From $140K Call to $85K Put: Bitcoin Positioning Reverses Completely

Bernstein ka kehna hai ke U.S. crypto framework tezi se mulk ko global leadership ki taraf le ja raha hai. Unke mutabiq, stablecoin-focused GENIUS Act ka already implement hona aur jald aane wala CLARITY Act ka market-structure regime, dono mil kar regulatory direction ko kaafi clear bana rahe hain. Ye steps crypto ecosystem ko zyada transparent, secure aur institution-friendly banane me madad de rahe hain.

Broker ka yeh bhi argument hai ke regulation, institutional adoption aur capital-markets integration ek doosre ko reinforce kar rahe hain, jis se sector me ek sustainable growth cycle develop ho rahi hai. Jaise-jaise bade financial players crypto me enter kar rahe hain, market ki maturity barhti ja rahi hai, aur U.S. apni policymaking se global standards set karne ke qareeb hota ja raha hai.

Why this matters now

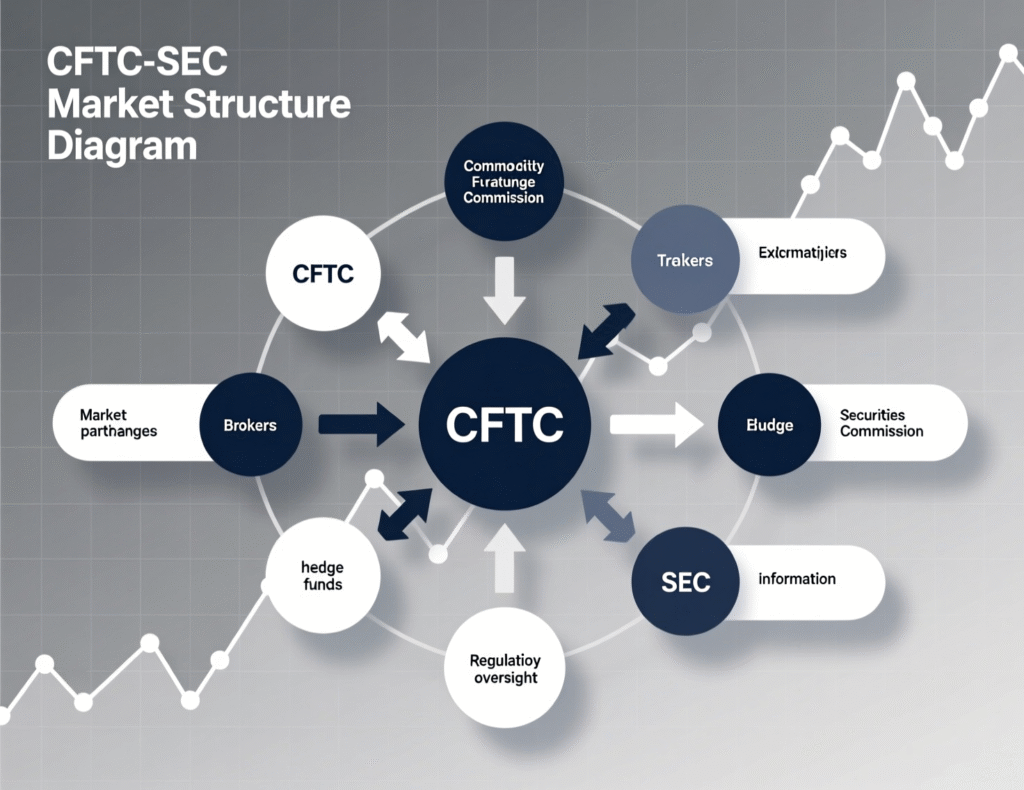

With the GENIUS Act signed into law in July 2025, the U.S. gained a federal blueprint for payment stablecoins, including reserve requirements and disclosures. A House-passed CLARITY Act now echoed by a fresh Senate draft aims to clearly divide jurisdiction between the SEC and CFTC for digital assets, addressing years of uncertainty. Meanwhile, SEC Chair Paul S. Atkins’ “Project Crypto” sets a roadmap for incorporating blockchain into securities plumbing. Securities and Exchange Commission+4Congress.gov+4Financial Times+4

Market Structure and Oversight

The GENIUS Act: Stablecoin guardrails

Establishes a federal framework for payment stablecoin issuers (backing, liquidity, disclosures)

Signed into law July 18, 2025; Public Law 119–27.

Seen by analysts as accelerating U.S.-dollar stablecoin supply and institutional use.

The CLARITY Act: From House passage to Senate draft

House (H.R. 3633)

Passed with bipartisan support; defines digital commodities vs. securities and allocates SEC/CFTC roles.

Senate

Committee discussion draft released Nov. 10, 2025, closely tracking the House framework and expanding CFTC spot-market authority.

Timing

Senate leaders target committee action in coming weeks.

Project Crypto and the U.S. crypto framework

Under Project Crypto, SEC Chair Paul S. Atkins has outlined principles for tokenized securities, disclosure modernization, and venue registration pathways framing how securities law will apply across a spectrum of crypto assets within the U.S. crypto framework.

How Project Crypto interacts with the U.S. crypto framework

The SEC’s approach is designed to dovetail with CLARITY’s asset classification, reducing friction between securities and commodities rules while keeping investor protections intact.

Stablecoins and Institutional Flows

Bernstein ties the policy shift to a jump in stablecoin usage and capital-markets activity. Stablecoin supply exceeded $260bn earlier in 2025 and is now around/above $300bn, per multiple trackers and reports. Treasury officials and banks see stablecoins increasing demand for T-bills and enabling tokenized-cash rails for ETFs and settlement.

What market participants should expect

Issuers

Enhanced reserve, audit and disclosure regimes under the GENIUS Act.

Venues/Brokers

Prospective CFTC registration for digital commodity spot activity under the Senate draft; SEC pathways for tokenized securities.

Institutions

Clearer rails for ETFs, tokenized funds and on-chain settlement as agencies coordinate.

Context & Analysis

Policy momentum reflects a coordinated push: the White House endorsed stablecoin legislation; the House advanced CLARITY; Senate committees introduced a parallel draft; and the SEC signaled openness to tokenization through Project Crypto. Some policy shops still argue for deeper consolidation of SEC/CFTC mandates or warn of AML and national-security risks, underscoring debates that could shape final rules.

Conclusion

The U.S. crypto landscape is shifting from a scattered approach to a clearer, more structured framework. Bernstein notes that the passage of a stablecoin statute and progress on market-structure bills signal a move toward a unified national strategy. These developments reflect growing political will to formalize crypto oversight and support responsible adoption.

A crucial phase now lies ahead, driven by Senate decisions and coordinated rulemaking among federal agencies. At the same time, the industry must prepare to meet higher compliance and operational standards. How effectively these pieces align will determine the country’s ability to lead in the global crypto space.

FAQs

Q : What is the GENIUS Act?

A : A federal law setting reserve, disclosure, and supervision standards for U.S. payment stablecoin issuers.

Q: What does the CLARITY Act change?

A : It defines digital asset categories and allocates oversight between the SEC and CFTC; it passed the House and is under Senate consideration.

Q : Who leads Project Crypto at the SEC?

A : SEC Chair Paul S. Atkins, who outlined the initiative publicly on Nov. 12, 2025.

Q : How big is the stablecoin market now?

A : It topped $260bn earlier this year and is around $300bn+ as of Oct–Nov 2025, per multiple trackers.

Q : Why does Bernstein say the U.S. crypto framework matters?

A : Because clearer rules plus institutional demand can drive a more sustainable market cycle.

Q : Will the U.S. merge the SEC and CFTC?

A : Some experts advocate it, but current bills keep separate roles while clarifying boundaries.

Q : Is the U.S. crypto framework finalized?

A : Stablecoin rules are law; broader market structure awaits Senate action and agency rulemaking.

Facts

Event

Bernstein says U.S. regulatory moves position America as global crypto leaderDate/Time

2025-11-19T00:00:00+05:00Entities

Bernstein; U.S. Congress; U.S. Securities and Exchange Commission (SEC); Commodity Futures Trading Commission (CFTC)Figures

Stablecoin supply >$260bn (earlier 2025), ~>$300bn by Oct–Nov 2025 (USD)Quotes

“The SEC’s Approach to Digital Assets: Inside ‘Project Crypto’.” Paul S. Atkins, SEC Chair (speech) Securities and Exchange CommissionSources

CoinDesk report (Bernstein) + URL; Public Law 119–27 (GENIUS Act) + URL