Crypto Stability

Stablecoins promised a safer on-ramp to crypto: blockchain assets pegged 1:1 to fiat, moving at internet speed with bank-grade reserves. But can stablecoins really hold the line in a true global crisis when credit tightens, liquidity vanishes, and flight-to-quality turns ruthless? This guide pressure-tests stablecoins across design, reserves, regulation, and market structure, drawing lessons from depegs and redemptions since 2022 and outlining a practical resilience checklist for treasurers and builders.

We’ll examine fiat-backed, over-collateralized crypto-backed, and algorithmic models, highlight what failed (Terra/UST), what wobbled (USDC in the SVB weekend), and what redeemed at scale (USDT), then map the policy backdrop (FSB/IMF, BIS, EU MiCA) shaping what “stable” must mean when stress hits every corner of global markets. ESMA+5ScienceDirect+5Chainalysis+5

The Three Faces of “Stable”

Fiat-backed (custodial)

Mechanism

1:1 claim on cash, T-bills, and money-market instruments held by a regulated trust or issuer.

Crisis lever

Quality and duration of reserves (T-bills vs. credit), banking counterparties, and redemption pipes.

Examples

USDT, USDC, PYUSD. PayPal’s PYUSD launched with Paxos as issuer, fully backed by cash and short-duration Treasuries.

Crypto-backed (over-collateralized)

Mechanism

On-chain collateral (e.g., ETH) exceeds liabilities by a safety margin; liquidations keep the peg.

Crisis lever

Collateral drawdowns and oracle latency; liquidity on venues to liquidate collateral promptly.

Algorithmic / partially collateralized

Mechanism

Incentive/game-theoretic pegs (mint/burn seigniorage).

Crisis lever

Confidence loops. If demand collapses, reflexivity can break pegs fast—as seen in Terra/UST’s failure in May 2022.

What We Learned from Real Stress Events

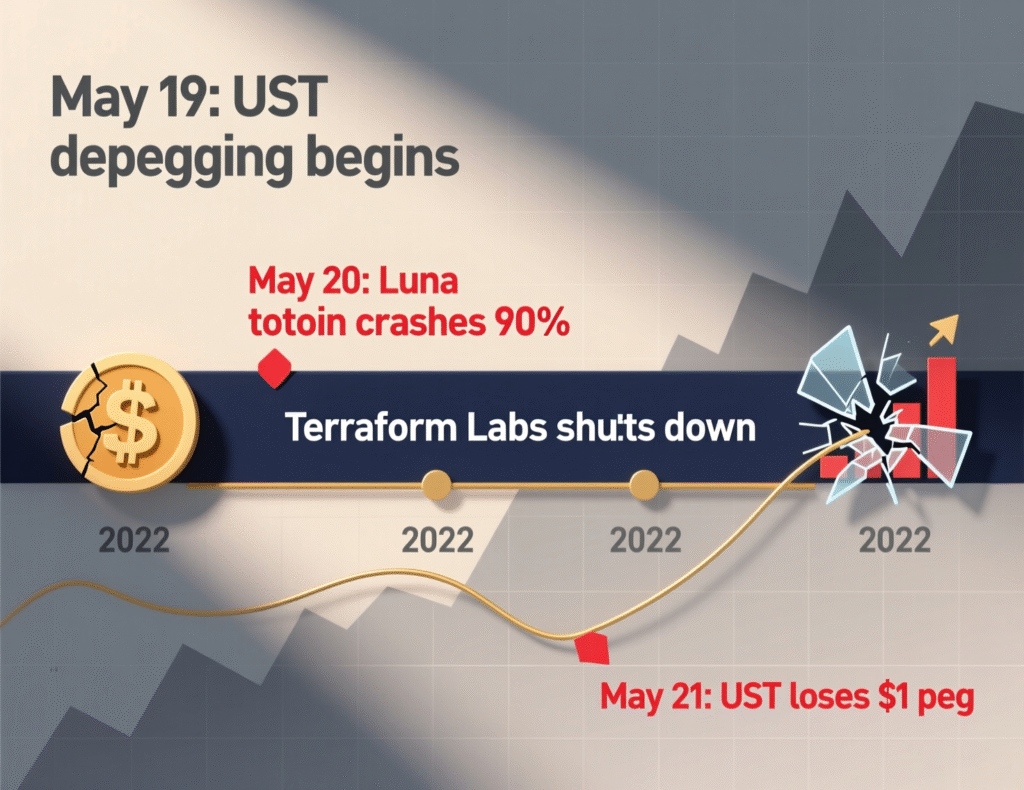

Terra/UST: A Design Fragility Exposed

Terra’s algorithmic stablecoin UST suffered a death spiral in May 2022. Without hard, high-quality reserves, redemptions amplified sell pressure, the sibling token collapsed, and the peg evaporated. Academic and central-bank analyses now use Terra as a canonical example of reflexive failure in algorithmic pegs.

USDC’s SVB Weekend (March 2023): Banking Counterparty Risk

USDC briefly traded below $1 after news that a portion of reserves sat at Silicon Valley Bank. When U.S. authorities assured deposit access, the peg normalized. The episode underlined concentration risk in banking partners and the need for transparent, short-duration reserves and diversified custodians.

Tether Redemptions (May–June 2022): Liquidity at Scale

Following the Terra shock, stablecoins faced mass redemptions. Tether reports it processed ~$10B in a week and ~$20B in a month material for any money-like instrument without breaking the peg, highlighting the importance of T-bill heavy portfolios and operational redemption capacity. Independent commentary references similar figures.

Takeaway

Designs with transparent, short-duration, high-quality reserves and robust redemption rails weather stress better than models depending on reflexive incentives.

The Market Today: Size, Dominance, and Macro Linkages

Scale

The total stablecoins market cap is around $300B, led by USDT (~60% dominance), with USDC in second place. Growth rebounded through 2024–2025 after the 2022–2023 drawdown.

Payment traction

PYUSD shows the payments angle interoperability between PayPal and Venmo users with on/off ramps to external wallets.

Policy mood

The BIS and the FSB/IMF synthesis papers push toward stricter global rules, particularly on reserve quality, disclosures, and redemption rights.

Macro reality

In a true global crisis, demand can bifurcate on-chain actors rush into stablecoins as a USD proxy, while off-chain redemptions may surge if holders prefer insured bank cash or T-bills. The survival hinge: reserves quality + redemption operations + legal claim clarity.

Regulation: The New Definition of “Stable”

EU MiCA

From June 30, 2024, rules for e-money tokens (EMTs) and asset-referenced tokens (ARTs) began to apply: full liquid backing, capital, whitepapers, and audits. This formalizes reserve and disclosure expectations for stablecoins in the EU.

Global push

FSB/IMF workstream aligns national supervisors on liquidity, redemption rights, disclosures, and AML/CFT expectations. BIS research stresses money-like obligations and “singleness” of money as a policy benchmark.

Implication

The “minimum viable stablecoin” in 2025 equals cash/T-bill backing, daily NAV transparency, third-party assurance, and next-day (or faster) fiat redemption codified by law or enforced by market discipline.

Can Stablecoins Withstand a Global Crisis? A Stress Framework

Reserve Quality & Liquidity

Target

≥90–100% cash and short-dated U.S. Treasuries; minimal unsecured credit.Test

Would these reserves hold value and stay liquid if policy rates spike and credit markets freeze?Red flags

Long-duration bonds, commercial paper of uncertain quality.

Banking & Custody Diversification

Target

Multiple regulated custodians and banks in strong jurisdictions; clear segregation of client assets.

Test

Counterparty failure (SVB-style) shouldn’t imperil peg.

Redemption Mechanics

Target

Documented 1:1 redemption with clear SLAs; demonstrated high-volume processing.

Test

Can the issuer process 10–25% of circulating supply in days without gating? Tether’s 2022 redemptions are an empirical reference point, albeit issuer-reported.

Transparency & Assurance

Target

Daily reserve breakdowns; monthly attestation; periodic audits by reputable firms.

Test

Can treasurers reconcile on-chain liabilities with off-chain assets quickly in stress?

Legal Claim & Priority

Target

Clear claim structure (trust/EMI) giving holders first-priority claim on reserves.

Test

Would a court in major jurisdictions affirm 1:1 redemption rights during wind-down?

On-Chain Market Structure

Target

Deep liquidity across major venues; robust oracles; circuit breakers for outlier prints.

Test

Slippage and peg variance during volatility; collateral liquidation efficiency for crypto-backed stablecoins.

Scenario Analysis: Global Crisis Playbook

Global Dollar Squeeze

Pressure

Surging demand for USD, widening spreads, banks shrink balance sheets.

Outcome for fiat-backed: If reserves = T-bills/cash and redemption pipes are open, peg should hold with possible temporary market discounts on secondary markets.

Outcome for crypto-backed: Elevated liquidation risk; if collateral markets gap, pegs may widen until stability modules catch up.

Banking Counterparty Shock

Pressure

One or more custodial banks fail.

Mitigation

Diversified custody, ring-fenced assets, and government backstops (where applicable) reduce peg risk as seen when access to SVB deposits was assured, helping USDC recover.

Sustained Risk-Off + Regulatory Clampdown

Pressure

New rules restrict issuance or redemptions; offshore banking links tighten.

Mitigation

Issuers with licensed status (e.g., e-money frameworks), audited reserves, and strong compliance footprints remain usable; opaque models risk sustained discounts.

Real-World Examples You Can Learn From

Example #1 (Treasury Use)

A Web3 exchange treasury kept settlement float in a fiat-backed stablecoin concentrated at one bank. After the SVB weekend, they moved to a dual-issuer, multi-custodian policy; exposure per bank now capped at 25% with weekly attestations checked. Result: peg variance in later volatility was negligible, and redemptions were executed within 24 hours (issuer SLA).

Example #2 (Cross-border Payments)

A remittance startup layered stablecoins (PYUSD/USDC) for U.S.-to-LATAM corridors with automated T-bill sweep accounts at destination PSPs. During a risk-off week, on-chain transfers continued at normal speed; end-users were shielded from FX spikes because settlement remained in USD-pegged units with rapid fiat conversion.

A Practical Resilience Checklist (for Teams Holding or Building on Stablecoins)

Reserves

Prefer T-bill/cash portfolios; avoid long duration and unsecured credit.

Redemptions

Demand written SLAs and test small redemptions monthly.

Diversification

Use ≥2 issuers; cap exposure per custodian; keep a cash buffer.

Transparency

Monitor daily NAV/holdings dashboards; require monthly attestations.

Legal

Ensure first-priority claim on reserves under governing law.

On-chain

Route via deep pools; monitor oracle health; use circuit breakers.

Compliance

Map MiCA/FSB expectations across your operating geographies.

Wrap It Up

Stablecoins are no longer experiments: they’re a $300B+ settlement layer moving trillions annually. But “stable” is earned, not assumed. Fiat-backed stablecoins with short-duration reserves, diversified custody, transparent reporting, and proven redemption ops can withstand severe stress though secondary-market discounts may appear in panic.

Crypto-backed stablecoins can be resilient if over-collateralization, liquidation mechanics, and oracles hold up; purely algorithmic designs remain crisis-fragile. The direction of travel BIS, FSB/IMF, and MiCA pushes the industry toward bank-grade standards. If you hold or build with stablecoins, adopt the resilience checklist now and rehearse your crisis runbooks before the next shock.

CTA

Want a custom risk playbook for your stablecoin use case (treasury, payments, DeFi)? Reach out we’ll map your exposure, simulate crisis paths, and implement controls in 2 weeks.

FAQs

Q1 : How do stablecoins maintain their peg?

A : Fiat-backed stablecoins hold reserves (cash/T-bills) and offer 1:1 redemptions; crypto-backed use over-collateralized vaults and liquidations; algorithmic rely on incentives. Peg integrity depends on reserve quality, redemption mechanics, and market liquidity, especially in stress.

Q2 : How can companies evaluate a stablecoin’s reserves?

A : Ask for daily/weekly holdings, auditor attestations, jurisdiction, and bank/custodian concentration. Prefer short-duration Treasuries and cash with minimal credit exposure; confirm written redemption SLAs.

Q3 : How did USDC’s 2023 depeg resolve?

A : USDC fell below $1 when part of its reserves were stuck at SVB. After authorities enabled deposit access, USDC regained its peg highlighting counterparty risk and transparency value.

Q4 : How resilient are T-bill-backed stablecoins in a crisis?

A : Short-dated Treasuries tend to stay liquid and hold value in risk-off periods. Issuers that publish holdings and process large redemptions smoothly show stronger crisis durability.

Q5 : How do algorithmic stablecoins fail?

A : Without hard reserves, reflexive sell pressure can trigger death spirals. Terra/UST’s 2022 collapse is the clearest example.

Q6 : How does regulation like MiCA change things?

A : MiCA enforces full liquid backing, capital, disclosures, and audits for EU stablecoins, raising the floor for quality and transparency.

Q7 : How can I reduce operational risk when holding stablecoins?

A : Diversify issuers/banks, test redemptions monthly, maintain a fiat buffer, and set monitoring for peg deviations and on-chain liquidity.

Q8 : How do stablecoin market caps reflect systemic importance?

A : The market has rebounded toward/above $300B, indicating significant settlement use and liquidity gravity that regulators now address with coordinated frameworks.

Q9 : How should crypto-backed stablecoins prepare for crashes?

A : Maintain conservative collateral ratios, robust liquidations across venues, and oracle redundancy; publish stress-test results.