU since late 2024, creates a harmonised regime for EU crypto-asset service providers, including whitepaper requirements, prudential rules and conduct standards. Bahrain’s CRA module comes closest in the GCC to that level of detail, especially around tech governance and custody.

Oman’s framework is more focused on AML/CFT and registration at this stage, aligning with FATF recommendations rather than replicating MiCA’s product-level detail. Kuwait’s outright ban contrasts with regulators like the FCA, BaFin, SEC, CFTC and FinCEN, which are moving toward tighter but still permissive regulation of crypto intermediaries rather than blanket prohibition.

For firms marketing to EU retail from a Bahrain or Oman hub, issues like financial promotions, cross-border reverse solicitation and Travel Rule compliance must be mapped carefully against MiCA, UK-GDPR/GDPR and local GCC AML rules. Thoughtful content and indexing – for example, using Mak It Solutions’ indexing controls guide can help ensure that your regulatory pages are visible to the right audiences without overexposing sensitive or jurisdiction-specific material.

Which Jurisdiction Fits Which Business Model?

Centralised exchanges & brokers

Bahrain is usually the first GCC stop, particularly for London- and New York-based firms looking for a supervised environment compatible with MiCA/FCA/SEC expectations.

Custodians & tokenised securities platforms

Bahrain again leads, with Oman as a possible future secondary hub when securities-style virtual asset rules mature.

DeFi interfaces, wallets and Web3 projects

Often operate from EU hubs like Berlin or Luxembourg today, but may register in Oman once the framework clarifies how non-custodial models fit.

Funds and ETPs

German, Luxembourgish or Irish vehicles typically keep portfolio management in the EU, treating Bahrain/Oman primarily as counterparties and market access points rather than as booking centres.

Kuwait, at present, does not sensibly “fit” any of these models for onshore activity.

Practical Compliance Steps for US, UK and EU Firms in the GCC

Foreign firms should start with a tri-jurisdiction risk review, pick a primary GCC hub (usually Bahrain), align their controls with FATF, MiCA/UK standards and local rules, and commission tailored legal opinions before onboarding GCC-based users.

Pre-Entry Checklist for Bahrain, Oman and Kuwait

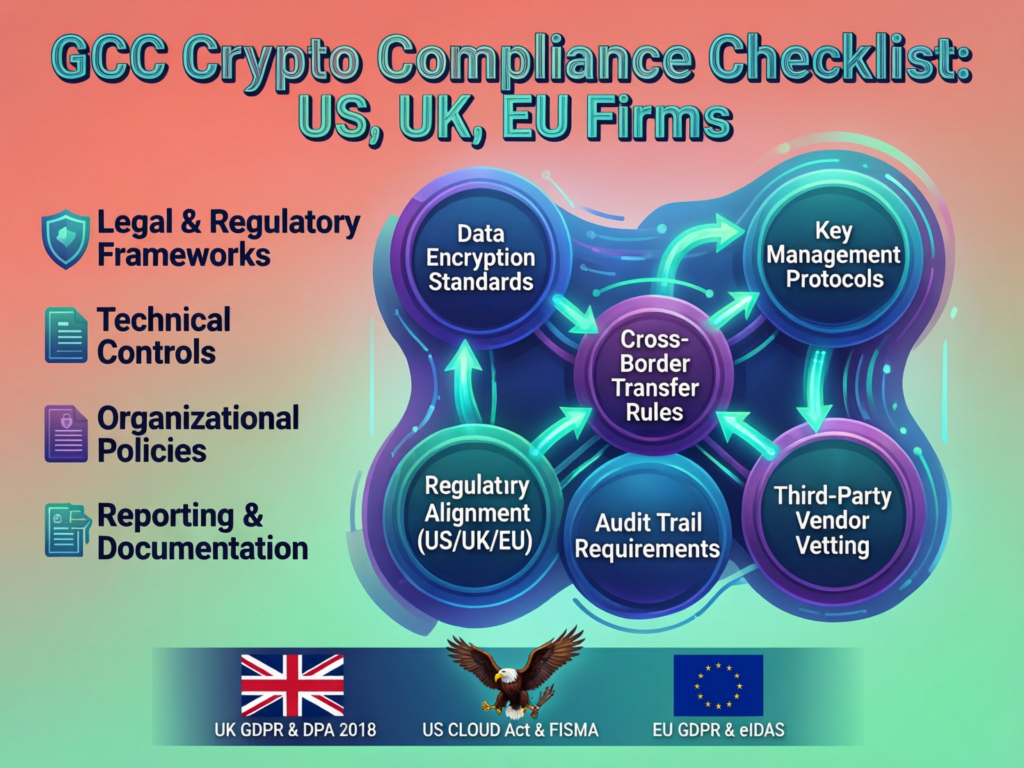

A simple GCC crypto regulations checklist for US companies and UK/EU-regulated fintechs might look like this.

Map your activities

Are you exchanging, broking, custodying, issuing tokens, or just providing tech?

Locate your clients

Identify where users sit (Manama, Muscat, Kuwait City, London, New York, Frankfurt, Berlin) and where onboarding actually happens.

Screen sanctions and PEP risk

Align GCC AML/CFT rules with your US, UK and EU sanctions frameworks.

Choose your hub

For now, treat Bahrain as “build”, Oman as “watch/build later”, Kuwait as “avoid for operations”.

Design data flows

Ensure GDPR/DSGVO, UK-GDPR and US privacy rules continue to apply when data leaves the EU or UK for GCC systems.

Select banking, custody and vendors

Prefer partners already familiar with PCI DSS-grade security, SOC-style monitoring and Travel Rule support across Bahrain/Oman.

This is where Mak It Solutions can help with data architecture, cross-border analytics and secure integration patterns that actually pass audits in the US, UK, Germany and the wider EU. ([Mak it Solutions][16]) For broader multi-country builds, you can also look at their services overview.

Aligning AML/CFT and Data Protection Across GCC and US/UK/EU Rules

GCC AML/CFT rules are steadily converging toward FATF standards, with Bahrain, Kuwait and Oman all subject to recent FATF evaluations.

From a controls standpoint, you’ll want.

Group-wide AML/KYC policies that satisfy FATF, EU AMLDs, UK rules and US BSA/FinCEN guidance.

Travel Rule-enabled tooling that handles flows between EU, UK, GCC and US counterparties.

Data protection controls that respect GDPR/DSGVO, UK-GDPR and, where relevant (for example, tokenised health data), HIPAA-style privacy expectations.

Regulators increasingly expect evidence: policies, monitoring rules, audit trails and periodic testing. This is where your BI and analytics stack for example, built with Mak It Solutions’ business intelligence services – can generate regulator-ready compliance reports and dashboards. ([Mak it Solutions][16]) If you are also investing in AI-assisted SOC capabilities, their work on cybersecurity skills and automation is a useful reference.

When to Seek Local and Cross-Border Legal Opinions

In practice, a US or UK crypto firm complies with Bahrain’s Crypto-Assets Module and local AML/CFT rules by.

Licensing a Bahrain entity with the CBB.

Aligning its AML controls with Bahraini and FATF standards; and

Ensuring its US/UK regulatory obligations are still met for cross-border users.

You should seek.

Local opinions in Bahrain and Oman on the precise scope of your activities, marketing and data handling.

Home-state opinions (SEC/FinCEN in the US, FCA in the UK, BaFin or other EU regulators) on how GCC entities interact with your existing licences.

Ongoing update memos as MiCA, UK crypto rules and Oman’s framework evolve.

A coinlaw.io-style comparative memo can bundle Bahrain, Oman, Kuwait and your home jurisdiction into a single, readable risk view helpful for boards, risk committees and investors.

Key Takeaways

Ultimately, Bahrain is your regulated entry point, Oman is a serious “watch and prepare” jurisdiction as its VASP framework matures, and Kuwait is one to avoid for active operations until the current ban changes. Whatever your model exchange, custody, DeFi gateway or tokenisation platform assume that GCC crypto regulations will keep tightening in line with FATF, MiCA and FCA-style expectations, and that you’ll need regular local legal input to stay ahead.

As always, this article is general information, not legal or financial advice. You should obtain independent advice before making structuring or investment decisions.

One-Page Summary for Decision Makers

Where to build

Manama (Bahrain) for now; consider Muscat (Oman) in the medium term.

Where to watch

Oman’s Virtual Asset Regulatory Framework and its alignment with MiCA and FATF.

Where to avoid

Kuwait for any onshore crypto activity, particularly mining or investor-facing services.

What to align

AML/CFT, Travel Rule, data protection and marketing rules across US/UK/EU and GCC.

What to budget

Licensing costs in Bahrain, legal opinions in each jurisdiction, plus compliance tooling and secure infrastructure.

How Coinlaw-Style Comparative Advice Reduces GCC Risk

A comparative, coinlaw.io-style approach pulls together official texts, FATF reports and regulator guidance from Bahrain, Oman, Kuwait and your home markets into a single decision document. That lets founders, general counsel and compliance leads move beyond folklore (“X is crypto-friendly”) to specific, cited answers about licensing, bans and enforcement. (CoinLaw)

Pair that kind of memo with a technical partner like Mak It Solutions for architecture, data and security, and you get a faster, safer route from “we need a GCC presence” to a live, regulator-ready stack.( Click Here’s )

FAQs

Q : Is it easier to get a crypto-asset licence in Bahrain than in the UAE or Saudi Arabia?

A : For many firms, Bahrain is currently simpler than Saudi Arabia and more predictable than parts of the UAE. The CBB Crypto-Assets Module provides a single, well-documented path to licensing for exchanges, custodians and brokers, whereas Saudi Arabia remains cautious and often focuses on pilots. The UAE offers multiple regimes (VARA, ADGM, DIFC), which can be attractive but also complex. Whether Bahrain is “easier” ultimately depends on your risk appetite, business model and tolerance for multi-regime structuring.

Q : Can a European or UK resident still use offshore crypto exchanges while living in Kuwait?

A : Kuwait’s circulars focus on activities carried out in Kuwait payments, investment services, mining and licensing rather than explicitly banning individuals from holding offshore accounts. However, promoting or intermediating such services locally could be seen as violating the “absolute prohibition,” and there is no investor protection if things go wrong. Anyone relocating from London, Berlin or elsewhere in Europe to Kuwait should treat active trading, and especially any business use of crypto, as high-risk and seek local legal advice before acting.

Q : How do GCC crypto regulations affect stablecoins and tokenised securities issued from Europe?

A : MiCA already regulates many EUR- and USD-denominated stablecoins and tokenised instruments within the EU, while GCC rules are mainly focused on intermediaries rather than issuers abroad. In practice, if your Luxembourg or Frankfurt vehicle issues a stablecoin or tokenised security and then markets it into Bahrain or Oman, local regulators may treat your EU entity as a VASP or securities firm needing approval. Kuwait’s ban effectively closes that market for now. Structuring, offering documents and distribution strategies must be reviewed against both MiCA and relevant GCC rules.

Q : What tax and reporting issues should US and EU investors consider when holding crypto via Bahrain or Oman structures?

A : From a tax perspective, US investors remain subject to IRS rules on crypto as property, regardless of whether they hold via a Bahrain or Oman vehicle; EU investors face their own domestic capital gains and reporting regimes. The main GCC angle is transparency: regulators in Bahrain and Oman are tightening AML, KYC and reporting, which increases the likelihood that foreign tax authorities can access information through existing exchange-of-information channels. Investors should obtain tax advice covering both the holding structure (fund, SPV, direct account) and the interaction with home-state reporting regimes such as FATCA or CRS.

Q : How often do Bahrain, Oman and Kuwait update their crypto rules, and how can firms monitor regulatory change?

A : Bahrain has amended its Crypto-Assets Module several times to keep pace with FATF guidance and market developments. Oman is actively developing its Virtual Asset Regulatory Framework and may issue further decisions as consultation feedback is digested. Kuwait’s stance is newer but linked to ongoing FATF scrutiny, so enforcement practice and interpretive guidance may continue to evolve. Firms should subscribe to regulator mailing lists, follow major law-firm briefings, monitor FATF updates and, ideally, commission an annual “horizon scan” memo from a specialist advisor.