‘Fat-Finger’ Fail? Cardano Whale Torches $6M After Hitting Illiquid USDA Pool

A dormant Cardano wallet sparked major attention after it accidentally routed a massive swap through the highly illiquid Cardano whale USDA pool, triggering one of the largest on-chain slippage events on the network. With almost no liquidity to support the transaction size, the trade instantly collapsed the pool’s depth and exposed how dangerous thin liquidity can be for high-value swaps.

The wallet attempted to exchange 14.4 million ADA—worth about $6.9 million—but received only 847,695 USDA in return. This meant the holder effectively lost around $6.05 million in a single transaction. The incident highlights the critical need for traders to verify pool depth, use routing safeguards, and rely on tools that prevent catastrophic slippage before executing large swaps on decentralized platforms.

What happened in the Cardano whale illiquid USDA pool trade

The wallet, inactive since 2020, reappeared and executed a market-style ADA→USDA swap through a shallow pool.

Execution priced USDA at more than $8 per token far above its intended $1 peg leaving the trader with under $0.06 on the dollar. CoinDesk

The order briefly lifted USDA to around $1.26 on Cardano DEXs before retracing near peg as liquidity normalized.

Market context and slippage mechanics

Large orders against automated market makers move price along the bonding curve; in micro-cap or low-liquidity pools, price impact accelerates sharply. Here, USDA’s limited depth and modest market capitalization compounded slippage, converting $6.9M in ADA into ≈$0.85M in USDA.

Why the Cardano whale illiquid USDA pool route proved costly

Thin depth

Insufficient counter-liquidity to absorb 14.4M ADA.

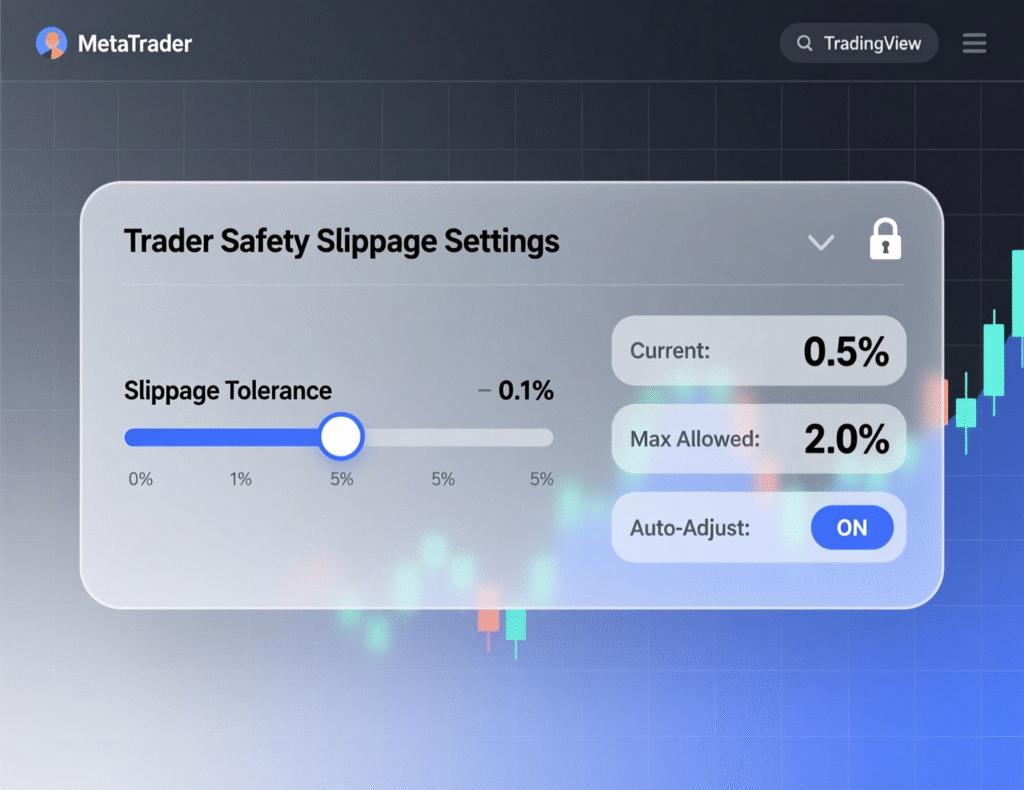

No/loose slippage checks

A protective max-slippage parameter likely wasn’t set or was too high.

Ticker confusion risk

Cardano hosts multiple USD-denominated assets with similar tickers, increasing error likelihood.

Reaction and verification

ZachXBT highlighted the transaction, after which multiple outlets reported the loss; price trackers reflected the brief USDA peg deviation and subsequent normalization.

Context & Analysis

The incident is a textbook AMM failure mode: routing a very large clip into a thin pool without guardrails. It also shows operational risk for dormant wallets resurfacing years later tooling, tickers, and liquidity change, and assumptions from 2020 no longer fit 2025 markets.

Conclusion

Stronger default slippage protections, clearer ticker and contract displays, and more reliable routing are expected to become key discussion points across Cardano DeFi. The recent incident has highlighted how easily users can be misled by poor interface cues or unsafe automated paths during large swaps.

For high-value transfers, staged execution and pre-trade simulation are becoming essential practices. Breaking orders into smaller parts and testing routes can drastically reduce the risk of catastrophic losses. As Cardano’s DeFi ecosystem grows, these safeguards will likely become standard to protect users from thin liquidity and unexpected price impacts.

FAQs

Q : What exactly happened in the Cardano whale illiquid USDA pool trade?

A : A large ADA swap was executed into a very thin USDA liquidity pool, causing extreme slippage and converting roughly $6.9M in ADA into only ~847K USDA.

Q : Who flagged the transaction?

A : On-chain investigator ZachXBT first highlighted the incident via Telegram.

Q : Did USDA de-peg?

A : Yes USDA briefly traded above $1 on Cardano DEXs due to the massive price impact, but later returned toward its peg.

Q : Could slippage settings have prevented this?

A : Yes. Tight slippage limits and splitting the swap into multiple smaller trades would have significantly reduced losses.

Q : Was the wallet truly dormant?

A : Reports indicate the wallet had no activity for nearly 5 years before performing this swap.

Q : How can traders reduce similar risks?

A : Simulate trades before execution

Use strict slippage settings

Verify tickers & contract addresses

Break large trades into smaller chunks

Q : Did ADA’s market price react?

A : ADA’s broader market price fluctuated that day, but the incident primarily impacted the thin USDA pool, not the global price.

Facts

Event

Large ADA→USDA swap in illiquid pool causes ~$6.05M realized lossDate/Time

2025-11-17T11:20:00+05:00Entities

Cardano (ADA); USDA (Cardano-native USD stablecoin); on-chain investigator ZachXBTFigures

14.4M ADA (~$6.9M) swapped for 847,695 USDA; loss ≈$6.05M; USDA briefly ~$1.26 on DEXs (nominal). CoinDeskQuotes

“The trade was first flagged by on-chain investigator ZachXBT in their Telegram channel.” CoinDesk report. CoinDeskSources

CoinDesk; Cointelegraph (via TradingView)