Financial Inclusion With Crypto in MENA: A Practical Guide

Financial inclusion with crypto in MENA means using stablecoins, blockchain wallets and compliant on-chain payment rails to give unbanked and underbanked people affordable access to payments, savings and credit.

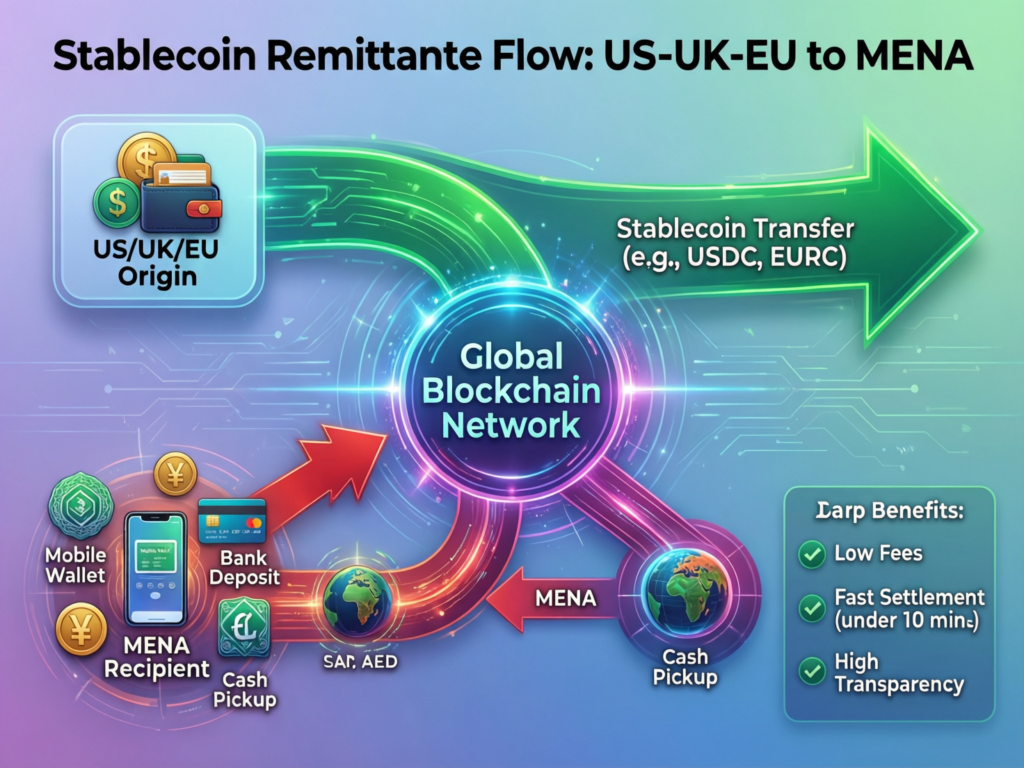

In practice, NGOs, development banks and fintechs in the US, UK and EU partner with regulated MENA providers to move funds on-chain, then cash out locally via mobile wallets, agents and banks while staying aligned with MiCA, FCA, BaFin, FATF and local central bank rules. Crypto is one rail in a broader digital finance stack, not a standalone replacement for banks or mobile money.

Introduction.

Financial inclusion with crypto in MENA is no longer a fringe experiment; it now sits at the intersection of remittances, humanitarian aid and digital transformation across Egypt, Morocco, Jordan, Lebanon, the GCC and beyond. Global account ownership has risen to about 76% of adults, yet more than a billion people still lack access to formal financial services, with many concentrated in emerging regions including MENA.

At the same time, remittances to the Middle East and North Africa fell sharply to around $55 billion in 2023, driven largely by a drop in flows to Egypt and FX challenges that pushed money into informal channels. Meanwhile, MENA’s crypto economy handled an estimated $389.8 billion in on-chain value between mid-2022 and mid-2023, about 7.2% of global volume, with strong activity in Turkey, Morocco and other markets.

If you’re sitting in New York, London, Berlin or Frankfurt and working in NGOs, impact funds, banks, regulators or fintechs, this is a strategic inflection point. This guide is a practical playbook: you’ll get definitions, adoption data, use cases, regulatory guardrails, design principles and a geo-specific action plan for US, UK and EU teams exploring crypto as one tool for digital financial inclusion in the MENA region.

What Is Financial Inclusion and How Can Crypto Improve It in MENA?

At its core, financial inclusion in the MENA region means that all adults including refugees, informal workers and rural households can affordably access useful financial services such as payments, savings, credit and insurance. (World Bank)

Financial inclusion with crypto in MENA becomes powerful when crypto is used as a programmable payment rail (especially via stablecoins) that lowers cross-border costs, reduces settlement risk and extends digital wallets to people who are currently cash-only or excluded from banks.

Defining Financial Inclusion for MENA Contexts

In MENA, financial inclusion is not just “having a bank account.” It’s the ability for a Syrian refugee in Amman, a domestic worker in Dubai or a smallholder farmer near Casablanca to.

Receive wages or remittances digitally

Store value safely (even in hard-currency terms)

Make everyday payments without punitive fees

Access fair credit or micro-insurance

Global Findex data shows big gaps: while global account ownership reached around 76% in 2021, many MENA economies still trail this average significantly, and women, youth and low-income workers are disproportionately excluded. (Microdata Library)

Where Crypto, Stablecoins and DeFi Fit Alongside Mobile Money and CBDCs

Crypto is one tool in a wider digital finance toolbox, alongside:

Mobile money and mobile banking

Prepaid and debit cards

CBDCs and fast payment systems

Traditional remittance operators and banks

For inclusion, the most relevant crypto building blocks are.

USD/EUR stablecoins (e.g., USDC/USDT in context) for dollar-linked value

On-chain rails for cross-border transfers between US/UK/EU and MENA

Non-custodial or semi-custodial wallets integrated into existing mobile apps

DeFi protocols (carefully gated) for savings-like returns or SME lending

CBDC pilots in the UAE, Saudi Arabia and Bahrain, plus instant payment systems in markets like Saudi Arabia (Sarie) and Egypt, may eventually interoperate with or compete against stablecoin rails. For most NGOs and fintechs today, the realistic pattern is stablecoins → local off-ramp → mobile wallet/bank/card, not “pure crypto” in isolation.

Current State of Crypto Adoption and Unbanked Rates in MENA

Chainalysis data suggests that MENA has become one of the more active crypto regions, with transaction volumes reportedly peaking above $60 billion in December 2024 and remaining resilient through 2025 despite geopolitical shocks. Turkey, Morocco and Egypt feature prominently in grassroots adoption rankings, often driven by FX pressures and remittance needs.

On the traditional side, countries such as Morocco and Egypt have been repeatedly listed among the world’s most unbanked, with roughly half or more adults outside formal banking as of the early 2020s. Yet Dubai, Abu Dhabi, Riyadh and Istanbul are emerging as regional digital-asset and fintech hubs, with regulated exchanges, sandboxes and Web3 ecosystems serving both local and cross-border demand.

Who Is Still Unbanked in MENA and Why Traditional Systems Miss Them

Unbanked and underbanked populations in MENA are not a monolith. They include low-income migrant workers in the GCC, women running informal micro-businesses, rural farmers and displaced communities in fragile states. Traditional systems miss them because of rigid KYC rules, distance from branches, limited digital channels and deep mistrust after repeated crises.

Key Segments.

Across Egypt, Morocco, Jordan, Lebanon, Yemen and Iraq you typically see:

Low-income migrant workers in Riyadh, Dubai, Doha or Kuwait City sending small but frequent transfers home

Refugees and IDPs in Jordan, Lebanon, Iraq, Palestine or Yemen who may lack formal IDs, proof of address or stable connectivity

Women and youth operating in cash-only informal economies, often without control over household bank accounts

Rural farmers and micro-entrepreneurs with seasonal income, weak connectivity and limited collateral

Digital financial inclusion in the MENA region needs products that respect social norms (e.g., gender dynamics), language (Arabic/French/English) and device realities (basic Android phones, sometimes shared).

Structural Barriers

People are excluded because they lack government-issued IDs or residency papers, live hours away from the nearest branch, or face fee structures that make small transactions uneconomical. They may also be wary of banks after devaluations or bail-ins, as seen in parts of Lebanon and Egypt.

So the micro-answer here: people are excluded due to ID gaps, high fees, distance from branches, low digital literacy and mistrust of formal institutions. Any crypto-based solution that ignores these barriers will simply replicate existing exclusion patterns.

How US, UK and EU Policy Choices Shape Access to MENA Finance

De-risking decisions made in New York, London or Frankfurt whether by global banks or regulators cascade down into MENA:

Sanctions and AML rules (OFAC, FATF, EU measures) can lead large correspondent banks to cut ties with MENA institutions they view as high risk.

This can shrink access to US-dollar clearing and increase remittance costs, even for fully compliant NGOs or micro-remittance providers.

FCA, BaFin and MiCA rules on cryptoasset services shape what US/UK/EU-based fintechs are allowed to offer MENA customers.

A key design task for impact-minded actors is to build inclusion projects that satisfy these upstream regulators while still reaching last-mile users in Cairo, Casablanca, Amman or Sana’a.

How Stablecoins and Crypto Rails Can Improve MENA Remittances and Everyday Payments

Stablecoins and blockchain-based wallets are promising for MENA remittances and aid payments because they can dramatically reduce FX friction, settlement times and fees compared with traditional bank transfers and some MTO corridors. Global average remittance costs still sit around 6–6.5% of the amount sent, more than double the UN SDG target of 3%, while many on-chain transfers clear for well under 1% in network and spread costs.

Mapping the Main MENA Remittance Corridors (GCC→MENA, US/UK/EU→MENA)

Key corridors include

GCC → MENA.

UAE, Saudi Arabia, Qatar, Kuwait and Bahrain to Egypt, Jordan, Lebanon, Yemen and South Asia; GCC states are consistently among the top remittance sources globally.

US/UK/EU → MENA.

workers and diaspora in New York, London, Manchester, Berlin and Paris sending funds to families in Cairo, Casablanca, Amman and Beirut.

Intra-MENA and Turkey flows.

Turkey, UAE and Saudi Arabia acting as hubs for inward and outward flows, including refugees and cross-border trade.

Remittances to MENA fell by around 15% in 2023, but parallel-market FX in Egypt and other countries suggests real flows may be higher than official channels capture.

Why Stablecoins and On-Chain Transfers Can Cut Costs and Delays

Micro-answer

USD/EUR stablecoins plus local off-ramps can reduce fees, cut settlement from days to minutes and minimise FX spread for low-income senders.

The pattern looks like this.

Sender loads dollars or pounds from a US/UK bank, card or wallet into a regulated platform.

Funds are converted into a reputable USD or EUR stablecoin.

Stablecoins move on-chain (often within seconds or minutes).

A local partner in Egypt, Morocco, Jordan or Lebanon cashes out into local currency via bank account, mobile wallet balance or agent.

When designed well, blockchain-based financial inclusion solutions can:

Avoid multi-step correspondent chains and opaque FX spreads

Offer transparent fees upfront

Support small, frequent payments that are uneconomical for banks

Realistic Delivery Models.

There is no one “super app” that magically solves this. You’ll typically combine:

Regional exchanges and VASPs (e.g., licensed platforms in Bahrain, UAE and other hubs) that handle crypto-fiat conversion under CBB, VARA, ADGM or SCA rules.

Local fintechs and banks providing e-money accounts, prepaid cards or mobile wallets.

Agent networks and merchants for rural cash-in/cash-out and QR payments.

From a controls perspective, US and EU partners will expect:

PCI DSS for card data, SOC 2 for security and availability

Strong AML/KYC, FATF Travel Rule implementation for on-chain transfers

Clear sanctions screening and transaction monitoring, often with Chainalysis-style tools on the rails themselves.

Regulation, Compliance and Risk.

To use crypto for financial inclusion without creating new problems, you have to work inside a layered regulatory stack: MENA central banks and digital-asset laws, plus MiCA, BaFin, FCA, GDPR/DSGVO, UK-GDPR and US rules from FinCEN/OFAC.

MENA Crypto Regulation 101.

Key trends across MENA include.

UAE

Multiple regimes (ADGM, DIFC, VARA, SCA) license VASPs, with specific rules for crypto tokens, custody and market integrity.

Bahrain

The CBB has a well-established crypto-asset regulatory framework and a fintech sandbox, hosting licensed exchanges and custody providers.

Saudi Arabia

SAMA runs a Regulatory Sandbox that admits fintechs experimenting with digital payments and new rails, aligned with Vision 2030.

Egypt & Jordan

Both central banks run thematic regulatory sandboxes, mostly focused on payments, lending and open banking, but relevant to tokenised or blockchain-based models.

Many jurisdictions still prohibit unlicensed crypto trading or speculative activity, even as they explore CBDCs and tokenisation. Humanitarian and remittance projects must therefore work with licensed VASPs or banks, not grey-market platforms.

How US, UK and EU Rules Affect MENA Inclusion Projects

Micro-answer

Cross-border inclusion projects must align MENA rules with MiCA/UK/FATF standards plus data-protection laws like GDPR and UK-GDPR.

Key overlays.

MiCA (EU Regulation 2023/1114) fully applies from December 2024, harmonising crypto-asset regulation across the EU and making national supervisors such as BaFin responsible for enforcement in Germany.

The FCA’s financial-promotion rules for cryptoassets apply to all firms marketing to UK consumers, including overseas NGOs and platforms.

The EU GDPR/DSGVO and UK-GDPR require lawful bases, minimised data and strong security when handling refugee or beneficiary data, often more stringent than some local frameworks.

FATF Travel Rule and the EU’s updated Transfer of Funds Regulation (TFR) set expectations for originator/beneficiary data on crypto transfers.

Practically, this means drafting data-protection impact assessments, choosing EU/UK cloud regions (AWS, Azure, GCP) carefully, and ensuring contracts with MENA partners include GDPR-grade clauses something Mak It Solutions already handles in its cloud and data projects in the GCC and EU. (Mak it Solutions)

Managing Real Risks

Regulators worry about.

Volatility of non-stablecoin assets wiping out poor users’ savings

Scams and rug pulls targeting low-literacy communities

Sanctions evasion and terrorist financing

Loss of private keys or credentials without recourse

NGOs, banks and fintechs can mitigate these risks by:

Using only fiat-backed stablecoins from reputable, well-regulated issuers

Strictly separating “utility rails” from speculative trading interfaces

Implementing limits, tiered KYC and strong consumer disclosures in Arabic/French/English

Logging on-chain activity with robust analytics and real-time sanctions screening

DeFi, Web3 and Impact Finance.

DeFi and Web3 can move beyond basic wallets into micro-credit, SME financing and tokenised aid but only if governance, risk and compliance are first-class citizens.

DeFi Lending and Savings Pilots for MENA SMEs and Farmers

DeFi lending can, in theory, connect global liquidity with MENA SMEs or farmers via:

Tokenised invoices or purchase orders

Stablecoin-denominated micro-loans

“Savings vaults” that share protocol yields with users

In practice, impact-oriented pilots often use permissioned or whitelisted DeFi, where only vetted borrowers and liquidity providers participate and where on-chain contracts are mapped to real-world legal agreements. Development banks, DFIs and actors like KfW or GIZ will expect conservative risk modelling, transparent governance and clear exit strategies.

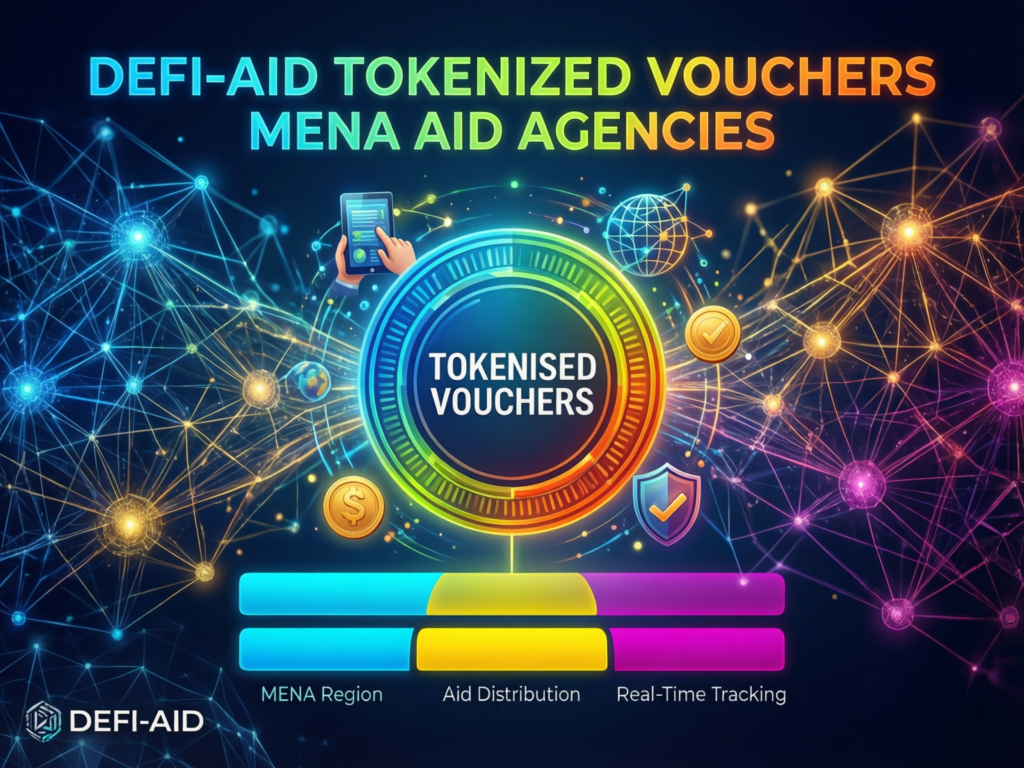

Tokenised Aid, Cash Transfers and Identity on Blockchain

Micro-answer.

Tokenised vouchers and blockchain IDs can speed up aid delivery and improve traceability, but only if designed for low-literacy, low-connectivity users.

Humanitarian agencies in MENA are testing models where.

Beneficiaries receive tokenised vouchers that can be redeemed at approved merchants

IDs are anchored to a blockchain with privacy-preserving techniques and off-chain storage of sensitive data

NGOs and donors see real-time dashboards of how funds move, reducing fraud and leakage

For fragile contexts (Yemen, parts of Syria, Gaza), solutions must work offline or with intermittent connectivity, integrate with existing cash-and-voucher programmes and never require users to manage seed phrases.

What Impact Investors and Development Banks Look for in Web3 Inclusion Deals

Impact investors, DFIs and EU programmes typically look for:

Strong governance and board oversight

Clear regulatory alignment (MiCA, BaFin, FCA, local central banks)

ESG reporting aligned with SDG metrics

Robust data protection and cybersecurity posture (e.g., SOC 2, ISO 27001)

Credible local partners in Cairo, Amman, Casablanca, Dubai or Riyadh

A Web3 inclusion project that can’t pass a standard development-finance due-diligence process will not scale, no matter how elegant the protocol.

How to Design Crypto Products That Truly Reach Unbanked Users in MENA

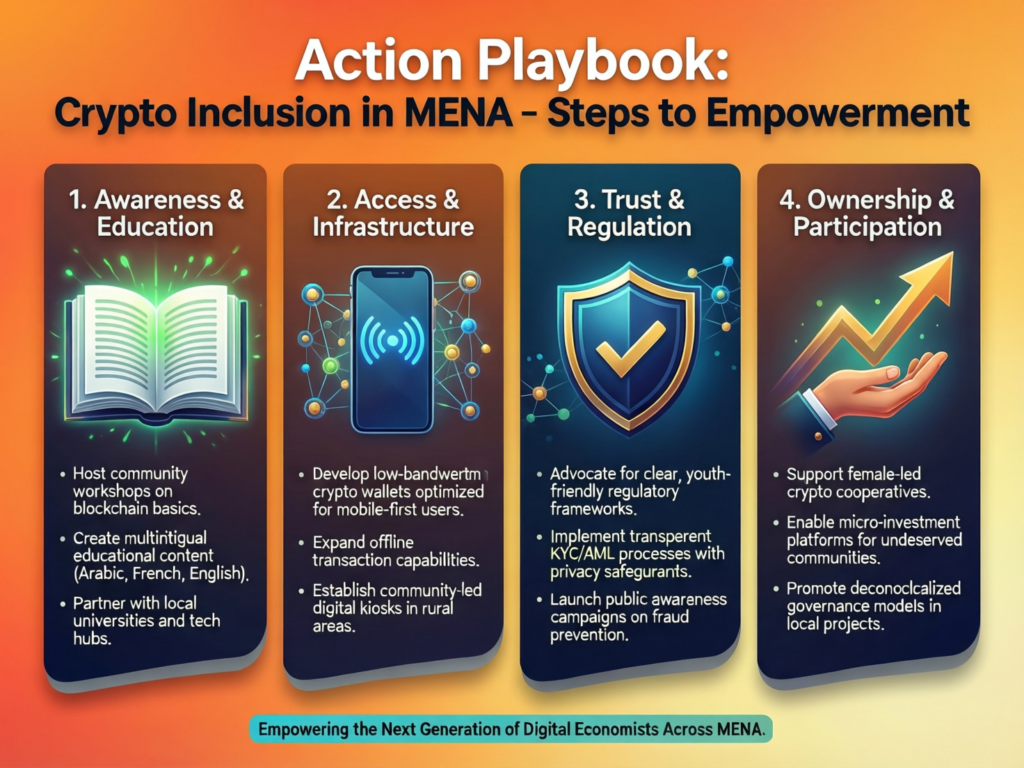

Crypto products genuinely reach unbanked MENA users when they start from field research, use low-tech channels and embed risk and privacy controls from day one. NGOs, development banks and fintechs should treat UX, compliance and partner selection as a single integrated design problem not three separate tracks.

Ground Research and Co-Design With Local Communities

Effective projects begin with.

Ethnographic research and interviews with women, migrants, refugees and merchants in Cairo, Alexandria, Casablanca, Amman, Beirut, Aden or rural areas

Co-design workshops with community-based organisations, MFIs, local NGOs and sharia scholars where relevant (especially in GCC or conservative contexts)

Small pilots (a few hundred users) with clear hypotheses and metrics

Mak It Solutions often combines this with broader digital roadmaps—e.g., mapping how a new wallet will integrate with mobile apps, cloud infrastructure and BI dashboards so NGOs can track impact in near real time. (Mak it Solutions)

Product Principles.

Micro-answer.

Winning products run on basic phones, support Arabic/French/English, and provide offline or USSD/SMS flows where connectivity is weak.

Practical design principles.

Mobile-first, with lightweight Android apps and responsive web for low-end devices

USSD/SMS and IVR fallbacks for rural areas or older users

Interfaces in Arabic, French and English, with icons and voice prompts to support low literacy

Simple concepts: “balance,” “voucher,” “send,” “cash out” not “liquidity pools” or “APY”

Clear support for dispute resolution and human help via call centres, WhatsApp or local agents

Compliance-by-Design

Compliance-by-design means.

Tiered KYC

Tier 0: minimal KYC + low limits for basic wallets (e.g., SIM-KYC + agent verification)

Tier 1–2: stronger KYC for higher limits or business accounts

Built-in transaction monitoring and simple risk scores

Data minimisation, encryption and GDPR/UK-GDPR-aligned privacy policies from day one

Here Mak It Solutions’ experience with cloud cost optimisation, multi-cloud strategies and data governance for GCC CIOs can be repurposed: the same zoning and data-residency patterns that serve PDPL and GDPR can underpin safe Web3 inclusion pilots. (Mak it Solutions)

Action Playbook for US, UK and EU Stakeholders Working on MENA Crypto Inclusion

Think of this section as your practical “how-to” for going from idea to pilot.

For US Fintechs and NGOs.

US-based teams in New York, Washington DC or San Francisco should.

Map corridors and users: e.g., US→Egypt, US→Morocco, US→Lebanon, focusing on migrants’ income levels and device access.

Screen potential partners: licensed VASPs, banks and fintechs in UAE, Bahrain, Egypt or Jordan, checking licences, audits and SOC 2/PCI DSS status.

Run OFAC, FinCEN and FATF risk assessments on products and flows.

Start with a tightly scoped pilot, with impact metrics (cost reduction, speed, leakage, female uptake) baked into the design.

For UK Charities and London Fintech Firms.

From London or Manchester, you’ll need to:

Align any UK-facing promotions with FCA crypto financial-promotion rules and related guidance.

Frame projects in terms of consumer protection, value for money and SDGs, echoing FCDO-style development logic.

Focus on corridors like UK→Egypt, UK→Morocco, UK→Pakistan via GCC, where remittance prices remain high and large diaspora communities already send funds regularly.

For German/EU Banks and Impact Funds

For Berlin, Frankfurt or Brussels teams.

Treat MiCA and BaFin as your baseline, not afterthoughts: any MENA-linked VASP partners should be able to pass MiCA-equivalent scrutiny.

Ensure GDPR-grade data-protection contracts and a clear stance on Travel Rule, TFR and sanctions.

Use EU or German development-finance tools (KfW, EIB, EU neighbourhood programmes) to de-risk pilots via blended finance or guarantees.

Key Takeaways

Crypto is a rail, not a religion: stablecoins, wallets and tokenisation should complement not replace mobile money, CBDCs and banks.

The biggest early wins are in remittances, aid disbursements and SME cash-flow support, not speculative trading.

Regulatory alignment (MiCA/FCA/BaFin + MENA sandboxes) and GDPR-grade data protection are non-negotiable for US/UK/EU institutions.

Design must be mobile-first, low-tech-friendly and language-local, built with and for women, migrants and refugees.

Impact investors and DFIs will back projects that show concrete cost/time savings, strong governance and local partnerships.

How to Prioritise Countries, Corridors and Partners

For a first pilot, pick 2–3 focus markets that combine:

High remittance volumes or aid flows (e.g., Egypt, Morocco, Jordan, Lebanon)

Reasonably clear digital-asset or payments regulation (e.g., UAE, Bahrain, Saudi Arabia, Jordan, Egypt)

Strong local partners (banks, fintechs, NGOs, agent networks)

Then choose one corridor and one use case for example, UK→Jordan remittances for refugees, or EU→Morocco cash-for-work programmes and design the rails, UX and compliance stack specifically for that scenario before expanding.

Download the Full Playbook / Book a Strategy Workshop

If you sit in a US NGO, a UK charity or a German/EU bank or impact fund, you don’t need to figure this out alone. A practical next step is to commission a short, cross-functional strategy sprint mapping corridors, risks and product options and then move into a tightly scoped pilot with clear learning goals.

If you’d like help turning this outline into a real-world pilot, Mak It Solutions can support you from concept note to production launch combining MENA cloud architecture, mobile apps, data analytics and compliance-aware product design. Share your target corridors, user segments and regulatory constraints, and request a scoped estimate or a strategy workshop to stress-test your ideas before you commit serious budget. (Click Here’s )

FAQs

Q : How realistic is it to use crypto for financial inclusion in fragile and conflict-affected MENA states?

A : It is realistic, but only in very controlled, partnership-heavy ways. In fragile states like Yemen, parts of Syria or Gaza, connectivity, security and governance risks are much higher than in cities such as Cairo or Dubai. Crypto rails can still help move funds quickly and transparently to trusted NGOs or merchants, but last-mile delivery often needs hybrid models: vouchers, cash-out via agents, offline cards and strong community validation. Most actors start with tightly scoped, tokenised aid or remittance pilots, with conservative limits and active monitoring to avoid abuse.

Q : What data and impact metrics should NGOs track in a MENA crypto inclusion pilot?

A : For a crypto-inclusion pilot, you should track cost, speed, reliability and inclusion. That means baseline vs pilot remittance fees, average settlement time from donor to beneficiary, failure or dispute rates, and user-level metrics such as percentage of women users, rural users and first-time account owners. Qualitative data user satisfaction, perceived safety, trust in the system matters as much as quantitative metrics. Donors will want evidence of cost savings and better traceability, without new harms like data breaches or scams, before they scale.

Q : How can traditional banks in MENA partner with Web3 startups without taking on excessive regulatory risk?

A : Traditional banks can start by treating Web3 firms as specialised technology partners, not deposit-taking competitors. They can provide accounts, FX, custody or compliance services to licensed VASPs and wallet providers while keeping retail engagement under their own brand. Joint sandboxes with central banks, ring-fenced pilot environments, clear SLAs and rigorous due diligence on security, AML and governance all reduce risk. By keeping speculative products separate from remittance and inclusion rails, banks can support innovation while satisfying supervisors in the UAE, Saudi Arabia, Bahrain, Egypt or Jordan.

Q : What are the main differences between using stablecoins, CBDCs and mobile money for unbanked users in MENA?

A : Stablecoins are typically hard-currency-linked digital tokens that can be held in non-custodial wallets and moved across borders quickly; they’re strong for remittances and on-chain savings but depend on private issuers and local off-ramps. CBDCs are state-issued digital currencies that may plug directly into domestic payment systems and social transfers but remain mostly in pilot stages in MENA. Mobile money is already proven for inclusion, with agents and USSD interfaces that work well for basic phones, but often struggles with cross-border interoperability. The right answer is usually a blend: stablecoins for cross-border rails, CBDCs or central-bank systems where available, and mobile money for last-mile access.

Q : How can US, UK and EU donors avoid “testing crypto on the poor” while still supporting innovation in MENA?

A : The simplest safeguard is to apply the same ethics, consent and risk standards you’d use for any financial or digital programme crypto or not. Start with clear problem statements (e.g., “reduce remittance costs by 30% for X corridor”), involve affected communities in design and ensure beneficiaries always have a non-crypto fallback route. Independent ethics review, transparent communication about risks and rights, and robust data-protection practices (GDPR/UK-GDPR-grade) are essential. Donors should fund open evaluations and share lessons, including what didn’t work, so that MENA communities benefit from collective learning rather than repeated experiments on the same vulnerable groups.