Cryptocurrency valuation factors: how pricing, risk, and rules shape digital assets

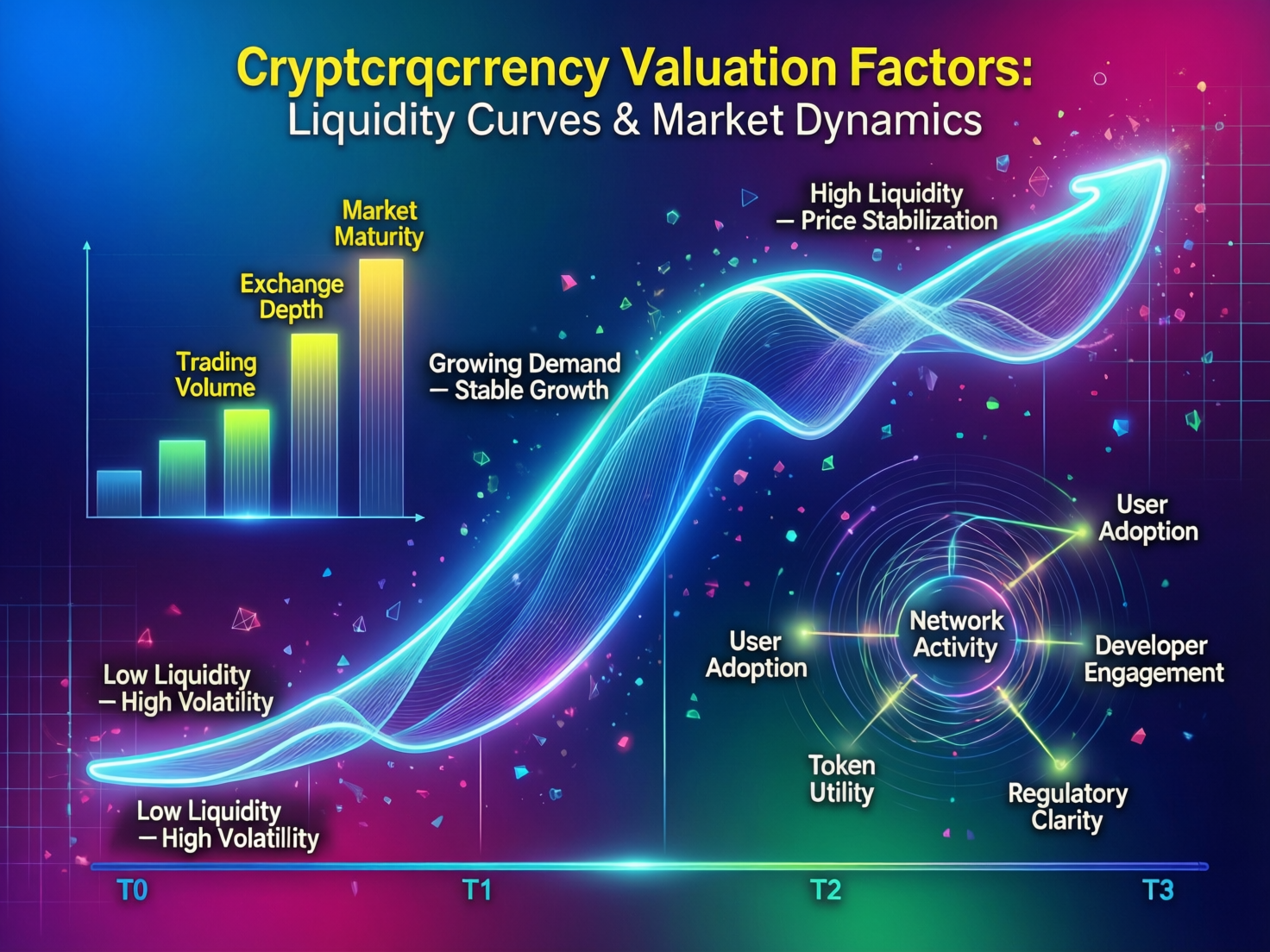

Cryptocurrency valuation depends on several real-world factors that shape price movement and market stability. Recent regulatory developments, evolving compliance standards, and clearer government frameworks now play a major role in determining investor confidence. At the same time, token design elements such as supply mechanics, incentive models, and governance structures directly influence how digital assets behave in different market conditions. Understanding these fundamentals helps reveal why certain tokens gain traction while others lose relevance.

Market sentiment is also shaped by network activity, including transaction volume, developer engagement, and ecosystem growth. These on-chain signals act as indicators of long-term sustainability. For both investors and project teams, strong due diligence should focus on liquidity, real utility, security practices, and the health of the supporting community. This expert Q&A highlights the key metrics and risks that matter most.

What is the blockchain “trilemma” and why it matters

The trilemma scalability, decentralization, security forces trade-offs that shape throughput, fees, and attack resistance. Those trade-offs feed directly into valuation by influencing user adoption, regulatory perception, and operating risk.

Categories of digital assets since Bitcoin

Base-layer platforms & VMs

Ethereum pioneered the EVM; alternative L1s/L2s optimize cost/speed with different security or decentralization choices.

Fiat-backed stablecoins

One-to-one (e.g., USDT, USDC) instruments that compress volatility and lubricate cross-border flows; their chain distribution concentrates liquidity on specific networks.

DApps & protocols

DeFi, oracles, exchanges, gaming, and infra tokens derive value from fee accrual, governance, or required gas.

Other tokens

NFTs, meme coins, and rollup tokens illustrate how community, utility, and token mechanics interact.

Core pricing drivers investors actually see

Supply mechanics

Hard caps (e.g., Bitcoin) or dynamic issuance/burn policies (e.g., EIP-1559) set structural scarcity.

Utility

Required gas (e.g., ETH for smart contracts) and protocol fee sinks create baseline demand.

Liquidity depth

Tight spreads and deep books reduce impact costs and dampen volatility.

Distribution & concentration

Whale/top-holder concentration raises manipulation and gap-risk potential.

Macro & regulation

Policy clarity and access vehicles (ETPs/ETFs) expand addressable demand. In the U.S., spot Bitcoin ETPs were approved on Jan. 10, 2024; the SEC followed with disclosure guidance for crypto ETPs on July 1, 2025.

Tokenomics: why supply distribution changes risk

Vesting schedules and emission curves throttle new supply, reducing cliff risk and dampening dilution. Fixed halving schedules (Bitcoin) and variable burn dynamics (Ethereum) demonstrate how rule sets can be either disinflationary or, at times, net-deflationary. Properly staggered unlocks support healthier secondary markets.

How regulators evaluated spot crypto ETPs

After a D.C. Circuit ruling criticizing prior denials, the SEC approved multiple spot Bitcoin ETPs with investor-protection requirements (disclosure, regulated venues) on Jan. 10, 2024. In July 2025, the SEC’s Corporation Finance division outlined disclosure expectations for crypto ETP issuers focusing on risk factors, market quality, safekeeping, and conflicts.

XRP Ledger (XRPL), Ripple, and governance

XRPL launched in 2012 with XRP as its native currency. Consensus relies on Unique Node Lists (UNLs) validator lists trusted not to collude. Operators can select their own lists; default lists are maintained by publishers including Ripple and the XRP Ledger Foundation, with ~35 validators reflected in default UNLs as of mid-2024, a design that critics say concentrates influence. XRP Ledger+1

Ripple, enforcement history, and payments adoption

The SEC sued Ripple in 2020; a July 2023 ruling found institutional XRP sales unregistered while exchange (programmatic) sales were not investment contracts. In May 2025, the SEC announced a settlement framework including a civil penalty of ~$125 million; Commission statements summarize outcomes and remaining contours. Justia+2SEC+2

Ripple later announced RLUSD, an enterprise-grade USD stablecoin, on Dec. 17, 2024, broadening payment options while XRPL fees continue to burn small amounts of XRP.

RippleNet reports hundreds of financial-institution integrations globally; public case studies cite prominent banks using Ripple services for cross-border flows. (Scale and exact XRP usage rates vary by corridor and product.)

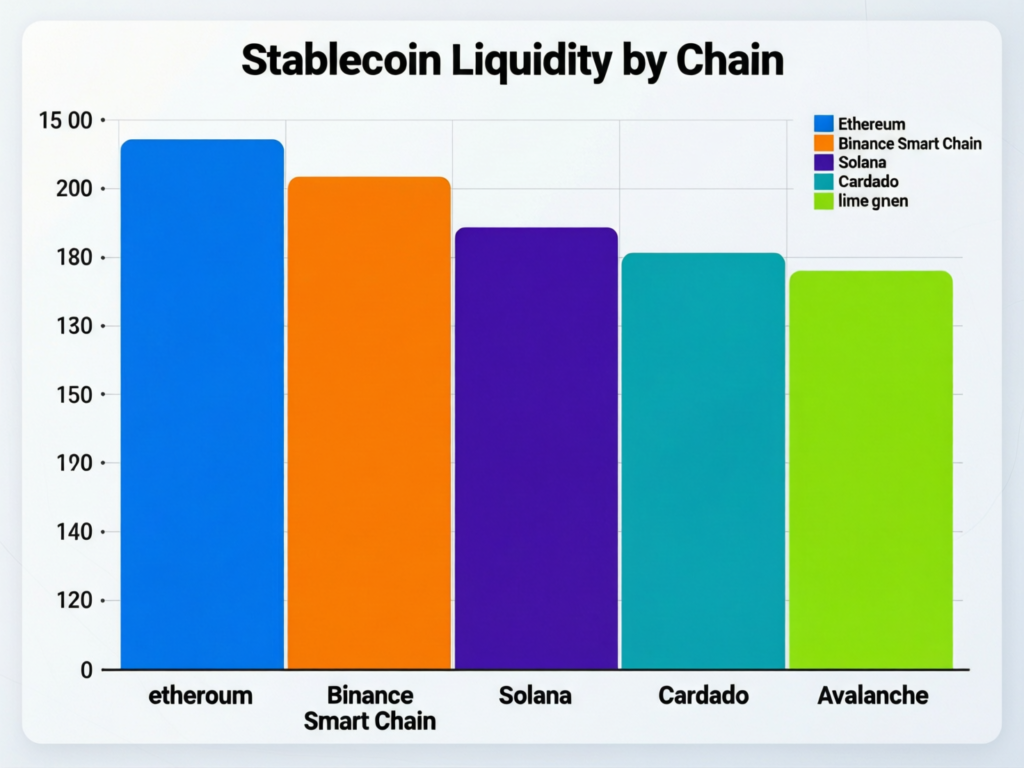

Liquidity and stablecoin distribution

Stablecoin supply concentration by chain (e.g., Ethereum, Tron, Solana) determines where liquidity and therefore tighter pricing aggregates. Investors should track chain-share shifts, as market-making and venue support follow that liquidity.

Cryptocurrency valuation factors in practice

On-chain activity: fees, transactions, active addresses, TVL.

Market structure: derivatives basis, funding, open interest, off-exchange reserves.

Idiosyncratic risk: governance keys, validator sets, oracle dependencies, smart-contract audits.

Regulatory catalysts: ETP approvals, stablecoin statutes, exchange registrations.

Applying cryptocurrency valuation factors to research checklists

Token supply & unlock calendar, treasury controls

Utility map (who must buy/hold, why, and when)

Liquidity venues and market-maker coverage.

Legal posture (commodities vs. securities debates), disclosures, and enforcement history.

Competitive moat and switching costs.

Context & Analysis

The combination of spot Bitcoin ETP access and 2025 disclosure guidance reduced frictions for institutions. At the same time, liquidity has gravitated to chains with large stablecoin floats, reinforcing network effects that can lift or depress asset valuations cyclically.

Last Words

Crypto valuation today depends on a mix of thoughtful token design, real user activity, market liquidity, and ongoing regulatory developments. The way a token is structured its supply model, incentives, and utility shapes how it performs across different market environments. Actual network usage and transaction flows further reveal whether a project has genuine traction or short-term hype.

To identify durable networks, investors can rely on a disciplined checklist. Evaluating tokenomics, liquidity depth, and exchange market structure provides clarity on long-term viability. Assessing regulatory alignment and compliance signals also helps filter strong projects from momentum-driven outliers.

FAQs

Q1 : What are the main cryptocurrency valuation factors?

A : Supply/emissions, utility/fee sinks, liquidity depth, holder concentration, and regulation.

Q2 : How do vesting and emissions affect price?

A : They govern new supply, influencing dilution, sell-pressure timing, and volatility.

Q3 : Did the SEC approve spot Bitcoin products?

A : Yes. On Jan. 10, 2024, the SEC approved listings for multiple spot Bitcoin ETPs.

Q4 : How does XRP’s consensus differ from proof-of-work?

A : XRPL uses a UNL-based consensus where servers follow trusted validators instead of mining.

Q5 : Are stablecoins important to valuation?

A : Yes, their chain distribution directs liquidity and price discovery.

Q6 : What is RLUSD and why does it matter?

A : Ripple’s USD stablecoin (announced Dec. 17, 2024) may broaden payment options while XRPL fees still burn XRP.

Q7 : Where can I track market-wide dominance or snapshots?

A : Use CoinMarketCap’s historical snapshots and dominance charts.

Facts

Event

Expert Q&A on valuation, risk, and regulation in digital assetsDate/Time

2026-01-01T12:00:00+05:00Entities

XRP Ledger (XRPL); Ripple; U.S. SEC; Bitcoin (BTC); Ethereum (ETH); RLUSDFigures

SEC civil penalty in settlement framework ~USD 125 mn (May 2025); default UNL ≈35 validators (mid-2024)Quotes (sources)

“Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares.” SEC Chair Gary Gensler, 2024-01-10. SEC

Sources

SEC statement on spot Bitcoin ETPs SEC; SEC staff statement on crypto ETP disclosures SEC