FOMOing into Bitcoin? Check Out These Bullish BTC Plays Favored by Analysts

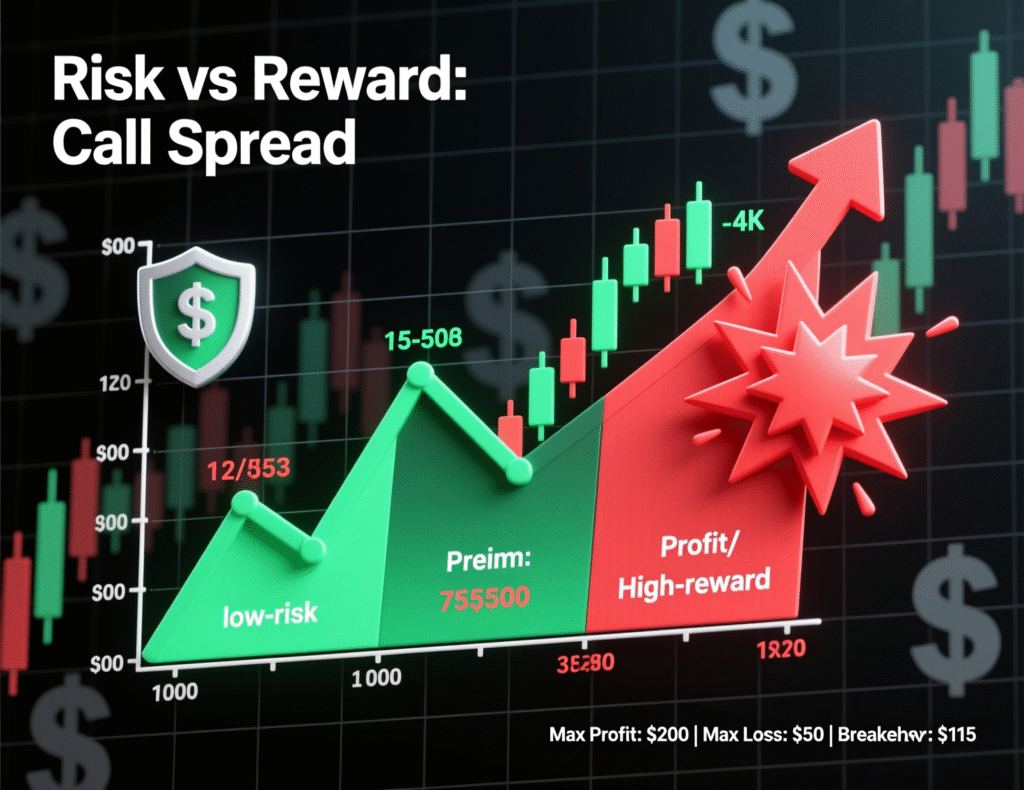

With Bitcoin trading near record highs, traders weighing whether to join the rally can explore a call spread strategy to gain upside exposure while keeping potential losses limited. This approach allows participation in price appreciation without taking on the full risk of a direct long position.

Market professionals suggest using out-of-the-money (OTM) calls or call spreads, which offer a cost-efficient way to express a bullish outlook. Some even recommend financing these call spreads by selling OTM puts, reducing overall premium costs. Such strategies help traders manage volatility and maintain balanced risk-reward as Bitcoin tests new highs.

BTC at all-time highs: what the options market is signaling

Bitcoin’s intraday high topped $126,000 today before easing, underscoring strong “Uptober” seasonality and brisk options activity. Deribit flow has featured sizable block trades in call spreads, clustered in very short tenors and as far out as September 2026—evidence of both tactical and longer-dated positioning. CoinDesk

What is the Bitcoin call spread strategy?

A bull call spread pairs a purchased call at a lower strike with a sold call at a higher strike in the same expiry (e.g., $130K/$145K). The short call lowers premium outlay and defines max profit at the upper strike, while max loss is limited to the net debit paid. As 10x Research’s Markus Thielen puts it, “Buying 1–2 month out-of-the-money (OTM) calls or call spreads (for example, $130,000/$145,000) allows traders to participate in further upside without overpaying for implied volatility.”

Risks of the Bitcoin call spread strategy

Your profit is capped at the higher strike; if BTC explodes beyond it you won’t capture further gains. If BTC stalls or falls, the spread can decay quickly. Position sizing and exit rules (profit targets/time stops) are essential especially in a high-volatility asset class like crypto.

Financing call spreads with OTM puts

Amberdata’s Greg Magadini notes an alternative: sell an OTM put and use the premium to fund multiple call spreads. In his words, “Selling the OTM put and using the proceeds to buy multiple call spreads … can help minimize the term structure vol expense [and] still capture upside.” This reduces upfront cash but creates a contingent obligation to buy BTC at the put strike if price falls—exposing you to potentially large downside.

Flows and positioning to watch

Deribit’s Asia BD head Lin Chen told CoinDesk that blocks are “dominated by large … call spreads,” either very short-dated or out to Sep 2026, with profit-taking also evident color that aligns with the record-high backdrop and tactical hedging.

<section id=”howto”> <h3>How to build a BTC bull call spread (step-by-step)</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Pick an expiry 30–60 days out that spans your thesis window.</li> <li id=”step2″><strong>Step 2:</strong> Buy a call near the money or slightly OTM (e.g., $130K).</li> <li id=”step3″><strong>Step 3:</strong> Sell a higher-strike call (e.g., $145K) in the same expiry to cut premium.</li> <li id=”step4″><strong>Step 4:</strong> Calculate net debit, max profit/loss; size the trade accordingly.</li> <li id=”step5″><strong>Step 5:</strong> (Optional) If experienced, sell a farther OTM put to help finance—fully understand assignment risk.</li> </ol> <p><em>Note: Process may vary by venue and jurisdiction. Confirm requirements, fees, and suitability before trading.</em></p> </section>

Context & Analysis

The preference for spreads over outright calls reflects elevated implied vols around ATHs and the desire to cap spend while keeping delta exposure. Put-financed structures can improve capital efficiency but convert a limited-risk profile into one with potentially large downside appropriate mainly for traders prepared to own BTC at the put strike.

Conclusion

With Bitcoin hovering near record levels, maintaining trading discipline is crucial. Using a defined-risk spread allows traders to capture potential upside if momentum continues, while position sizing and clear exit rules protect against pullbacks or sudden pauses in the rally.

For those financing the trade by selling puts, the chosen strike should be viewed as a conditional buy order for Bitcoin. This approach ensures that if the market dips, traders are prepared to own BTC at a price they’re comfortable with, keeping the strategy controlled and aligned with their overall risk tolerance.

FAQs

Q : What is a bull call spread in BTC options?

A : It’s a defined-risk strategy: buy a lower-strike call and sell a higher-strike call in the same expiry to cut premium and cap max profit.

Q : Why consider a Bitcoin call spread strategy instead of an outright call?

A : To reduce upfront cost and limit maximum loss while maintaining upside exposure up to the short strike.

Q : How do traders finance call spreads with puts?

A : By selling an OTM put and using the premium to buy one or more call spreads; this adds downside obligation if BTC drops below the put strike.

Q : What are current market flows telling us?

A : Large block call spreads—very short-dated and out to Sep 2026—suggest both tactical and long-dated bullish positioning.

Q : Is this suitable for beginners?

A : Spreads can simplify risk, but put-financing is advanced and can lead to large losses; paper-trade first and understand assignment risk.

Q : What happens if BTC rallies far beyond my short call strike?

A : Your profit is capped at the higher strike; consider rolling the short call if rules and margin allow.

Q : Does seasonality matter with BTC?

A : October has a bullish reputation, but past performance doesn’t guarantee future results; manage risk regardless.