Dubai Blockchain Strategy and Crypto Regulations in 2025

The Dubai Blockchain Strategy is a government programme led by Digital Dubai and the Dubai Future Foundation to make Dubai a blockchain-powered government and attract global Web3 and virtual asset businesses. Combined with VARA’s dedicated virtual asset regulation and the wider UAE framework (SCA, ADGM, DIFC), it has turned Dubai into a regulated crypto hub for US, UK, German and European founders looking for clarity, access to capital and tax efficiency.

Introduction

Dubai didn’t become a crypto hub by accident. The Dubai Blockchain Strategy set out to build the first “blockchain-powered government” and then layered on virtual asset regulation, tax advantages and a strong Web3 ecosystem to compete with London, New York, Frankfurt, Zurich and Singapore.

For founders in the USA, UK, Germany and the EU, the key questions are simple: Is crypto legal? Who regulates it? How do I get a license? Today, virtual asset regulation in Dubai is led by the Virtual Assets Regulatory Authority (VARA), supported by the UAE’s federal Securities and Commodities Authority (SCA) and regulators in the financial free zones of Abu Dhabi Global Market (ADGM/FSRA) and Dubai International Financial Centre

This guide walks through the Dubai Blockchain Strategy, the evolution into a broader blockchain and crypto strategy, how VARA licensing works in practice, and how US, UK and EU teams can evaluate Dubai against home hubs like London or Frankfurt.

What is the Dubai Blockchain Strategy?

The Dubai Blockchain Strategy is an official government programme led by Digital Dubai and the Dubai Future Foundation to use blockchain across government and key industries and position Dubai as a global leader in digital assets. It’s built on three pillars government efficiency, industry creation and international leadership and is one of the foundations of Dubai’s later Web3 and virtual asset regulation push.

Origins and vision of the Dubai Blockchain Strategy

Launched in 2016, the Dubai Blockchain Strategy was designed to make Dubai the first city fully powered by blockchain by 2020, linked closely with Smart Dubai (now Digital Dubai) and the Dubai Future Foundation. The vision is simple but ambitious: digitise and secure government records, reduce paper-based processes, and build a digital economy that naturally includes virtual assets and tokenised finance.

For global investors in New York or London, that early, top-down commitment is a strong policy signal. US and UK founders used to dealing with the SEC, CFTC, FinCEN or the FCA can see that the UAE is not experimenting at the edges; it is building a state-level digital infrastructure in which virtual asset regulation is a logical next step. German and wider EU investors, who are now working under MiCA, read the strategy as long-term industrial policy rather than a short-lived “crypto experiment.”

Pillars of the Dubai Blockchain Strategy and smart city adoption

The strategy’s three pillars are

Government efficiency using blockchain to streamline and secure government services.

Industry creation attracting blockchain and Web3 companies and talent.

International leadership positioning Dubai as a reference point for global standards.

You can see this in practice at the Dubai Land Department, which has piloted blockchain-based property transactions and title management a key signal to real-estate and institutional investors from the US, UK and EU that the government is willing to use the same rails it expects the private sector to adopt.

These initiatives reduced friction (fewer manual checks, faster settlements) and showed founders that Dubai’s interest in Web3 was not just about short-term trading, but about long-term infrastructure for finance, logistics and public services.

Key entities driving blockchain in Dubai

Several entities work together to execute this strategy.

Digital Dubai responsible for digital government and blockchain deployment.

Dubai Future Foundation runs regulatory sandboxes and innovation programmes.

Dubai Land Department early adopter for property and land registries.

DIFC Innovation Hub hosts fintech and Web3 startups in an English law-based environment inside DIFC.

For US, UK and EU investors assessing political and regulatory risk, this level of institutional backing matters. It’s closer to working with BaFin-supervised banks in Frankfurt or FCA regulated fintechs in London than with an unregulated offshore exchange.

From blockchain strategy to Dubai blockchain and crypto strategy

Dubai’s blockchain strategy evolved into a broader blockchain and crypto strategy by combining government adoption, favourable tax policy and specialised virtual asset regulation under VARA. That transition is why Dubai is now routinely benchmarked against Singapore, Zurich and New York as a leading global crypto hub.

How blockchain pilots evolved into a Web3 and crypto ecosystem

Early blockchain pilots in government created local expertise, vendors and expectations. Over time, this ecosystem expanded into:

Virtual Asset Service Providers (VASPs) exchanges, brokers, custodians and payment providers.

DeFi, NFT and gaming projects using Dubai as a GCC crypto hub base.

Infrastructure players offering custody-as-a-service, compliance and RegTech.

As of 2024, Dubai reportedly hosts over 700 blockchain companies, and the broader MENA blockchain market is projected to reach roughly USD 40 billion by 2027. In parallel, global crypto market capitalisation has hovered around USD 3 trillion in late 2025, showing that the space is large enough to sustain multiple hubs.

Why Dubai is seen as a global crypto and Web3 hub

Compared with Singapore, Zurich, London, Frankfurt and New York, Dubai offers an unusual mix:

Regulatory clarity via VARA and, in Abu Dhabi, ADGM’s FSRA.

Tax environment with no personal income tax and business-friendly company rules.

Lifestyle and time zone that lets teams cover both Asian and European trading hours from one base.

For US founders, Dubai can feel like a more predictable alternative to a shifting SEC/CFTC environment. For UK teams used to FCA scrutiny, VARA’s rulebooks feel structured and familiar. For German and EU founders, the move can complement MiCA licensing another regulated foothold, rather than a regulatory escape route.

Dubai vs UAE crypto hub narrative: role of Abu Dhabi and ADGM

It’s important to see Dubai as part of a UAE-wide crypto story. Abu Dhabi’s ADGM (regulated by the FSRA) and Dubai’s DIFC (regulated by the DFSA) are financial free zones with their own digital asset regimes, while VARA covers most of Dubai outside DIFC.

Many international firms

Incorporate and obtain a licence in ADGM or DIFC first (where English law and familiar court systems are a plus).

Then expand into VARA-regulated Dubai to reach a broader retail and institutional client base.

This combination is attractive for US, UK and German institutional investors that want both local market access and robust regulatory architecture.

Who regulates crypto in Dubai and the wider UAE?

Crypto and virtual assets in the UAE are regulated by multiple authorities primarily VARA in Dubai, the SCA at federal level, and FSRA/DFSA in financial free zones like ADGM and DIFC. For founders, that means you must decide early which regulator and which zone you want as your “home” supervisor.

VARA, SCA, ADGM and DIFC roles and scope

High-level mapping.

VARA sole virtual asset regulator for the Emirate of Dubai (excluding DIFC), supervising VASPs and issuing detailed rulebooks.

SCA federal regulator overseeing securities and commodity-style crypto assets across the UAE, including some VASPs.

FSRA (ADGM) regulates virtual assets within ADGM, with a comprehensive framework under its Financial Services and Markets Regulations.

DFSA (DIFC) supervises “investment tokens” and other digital assets in DIFC’s common-law environment.

If you are used to the SEC/CFTC split in the US, FCA/PRA in the UK or BaFin in Germany, think of the UAE as a similar multi-layer system: a federal anchor (SCA), local specialist regulator (VARA) and independent free-zone regulators (FSRA, DFSA).

Key features of Dubai’s VARA rulebooks and virtual asset law

Dubai’s Virtual Assets and Related Activities Regulations 2023 form the backbone of VARA’s framework, supported by compulsory rulebooks and activity-specific rulebooks.

Activities that typically require a VARA licence include:

Operating an exchange or order-book platform

Brokerage and dealing

Custody and safekeeping

Lending, staking and certain DeFi-style services

Portfolio management and advisory

Obligations cover governance, risk management, capital, client asset segregation, financial reporting, marketing and detailed AML/CTF controls aligned with FATF guidance on virtual assets and VASPs.

Onshore vs free-zone regulation across the UAE

You can structure a UAE presence in several ways.

Onshore UAE subject to SCA and emirate-level rules.

ADGM / DIFC common-law free zones with FSRA/DFSA supervision.

Dubai (VARA) for VASPs serving Dubai outside DIFC.

European firms preparing for MiCA, or already supervised by BaFin or another EU authority, often prefer a free zone like ADGM first (for comfort around legal system and dispute resolution), then later add a VARA licence when they want broader Dubai coverage.

Getting a Dubai crypto license under VARA.

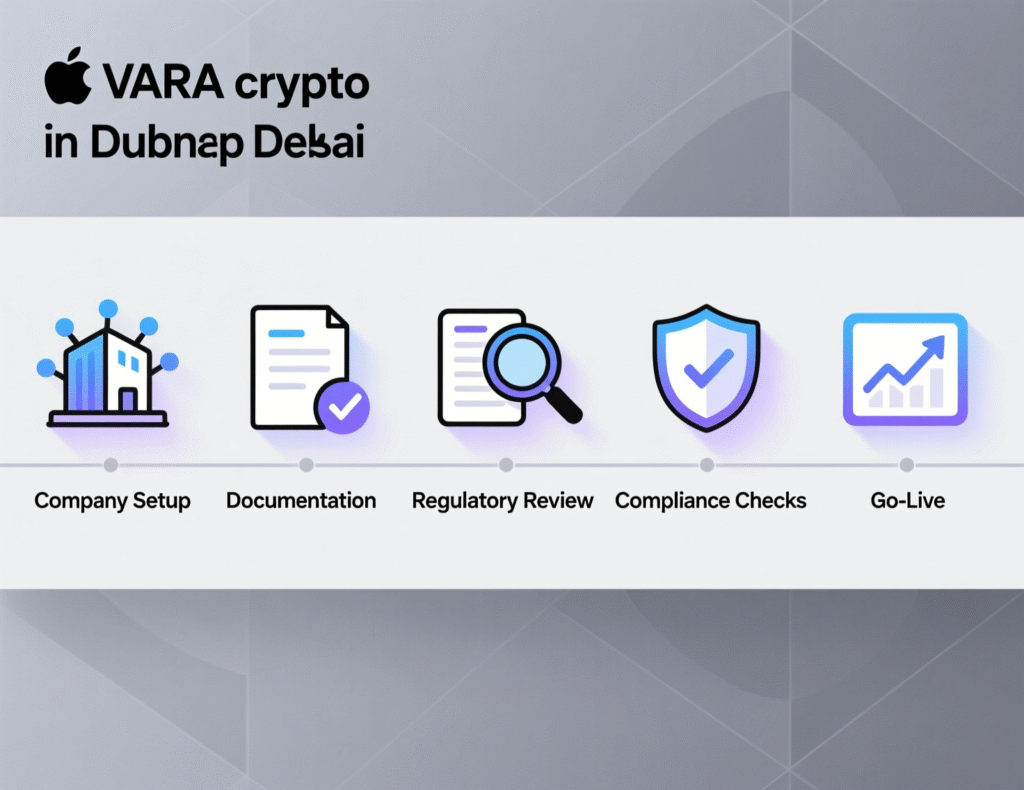

To obtain a Dubai crypto license, foreign companies typically incorporate a local entity, choose their VARA activity category, apply with a detailed business and compliance plan, and complete fit-and-proper, technical and AML/KYC checks before going live.

Licensing journey for foreign companies

A typical roadmap looks like this

Choose jurisdiction and zone

Decide between Dubai mainland or a free zone like Dubai World Trade Centre (DWTC), and whether you also need ADGM or DIFC entities.

Incorporate the entity

Set up the UAE company, open bank relationships where possible and appoint key personnel (MLRO, Head of Compliance, CTO).

Initial approvals and IDQ

Submit an Initial Disclosure Questionnaire (IDQ) to Dubai Economy & Tourism or the relevant free zone and pay initial fees.

VARA application and rulebook mapping

File your VARA application with a detailed business plan, compliance framework and technology description, mapping your activities to the relevant rulebooks (e.g., Exchange, Custody, Broker-Dealer).

Fit-and-proper, technical and AML checks

VARA will assess owners and senior management, review your AML/KYC stack, travel-rule tooling and sanction screening, and may request penetration tests or architecture reviews.

Final licence and go-live

After preliminary approval, you may face staged go-live conditions and ongoing reporting, similar to SEC, FCA or BaFin-supervised firms.

Specialist advisors, law firms and compliance vendors usually support documentation, RegTech integration and staff training.

Requirements for US, UK and European VASPs

If you are already supervised by the SEC, FinCEN, FCA, BaFin or an EU authority under MiCA, VARA will expect to see.

Group-level AML/CTF controls aligned with FATF guidance, including robust travel rule implementation.

Sanction screening that reflects US OFAC and EU/UK lists.

Clear booking models and client onboarding flows for US, UK, German and EU residents.

For EU CASPs, the interaction between MiCA and VARA can be a strength: you can design a single policy framework that meets both EU and UAE requirements and adjust local add-ons (for example, specific VARA marketing rules).

Timelines, costs and operating models founders should expect

Indicative (not guaranteed) expectations.

Timelines

Simple brokerage or custody models may license faster than full order-book exchanges, especially if technology and governance are already proven; more complex models can extend the process materially.

Cost drivers

Legal fees, regulatory capital, compliance stack (KYC, AML, travel-rule, monitoring), key hires in Dubai and potential local data hosting.

Operating models

Options range from fully regulated exchanges to brokers, liquidity providers, funds and infrastructure providers. US or UK firms with heavy front-end regulation sometimes begin with infrastructure or B2B custody to reduce initial scope, while German and EU funds might focus on tokenised securities or structured products.

Compliance, security and risk for crypto firms in Dubai

Dubai’s value proposition is not “light touch” but clear rules with room to innovate. The UAE handled an estimated USD 25 billion in crypto transactions in 2022, with more than 1,000 crypto firms operating, so regulators are increasingly assertive.

AML/KYC and marketing rules vs SEC, FCA and BaFin standards

VARA and the SCA implement FATF’s standards on virtual assets and VASPs, including customer due diligence, ongoing monitoring, travel rule compliance and suspicious activity reporting.

Marketing and promotions are also supervised:

Firms must avoid misleading claims and clearly label risks.

Unlicensed promotion can trigger enforcement; in 2025 VARA sanctioned 19 crypto firms for unlicensed operations and marketing breaches.

For teams used to SEC, FCA or BaFin rules on financial promotions, these expectations will feel demanding but familiar, and can be turned into a competitive advantage when dealing with institutional clients (for example, US banks or BaFin-supervised institutions in Frankfurt).

Data protection, GDPR/DSGVO and cross-border data flows

The UAE’s federal Personal Data Protection Law (PDPL – Federal Decree Law No. 45 of 2021) sets baseline privacy requirements, including lawful processing, transparency and data subject rights. In the EU, GDPR and German DSGVO, and in the UK, UK-GDPR overseen by the ICO, remain the strictest benchmarks.

For exchanges and custodians, a practical architecture often includes.

Regional cloud hosting (e.g., AWS UAE, AWS Frankfurt, Azure UAE, GCP Europe-West) to respect data residency for EU, UK and GCC clients.

Strong vendor due diligence and DPAs for RegTech, analytics and marketing tools.

Alignment with SOC 2, ISO 27001 and PCI DSS for security assurance, especially when handling payment data alongside crypto transactions.

Enforcement, security incidents and best-practice controls

Global crypto has seen repeated hacks, smart-contract exploits and governance failures, which now shape institutional risk appetite. Regulators and counterparties increasingly expect Dubai- and UAE-based firms to demonstrate:

Robust incident response and penetration testing.

Segregation of client assets and clear proof-of-reserves methodologies.

Board-level risk management frameworks, not just technical controls.

For US, UK and German institutions used to working with HIPAA-grade healthcare providers (e.g., NHS environments) or PCI DSS-compliant payment processors, these controls are familiar checkboxes that can make Dubai-based VASPs bankable.

Is Dubai the right crypto hub for US, UK and EU founders?

Dubai works best for growth-oriented crypto and Web3 businesses that want regulatory clarity, tax efficiency and access to Middle East capital but it is not a one-size-fits-all solution for every risk profile or business model.

Profiles of firms that benefit most from Dubai

You’re likely to benefit from Dubai if you are.

A global exchange or liquidity provider targeting EMEA and Asia.

A Web3 startup in gaming, NFTs, infrastructure or DeFi that needs a clear virtual asset regulation regime.

A fund or market maker looking for tax-efficient structures and regional capital in Dubai and Abu Dhabi.

US founders gain timezone coverage from New York through to Asia, UK teams can balance FCA rules with VARA’s clarity, and German founders benefit from a complementary hub to MiCA and BaFin supervision. The original Dubai Blockchain Strategy is an important signal that this is long-term policy, not a short-term bull-market pivot.

When other hubs.

Dubai is not always the optimal choice:

London or Frankfurt may be better if your investors or clients insist on EU or UK supervision only, or if your products are tightly linked to regulated securities.

ADGM in Abu Dhabi can suit firms that want a single, bank-grade regulatory home with strong institutional positioning.

Singapore or Switzerland (FINMA) may be preferable for Asia-Pacific strategies or when Swiss regulatory branding is central to your pitch.

Founders should weigh home-regulator expectations, investor base, treasury strategy and long-term hiring plans before committing.

How to evaluate relocation and licensing with experts

A simple checklist for founding and compliance teams.

Regulation which regulator (VARA, FSRA, DFSA, SCA) fits your model and home licences?

Tax and corporate how will Dubai interact with US, UK, German or EU tax obligations?

Governance and risk can you meet VARA and FATF standards without over-stretching the team?

Data protection are you comfortable aligning PDPL with GDPR/DSGVO/UK-GDPR?

Banking and fiat rails do you have realistic options for accounts in UAE, EU and UK?

This is where a partner like Mak It Solutions can help you map requirements into actual systems: cloud architectures, data pipelines, analytics and reporting, and secure web and mobile platforms for your VASP or Web3 product. (Click Here’s ) makitsol.com+5makitsol.com+5makitsol.com+5

Bottom lines

Dubai’s journey from the Dubai Blockchain Strategy to a full blockchain and crypto strategy anchored by VARA and complementary UAE regulators has created one of the world’s most mature environments for virtual asset regulation.

For serious US, UK, German and EU players, crypto is clearly legal and regulated in Dubai; the challenge is choosing the right structure, licence and operating model. With the right advisory, regulatory and technology partners, founders can use Dubai as a long-term base for compliant growth across the GCC, Europe and beyond.

If you’re evaluating Dubai, Abu Dhabi or another crypto hub for your next phase of growth, you don’t have to decode the Dubai Blockchain Strategy and VARA rulebooks alone. Mak It Solutions can help you turn regulatory requirements into concrete architectures, data pipelines and secure web and mobile platforms tailored to your VASP or Web3 business.

Reach out to our team to explore a scoped feasibility assessment for your Dubai/UAE crypto hub strategy including licensing options, technical design and analytics/compliance tooling.

FAQs

Q : Is crypto legal in Dubai and across the wider UAE for individual investors?

A : Yes. Crypto trading is legal in Dubai and across the wider UAE, provided users use platforms that are properly licensed or registered with VARA, SCA, ADGM FSRA or DIFC DFSA, depending on the jurisdiction. Regulators have clarified that virtual assets can be offered and traded under specific frameworks, and the UAE has processed tens of billions of dollars in crypto transactions in recent years.

Q : Do I need to relocate to Dubai to obtain and maintain a VARA crypto license?

A : Not always. Many US, UK and EU founders keep group headquarters in New York, London, Berlin or Zurich while establishing a Dubai entity with local responsible individuals for VARA supervision. VARA does, however, expect real local substance key personnel, decision-making and operations in the Emirate so you cannot simply use a nominal shell company and remote staff.

Q : How do Dubai’s crypto tax rules compare to those in the US, UK and Germany?

A : Dubai offers a generally more favourable tax environment: there is no personal income tax, and corporate tax rules remain business-friendly compared with US federal and state taxes, UK corporation tax or Germany’s combined corporate and trade taxes. That said, your home-country tax residency, CFC rules and double-tax treaties still matter, so US, UK and German founders should always obtain cross-border tax advice before relocating or booking profits in the UAE.

Q : Can an EU or MiCA-regulated exchange also operate in Dubai under VARA or ADGM?

A : Yes. An EU or MiCA-regulated exchange can apply for a separate licence with VARA in Dubai or FSRA in ADGM and operate both regimes in parallel, provided it meets local requirements and properly segregates entities and client bases where needed. Many firms design a core policy framework that satisfies MiCA, BaFin or other EU regulators, then extend it with UAE-specific requirements on marketing, local AML/CTF and data protection.

Q : What are the most common mistakes startups make when applying for a Dubai crypto license?

A : Typical mistakes include underestimating timelines, treating VARA as “light touch,” submitting shallow AML/KYC frameworks, and failing to align technology architecture with security and data protection expectations. Some startups also try to reuse offshore structures that don’t translate well into a multi-regulator environment like the UAE’s. Avoid these pitfalls by investing early in governance, risk management, cloud and data architecture, and by working with advisors who understand both UAE rules and SEC/FCA/BaFin or MiCA expectations.