Ethereum validator exit queue to spike as Kiln moves tokens

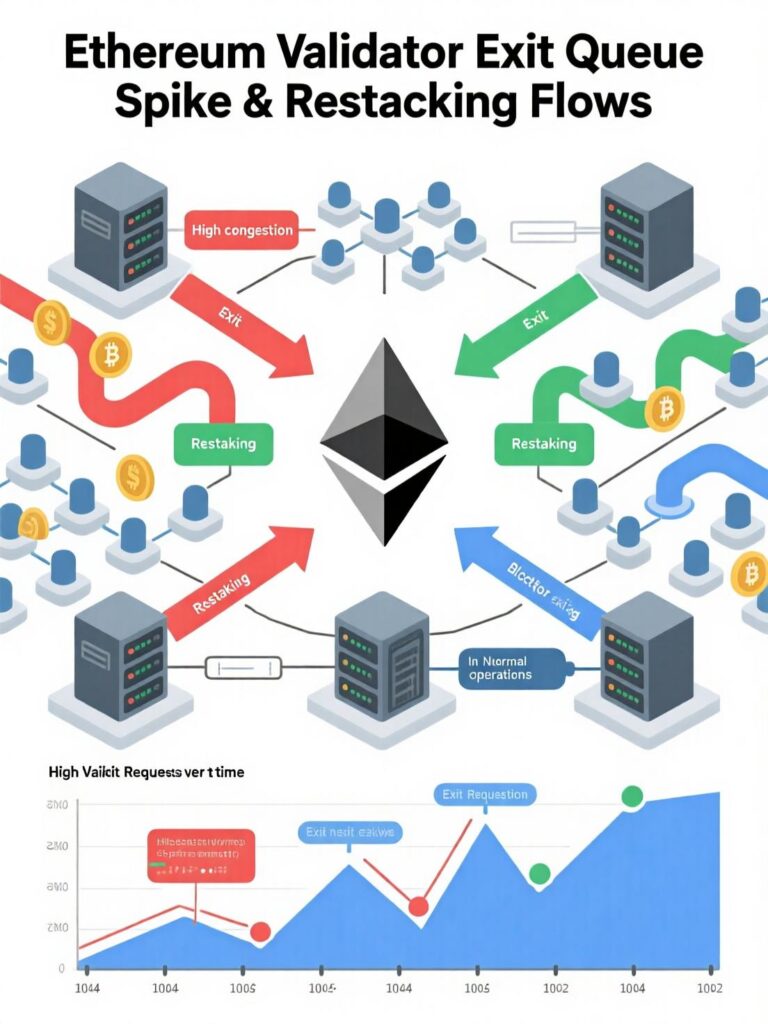

The recent spike in Ethereum’s validator exit queue appears to be a short-term event rather than a sign of large-scale selling pressure. The exits are linked to a security issue involving SwissBorg’s staking partner, Kiln, which led many validators to withdraw as a protective measure. This precautionary step has temporarily increased exit activity, creating concern in the market.

However, experts emphasize that most of the withdrawn ETH is expected to be restaked rather than sold. Validators are likely to shift their funds under new, secure validator keys to maintain staking rewards and network participation. This suggests the incident is more about safeguarding infrastructure than signaling bearish sentiment, reinforcing confidence that Ethereum’s staking ecosystem will remain strong despite the disruption.

Why the Ethereum validator exit queue spike is happening

Kiln began an “orderly exit” of Ethereum validators after SwissBorg disclosed that attackers exploited a vulnerability in Kiln’s API on another network (Solana), draining about 193,000 SOL from SwissBorg’s Earn program. Kiln said winding down validators is a defensive move to safeguard client assets across all networks while they rotate keys and harden processes.

What the Ethereum validator exit queue spike means for selling pressure

Ethereum educator Anthony Sassano expects the ETH in flight to be restaked with fresh keys, not sold. Practically, that points to operational rotation not an investor exodus so the spike shouldn’t automatically be read as bearish.

By the numbers behind the Ethereum validator exit queue spike

Exit queue: ~1,628,074 ETH waiting to withdraw

ETH staked: ~35.5M ETH, about 29.36% of supply

Context: Large outflow requests can look scary in dashboards, but they often reflect infrastructure hygiene (key rotation, custodian changes, or provider consolidation) rather than directional bets.

Exits over 10–42 days

Because of the Ethereum validator exit queue spike, withdrawals will roll out in batches. Kiln estimates 10–42 days for validators to fully exit, depending on each validator’s position in the queue and protocol constraints. That staged cadence helps smooth any impact on network metrics and liquidity.

Market snapshot and what to watch

As the Ethereum validator exit queue spike unfolds, ETH was recently quoted around $4,306 at the time of writing. Near-term, watch for:

Restaking activity as exited validators come back online under new keys

Queue dynamics: a declining exit queue and a rising deposit/restake queue would confirm rotation over liquidation

Operator updates from Kiln/partners as they complete their defensive playbook

Recent history, same lesson

Ethereum has already weathered periods of record entry and exit queues from a multi-week wave of planned exits to surges in staking demand from institutions. The takeaway: queue spikes are cyclical, and context (why exits are happening) matters more than the raw number.

Bottom line

The recent spike in Ethereum’s validator exit queue seems to reflect precautionary measures rather than a wave of mass selling. Validators are likely withdrawing temporarily to address security concerns and then restaking their ETH under safer setups. This indicates that the exits are more about maintaining security than signaling bearish market sentiment.

For long-term Ethereum participants, the bigger picture lies elsewhere. Key factors include stronger validator security practices, the continued growth of restaking activity, and the steady involvement of institutional players. These trends highlight resilience in the ecosystem and reinforce confidence in Ethereum’s staking economy moving forward.