Ethereum Price Prediction 2023-2032: Analyzing Factors Behind the $8,361 Forecast and Recent Market Developments

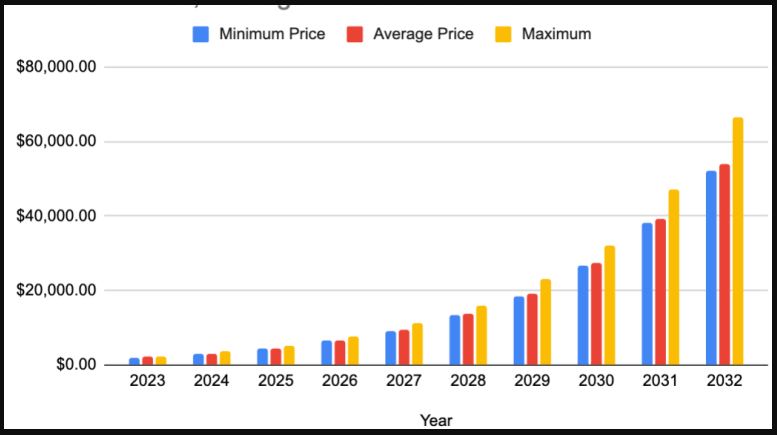

**Ethereum Price Predictions 2023-2032:**

1. **2023:** Projected to reach $2,517

2. **2026:** Anticipated to climb up to $8,361

3. **2029:** Foreseen at $26,021

4. **2032:** Predicted to soar to $77,366

*Fact Check: “The Merge did not change anything for holders/users.”*

While this statement holds true, sustained market recovery relies on new investments. Without fresh capital infusion, Ethereum may struggle to surpass its all-time high. Potential catalysts include retail participation, developments like Coinbase or NFT marketplaces, and the influence of crypto whales.

**Current Ethereum Overview:**

– Current Price: $2,292.34

– 24-Hour Trading Volume: $12,719,578,053

– Rank: #2 on CoinMarketCap

– Market Cap: $270,390,998,653

– Circulating Supply: 120,186,944 ETH

**Price Analysis (as of December 22, 2023):**

– Bullish Trend: Ethereum exhibits a strong bullish trend

– Support Level: $2,161.22

– Resistance Level: $2,278.12

– Recent Surge: ETH reaches $2,292.34, indicating a robust bullish momentum.

**Recent News and Opinions:**

1. **Versatus Labs’ Funding Boost:**

– Raised $2.3 million in seed funding for Ethereum scalability.

– LASR project aims to enhance Ethereum’s scalability, set to launch on the test net in January.

– Partnerships with EigenLayer and Stader Labs to further scaling initiatives.

2. **Large Investors Boost Ethereum’s Value:**

– Whales accumulating Ethereum, with over 1,000 addresses holding 10,000+ ETH.

– Impact on Market Price: Potential stabilization and surpassing the $2,000 mark.

– MVRV Z-score: Indicates Ethereum may be undervalued, currently at 0.40.

3. **Strategic Insights for Investors:**

– Long-term holders may benefit, given the Seller Exhaustion Constant at 0.055.

– Stable metrics suggest a conducive investment environment around the $2,000 price point.

Ethereum Price Predictions 2023-2032

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $2,214.53 | $2,447.64 | $2,517.57 |

| 2024 | $3,332.19 | $3,454.57 | $4,167.29 |

| 2025 | $4,702.56 | $4,875.28 | $5,877.50 |

| 2026 | $6,888.28 | $7,083.29 | $8,361.04 |

| 2027 | $10,450.58 | $10,804.74 | $12,009.41 |

| 2028 | $15,113.58 | $15,545.77 | $18,310.07 |

| 2029 | $22,631.04 | $23,252.87 | $26,021.98 |

| 2030 | $30,632.65 | $31,562.77 | $38,638.06 |

| 2031 | $44,728.92 | $46,307.06 | $53,650.88 |

| 2032 | $62,401.27 | $64,716.62 | $77,366.01 |

**Ethereum Price Prediction 2023: Unlocking the Potential**

In 2023, Ethereum is poised for substantial growth. Our predictions indicate a minimum trading price of $2,214.53, with an average value of $2,447.64. Considering ecosystem upgrades and market dynamics, Ethereum could surge to a maximum price of $2,517.57 by the year’s end. Stay informed to navigate the crypto market effectively.

**Ethereum Price Prediction 2024: Building Momentum**

As we look ahead to 2024, Ethereum’s journey continues with a forecasted minimum price of $3,332.19. The average trading price is expected to be $3,454.57, with the potential for Ethereum to peak at $4,167.29. Keep a close eye on the evolving crypto landscape for strategic investment decisions.

**Ethereum Price Prediction 2025: Charting Growth Paths**

In 2025, Ethereum’s price trajectory points towards a minimum of $4,702.56, an average of $4,875.28, and a potential maximum of $5,877.50. Explore the possibilities of significant growth and position yourself for success in the dynamic crypto market.

**Ethereum Price Prediction 2026: Surging Towards New Heights**

Projections for 2026 showcase Ethereum’s minimum at $6,888.28, an average of $7,083.29, and a potential maximum of $8,361.04. Witness Ethereum’s ascent to new heights and adapt your investment strategy accordingly.

**Ethereum Price Prediction 2027-2032: Strategic Insights for Long-Term Gains**

Looking ahead to 2027-2032, Ethereum’s bullish trend unfolds. Stay ahead with our forecasts, providing insights into minimum, average, and potential maximum prices each year. Anticipate the crypto market’s evolution for informed, long-term investment decisions.

**Wallet Investor’s Ethereum Price Prediction: A Cautionary Note for Long-Term Investors**

Wallet Investor takes a bearish stance on Ethereum, labeling it as a potentially poor long-term investment. Their forecast suggests Ethereum’s value will decline to $1564.380 in one year, projecting a substantial devaluation of -73.425% over the next five years. Explore the reasons behind this outlook and consider alternative perspectives for a comprehensive investment strategy.

**The Crypto City’s Insights: Navigating Ethereum’s Fluctuations**

According to The Crypto City, Ethereum’s 2023 outlook is characterized by a maximum trading price of $2,529, an expected minimum of $1,720, and an average of $2,023. Prepare for potential fluctuations as The Crypto City anticipates a maximum price of $2,133 in 2025, with a minimum of $1,450 and an average of $1,706. By 2027, Ethereum’s forecast includes a maximum price of $3,098, an average of $2,457, and a minimum of $2,104. Stay informed about these dynamic projections for strategic decision-making.

**Digital Coin Price’s Bullish Perspective: A Bright Future for Ethereum**

Contrary to some bearish views, Digital Coin Price adopts a bullish stance on Ethereum. Their optimistic forecast predicts a maximum value of $5,050 by the end of 2023, with an average trading price of $4,916 and a minimum of $2,060. Looking ahead to 2026, Digital Coin Price envisions a peak of $10,418, a minimum of $8,853, and an average of $10,205. By 2029, Ethereum’s potential is forecasted to soar, reaching a maximum of $17,226, a minimum of $15,529, and an average trading price matching the maximum. The long-term vision for 2032 showcases Digital Coin Price’s optimism with a projected maximum price of $44,660, a minimum of $43,117, and an average trading price aligning with the maximum.

**Insights for Investors: Navigating Diverse Predictions**

As an investor, understanding the diverse forecasts from Wallet Investor, The Crypto City, and Digital Coin Price is crucial. Evaluate the factors influencing each prediction, weigh the risks and rewards, and tailor your investment strategy accordingly. Stay updated on evolving market dynamics to make informed decisions in the ever-changing world of cryptocurrency.

Currency Overview

| Cryptocurrency: Ethereum | Ticker Symbol: ETH |

| Price: $2,240 | Cryptocurrency: Ethereum |

| Circulating Supply: 120,256,040 ETH | Trading Volume: $3,46B |

| All-time high: $4,891.70 | All-time low: $0.4209 |

**Ethereum Milestones: London Hard Fork and EIP 1559**

The Ethereum network witnessed a game-changing event in September with the London Hard Fork, resulting in significant Ethereum burning. This upgrade, incorporating five Ethereum Improvement Proposals (EIPs), introduced EIP 1559. This proposal aims to enhance cryptocurrency mining efficiency and accelerate Ethereum-based network transactions, marking a crucial milestone in Ethereum’s evolution.

**The Merge: Ethereum’s Transition to Proof-of-Stake**

The Merge marks the culmination of Ethereum’s vision, aligning with scalability, security, and sustainability goals. The original execution layer merged with the Beacon Chain’s proof-of-stake consensus layer, eliminating energy-intensive mining. This exciting step enhances Ethereum’s environmental friendliness and sets the stage for a more secure and scalable future.

**Merging with Mainnet: A Paradigm Shift in September 2022**

On September 15, 2022, the Beacon Chain successfully merged with Ethereum Mainnet, transitioning to a proof-of-stake consensus. This officially retired ETH miners, reducing energy consumption by an impressive ~99.95%. The merge retained Ethereum’s transaction history, ensuring a seamless transition and maintaining the continuity of Ethereum’s features, including transactions, smart contracts, NFTs, and ERC protocols.

**The Merge and Sharding: Shaping Ethereum’s Future**

Originally planning to address scalability issues through sharding, Ethereum prioritized transitioning from proof-of-work (POW) to proof-of-stake (POS) with The Merge. The success of layer 2 scaling solutions influenced this shift. Sharding, the next major upgrade, focuses on optimizing data storage distribution, paving the way for exponential growth in network capacity.

**Ethereum Triple Halving: A New Era for Validators**

The Ethereum network underwent a triple halving with The Merge. Validators (stakers) replaced miners, receiving ~1,400 new ETH per day. This shift reduced the chain’s inflation rate from around 4.5% annually to a projected 0.5%. Ethereum is on the path to becoming deflationary, thanks to EIP1559 and the POS merge.

**Gas Fees Dynamics: EIP1559 and POS**

Contrary to popular belief, the POS merger is not expected to reduce gas fees. EIP1559, introduced in August, burned all base fees, contributing to a 3% reduction in the annual supply of ETH. The total issuance is anticipated to be around -2.5% per year, making Ethereum potentially deflationary. However, gas fees might rise, maintaining higher levels until the implementation of sharding in approximately six years.

**Rollup-Centric Ethereum: Revolutionizing Transaction Efficiency**

Rollups in Ethereum bring a revolutionary reduction in gas fees, ranging from 100 to 1000 times, by consolidating numerous transactions into a single one. This not only makes transactions more cost-effective but also offers the flexibility of using a mix of on and off-chain data computation. As the network congestion increases, gas fees become cheaper, creating a more affordable transaction environment.

**Ethereum Price Predictions Amidst Structural Changes**

With the introduction of Rollup-centric Ethereum, the question arises: Will existing Ethereum Price Prediction algorithms hold with this new structure? The upcoming Merge plays a crucial role in this scenario, impacting $ETH prices. While market trends and inflation slowing down contribute to Ethereum’s price surges, the Merge’s influence cannot be overlooked.

**Ethereum Virtual Machine and EIP 1559: Transforming Transaction Landscape**

The EIP 1559 upgrade addresses Ethereum’s transaction cost and congestion issues by introducing a simplified burning method. Over $1 billion worth of Ethereum coins have been burned since the upgrade, reshaping the Ethereum Virtual Machine’s role. Ethereum is positioned to evolve into a world computer, amplifying its value in NFT and DeFi spaces as a blockchain pioneer.

**Latest Developments: Peking University Research and London Upgrade Effects**

Recent developments around Ethereum include a research paper from Peking University, endorsed by Ethereum founder Vitalik Buterin. Additionally, the after-effects of the London upgrade are evident, with the network burning 36 percent of newly issued Ethereum in just two days. Stay informed about these advancements shaping Ethereum’s future.

**Liquidity Depth and Scalability Solutions: Key Discussion Points**

The liquidity depth of Ethereum sparks discussions across social media platforms, highlighting the community’s interest in resolving scalability issues. Ethereum’s transition from PoW to PoS is a significant step in enhancing scalability and making transactions cleaner, faster, more scalable, and cost-efficient. While speculators aim to navigate volatility, Ethereum holders and believers continue to play a vital role in shaping the ecosystem.

**Decentralized Applications (DApps) and Smart Contracts on Ethereum**

Discover how Ethereum’s open-ended, blockchain-based platform facilitates the creation of Decentralized Applications (DApps) and Smart Contracts. These smart contracts, executed on Ethereum’s decentralized network, eliminate the need for intermediaries, ensuring transparent and efficient transactions with well-defined terms.

**Ethereum Mining and Cryptocurrency Usage**

Uncover the role of Ethereum in app development, with developers requiring Ethereum for building and executing applications. Explore how users can transmit Ethereum through smart contracts and learn about the mining process, where validators (miners) contribute to the network’s stability, security, and safety by validating transactions.

**Acquiring Ethereum: Methods and Exchanges**

Get insights into various methods of obtaining Ethereum, from exchanges that accept fiat currency to trading with Bitcoin. Understand the significance of Ethereum in the crypto market and explore leading cryptocurrency exchanges for trading Ethereum, including Binance, OKEx, Mandala Exchange, CoinTiger, and Huobi Global.

**Ethereum Network History: Evolution and Milestones (2015-2023)**

Trace the historical evolution of the Ethereum network, from its initial coin offering in 2014 to the activation of Ethereum 2.0 in 2023. Explore significant milestones, such as the Homestead and Byzantium upgrades, the DAO hack of 2016, and the transition to Ethereum 2.0, aiming for scalability, security, and sustainability.

**Ethereum’s Impact on Finance: ICOs, DeFi, and Beyond (2019-2021)**

Understand Ethereum’s role in revolutionizing financing models, from initial coin offerings (ICOs) to decentralized finance (DeFi). Explore the challenges of scalability and energy consumption while acknowledging the continuous improvements and proposals, including EIP-1559 and the transition to Ethereum 2.0.

**Ethereum 2.0 and Notable Developments (2021-2023)**

Dive into the recent advancements in Ethereum, particularly the transition to Ethereum 2.0, marked by “The Merge.” Witness the shift from proof-of-work to proof-of-stake, reducing energy usage and enhancing scalability. Explore the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), solidifying Ethereum’s position in the blockchain ecosystem.

**EIP-1559, London Hard Fork, and Ethereum’s Future Outlook**

Learn about the impact of proposals like EIP-1559 and the successful implementation of the London hard fork. Explore Ethereum’s potential to overcome scalability challenges and its transition towards energy-efficient proof-of-stake consensus. Witness Ethereum’s resilience and relevance, with experts predicting a promising future for this groundbreaking technology.

**Additional Revenue Streams: Staking and Market Dynamics**

Explore the impact of Ethereum reaching its maximum price and the subsequent changes in transaction fees. Understand the shift to Layer 2 scaling solutions and the effects of the London hard fork on fee dynamics. Gain insights into staking as an additional revenue stream and Ethereum’s resilience in the face of market fluctuations.

**Conclusion: Ethereum’s Resilience and Future Prosperity**

In conclusion, Ethereum stands as a testament to resilience and continuous evolution in the dynamic realm of blockchain technology. From its inception to the recent strides with Ethereum 2.0, the platform has weathered challenges, adapted to market demands, and emerged stronger. The implementation of proposals like EIP-1559 and the successful London hard fork showcase Ethereum’s commitment to addressing scalability concerns and enhancing user experience.

Looking forward, the fundamental strengths of Ethereum, including its decentralized applications, smart contracts, and robust ecosystem, position it for a promising future in 2023 and beyond. As the blockchain landscape evolves, Ethereum’s adaptability and innovative spirit suggest that investors who embrace the long-term perspective are likely to witness positive returns.

In this era of transformative changes, Ethereum continues to inspire confidence in blockchain solutions. The ongoing upgrades and advancements signify a technology that is not only relevant but poised to soar to new heights. Whether you are an avid participant or an investor, Ethereum’s journey reflects a compelling narrative of growth, innovation, and sustained value. Explore additional resources to stay informed and navigate the exciting developments within the Ethereum ecosystem.

FAQ’s

1. Will Ethereum reach $10,000 in 2024?

While some predictions like Digital Coin Price forecast Ethereum reaching $10,418 by 2026, others like The Crypto City anticipate a maximum of $4,167.29 in 2024. It’s crucial to consider diverse forecasts and weigh the factors influencing each prediction before making investment decisions.

2. Is Ethereum a good investment?

Wallet Investor takes a bearish stance, but Digital Coin Price adopts a bullish perspective. Consider the reasons behind each outlook, assess your risk tolerance, and conduct thorough research before investing.

3. How will The Merge impact Ethereum’s price?

The Merge is expected to enhance Ethereum’s sustainability and potentially increase its value due to a reduction in supply. However, gas fees might not decrease immediately. Stay informed about market dynamics and evolving predictions.

4. What are the main challenges facing Ethereum?

Scalability limitations and high gas fees are key challenges, but The Merge and Sharding aim to address these issues. Stay updated on the development of these solutions and their potential impact on the network.

5. How can I buy Ethereum?

Popular cryptocurrency exchanges like Binance, OKEx, and Mandala Exchange allow you to buy Ethereum with fiat currency or through trading with Bitcoin. Explore different platforms and choose one that aligns with your needs and security preferences.