Curve Finance Founder Michael Egorov Launches Bitcoin Yield Protocol

Curve Finance founder Michael Egorov has introduced the Yield Basis Bitcoin (YB) protocol, an innovative automated market maker built to provide BTC holders with sustainable on-chain yield. Unlike traditional DeFi pools, YB is designed to eliminate the risk of impermanent loss, making it a safer option for users seeking to earn returns on their Bitcoin holdings. The protocol is launching with capped pools, ensuring controlled liquidity in its early stages while maintaining efficiency and security.

In addition, the ecosystem introduces veYB governance, allowing users to participate in protocol decisions and shape its long-term direction. To further drive adoption, a token sale is planned through Kraken Launch, in partnership with Legion, giving investors and the wider crypto community early access to YB’s growth potential.

What is the Yield Basis Bitcoin yield protocol?

Yield Basis is a Curve-native AMM that keeps a constant leverage on BTC/crvUSD LP positions and uses a dynamic fee structure to align incentives among LPs and veYB voters. The design seeks to neutralize impermanent loss while maintaining deep two-asset liquidity. Early pools are capped to limit risk as integrations and arbitrage routes develop.

How the Yield Basis Bitcoin yield protocol aims to remove IL

According to the governance proposal and docs, Yield Basis borrows crvUSD against BTC wrappers and auto-re-leverages LP positions to hold target exposure, recycling 50% of trading fees and all borrow costs into a rebalancing budget. Unstaked ybBTC holders earn real trading fees (BTC-denominated), while veYB accrues the admin-fee portion; the split adjusts with staking. Curve.finance Governance+2docs.yieldbasis.com+2

Launch parameters, caps and credit line

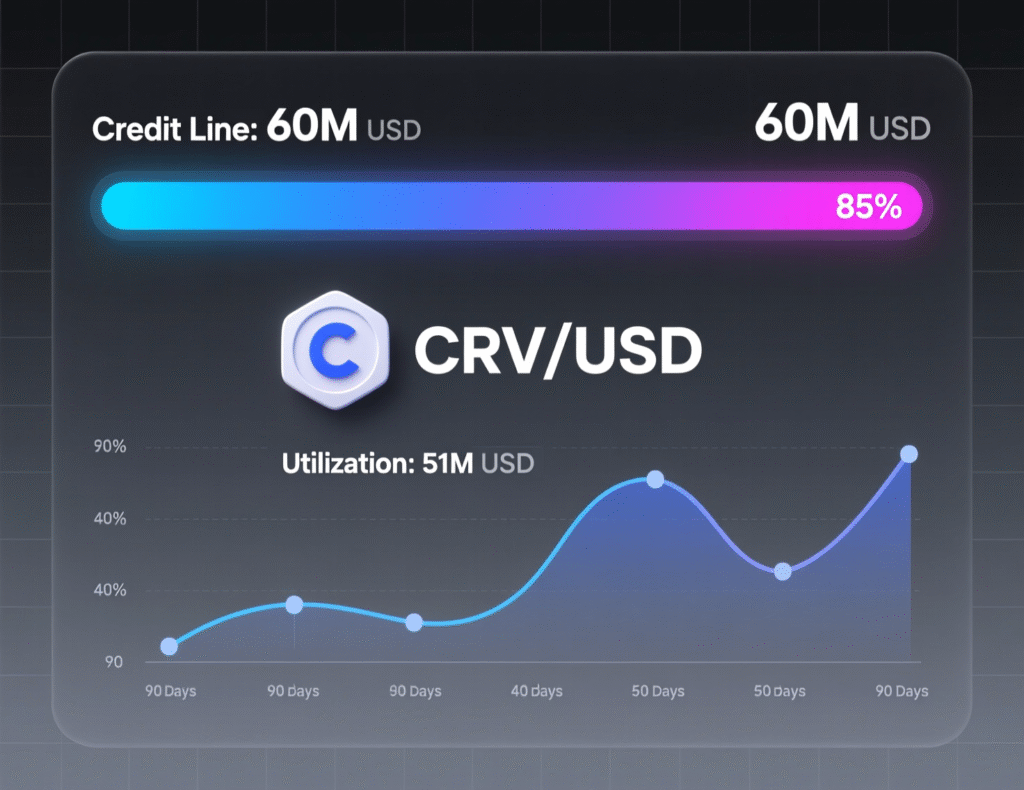

At launch, Yield Basis is using capped liquidity pools to manage early growth. Separately, the Curve DAO approved a proposal granting Yield Basis a $60 million crvUSD facility to support BTC-focused pools (WBTC, cbBTC, tBTC) on Ethereum an important liquidity backstop for the AMM. Caps communicated during the governance process referenced $10M per pool (with lower initial allocations), while reporting on launch day described $1M caps per pool.

Governance, emissions and fee mechanics

Yield Basis adopts veTokenomics (veYB). Token holders lock YB to participate in governance and receive protocol revenue via a dynamic admin fee. Docs outline a 50/50 split of trading fees between the rebalancing budget and distribution to veYB/unstaked LPs; fee share to veYB rises as more LPs opt into staking for emissions. Modeling presented to the Curve DAO suggests Curve/veCRV ultimately captures a meaningful portion of system value indirectly through stableswap activity and an allocation of YB emissions.

Funding, listings and expansion

Yield Basis raised $5 million in early 2025. The YB token will be offered on Kraken Launch (powered by Legion) beginning October 1 at 14:00 UTC with fixed pricing and purchase limits; a Kraken listing is expected after the TGE. Egorov indicated the approach could later extend beyond BTC to ETH and other on-chain assets.

How to join the YB token sale on Kraken Launch

<section id=”howto”> <h3>How to participate in the YB sale via Kraken Launch</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Verify your Kraken account to at least “Intermediate” (Business Pro for entities).</li> <li id=”step2″><strong>Step 2:</strong> Check regional eligibility (sale excludes residents of the US, Canada and Australia).</li> <li id=”step3″><strong>Step 3:</strong> Fund your account in USD, EUR, GBP or supported stables (USDC/USDT/“USDG,” per Kraken page).</li> <li id=”step4″><strong>Step 4:</strong> On <em>Oct 1, 14:00 UTC</em>, open Kraken Launch and select the **Yield Basis** sale.</li> <li id=”step5″><strong>Step 5:</strong> Commit your purchase (min $10; max $10,000) at the fixed sale price; a 0.5% fee applies (waived for Kraken+).</li> <li id=”step6″><strong>Step 6:</strong> After TGE and listing, manage YB like any asset on Kraken (no vesting/lock-ups per FAQ).</li> </ol> <p><em>Note: Terms, assets accepted and limits are set by Kraken; review official FAQs before participating.</em></p> </section> :contentReference[oaicite:13]{index=13}

Context & Analysis

Yield Basis is attempting a delicate balance: offering “real yield” to BTC LPs without equity-like dilution while maintaining Curve-aligned incentives. The crvUSD facility reduces bootstrapping friction, but concentrates risk if parameters or markets are stressed. Early caps and governance-controlled levers (admin-fee, emissions, credit ceiling) are designed to throttle growth and protect stableswap integrity. How third-party market-makers route arb (BTC↔crvUSD↔redeemable USD) will determine fee flow to both veYB and veCRV.

Conclusion

Yield Basis brings a fresh automated market maker model for Bitcoin liquidity, featuring governance-driven fee structures to align incentives. Its launch includes capped pools to manage initial liquidity and a DAO-approved crvUSD credit line, creating a foundation for stable on-chain yields without impermanent loss.

A public token sale is set to debut soon on Kraken Launch, offering early participants a chance to join the network’s growth. The key challenge now is market adoption and proving that its impermanent-loss-free design can maintain performance and scalability once real trading volumes and order flows begin to build.

FAQs

Q :What is the Yield Basis Bitcoin yield protocol?

A : It’s a Curve-native AMM that uses leverage and dynamic fees to neutralize impermanent loss (IL) while offering BTC-denominated yield.

Q :How does it remove impermanent loss?

A : By maintaining constant exposure via automated re-leveraging and using fees/borrow costs to fund rebalancing.

Q :What are the initial pool caps?

A : Governance materials discussed ~$10M per pool with smaller initial allocations; launch coverage cited ~$1M per pool to start.

Q :Who earns fees and how?

A : Unstaked ybBTC holders receive trading fees (BTC-denominated); veYB receives the admin-fee portion. 50% of fees fund rebalancing.

Q :When and where is the YB token sale?

A : Oct 1, 14:00 UTC on Kraken Launch (via Legion) with fixed price and purchase limits.

Q :How is Curve DAO involved?

A : It approved a $60M crvUSD credit line to help seed BTC-stable pools that the AMM relies on.

Q :Will Yield Basis support assets beyond BTC?

A : Yes, the founder indicated potential expansion to ETH and other assets over time.