Dormant Bitcoin Whale With $442M Awakens for First Time in 14 Years Amid Quantum Fears

A long-dormant Bitcoin whale wallet tied to early mining activity has resurfaced after 14 years, moving 150 BTC worth around $16.6 million from a stash of 4,000 BTC valued near $442 million. This marks the wallet’s first on-chain activity since 2011, drawing attention from analysts tracking historic addresses.

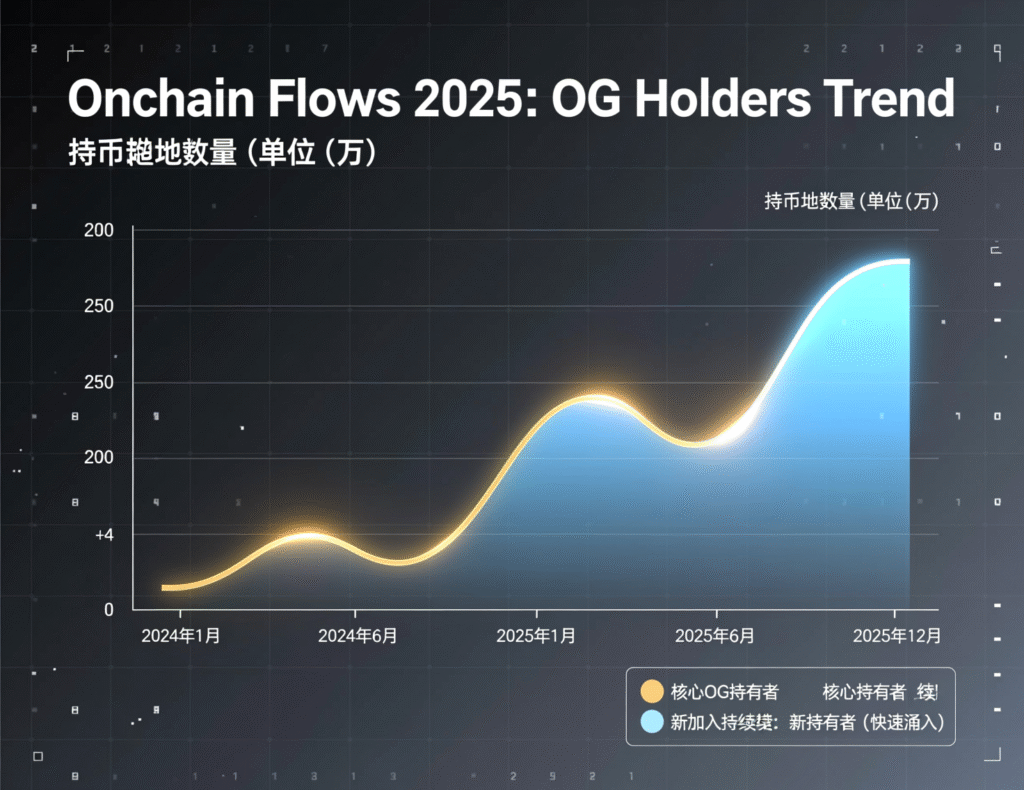

The move aligns with a broader 2025 trend of early Bitcoin holders reawakening their wallets as prices soar and profit-taking opportunities grow. Security experts note that many OG holders are transferring coins to new, more secure addresses to reduce exposure from outdated wallets, reflecting a cautious shift among early adopters amid the latest market upswing.

What moved, and why it matters

On-chain monitors identified a miner-linked wallet (label “18eY9o”) that aggregated coins mined in 2009 and consolidated in 2011. It sent 150 BTC today, leaving most funds untouched. Large, old-coin movements can precede rotation to new custody arrangements or OTC sales, but can also be simple hygiene or testing. Market impact so far appears contained.

Quantum risk debate resurfaces

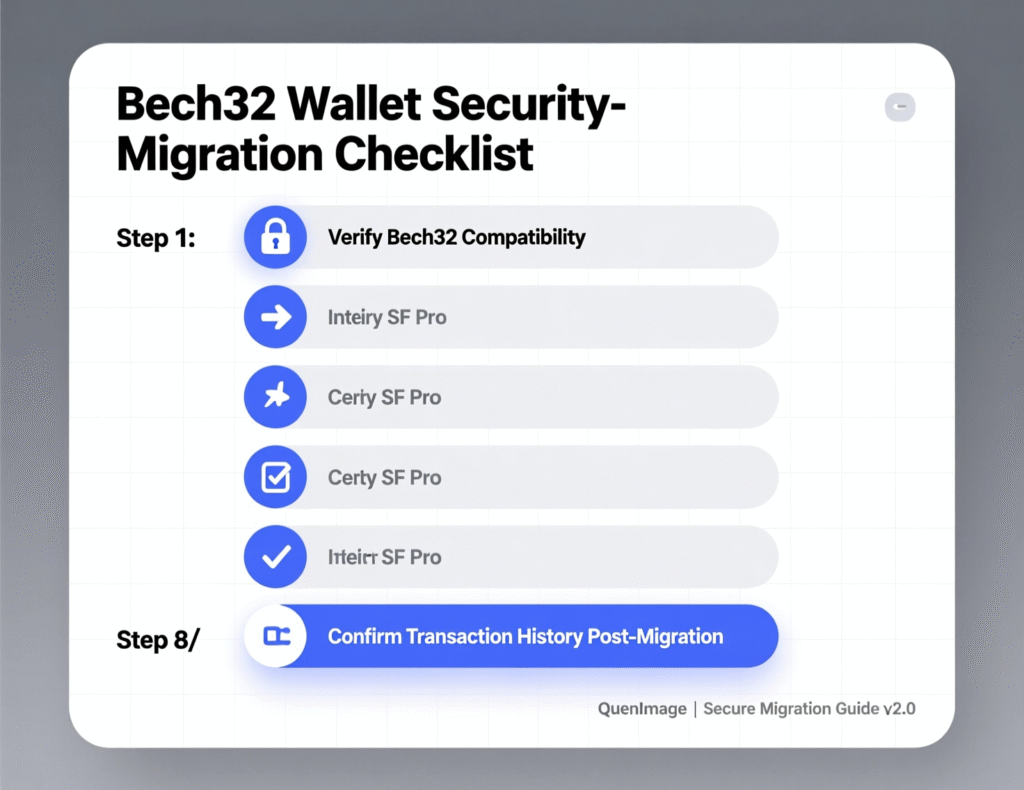

Security commentators note that certain early Bitcoin address formats pay-to-public-key (P2PK) and reused P2PKH expose public keys, theoretically making them more susceptible to future post-quantum attacks. Best practice for OG holders is to migrate to new, unexposed addresses where public keys remain hidden until spend time. While functional quantum threats to Bitcoin are not imminent, the “harvest-now, decrypt-later” concern motivates some preemptive moves.

Context: 2025’s OG selling and rotations

This year saw one of the largest notional BTC transactions ever: Galaxy executed sales totaling over 80,000 BTC (~$9B) for a Satoshi-era investor. That episode, alongside other dormant-wallet awakenings, frames today’s move as part of a broader reallocation by early holders. investor.galaxy.com+1

Market backdrop

Bitcoin’s rally has cooled as long-term holders realize profits and derivatives positioning turns more defensive conditions under which old-coin activity tends to attract outsize attention but doesn’t always signal imminent distribution.

Tracking the dormant bitcoin whale 14 years activity

First transfer since 2011; 150 BTC moved from a ~4,000 BTC miner wallet.

Coins originated from 2009 mining and were consolidated in 2011.

Potential motives range from security re-custody to liquidity management.

Address hygiene for OG holders and dormant bitcoin whale 14 years

Experts recommend avoiding reused legacy formats and considering fresh wallets or multi-sig with modern standards to mitigate any theoretical quantum exposure over long horizons.

Analysis (clearly labeled)

The transfer size (150 BTC) suggests caution rather than a liquidation.

Public discussion of quantum risks likely nudges OGs to refresh custody even absent near-term threats.

If more early addresses rotate, realized cap dynamics could reflect further profit taking, but OTC execution and staged tranches historically mute spot volatility.

Conclusion

A small yet symbolic move from a 2009-era miner wallet today highlights two key 2025 themes: early holders realizing profits and improving wallet security. The transfer adds to the growing wave of activity from long-dormant Bitcoin addresses reawakening as prices hit new highs.

Analysts say such transactions often precede broader shifts, including staged transfers or portfolio rebalancing. Market watchers are now keeping a close eye on follow-up moves whether tranche-based sends, refreshed addresses, or potential exchange inflows that could hint at profit distribution or renewed participation from Bitcoin’s earliest adopters.

FAQs

Q : What exactly moved today?

A : A miner-linked wallet first active in 2011 sent 150 BTC from a ~4,000 BTC balance, marking its first activity in 14 years.

Q : Why are OG holders moving coins now?

A : Higher prices, estate planning, custody refreshes, and concerns over quantum-exposed legacy addresses are prompting movements.

Q : Are quantum computers a real threat to Bitcoin today?

A : Not imminently, but addresses with exposed public keys (like P2PK or reused P2PKH) face higher long-term theoretical risk.

Q : Did this transfer mean the whale is selling?

A : Not necessarily. Such movements can be internal tests or wallet rotations, with no confirmed sale linked to this transaction.

Q : How do older coins reduce risk?

A : By migrating to fresh addresses (e.g., SegWit or Bech32), avoiding reuse, and using multi-sig or hardware wallets.

Q : What was the big 80,000 BTC sale earlier this year?

A : Galaxy facilitated a transaction exceeding 80,000 BTC for a Satoshi-era investor—one of the largest in history.

Q: Does this affect price?

A : Old-coin movements can briefly unsettle markets, but OTC and staggered transfers usually minimize direct spot impact.

Q : Does this article’s keyword “dormant bitcoin whale 14 years” refer to a specific wallet?

A : It’s a search term summarizing today’s miner wallet move after 14 years of inactivity.

Facts

Event

Early miner wallet awakens; 150 BTC moved from ~4,000 BTC balanceDate/Time

2025-10-24T14:10:00+05:00Entities

Bitcoin (BTC); Galaxy Digital (for context); Lookonchain/Arkham data mentions; analyst Nicholas Gregory (quoted by CoinDesk)Figures

4,000 BTC (~$442M), 150 BTC (~$16.6M); earlier context: 80,000 BTC sale in July 2025Quotes

“Coins from this era may be vulnerable to potential quantum attacks if their public keys have been exposed…” Nicholas Gregory, via CoinDesk. CoinDeskSources

CoinDesk (news) https://www.coindesk.com/… ; The Block (news) https://www.theblock.co/… ; Galaxy (press release) https://investor.galaxy.com/… ; Deloitte (explainer) https://www.deloitte.com/…