Dogecoin Leads Gain, Bitcoin Pops to $114K as M2 Setup Opens BTC Catchup Trade

Bitcoin climbed close to $114,200 during Thursday’s Asian trading session as major cryptocurrencies showed strength ahead of a busy macroeconomic week. The rally came at a time when market sentiment was upbeat, with investors eyeing key data releases and broader financial moves that could influence digital assets in the coming days.

At the same time, memecoins captured the spotlight, with Dogecoin leading the daily gains and drawing strong retail interest. Despite this short-term hype, some analysts pointed to valuation models linked to global money supply, suggesting that Bitcoin remains undervalued compared to its potential fair value. This perspective indicates the possibility of further upside, with the leading cryptocurrency positioned for a stronger catch-up rally as market dynamics unfold.

Market snapshot

Bitcoin was last around $114,200, up roughly 2.4% in 24 hours. Ether climbed to about $4,400 (also +2.4%), XRP reclaimed the $3 handle, BNB edged toward $900, and Solana’s SOL added nearly 3%. Dogecoin outperformed with a ~5% daily jump, extending its weeklong advance to ~16%. The tone has been “buy-the-dip” on intraday pullbacks, with bulls attempting to turn momentum higher into a packed data calendar.

Why Bitcoin price vs M2 money supply matters

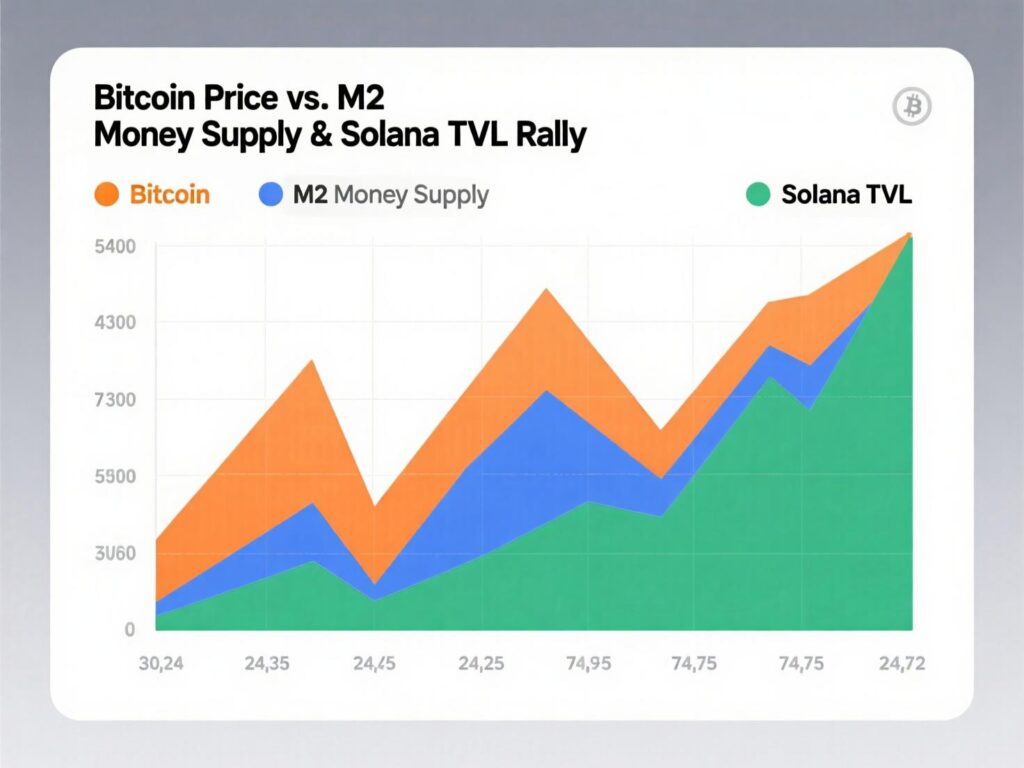

A fresh note from CF Benchmarks has traders re-examining how liquidity trends map to crypto valuations. When charted against U.S. money supply growth, the model suggests bitcoin is trading below its fair-value range similar to dislocations seen before notable rallies in 2016, 2019, and 2021. In other words, the Bitcoin price vs M2 money supply gap looks wide again, historically a setup that has preceded upside as liquidity filters through.

Over the past decade, bitcoin has tended to correlate positively with M2, with monetary growth often leading prices by about one quarter. If that relationship holds, the Bitcoin price vs M2 money supply backdrop implies potential tailwinds into late Q4 as liquidity effects show up in risk assets. It’s not a guarantee nothing is but it frames why some desks are treating weakness as opportunity.

Key levels and market structure

Technically, the “main battle” sits near $112K, where buyers have been defending shallow pullbacks. The real test is $115K, just above the 50-day moving average; a decisive hold would validate the nascent uptrend and could invite momentum flows. Options desks report firmer demand for near-term protection ahead of U.S. inflation data, consistent with neutral-to-cautious positioning even as the Bitcoin price vs M2 money supply narrative argues for medium-term resilience.

Levels to watch

Support: $112K, then $108K

Resistance: $115K (50-DMA zone), then $118K–$120K

Solana strength and memecoin flows

Solana continues to benefit from on-chain activity, with total value locked grinding to fresh highs (around $12.2B, up ~57% since June). That backdrop has some analysts floating $300 targets, though follow-through likely hinges on broader risk appetite. Meanwhile, memecoins drew fresh capital DOGE in particular helped by improving liquidity and rising open interest. For beta seekers, these pockets can outperform whenever the Bitcoin price vs M2 money supply theme pulls capital back into crypto.

Macro wildcards: CPI and the dollar

The near-term spoiler or accelerant arrives with U.S. CPI due Thursday. A cooler-than-expected print would strengthen the case for a near-term Fed cut and a softer dollar, usually constructive for bitcoin. A hot surprise would do the opposite and could challenge the Bitcoin price vs M2 money supply catch-up thesis in the short run, even if the medium-term liquidity picture stays supportive.

Conclusion

Market signals suggest that crypto risk appetite is gradually improving, while valuation models still indicate that Bitcoin could be trading at a discount relative to overall liquidity conditions. This setup is drawing attention from investors who see potential for further upside in the months ahead.

If the historical correlation between Bitcoin’s price and the global M2 money supply continues to hold, the final quarter of the year may lean toward a meaningful catch-up rally. For this scenario to play out, Bitcoin must secure key levels such as $115K, while broader macroeconomic factors remain supportive.

FAQs

Q1. What does Bitcoin price vs M2 money supply actually indicate?

A : It compares BTC’s price to U.S. liquidity growth; when M2 expands faster than BTC, the Bitcoin price vs M2 money supply model often signals room for a catch-up move.

Q2 . Is now a good time to buy based on the Bitcoin price vs M2 money supply model?

A : Historically, a wide gap favored upside, but timing risk is real. Use the Bitcoin price vs M2 money supply signal alongside technical levels and risk management.

Q3 . How do CPI and the dollar affect the Bitcoin price vs M2 money supply setup?

A : Cooler CPI can weaken the dollar and support risk assets, improving the Bitcoin price vs M2 money supply thesis; hot CPI can delay any catch-up.

Q4 . Why is Dogecoin outperforming while BTC lags the Bitcoin price vs M2 money supply model?

A : Flows into higher-beta coins are common early in risk-on phases. If liquidity broadens, the Bitcoin price vs M2 money supply backdrop may help BTC catch up.

Q5 . Does Solana’s rising TVL change the Bitcoin price vs M2 money supply view?

A : It doesn’t alter the model, but stronger on-chain activity can amplify crypto-wide risk appetite that the Bitcoin price vs M2 money supply theme relies on.