EU ban on Russian crypto transactions advances in new sanctions push

European Union officials are moving toward an EU ban on Russian crypto transactions in a new sanctions proposal designed to close loopholes that, officials say, have allowed Russia-linked crypto activity to persist despite earlier restrictions.

EU targets Russian crypto with a blanket prohibition

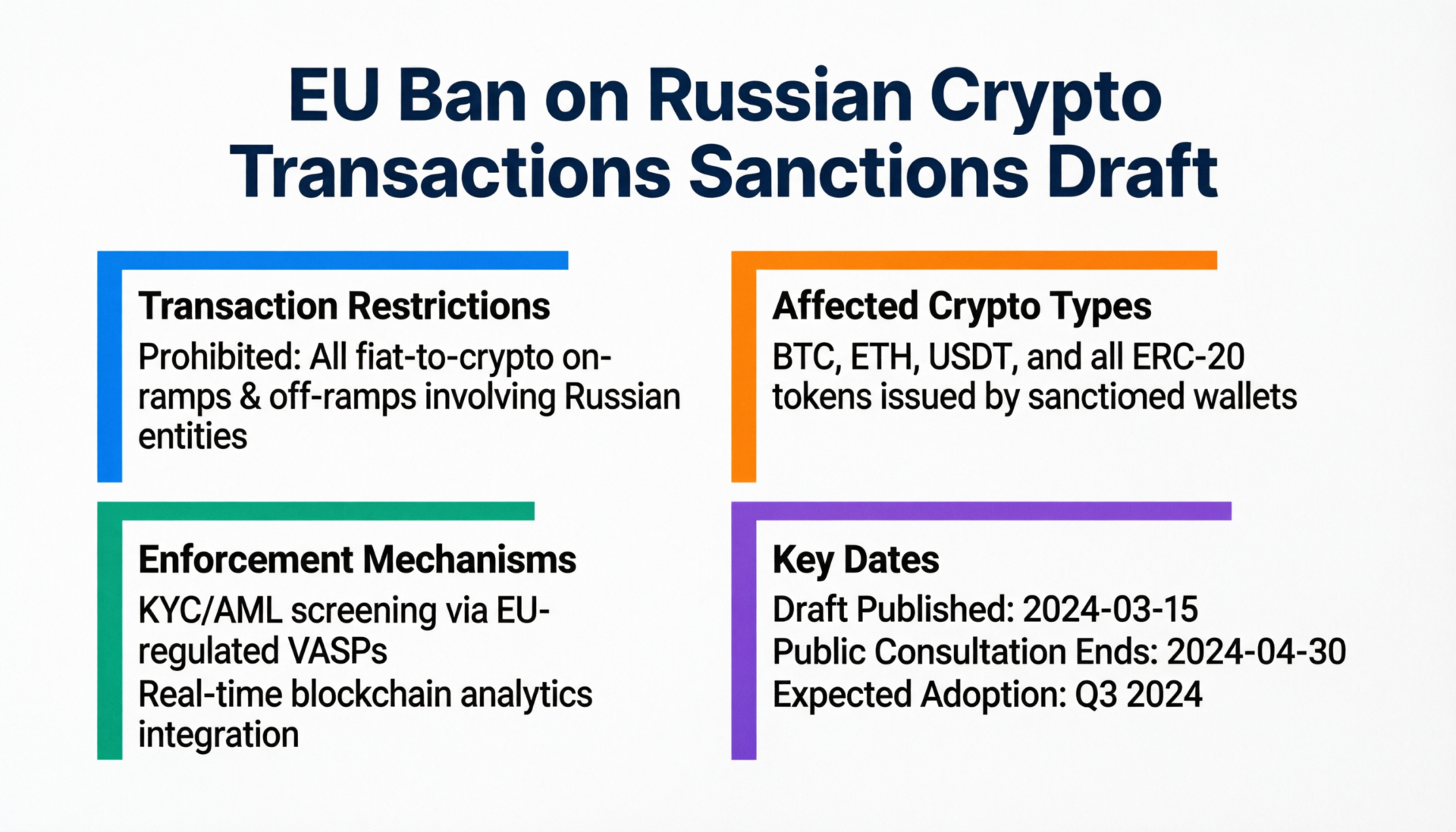

The European Commission’s draft 20th sanctions package would bar EU individuals and companies from engaging in cryptocurrency transactions involving any crypto-asset service provider established in Russia shifting from targeting specific platforms to restricting the broader pipeline.

Reporting on the draft says the approach is meant to prevent sanctioned entities from rebranding, changing corporate structures, or rerouting flows through replacement providers.

The proposal would still need unanimous approval by all 27 EU member states, a requirement that can complicate adoption and enforcement timelines.

What the EU ban on Russian crypto transactions is designed to stop

EU officials have argued that crypto assets including stablecoins and other digital payment rails can provide alternative channels for cross-border value transfer outside traditional banking oversight, which sanctions frameworks historically relied on.

In reporting on the draft, additional restrictions are described as targeting specific Russia-linked digital finance components, including a payment platform and a ruble-linked stablecoin, as well as transactions involving a prospective digital ruble.

Compliance pressure points under the EU ban on Russian crypto transactions

If adopted, the ban would likely concentrate compliance obligations on EU-based exchanges, brokers, custodians, and other regulated intermediaries, requiring enhanced screening of counterparties, service-provider establishment, and potentially exposure to Russia-linked rails described in the draft reporting.

Russia deepens crypto investment push via mining finance

While Brussels seeks to tighten external channels, Russia’s domestic crypto economy is expanding through institutional products tied to mining.

Finam, a major Russian brokerage, has launched (and has been reported as receiving regulatory registration/approval for) a crypto mining investment fund registered with the Bank of Russia, offering investors structured exposure to mining operations rather than direct token holdings.

Separate reporting describes the vehicle as financing industrial mining infrastructure, including gas-powered operations and facilities in regions such as Mordovia, positioning mining as an investable, regulated theme inside Russia.

Context & Analysis (labeled)

The proposed blanket approach reflects a policy judgment that targeting individual exchanges or wallets can be outpaced by rapid substitution—new providers, rebranding, and routing through third countries.

At the same time, Russia’s emphasis on regulated mining investment products suggests a domestic shift toward formal channels for crypto-linked returns, potentially reducing reliance on offshore access points targeted by external sanctions.

Final Thoughts

The Commission’s proposal, if unanimously approved and implemented, would mark one of the EU’s broadest crypto-related sanctions moves to date while Russia’s financial sector continues building regulated pathways for crypto-linked investment, particularly through mining finance.

FAQs

Q : What is the EU proposing on Russia-linked crypto activity?

A : The European Union is considering a draft sanctions proposal that would prohibit EU persons and firms from any crypto dealings involving a crypto-asset service provider established in Russia, regardless of whether that provider is directly sanctioned.

Q : Does the proposal target only specific exchanges?

A : No. The approach shifts away from listing named exchanges toward a blanket prohibition on Russia-established crypto service providers, aiming to close loopholes created by rebranding or routing transactions through intermediaries.

Q : When could the new restrictions take effect?

A : The package would require unanimous approval by all 27 EU member states. The timeline depends on negotiations and the final legal text, so there is no fixed effective date yet.

Q : How does the EU ban on Russian crypto transactions relate to stablecoins?

A : Draft reporting references restrictions tied to Russia-linked digital finance infrastructure, including a ruble-linked stablecoin and potential digital-ruble-related transactions, suggesting stablecoins connected to Russia could also fall under the ban.

Q : What is Finam’s new crypto-related product in Russia?

A : Finam has launched/registered a crypto mining investment fund with the Bank of Russia, offering structured exposure to mining operations.

Q : What did Joachim Nagel say about euro stablecoins?

A : In a Deutsche Bundesbank-published speech, Joachim Nagel said euro-denominated stablecoins may have merit for payments, even as work continues on a digital euro and wholesale CBDC.

Q: What is the GENIUS Act mentioned in U.S. stablecoin policy?

A : According to U.S. government sources, the GENIUS Act was signed into law on July 18, 2025, creating a regulatory framework focused on payment stablecoins.

Facts

Event

European Commission drafts a proposal to prohibit EU crypto transactions involving Russia-established crypto service providers; Russia expands regulated mining investment productsDate/Time

2026-02-17T10:57:00+05:00 (based on reported publication time)Entities

European Commission; European Union; Russia; Finam (broker); Bank of Russia; Deutsche Bundesbank; Joachim NagelKey points (reported)

“Blanket ban” approach; part of 20th EU sanctions package; unanimous approval required; mining investment fund registered/approvedSources

Financial Times report on draft sanctions; Bundesbank speech page; reporting on Finam mining fund