DeFi Tokens Weekly Update (Feb 7, 2026): TVL Near $100B as Sector Reprices Risk

DeFi has just come through another choppy week. ETH selling, a stETH liquidity scare and risk-off flows across majors have hit token prices hard but on-chain capital hasn’t fled in the same way.

This DeFi tokens weekly update for Feb 7, 2026 finds sector market cap sitting around $49.5B and total DeFi TVL hovering in the $100–150B band (depending on the data source), suggesting the market is repricing risk rather than abandoning DeFi entirely.

Where DeFi Tokens Stand This Week

Right now, the DeFi market cap is around $49.5B, with 24h sector gains of roughly +5–6%, while total DeFi TVL sits somewhere in the $100–150B range across major dashboards.Recent ETH selling and a stETH liquidity shock have pressured DeFi token prices, even as on-chain deposits and institutional DeFi products keep TVL relatively firm.For the moment, key “support” for the sector is holding above roughly $40B in DeFi market cap and $100B in TVL, with upside “resistance” around prior highs near $60B market cap and $130B+ TVL.

Key Data Snapshot (as of 7 Feb 2026, 09:18 UTC)

Sector overview (CoinGecko “DeFi” category)

DeFi market cap: ≈ $49.5B

24h change (sector): +5.5%

24h volume (sector): ≈ $6.6B

DeFi share of global crypto market: ~2.0%

DeFi : ETH ratio (by market cap): ~20.3%

TVL on CoinGecko DeFi page: ≈ $149.3B (broad DeFi definition)

At the post this time

Sector TVL (DeFiLlama-based estimates, via recent reports)

Recent DeFi TVL cited around $103.8B (Feb 2, 2026) and about $105B after a ~12% drop from ~$120B during the latest sell-off.

Takeaway.

Underlying capital remains relatively sticky even as token prices whipsaw.

Proxy basket (DeFi Pulse Index DPI, indicative only)

Current DPI price: roughly mid-$40s to low-$50s across major trackers (figures vary slightly by venue)

7d change (CoinGecko): ≈ –15.5% (DPI underperforming the broader crypto market over the week).

7d high / low (Crypto.com): high ≈ $59.35, low ≈ $52.71 – indicative weekly range for a diversified DeFi basket.

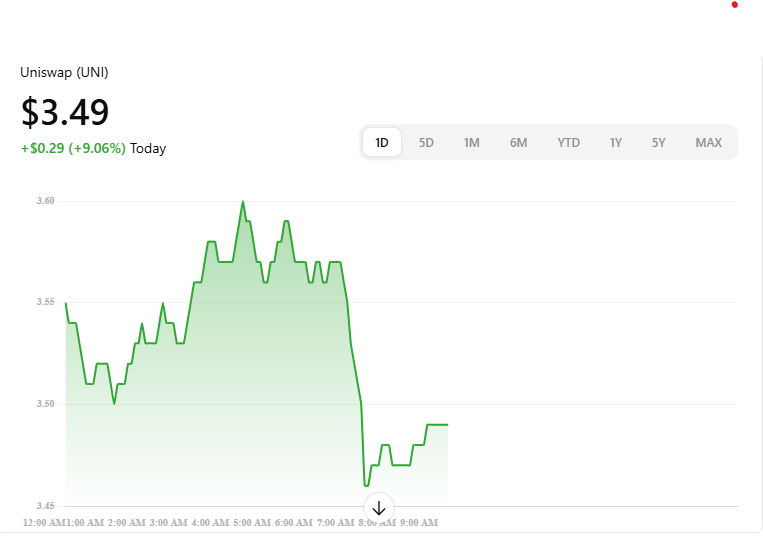

Token proxy spot check.

Here’s a quick look at Uniswap (UNI) as a leading DeFi token proxy:

UNI is a DeFi governance token trading in the crypto market, not traditional equities.

Indicative spot price: ~3.49 USD, a change of 0.29 USD (0.09%) versus the previous close.

Intraday range: 3.20–3.61 USD.

All numbers above are indicative only and can move quickly; always refer to live dashboards and exchanges for up-to-date data.

Main data sources: CoinGecko, DeFiLlama, CoinMarketCap, MetaMask price pages, Crypto.com, and recent coverage from CoinDesk and others.

This week’s DeFi tokens weekly update comes against a backdrop of sharp ETH selling and broader crypto risk-off flows. A high-profile ETH sale by Vitalik Buterin coincided with spot ETH ETF outflows and a brief drop in DeFi TVL below $100B, before stabilising back in the low-100B zone.

Despite the price pressure, TVL has fallen far less than token prices, suggesting many users are keeping capital in protocols rather than fully exiting on-chain finance. Several analyses highlight a TVL drawdown of around 12% (from roughly $120B to about $105B) versus much steeper declines in DeFi token valuations.

In other words: risk is being repriced, not necessarily abandoned.

DeFi Tokens Price Action & Key Levels

Weekly performance

Sector-wide, DeFi market cap is sitting around $49.5B, up ~5.5% on the day but still well below local highs above $60B seen in prior months.

As a diversified benchmark, the DeFi Pulse Index (DPI) shows an estimated –15% move over the past 7 days, underperforming both the overall crypto market and many large-cap L1s.

Within the DeFi category, top names like liquid-staking tokens (stETH / wstETH), oracle plays like Chainlink, and high-beta perps/DEX tokens show a mix of double-digit winners and losers, reinforcing the idea that intra-sector rotation is very active.

Short-term technical view

Using DPI and majors like Uniswap and Aave as proxies:

Trend: short-term trend is down-to-sideways after a sharp flush – lower highs on most DeFi charts, but with buyers defending major support levels set in late 2025.

Key “support zones” (sector level)

DeFi market cap: $40–45B (rough area where buyers stepped in during the latest sell-off).

TVL: $100B region (a sustained move below here would signal a deeper user exodus). (MEXC)

Key “resistance zones”

DeFi market cap reclaiming $60–65B.

TVL returning to $130B+, where it hovered earlier in the cycle. (Focus on Business)

Volatility remains elevated; intraday swings of 10–20% in mid-cap DeFi tokens are common, so position sizing and risk controls matter more than usual.

News & Narratives That Moved DeFi This Week

ETH selling & TVL wobble

A sizable ETH sale from Vitalik Buterin plus spot ETF outflows pushed ETH lower and dragged DeFi valuations with it, briefly knocking TVL below the $100B mark before a partial recovery.

StETH liquidity shock and depeg scare

A single 2.3M stETH withdrawal in Lido triggered a roughly 6% stETH depeg versus ETH, reminding markets that even “blue-chip” liquid-staking tokens carry real liquidity and concentration risks.

Institutional yield products building on DeFi

SCRYPT’s partnership with Gauntlet to offer Swiss-licensed, risk-managed DeFi yield strategies underlines growing institutional interest, with the announcement citing DeFi TVL of $103.8B as of Feb 2.

Bitcoin DeFi & BTCfi narrative

Fireblocks integrating the Stacks ecosystem for Bitcoin-native DeFi is another sign that DeFi is no longer just an Ethereum story, but spreading across L2s and alt-L1s as well.

Chain & TVL dispersion

Reports on the fastest-growing chains by TVL show that some ecosystems (for example, certain L2s and RWA-focused chains) are gaining share even as aggregate DeFi TVL pulls back, suggesting that narrative-driven capital rotation is still very much alive.

On-Chain, Derivatives & Sentiment

TVL resilience: multiple analytics pieces highlight that while DeFi TVL fell from ~$120B to ~$105B (~–12%), this is mild compared with token price drawdowns, implying that many lenders, LPs and stakers are riding out volatility rather than exiting DeFi entirely.

Ethereum dominance: the Ethereum DeFi stack still commands roughly 60–70% of all DeFi TVL, with estimates around $70B+ locked on Ethereum alone, underscoring the chain’s continued central role despite competition from Solana, BNB Chain and L2s.

Sentiment & leverage: derivatives and funding data (where available) point to reduced leverage, with many traders de-risking after the November–January run-up. That typically sets the stage for more “organic” moves driven by spot flows and fundamentals rather than by cascade liquidations.

Overall sentiment is cautiously bearish but far from capitulation – protocols with real cashflows and sticky TVL are holding up relatively better than purely narrative tokens.

DeFi Tokens vs Bitcoin & the Wider Crypto Market

Aggregate DeFi has underperformed BTC and the largest L1s over the last week and, in many cases, over the last month. DPI’s roughly –15% 7-day move contrasts with an estimated –10–12% drawdown in the broader crypto market.

However, DeFi’s TVL drawdown is smaller than its price drawdown, suggesting that the “fundamental” base of users is somewhat stronger than token charts alone might imply.

Chains with strong DeFi ecosystems (Ethereum, selected L2s and a handful of alt-L1s) still rely on DeFi as a major driver of on-chain fees and user retention, so how DeFi fares from here will heavily influence broader market structure.

What This Means for Traders & Long-Term Holders

For short-term traders

Expect high volatility in mid-cap DeFi names; daily swings of 10%+ are common.

Watch sector “macro levels”: DeFi market cap holding above $40–45B and TVL above $100B are important signals that the on-chain economy is still intact.

Liquidity events (like the stETH depeg shock) can create short-lived dislocations but also abrupt repricing in correlated tokens.

Orderbook depth is thinner after the latest sell-off; consider conservative leverage and clear invalidation levels rather than “all-in” bets.

For longer-term DeFi believers

The core thesis – programmable lending, trading and yield remains intact, and institutional experiments (structured DeFi yield, RWA-backed products) are slowly maturing.

Concentration risk is real: liquid-staking and a relatively small number of “blue-chip” protocols capture a large share of TVL, so governance and smart-contract risk in these hubs matter a lot.

Ethereum’s continued TVL dominance plus the rise of BTC-based and L2-based DeFi point to a multi-chain future, rather than a winner-takes-all outcome.

Regulatory treatment of yield-bearing tokens, stablecoins and RWAs will likely remain a key macro driver for DeFi valuations over 2026.

Risks, Scenarios.

Bullish scenario (medium term)

ETH stabilises, ETF outflows slow, and TVL climbs back toward $130–150B.

High-quality DeFi protocols grow revenues and fee discounts, and DPI-like baskets make new local highs.

Neutral scenario

DeFi grinds sideways with TVL stuck near $100–120B, while capital rotates between L2s, RWAs, DEXs and perps.

Strong protocols decouple slowly; weaker ones continue to fade out.

Bearish scenario

Further macro stress or crypto-specific shocks push ETH and majors lower again, dragging DeFi tokens into deeper drawdowns and knocking TVL well below $90–95B.

That would suggest users are not just repricing but actively leaving on-chain finance, at least temporarily.

Final Thoughts

This DeFi tokens weekly update shows a sector that’s bruised but far from broken. TVL holding near the $100B region, despite sharp price drawdowns and headline shocks, suggests users are repricing risk rather than abandoning on-chain finance. Fundamentals, not just narratives, still matter for capital allocation.

For traders and long-term believers alike, the coming weeks hinge on whether DeFi can defend key support zones and rebuild confidence after the latest volatility spike. Staying selective, managing position size, and respecting protocol risk remain essential as the market searches for its next sustained trend in what remains a high-risk experimental landscape.

FAQs

Q : Why did DeFi tokens underperform this week?

A : DeFi tokens lagged because the latest leg of the sell-off was centred on ETH and high-beta altcoins, and DeFi sits right in that risk bucket. At the same time, news about ETH selling, a stETH depeg scare, and profit-taking after strong 2025–early-2026 runs all weighed on sentiment, leaving DeFi baskets like DPI down more than the broader crypto market over the last 7 days.

Q : Is the drop in DeFi TVL a sign of a crisis?

A : Not necessarily. Recent data shows DeFi TVL fell roughly 12%, from around $120B to about $105B, while many DeFi tokens fell much more than that.That pattern suggests capital is repricing risk rather than abandoning DeFi altogether, although a sustained break much below $100B TVL would be more concerning.

Q : Which metrics should I watch for DeFi in the coming week?

A : Key metrics include total DeFi TVL (especially whether it holds above roughly $100B), sector market cap (around $49.5B today) and Ethereum’s share of DeFi TVL (around 60–70%). It’s also useful to track liquid-staking token health (like stETH’s peg), DEX volumes and funding/open interest on major perps exchanges for DeFi names.

Q : Are any parts of DeFi holding up better than others?

A : Yes. Liquid-staking, some yield-bearing tokens and blue-chip money markets tend to retain TVL better than more speculative farms and small-cap protocols. Recent reports highlight that while prices drop, many users keep collateral parked in lending markets and DEX LP positions, especially on Ethereum and a few leading L2s.

Q : Is DeFi still riskier than holding BTC or ETH spot?

A : In general, yes. DeFi adds smart-contract risk, governance risk, liquidity risk and sometimes regulatory risk on top of usual crypto price volatility. Incidents like the stETH liquidity shock show that even large protocols can face sudden stress events, so diversification, position sizing and careful protocol selection remain essential.