Cryptocurrency regulations in Qatar, Kuwait & Oman explained

Qatar and Kuwait largely ban or heavily restrict cryptocurrency services, while Oman is moving toward a licensing-based regime where only authorised virtual asset service providers (VASPs) can operate. For US, UK and EU investors looking at cryptocurrency regulations in Qatar, Kuwait and Oman, that means Kuwait is effectively off-limits, Qatar is very high-risk and limited to narrow QFC digital-asset use cases, and Oman is the only realistic option in this trio for regulated crypto activity.

Why GCC Crypto Rules Matter for US/UK/EU Investors

The Gulf Cooperation Council (GCC) is firmly on the radar for crypto exchanges, fintechs and high-net-worth investors from New York, London and Frankfurt. But when you zoom in on cryptocurrency regulations in Qatar, Kuwait and Oman, you find three very different regulatory philosophies shaped by Islamic finance, AML/CTF priorities and local risk appetites.

At a high level, Kuwait has adopted an absolute prohibition on most crypto activities, Qatar heavily restricts virtual asset services but now allows certain tokenised assets in the Qatar Financial Centre (QFC), and Oman is working toward a full VASP licensing regime under its Virtual Assets Regulatory Framework.

Against a backdrop where global crypto market capitalisation has hovered around USD 1–2 trillion since 2024, and roughly 6–7% of the world’s population is estimated to own some form of digital currency, these Gulf rules can strongly shape where US, UK and EU investors choose to live, bank and build products.

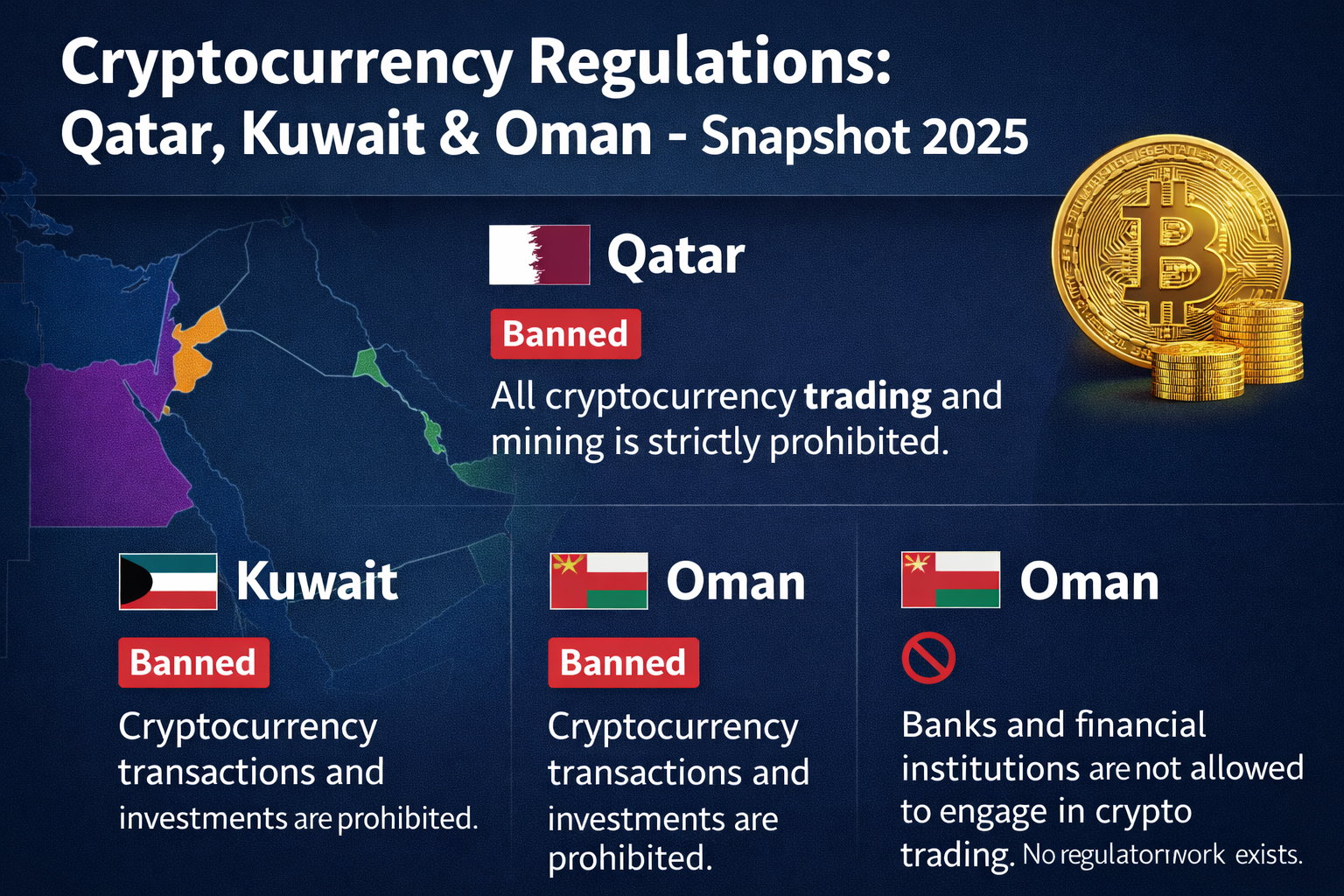

Snapshot Are Cryptocurrencies Legal in Qatar, Kuwait and Oman?

The short answer is: Kuwait = banned, Qatar = heavily restricted, Oman = allowed under a developing VASP framework. Qatar and Kuwait lean toward prohibition to reduce perceived money-laundering, consumer-protection and Sharia-compliance risks, while Oman is closer to UAE/Bahrain in building a regulated virtual-asset regime.

Quick legality table by country

(“Can residents trade?” in practice usually means using foreign platforms; local law may still treat such activity as non-compliant or risky.)

| Country | Can residents trade?* | Local exchanges / VASPs? | Bank support for crypto? | Penalties risk level |

|---|---|---|---|---|

| Qatar | Very limited; offshore, at personal risk | No QFC-licensed crypto exchanges; tokenised securities only | Banks generally avoid crypto-linked transfers | High – regulatory breaches can trigger enforcement |

| Kuwait | No – effective ban on payments, investment & mining | No licensing of VASPs permitted | Banks & licensed entities barred from supporting crypto | Very high – “absolute prohibition” stance |

| Oman | Yes, in principle, via licensed VASPs under new framework | VASP licensing regime under development with FSA | Expected to support regulated VASPs as regime matures | Medium–high – strong AML/CTF controls expected |

Qatar’s regulators have confirmed that virtual asset services may not be conducted in or from the QFC, even though a QFC Digital Assets Framework 2024 now recognises tokenisation and smart contracts for certain financial instruments.

Kuwait’s 2023 circulars go further, imposing an “absolute prohibition” on crypto payments, investments, mining and licensing of VASPs.

Oman’s Financial Services Authority (FSA, formerly the Capital Market Authority) is meanwhile building a Virtual Assets Regulatory Framework that will license exchanges, custodians and other VASPs under a risk-based model aligned with FATF guidance.

How These Stances Compare to Other GCC and Global Markets

Compared with UAE free zones such as Dubai’s VARA regime, Abu Dhabi’s ADGM or Bahrain’s crypto-friendly approach, Qatar and especially Kuwait are outliers on the restrictive side, while Oman is moving toward the more open, licensing-based camp.

From a global perspective

MiCA in the EU creates a harmonised passporting regime for crypto-asset service providers (CASPs), overseen by national regulators like BaFin in Germany.

FATF standards require countries to license or register VASPs and apply AML/CTF controls plus the Travel Rule, but leave room for states to choose stricter options, including outright bans.

In other words, FATF doesn’t require Kuwait to license VASPs; it simply demands that whatever approach is chosen (ban or licensing) still mitigates money-laundering and terrorist-financing risks.

What This Means If You’re Searching from the US, UK or Germany

US expats & investors (SEC, IRS, FATCA):

US persons remain taxable on worldwide crypto gains, whether trading from Doha, Kuwait City or Muscat. Exchanges supervised by the SEC or FinCEN will treat clients in high-restriction states (like Kuwait) as elevated AML risk and may block onboarding.

UK residents and firms (FCA, HMRC)

The FCA’s crypto-asset financial promotions rules and HMRC capital-gains regime apply even when you sit in GCC coworking spaces. Marketing to Qatar or Kuwait residents from London can still trigger local enforcement risk.

German/EU investors (BaFin, BMF, MiCA):

Under MiCA, BaFin will expect CASPs in Frankfurt or Berlin to treat GCC clients according to EU rules and to respect local prohibitions in Qatar and Kuwait, while potentially seeing Oman as an emerging but still high-risk VASP jurisdiction.

Qatar Restricted Crypto Market with a New Digital Assets Framework

Is Crypto Legal in Qatar?

Practically speaking, most crypto services are banned or heavily restricted in Qatar. The Qatar Financial Centre Regulatory Authority (QFCRA) prohibits virtual asset services like exchanges, transfers and custody from being conducted in or from the QFC.

However, the QFC Digital Assets Framework 2024 carves out space for tokenised securities and other regulated instruments, recognising smart contracts and tokenised ownership structures but not ordinary cryptocurrencies such as Bitcoin or stablecoins, which are treated as “Excluded Tokens”.

For individuals.

Holding crypto bought before moving to Qatar is generally not targeted in the same way as operating an exchange.

Using offshore exchanges from a Qatari IP may violate local rules for any business activity and can attract enhanced scrutiny from both local and home-country regulators.

Role of Qatar Central Bank, QFCRA and the QFC Digital Assets Framework 2024

Three actors matter most

Qatar Central Bank (QCB) oversees the wider banking and payments system, which tends to discourage direct links to crypto exchanges.

QFCRA supervises firms in the Qatar Financial Centre and explicitly bans VASP-style activities.

QFC Digital Assets Regulations 2024 provide a legal framework for tokenisation, digital securities, smart contracts and digital custody for permitted tokens.

This architecture lets Qatar experiment with institutional digital assets and Sharia-compliant tokenisation while still keeping speculative, retail-driven cryptocurrencies at arm’s length.

If you are building a compliant data platform or tokenised-asset solution for QFC firms, you’ll usually also need to align with global standards such as GDPR, BaFin expectations and SOC 2 – similar to how Mak It Solutions approaches secure cloud and analytics for regulated clients in Qatar and the wider GCC. (Mak it Solutions)

Practical Implications for US, UK and EU Investors Living in Doha

For a US engineer in Doha, a London-based trader working remotely, or a German fintech executive seconded to Qatar.

Existing holdings

Keeping crypto you already owned in New York or London is primarily a home-country tax question (IRS, HMRC, BMF), but you should avoid using that portfolio to provide any kind of “service” from Qatar.

Using home exchanges

Many US/UK/EU exchanges block Qatari IPs or treat accounts with Qatari residency as higher risk, in light of QFCRA’s stance. Expect geo-blocking, extra KYC, or off-boarding if your address switches to Doha.

Bank transfers

Local banks in Qatar often flag or refuse transfers to well-known foreign exchanges, especially where purpose isn’t clearly documented.

If you’re designing internal risk controls for a global platform, you’ll want a GCC-aware compliance stack similar to what Mak It Solutions describes in its GCC cybersecurity and zero-trust roadmaps: strong geo-IP controls, sanctions/PEP screening, and policies specific to restricted countries like Qatar. (Mak it Solutions)

Kuwait Absolute Crypto Ban and Compliance Risks

Is Crypto Legal in Kuwait Today?

No. Kuwait enforces an absolute ban on crypto payments, investments and mining, and prohibits local licensing of VASPs. Circulars issued in 2023 by the Capital Markets Authority (CMA) and Central Bank of Kuwait bar regulated entities from engaging in or promoting crypto activity and stress that virtual assets lack legal status.

Kuwait has recently reinforced this stance with crackdowns on crypto-mining operations, partly due to pressure on the power grid, signalling that authorities view both financial and energy impacts as public-policy concerns.

What the 2023 Circulars Mean for Banks, Fintechs and Individuals

The CMA’s guidance makes four points clear.

Payments

Using crypto as a payment method is strictly prohibited.

Investment

Dealing in virtual assets as an investment or offering related services to customers is banned.

Licensing

Regulators cannot issue licences for virtual-asset services, and none have been issued to date.

Mining and promotion

Mining, marketing and advertising of crypto products are treated as prohibited activities.

For a bank, e-money firm or open-banking fintech operating in Kuwait City, that means no crypto-linked cards, remittances, ETPs or marketing campaigns, even if the underlying service is technically provided from London or Berlin.

Guidance for US, UK and German Investors with Exposure to Kuwait

If you are

A US broker-dealer or exchange: onboarding clients resident in Kuwait will attract high AML/CTF and regulatory-arbitrage risk. Your SEC/FinCEN and FATF expectations may not bar you from serving them per se, but local law clearly does, so many firms de-risk these clients entirely.

A UK or EU platform: FCA and BaFin will expect your marketing and onboarding to respect Kuwait’s prohibition; ignoring it may undermine your MiCA-aligned risk assessments and Travel Rule implementation.

A German investor: even if BaFin-regulated products are legal in Frankfurt, using them from Kuwait may violate local rules and could also raise questions under home-country KYC files.

Enhanced due diligence is usually triggered when.

The customer has a Kuwaiti residential address or employer.

Transaction patterns show frequent inflows from Kuwaiti banks to crypto platforms.

Clients attempt to use VPNs or misstate location a classic red flag cited in FATF guidance for high-restriction jurisdictions.

For European CIOs and CFOs, the risk-based thinking here is very similar to what’s needed for zero-trust access, phishing-resilient identity controls and AI governance all themes Mak It Solutions has covered for GCC businesses and US/EU enterprises. (Mak it Solutions)

Oman From Consultation to Full VASP Regime

Is Crypto Legal in Oman and Under What Conditions?

Oman is transitioning toward a regulated environment where crypto activities can be carried out by licensed VASPs under a dedicated Virtual Assets Regulatory Framework, supervised by the Financial Services Authority (FSA).

Consultation papers and announcements indicate that Oman intends to regulate crypto assets, tokens, exchanges and initial coin offerings under a regime aligned with FATF standards rather than banning them outright. That makes Muscat far closer, in spirit, to Dubai, Abu Dhabi and Bahrain than to Kuwait.

Oman Virtual-Asset Regulation and VASP Licence Pathway

The Omani framework is expected to cover activities such as (FSA)

Operating crypto exchanges (fiat–crypto and crypto–crypto)

Providing custody and wallet services.

Running trading platforms and broker-dealer functions.

Conducting ICOs/ITOs and other token offerings.

Typical VASP licence requirements in such regimes (and likely in Oman) include.

Minimum capital and governance thresholds.

Documented AML/CTF programmes, including Travel Rule compliance.

Independent risk and compliance functions, plus regular reporting.

Strong technology controls logging, security monitoring, data-residency awareness (similar to what you’d need for PCI DSS or SOC 2 in cloud environments)

Strategically, Oman appears to be positioning itself as a compliant, Sharia-sensitive hub that can complement UAE and Bahrain rather than compete on a “light-touch” basis.

What a US-, UK- or EU-Based Exchange Needs to Serve Clients in Oman

A realistic roadmap for a New York, London or Berlin-based exchange might look like:

Initial risk assessment – Map Omani rules, FATF expectations and home-regulator (SEC, FCA, BaFin) positions on cross-border VASPs.

Local counsel engagement

Work with Muscat-based law firms and Big-4 advisory teams already familiar with the Virtual Assets Regulatory Framework. (laraontheblock.com)

Entity & licensing design

Decide whether to set up a local entity or operate via passporting/equivalence mechanisms if available; scope out your VASP application.

Application & implementation

Submit to the FSA, implement Travel Rule-compliant transaction monitoring, and align your data and security architecture with GCC cloud and data-localisation expectations (Mak It Solutions’ cloud and data-privacy guides for GCC CIOs are a useful analogue here). (Mak it Solutions)

Ongoing compliance

Build out reporting, periodic risk assessments and governance echoing best practices from AI governance and data-privacy operating models in US/UK/EU. (Mak it Solutions)

For UK open-banking providers and EU fintechs connecting fiat rails into Omani VASPs, the biggest challenge will be designing end-to-end AML, sanctions and data-protection controls that satisfy both MiCA/GDPR and Omani expectations.

Tax, Reporting and Cross-Border Payments

Home-Country Tax Rules for Expats in Qatar, Kuwait and Oman

For most readers, home-country tax follows you to Doha, Kuwait City or Muscat.

US persons:

The IRS taxes worldwide capital gains, including crypto, and FATCA reporting can surface offshore accounts and wallets connected to US banks or brokers.

UK residents

HMRC treats crypto as a chargeable asset; moving to Qatar or Oman doesn’t magically erase your UK tax residence or reporting obligations if you remain UK-domiciled.

German/EU investors

BaFin and the BMF apply MiCA and national tax rules; crypto held via German platforms or accounts may still be reportable and taxable even when trades occur on foreign exchanges.

Eurozone data suggests roughly 9% of adults held crypto-assets in 2024, underlining why European tax authorities are actively scrutinising cross-border trading patterns.

Reporting and AML/CTF Obligations for Institutions

If you operate an exchange, neobank or cross-border payment platform, you need to consider:

FATF virtual-asset guidance

VASPs should be licensed, apply full customer due diligence, report suspicious activity and implement the Travel Rule, even when some counterparties are in banned jurisdictions like Kuwait.

MiCA + GDPR/DSGVO + UK-GDPR

Onboarding GCC residents into EU or UK services still triggers data-protection duties, from lawful bases and DPIAs to data-residency choices in AWS/Azure/GCP regions. (Mak it Solutions)

Mak It Solutions’ broader work on data-privacy laws, cloud security and AI governance outlines the same pattern: treat compliance as an architecture problem, not just a policy PDF, and embed controls directly in platforms and analytics pipelines. (Mak it Solutions)

Remittances, Stablecoins and Cross-Border Payments to the Gulf

With global remittances expected to reach around USD 900+ billion in 2024, a small but growing slice is experimenting with crypto rails

However

Kuwait

Using crypto as a remittance tool is directly at odds with the prohibition; regulated firms should avoid offering such channels.

Qatar

Retail stablecoin transfers from US/UK/EU to residents in Qatar risk running into QFCRA restrictions and local banking blocks.

Oman

In future, licensed VASPs may be able to offer compliant stablecoin or tokenised-remittance products, but these will sit under FSA supervision and FATF Travel Rule requirements.

For many families sending money from London or Berlin to relatives in the Gulf, regulated remittance providers, bank wires and card-based transfers remain the safer path particularly where Islamic finance and Sharia-compliant structures are a concern.

Practical Compliance Checklist for Investors, Exchanges and Fintechs

Red-Flag Scenarios for Individuals and Companies

Some patterns that should immediately ring alarm bells.

Trading or mining from inside Kuwait, even via VPNs.

Marketing yield-bearing crypto products online and targeting Qatar residents in Arabic or English.

Onboarding customers who hide or misstate GCC residency or employer details.

Offering “shadow” stablecoin remittance services into Gulf markets without local licences.

Consequences can range from frozen accounts and forced off-boarding to local enforcement, fines or, in extreme cases, criminal investigations under AML/CTF laws.

Building a GCC-Sensitive Compliance Stack

For US, UK, German and wider EU firms, a GCC-aware compliance stack typically includes:

Geo-IP and device-fingerprinting to enforce Kuwait and Qatar blocks.

KYC/AML enhancements that explicitly capture country of residence, employer and source of funds in Gulf states.

Sanctions and PEP screening, re-used from broader zero-trust and cloud-security architectures. (Mak it Solutions)

Data-governance design that respects GDPR/UK-GDPR while still meeting local data-residency expectations something Mak It Solutions frequently solves in its GCC-focused AI and data projects. (Mak it Solutions)

Think of it as the crypto-specific layer atop the same identity-centric security and compliance models you’d deploy for SaaS, AI or telemedicine platforms in the region. (Mak it Solutions)

When to Seek Specialist Legal and Tax Advice

You should always consider external advice when.

Opening an office or regulated entity in Doha, Kuwait City or Muscat.

Launching a new product that touches VASP activities or stablecoin rails into the GCC.

Onboarding high-volume clients from Gulf sovereign-wealth funds, family offices or financial institutions.

In practice, that often means a three-layer advisory model

Big-4-style tax and regulatory teams in New York, London or Frankfurt.

Local firms in Qatar, Kuwait and Oman who live and breathe the latest circulars.

A technology partner like Mak It Solutions to translate policy into concrete cloud, data and security architectures that actually work. (Mak it Solutions)

Bottom Lines

Qatar

Broad prohibitions on VASP-style crypto services, but a sophisticated 2024 digital-assets framework for tokenised securities and smart contracts in the QFC best for institutional, not retail, plays.

Kuwait

Absolute ban on payments, investments, mining and local licensing of VASPs, now backed by enforcement against mining activity and strong consumer warnings.

Oman

Evolving into a regulated VASP hub under its Virtual Assets Regulatory Framework, offering cautious opportunities for licensed exchanges and custodians that align with FATF standards.

How US/UK/EU Readers Should Move Forward

For US, UK and EU investors and fintechs, the priority is to.

Treat Kuwait as strictly off-limits for crypto activity.

Handle Qatar with extreme care, focusing only on permitted digital-asset use cases within the QFC and avoiding retail-style services.

Explore Oman as an emerging, but still maturing, VASP destination — always grounded in documented risk assessments, board-level governance and a robust compliance/technology stack.

Put simply: if you’re navigating cryptocurrency regulations in Qatar, Kuwait and Oman, your growth strategy has to be joined at the hip with your legal, tax and cloud-security strategy.

Key Takeaways

Regulatory divergence is stark

Kuwait has an absolute ban, Qatar prohibits VASPs but allows narrow QFC digital-asset use cases, and Oman is building a licensing-based regime.

Home-country rules still apply

IRS, HMRC, BaFin and other authorities tax worldwide crypto gains and expect FATF-aligned controls, even when trading from Doha or Muscat.

Compliance is an architecture problem

Identity-centric security, geo-IP blocks, data-governance and Travel Rule tooling matter just as much as written policies.

Oman is the realistic opportunity

Among the three, Oman is the only jurisdiction trending toward a MiCA-style licensing model that global exchanges can plug into.

You can’t “VPN away” the risk

Using VPNs from Kuwait or Qatar may simply add misrepresentation and AML red flags on top of already-restricted activity.

Tech + legal is the winning combination

Pair local counsel and Big-4-style advisers with a cloud/data partner that understands GCC regulation to avoid expensive re-builds later.

If you’re a US, UK or EU investor, exchange or fintech trying to make sense of Qatar, Kuwait and Oman, you don’t just need a memo you need an execution plan. Mak It Solutions helps teams turn complex GCC rules into clear architectures for cloud, data, identity and analytics.

Reach out via our contact page to discuss a scoped assessment of your GCC-facing crypto or digital-asset roadmap, including integration with your existing security, AI and data-platform investments. (Mak it Solutions)

FAQs

Q : Can I keep using my US or UK crypto exchange account after moving to Qatar, Kuwait or Oman?

A : Technically, your US or UK account may still exist, but local law and platform risk controls can make using it problematic. In Kuwait, authorities have imposed an absolute ban on crypto payments, investments and mining, which makes continued trading highly risky. In Qatar, QFCRA restrictions mean many exchanges block Qatari IPs or off-board Qatari residents.Oman is more permissive but is moving toward a supervised VASP regime, so foreign exchanges will likely adapt their onboarding and KYC flows as the framework matures. Always check both your provider’s terms and local regulations before using an existing account from the Gulf.

Q : How should US, UK and German tax residents report crypto gains earned while living in the Gulf?

A : For US citizens and green-card holders, the IRS taxes worldwide crypto gains, and FATCA reporting can expose offshore holdings linked to US financial institutions. UK residents generally report crypto disposals under capital-gains rules to HMRC, even if trades occur via non-UK exchanges while you’re temporarily in Doha or Muscat. In Germany, BaFin and the BMF apply MiCA-aligned treatment and existing national tax rules, so German taxpayers usually must report gains regardless of where the exchange is based. Local Gulf rules may restrict trading, but they rarely remove home-country tax duties.

Q : Are VPNs a safe or legal workaround for trading crypto from banned jurisdictions like Kuwait?

A : No. Using a VPN to bypass Kuwait’s crypto prohibition does not change the law — it simply adds additional risks. Regulators in Kuwait have clearly prohibited crypto payments, investments, mining and licensing, and AML/CTF standards treat deliberate location obfuscation as a classic red flag. Exchanges that detect VPN or mismatched-location signals may freeze accounts or file suspicious-activity reports. From a compliance-program perspective, it is safer to block such activity outright rather than rely on “don’t ask, don’t tell” arrangements.

Q : Which GCC country is currently the most crypto-friendly for setting up a regulated exchange?

A : Within the trio of Qatar, Kuwait and Oman, Oman is by far the most crypto-friendly for regulated exchanges, thanks to its Virtual Assets Regulatory Framework and plans to license VASPs under the FSA.However, if you widen the lens to the whole GCC, UAE free zones (like Dubai’s VARA or Abu Dhabi’s ADGM) and Bahrain remain the leading hubs for fully licensed crypto businesses. Oman is attractive for players who want a more focused, Sharia-sensitive jurisdiction, but you should still expect intensive AML/CTF, Travel Rule and technology-governance requirements.

Q : What compliance checks should European fintechs run before onboarding customers from Qatar, Kuwait or Oman?

A : European fintechs should start with country-of-residence assessments and geo-IP checks, flagging Kuwait and Qatar for stricter rules or outright blocks. They should then apply enhanced due diligence for GCC customers, including detailed source-of-funds questions, sanctions and PEP screening, and clear disclosures about what crypto products (if any) are available in each jurisdiction. At the same time, platforms must ensure compliance with MiCA, GDPR/DSGVO and local data-protection rules, which may influence where customer data is hosted (for example, EU regions in AWS, Azure or Google Cloud). Internal controls similar to those Mak It Solutions uses in its GCC cybersecurity and AI-governance projects can help operationalise these checks. (Mak it Solutions)