Ethereum (ETH) Weekly Update – Fusaka Upgrade, ETF Shift and Key Price Levels to Watch (Dec 6, 2025)

Introduction

Ethereum’s Fusaka hard fork went live on December 3, delivering another scaling-focused upgrade just as the market digests a sharp early-December correction. Despite volatility, ETH has held above $2,800 and clawed back toward the $3,000–$3,200 zone, modestly positive on the week while still below recent local highs.

At the same time, ETF flows and access are diverging: Ethereum spot ETFs saw record November outflows of about $1.4B, yet large brokers like Vanguard are now opening their platforms to crypto ETFs, including Ether, which could broaden mainstream exposure over time.CoinGecko+1

Ethereum Price Action & Key Levels

Weekly Performance

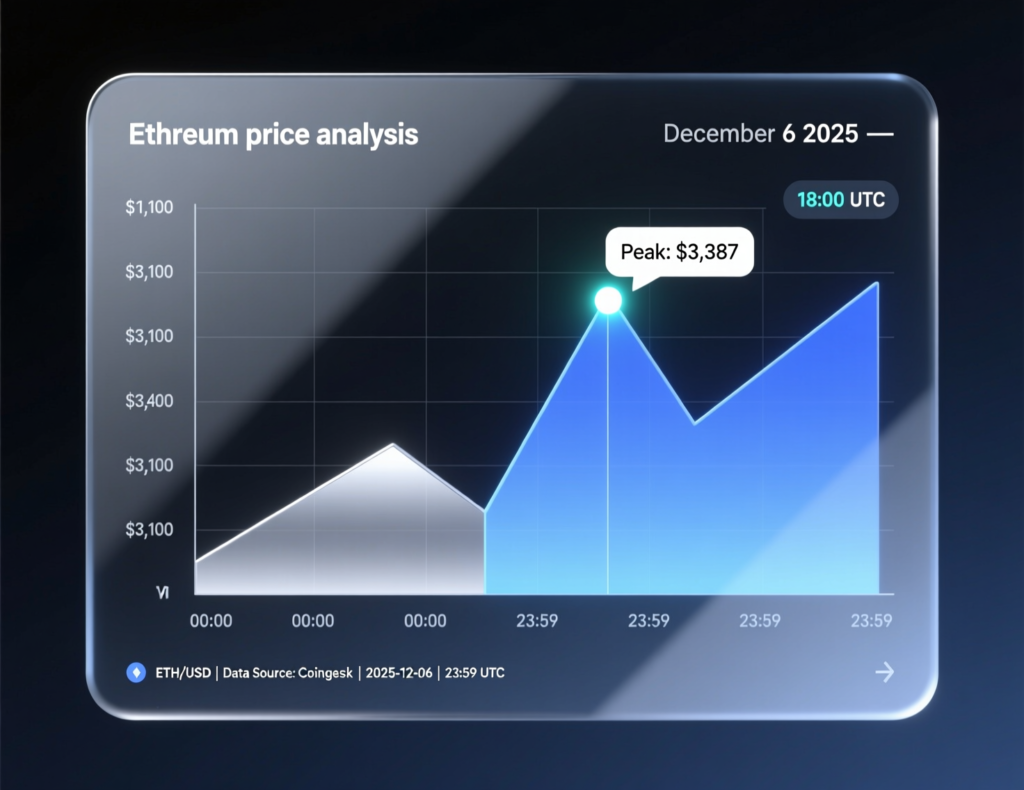

Over the last 7 days, ETH traded between roughly $2,799 (weekly low) and $3,195 (weekly high), ending the week around $3,030–$3,050.That leaves Ethereum slightly green (~+1%) on the week, despite being down about 3% over the last 24 hours as volatility picked back up.

Compared with Bitcoin, ETH has slightly outperformed: while BTC has swung between $84k and $93k, ETH has gained about 2–2.5% versus BTC over 7 days, with ETH/BTC near 0.0339 and up versus last week.

Short-Term Technical View

Immediate support

Structural support zone: $2,800–$2,900 (weekly low + psychological round numbers)

Near-term resistance

First key level: $3,200 highlighted by multiple analysts and recent price rejection.

Next major zone: $3,500, where prior consolidation and sell pressure appeared.

Price is currently consolidating just above $3,000 after a sharp early-December flush, with futures funding and open interest showing mild de-leveraging rather than outright panic. Volatility remains elevated but contained within this $2.8k–$3.2k range.

News & Narratives That Moved ETH This Week

Fusaka upgrade goes live

Ethereum’s Fusaka hard fork activated on Dec 3, increasing blob capacity and introducing PeerDAS (data sampling) to make rollups cheaper and the network more scalable. This upgrade is framed as the biggest throughput step since proto-danksharding (EIP-4844).

ETF flows flip negative, then access widens

November saw the largest monthly outflow on Ethereum spot ETFs (~$1.4B), signaling profit-taking and rotation just ahead of Fusaka.Yet Vanguard’s move to allow trading of Bitcoin and Ether ETFs for its 50M+ clients is a structural positive for long-term demand.

Macro: Crypto corrects, then stabilizes

Bitcoin’s drop from the mid-$120k October peak to the mid-$80k–$90k area weighed on ETH, but the broader market has stabilised around a $3.1T cap, with Ethereum maintaining ~11–12% dominance.

On-Chain, Derivatives & Sentiment

On-chain, daily active addresses sit around 580k, still comfortably above last year’s levels, showing continued user activity even through volatility. YCharts+1 DeFiLlama data shows over $120B in native TVL on Ethereum, plus substantial bridged liquidity, with about $13.6B in DEX volume and nearly $20B in perps volume over the past week. DeFi Llama+1

On derivatives venues, ETH futures and perp open interest is around $130B notional, down roughly 1–2% in 24 hours, consistent with some leverage wash-out but not a capitulation event. Sentiment gauges remain in “cautious” territory, with funding near neutral and traders waiting to see if Fusaka triggers sustained usage spikes rather than a short-lived hype move.

Ethereum vs Bitcoin & the Wider Crypto Market

Bitcoin is still the macro driver, fluctuating around $92k after a steep early-December slide, while ETH has managed to hold key supports and slightly outperform on a relative basis this week. Ethereum’s share of total crypto market cap (~11.7%) remains stable, even as money rotates between majors and high-beta altcoins.

For multi-asset crypto portfolios, that means ETH has acted as a middle-ground risk asset: more volatile than BTC, but less extreme than some L1/L2 and meme-coin plays.

What This Means for Traders & Long-Term Holders

For traders (short-term)

Watch the $2,800–$2,900 zone for any breakdown; a loss of that region could open room toward earlier cycle lows.

Upside focus is on $3,200, then $3,500, where multiple attempts have recently stalled.

Elevated but controlled volatility means position sizing and risk management matter more than trying to catch every move.

Derivatives metrics show moderate de-risking, suggesting liquidations have eased for now but can flare up quickly around news.

For long-term holders

Fusaka continues Ethereum’s multi-year path toward cheaper rollups and higher throughput, reinforcing the thesis of ETH as core settlement and collateral infrastructure.

Record ETF outflows highlight that institutional flows can cut both ways, even while access expands through platforms like Vanguard.

On-chain activity, DeFi TVL, and active addresses remain robust versus last year, suggesting continued fundamental usage.

Risks, Scenarios & Closing Thoughts

Bullish scenario

ETH holds above $2,800, breaks $3,200 on convincing volume, and ETF flows turn net-positive again as Fusaka’s scaling benefits start to reflect in cheaper rollup fees.

Neutral scenario

Price ranges between $2,800–$3,500 into year-end, with choppy ETF flows and gradual on-chain growth but no clear breakout.

Bearish scenario

Macro risk-off or further ETF outflows push ETH back below $2,800, re-testing deeper support zones and pressuring DeFi valuations.

As always, this is not financial advice. Do your own research and consult a licensed professional before making any investment decisions.

Final Words

Ethereum’s week closes with cautious optimism: price is holding above key support, Fusaka has moved the roadmap forward, and ETF access is quietly expanding even as flows remain mixed. Short-term, ETH looks range-bound between roughly $2,800 and $3,200, with $3,500 the next big test if momentum returns. Longer term, healthy DeFi TVL, active addresses and continuous upgrades keep the core thesis for Ethereum intact, though macro shocks and regulatory headlines remain key risks. As always, this is not financial advice. Do your own research and consult a licensed professional before making any investment decisions.

FAQs

Q : Why did Ethereum (ETH) move this way over the last week?

A : Ethereum spent the week digesting a sharp early-December sell-off while reacting to the Fusaka upgrade and shifting ETF flows. The price bounced from lows near $2,800 back above $3,000, leaving ETH slightly positive on the week despite a ~3% daily drop in the latest 24 hours.

Q : What are the most important Ethereum price levels to watch right now?

A : On the downside, the $2,800–$2,900 zone is a key support band defined by this week’s low and recent order-flow. On the upside, markets are watching $3,200 as immediate resistance, with $3,500 as the next major area where price previously stalled. A sustained close above $3,200 would be the first sign that bulls are regaining control.

Q : How did the Fusaka upgrade affect Ethereum this week?

A : Fusaka, activated on Dec 3, increases blob capacity and introduces PeerDAS, making it easier for rollups to scale and reducing data bottlenecks. The upgrade coincided with a move back above $3,000, but the price action so far looks like a combination of fundamental optimism plus broader market volatility, rather than a pure one-way rally.

Q : What on-chain and derivatives signals are worth noting for ETH this week?

A : Ethereum still sees hundreds of thousands of active addresses per day and over $120B in DeFi TVL, showing that usage remains strong. At the same time, futures/perps open interest is around $130B and slightly down on the day, pointing to a modest de-risking in leveraged positions rather than a full unwinding.

Q : Is Ethereum safer than other altcoins during this recent volatility?

A : “Safer” always depends on your risk tolerance, but this week ETH has outperformed many altcoins while still underperforming or tracking Bitcoin at times. With large ETF markets, deep liquidity and ongoing upgrades like Fusaka, Ethereum tends to behave as a large-cap, high-liquidity asset rather than a speculative small cap but it is still a volatile crypto asset and can experience large drawdowns.