From Circle to Medline: What drove US IPO performance 2025

US IPO performance 2025 trailed the broader market as investors favored established cash flows over thematic growth stories. Across all 2025 US listings (ex-SPACs/CEFs), weighted average returns were 13.9% versus roughly 16% for the S&P 500, with crypto and AI names contributing to the shortfall.

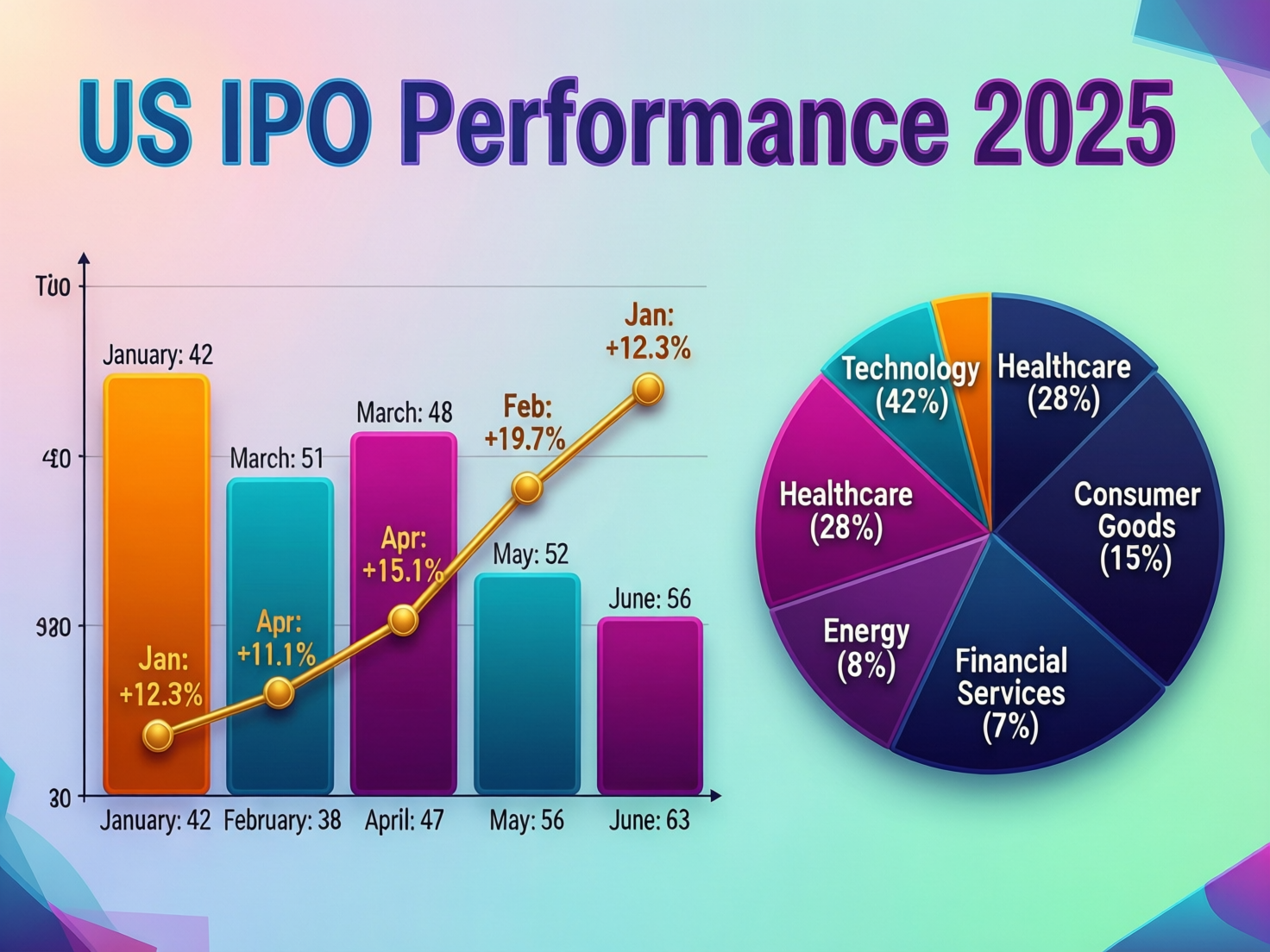

Market recap: The numbers behind a “mixed” IPO year

Bloomberg’s year-end tally shows 2025 US IPOs returned 13.9% on a weighted basis, under the S&P 500’s ~16% gain. The backdrop: higher selectivity, tighter pricing, and investors rewarding clear profitability and visibility over momentum narratives

PwC’s US IPO lead Mike Bellin summed it up as a “distinctly mixed year,” with the market reopening selectively.

Company snapshots and US IPO performance 2025

Medline (MDLN)

The largest US IPO of 2025 raised about $6.26bn–$7.2bn and rallied on debut, becoming a bellwether for fundamentals-first, cash-generative issuers.

Venture Global

The LNG exporter raised $1.75bn in January; shares later slumped amid contract disputes, marking one of the year’s weakest post-IPO trajectories.

Circle (CRCL)

Stablecoin issuer priced at $31 and jumped nearly 170% on day one, highlighting exuberance that later moderated.

Bullish (BLSH)

Crypto exchange soared ~80%+ on debut before subsequent volatility typical of the sector.

What drove US IPO performance 2025 to lag the S&P 500?

Two themes dominated: (1) thematic volatility in crypto/AI fast money in, fast money out and (2) return of fundamentals, where profitable leaders with pricing power (e.g., in healthcare supplies) drew sustained demand. Market conditions favored larger, cash-flowing issuers and penalized early-stage growth stories without clear visibility.

Context & Analysis

The 2025 cohort underscores a re-ranking toward balance-sheet strength and pricing discipline. Blockbuster offerings (Medline) absorbed capital effectively, while some high-beta categories (crypto, AI infrastructure/apps) saw sharp reversals after headline-grabbing debuts. For 2026, issuers with profitable growth and transparent unit economics are best positioned to clear investor hurdles noted by PwC’s Bellin.

Concluding Remarks

The lesson from US IPO performance in 2025 is straightforward: flashy first-day gains cannot replace solid business fundamentals. While initial hype may attract short-term attention, it does little to support long-term value if a company lacks strong financial health, transparent governance, and sustainable growth. Investors have become more cautious after seeing several high-profile listings fail to maintain momentum beyond their debut.

Looking ahead to 2026, investors are expected to raise their standards. Companies will need to demonstrate stronger operating metrics, cleaner governance structures, and more realistic valuations. This shift will be especially important for thematic and trend-driven names, where credibility and execution will matter more than excitement alone.

FAQs

Q : Did US IPO performance in 2025 beat the S&P 500?

A : No. Weighted average IPO returns were 13.9%, compared with roughly 16% for the S&P 500.

Q : Which 2025 IPOs stood out?

A : Medline rallied after a multi-billion-dollar offering; Venture Global fell sharply; several crypto listings were highly volatile.

Q : How did crypto-related IPOs fare?

A : They saw big first-day moves (e.g., Bullish, Circle) but experienced choppier follow-through due to sector volatility.

Q : What explains the underperformance vs. the S&P 500?

A : Rising selectivity investors favored profitability and visibility over thematic momentum.

Q : Was Circle’s IPO really that strong on day one?

A : Yes. Priced at $31, it surged nearly 170% on debut.

Q : Are larger IPOs performing better than mid-sized ones?

A : Evidence suggests larger, fundamentals-rich deals (e.g., Medline) held up better than mid-sized, higher-beta listings.

Q : What should investors watch in 2026 IPOs?

A : Profitability, unit economics, regulatory overhangs (especially crypto/AI), and lock-up calendars.

Facts

Event

2025 US IPOs underperform the S&P 500; thematic listings volatileDate/Time

2026-01-06T12:00:00+05:00Entities

Medline Inc. (MDLN), Venture Global LNG, Circle Internet Group (CRCL), BullishFigures

13.9% weighted IPO return vs. ~16% S&P 500; ~$6.26–$7.2bn raised by Medline; $1.75bn raised by Venture Global; Circle priced at $31 and rose ~170% day one. Barron’s+3Bloomberg+3Reuters+3Quotes

“2025 was a distinctly mixed year for IPOs.” Mike Bellin, PwC US IPO leader. LinkedInSources

Bloomberg “US IPO Performance Lags S&P 500 in 2025…”; Reuters “Venture Global LNG raises $1.75 bln…” (URLs below)