Ethereum and Bitcoin spot ETFs’ combined daily inflows top $1 billion

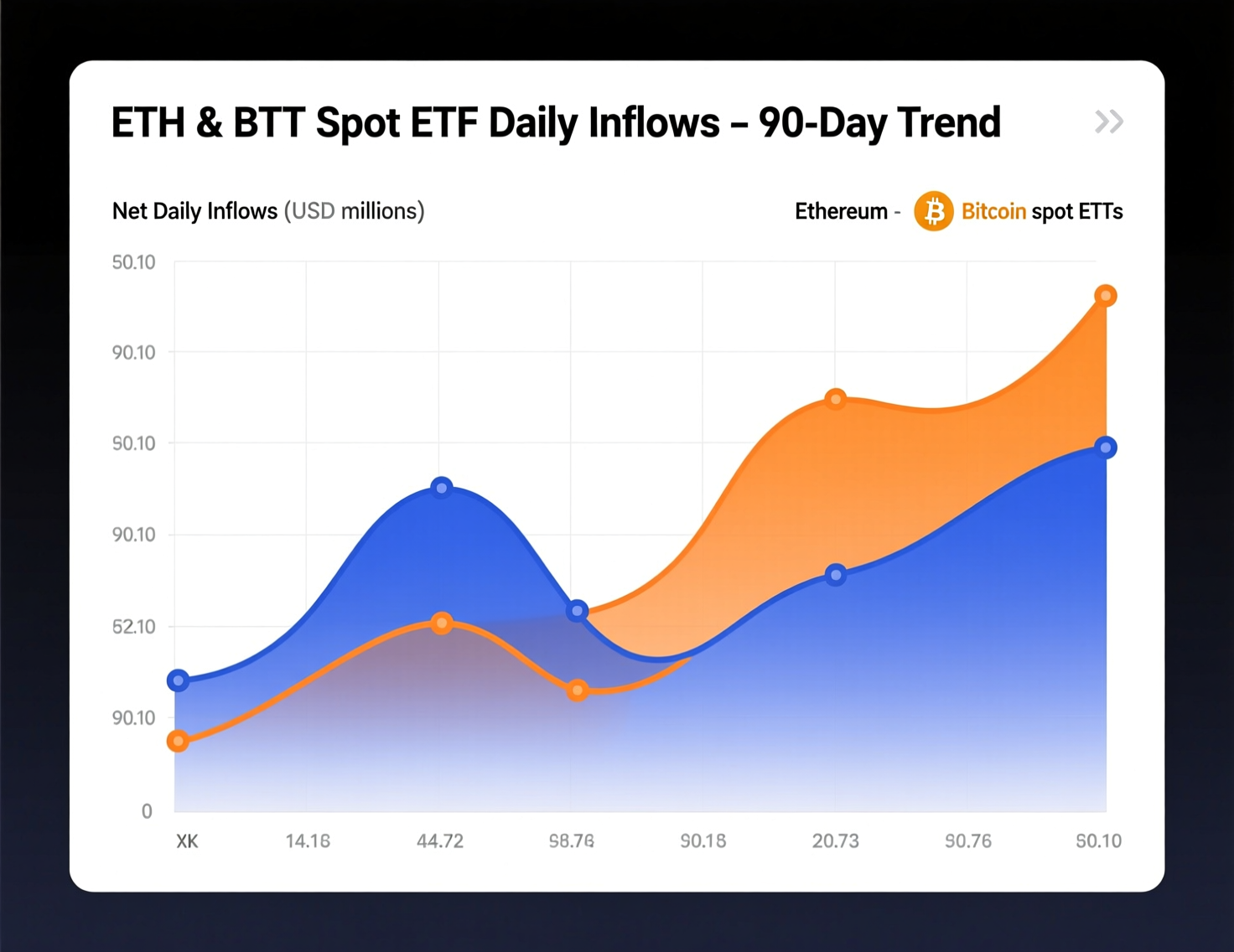

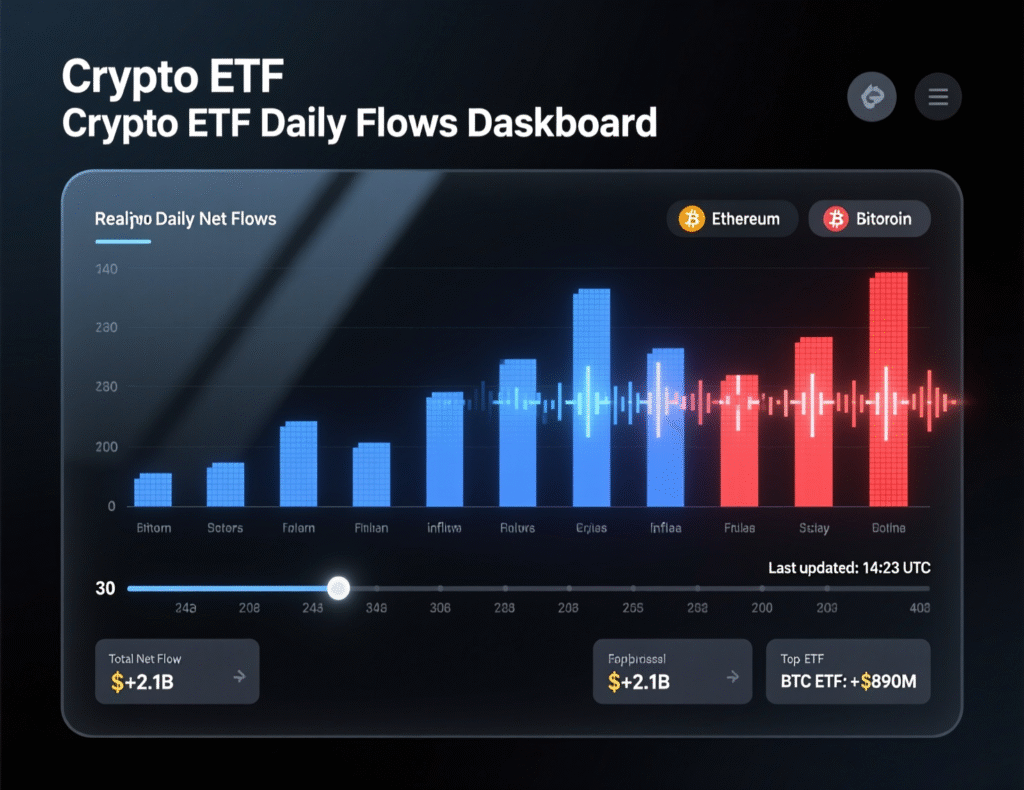

U.S.-listed cryptocurrency funds saw a sharp rebound on Monday, with combined inflows into Bitcoin and Ethereum spot ETFs surpassing $1 billion. The surge marks a strong return of institutional appetite following the pullback observed in mid-September. Analysts suggest the renewed activity signals growing confidence in digital assets, as investors continue to favor regulated, exchange-traded products over direct holdings.

Ethereum-based funds led the rally, attracting approximately $547 million in net inflows, while Bitcoin ETFs followed closely with around $522 million. Data compiled from SoSoValue, Farside Investors, and The Block highlights this balanced demand between the two largest cryptocurrencies. Market watchers believe this shift could set the tone for stronger momentum in Q4, as traditional financial players deepen exposure to crypto through spot ETF structures.TradingView+2Farside+2

Ethereum and Bitcoin spot ETFs daily inflows: by the numbers

Ethereum (nine spot ETFs)

+$547M net on Sept. 29. Fidelity FETH +$202M; BlackRock ETHA +$154M. ETH ETF AUM ≈ $27.5B (~5.4% of ETH market cap).Bitcoin (twelve spot ETFs)

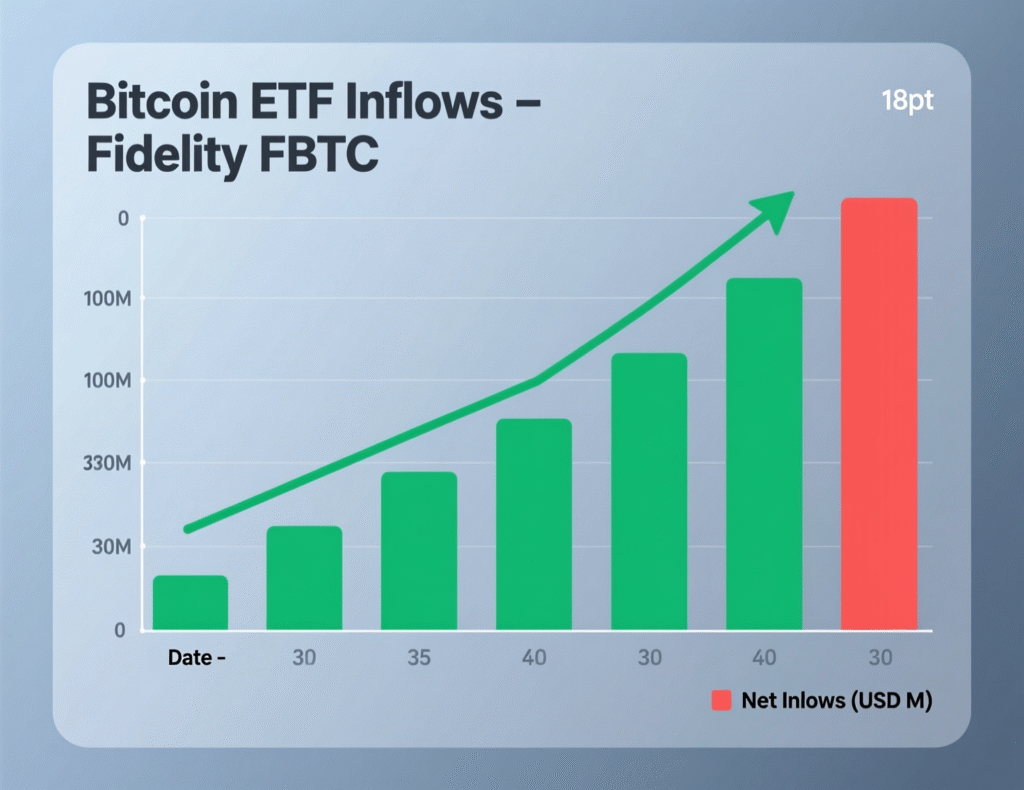

+$522M net. Fidelity FBTC +$298.7M, ARK 21Shares ARKB +$62.2M, Bitwise BITB +$47.2M; BlackRock IBIT −$46.6M. BTC ETF AUM ≈ $150B (~6.6% of BTC market cap).

Drivers of the Ethereum and Bitcoin spot ETFs daily inflows

Analysts point to dip-buying after September’s deleveraging and seasonal “Uptober” optimism. Price pages and market coverage show BTC near $113–114k and ETH near $4.18k into Sept. 30, underscoring improving sentiment alongside the ETF turn.

Issuer and product highlights

Fidelity dominated both asset classes (FBTC +$298.7M; FETH +$202M).

BlackRock saw mixed flows (ETHA +$154M; IBIT −$46.6M).

ARK 21Shares (ARKB) and Bitwise (BITB) posted notable BTC inflows.

<section id=”howto”> <h3>How to track daily U.S. spot crypto ETF flows</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check **Farside Investors’** BTC ETF flow table for issuer-level breakdowns (e.g., FBTC, IBIT, ARKB). :contentReference[oaicite:12]{index=12}</li> <li id=”step2″><strong>Step 2:</strong> Open **SoSoValue’s ETH spot ETF dashboard** for ETH flows, totals, and AUM. :contentReference[oaicite:13]{index=13}</li> <li id=”step3″><strong>Step 3:</strong> Cross-reference with trusted newsroom write-ups (e.g., *The Block*) for context and market color. :contentReference[oaicite:14]{index=14}</li> <li id=”step4″><strong>Step 4:</strong> Note the **date/time zone** on each dataset (U.S. ET vs. local) to align “daily” figures correctly.</li> <li id=”step5″><strong>Step 5:</strong> Record AUM and market-cap ratios to gauge structural demand over time. :contentReference[oaicite:15]{index=15}</li> </ol> <p><em>Note: Process may vary by data provider and disclosure timing. Confirm definitions before acting.</em></p> </section>

Market context

Monday’s flows arrived as crypto markets stabilized after September’s selloff; BTC and ETH hovered near $113k and $4.18k, respectively, into Tuesday, Sept. 30 (Asia/Karachi).

Analysis

Institutional allocations continue to gravitate toward low-fee, liquid spot ETFs, and Monday’s $1B+ swing suggests inflows remain sensitive to price resets and seasonality. While single-day prints can whipsaw, AUM share of underlying market cap—~6.6% for BTC and ~5.4% for ETH indicates a growing structural footprint in U.S. markets.

Conclusion

If inflows continue into early October, spot crypto ETFs may regain a positive weekly trend after September’s temporary slowdown. The renewed momentum could reinforce institutional confidence and keep digital assets in the spotlight, particularly among traditional investors seeking regulated exposure.

Attention will remain on key factors shaping the market, including ongoing issuer fee competition, the strength of ETF liquidity, and the timing of new product approvals. Any additional launches could broaden investor access and further fuel adoption, positioning ETFs as an increasingly central gateway for crypto investment in the months ahead.

FAQs

Q : What happened on Sept. 29 with U.S. spot crypto ETFs?

A : Combined net inflows topped about $1.07B: ETH added $547M, while BTC gained $522M.

Q : Which issuer led the day?

A : Fidelity led with FBTC +$298.7M and FETH +$202M.

Q : Did any major Bitcoin ETF see outflows?

A : Yes. BlackRock’s IBIT recorded −$46.6M.

Q : How large are these ETF markets now?

A : BTC spot ETFs hold about $150B AUM (~6.6% of BTC market cap), while ETH spot ETFs total roughly $27.5B (~5.4%).

Q : Why did flows rebound?

A : Following September’s pullback, dip-buying and seasonal optimism lifted investor risk appetite.

Q : Where can I verify the numbers?

A : Farside (BTC), SoSoValue (ETH), and reporting by The Block.

Q : Does this affect prices immediately?

A : Not always. Flows and prices are correlated but not deterministic. Still, BTC hovered near $113k and ETH at $4.18k into Sept. 30.