DOGE Chart Turns Fully Bearish After Multi-Level Support Failure

The U.S. crypto regulatory landscape is entering a new phase as Bernstein argues that America’s “global leader” narrative is now supported by concrete laws and active rulemaking. A major milestone is the GENIUS Act, signed on July 18, 2025, which establishes a stablecoin-focused framework designed to boost transparency, consumer protection, and responsible innovation. This legislation has given policymakers and institutions clearer guidance on how regulated digital dollar instruments should operate within the broader financial system.

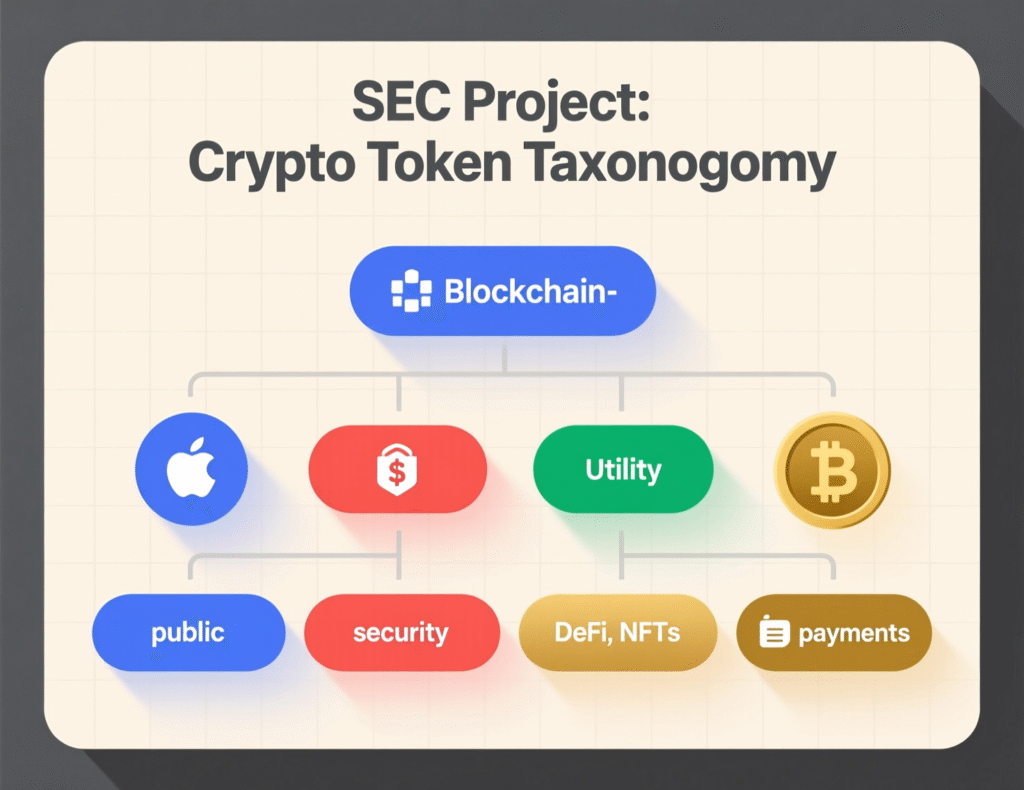

Momentum is also building behind the House-approved Digital Asset Market CLARITY Act, which aims to establish a unified market structure and clearly divide oversight responsibilities between the SEC and CFTC. Meanwhile, the SEC’s “Project Crypto” initiative under Chair Paul S. Atkins reinforces the shift toward clearer rules, signaling that the U.S. is positioning itself to attract greater institutional participation in digital assets.

The U.S. regulatory turn, at a glance

GENIUS Act now in force

The first federal statute addressing payment stablecoins, intended to boost transparency, reserve quality and supervision.

CLARITY Act advancing

The House passed a comprehensive market-structure bill in July; Senate committees have released discussion drafts that build on it.

SEC’s “Project Crypto”

Chair Atkins outlined a token-classification approach and other measures to align securities rules with blockchain markets.

Market impact: stablecoins, ETFs and listings

Bernstein highlights three signposts of maturation

Stablecoins

JPMorgan estimates total supply around $260bn, aided by clearer rules and institutional participation.

ETFs

BlackRock/iShares pegs global bitcoin ETF AUM near US$160bn, reflecting deeper institutional channels.

Index inclusions

Coinbase entered the S&P 500 in May; Robinhood followed in September symbolic steps for crypto-exposed equities. S&P Global+1

How the U.S. crypto framework could work

What GENIUS + CLARITY mean for oversight

The GENIUS Act addresses payment-stablecoin issuance and reserves. The House-passed CLARITY Act would delineate “digital commodities” vs. securities and direct the SEC and CFTC to implement rules while the Senate’s bipartisan drafts iterate on the CFTC’s remit over digital commodities.

SEC’s Project Crypto and the U.S. crypto framework global leader thesis

Chair Atkins’ remarks signal a forthcoming “token taxonomy,” potential exemptions for certain digital-asset securities, and modernization of market plumbing for tokenization and 24/7 settlement aimed at lowering costs and improving interoperability with securities systems.

Implementation path within the U.S. crypto framework global leader

taxonomy to classify tokens; 2) tailored disclosure/registration where needed; 3) broker-dealer permissions for tokenized assets; 4) coordination with CFTC on digital commodities; and 5) phased rulemaking aligned to statutory mandates.

Context & Analysis

The U.S. is moving from “regulation by enforcement” toward codified rules. The combination of a stablecoin statute, a House-passed market-structure bill, and an SEC classification push addresses long-standing uncertainty. That said, Senate negotiations and final rule texts will determine how far and how fast the institutional build-out proceeds.

Conclusion

If Congress succeeds in passing comprehensive market-structure legislation and the SEC fully implements its proposed crypto taxonomy, the U.S. could secure a long-lasting leadership position in digital asset regulation. Such clarity would give institutions, issuers, and investors more confidence in how digital assets are categorized and supervised across the financial system.

This progress could pave the way for greater stablecoin adoption, wider use of crypto-based ETFs, and the expansion of tokenized market infrastructure. Together, these developments would reinforce Bernstein’s view that the U.S. is on track to shape the next phase of global crypto innovation and adoption.

FAQs

Q : What is the GENIUS Act?

A : A federal law establishing a framework for payment stablecoins, signed on July 18, 2025.

Q : What does the CLARITY Act do?

A : It sets out a market-structure framework and directs SEC/CFTC rulemaking; it passed the House and is before the Senate.

Q : How does the SEC’s “Project Crypto” fit in?

A : It proposes a token taxonomy and other measures to align securities regulation with blockchain markets.

Q : Are stablecoins growing under the new regime?

A: Yes. JPMorgan estimates total stablecoin supply around $260bn in 2025.

Q : Do ETFs matter here?

A : Yes. Global bitcoin ETF AUM is around US$160bn, giving institutions regulated access.

Q : Which public companies signal mainstreaming?

A : Coinbase joined the S&P 500 in May, and Robinhood was added in September 2025.

Q : Does this make the U.S. crypto framework a global leader?

A : According to Bernstein, yes thanks to new laws and rulemaking momentum. Final Senate action and SEC/CFTC rules still remain pivotal.

Facts

Event

Bernstein says the U.S. regulatory framework now positions America as global leader in crypto.Date/Time

2025-11-12T13:54:00+05:00Entities

Bernstein; U.S. Congress; U.S. Securities and Exchange Commission (SEC); Commodity Futures Trading Commission (CFTC); JPMorgan; BlackRock/iShares; Coinbase (COIN); Robinhood (HOOD).Figures

Stablecoin supply ≈ $260bn (global); Global bitcoin ETF AUM ≈ US$160bn; S&P 500 inclusions COIN (May 19, 2025), HOOD (Sept 22, 2025). Reuters+3Reuters+3BlackRock+3Quotes

“Project Crypto” and a forthcoming “token taxonomy” outlined by SEC Chair Paul S. Atkins (Nov. 12, 2025). ReutersSources

CoinDesk (news) + Reuters (GENIUS/Atkins) + S&P Dow Jones (S&P 500) + BlackRock (ETF AUM)