Crypto sentiment index sinks to lowest score since February

Crypto markets delivered their most anxious signal in more than eight months this Saturday, with the fear and greed index plunging to an extreme fear level of 10. The sharp drop reflected widespread caution as Bitcoin struggled to stay above the $96,000 threshold, fueling concerns about deeper downside pressure. Traders remained defensive, liquidity stayed thin, and sentiment across altcoins weakened, adding to the overall uncertainty in the market.

Even so, several analysts suggested that the pessimism might be temporary. They pointed to improving technical structures, early signs of seller exhaustion, and sentiment divergences that often precede relief bounces. According to them, if Bitcoin can stabilize near current levels and volatility cools, the market may be positioned for a short-term recovery, especially as broader indicators begin to turn more constructive.

Sentiment hits “Extreme Fear” at 10

Alternative.me’s widely watched Crypto Fear & Greed Index dropped to 10, the first “Extreme Fear” print this deep since Feb. 27. The index aggregates market drivers such as price momentum, volatility and social trends on a 0–100 scale (0 = extreme fear; 100 = extreme greed). Historically, persistent fear readings have coincided with elevated volatility and, at times, counter-trend rallies.

Bitcoin slides below $96K amid macro uncertainty

Bitcoin slipped under ~$96,000 during the sell-off, a pullback from early-November levels above $110,000. The retreat follows weeks of choppy risk sentiment linked to interest-rate expectations and mixed crypto fund flows.

Crypto fear and greed index extreme fear vs recent downturns

Some research desks contend the current slump looks less severe than earlier corrections when measured across multiple inputs. Bitwise’s European head of research Andre Dragosh noted on X that Bitwise’s internal Cryptoasset Sentiment Index shows a positive divergence, suggesting downside pressure may be fading.

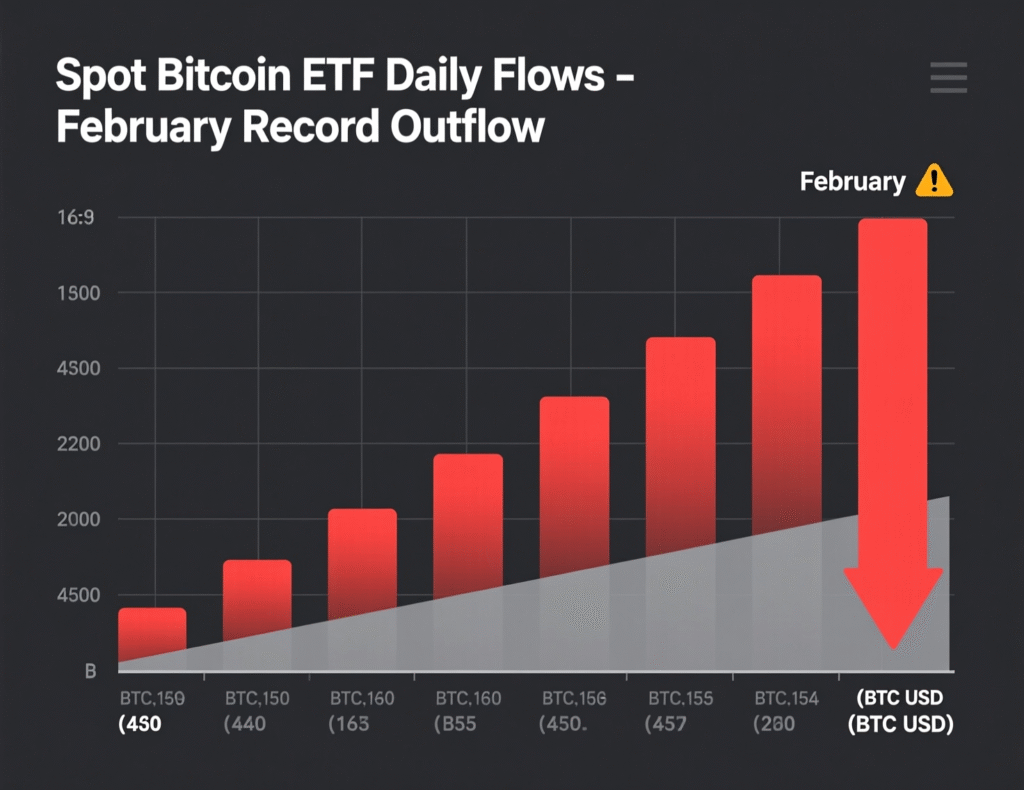

ETF flows remain a key barometer

Market participants continue to track U.S. spot bitcoin ETF flows as a proxy for institutional demand. Earlier this year, funds posted a record one-day outflow of ~$1.14bn in late February, a data point investors cite when gauging stress versus today’s backdrop.

Technicals: Looking for confirmation

Trader Sven Henrich highlighted a potential falling wedge and positive divergence on Bitcoin’s chart patterns that can precede upside breaks but stressed the setup remains unconfirmed pending follow-through. As always, chart formations require validation with price and volume.

Context & Analysis

“Extreme Fear” prints often coincide with forced selling, elevated realized volatility and thin liquidity. Yet, divergences across alternative sentiment composites and any stabilization in ETF flow data could set the stage for mean reversion. Still, macro catalysts (central-bank rate paths, liquidity conditions) can overwhelm technical setups; risk management remains paramount.

Conclusion

Sentiment remains deeply negative, with the Crypto Fear & Greed Index stuck at 10, signaling extreme fear across the market. Even so, a few technical patterns and survey readings are beginning to show early signs of a potential short-term reversal, provided market flows stabilize. These signals suggest sellers may be losing momentum, but the overall mood is still cautious.

Traders aren’t assuming that capitulation has fully played out just yet. Instead, they’re watching closely for confirmation through higher lows and improving demand before shifting their stance. Until buyers step in with conviction, the broader market will likely remain in wait-and-see mode.

FAQs

Q : What is the Crypto Fear & Greed Index?

A : It’s a composite sentiment gauge (0–100) that tracks crypto market mood; 0 is “Extreme Fear,” 100 is “Extreme Greed.”

Q : Why did the index drop to Extreme Fear?

A : A combination of price weakness, higher volatility and negative risk appetite pushed the reading to 10.

Q : Did Bitcoin fall below $96,000 during this move?

A : Yes live pricing showed sub-$96K levels during the decline.

Q : How do ETF flows affect sentiment?

A : Large outflows can signal de-risking; February saw a record one-day $1.14bn net outflow, a benchmark for stress.

Q : Are there bullish signs despite the fear?

A : Some analysts note positive sentiment and momentum divergences and a potential falling wedge, but these need confirmation.

Q : Is ‘Extreme Fear’ a buy signal?

A : Not by itself. It can precede rebounds, but it also appears during prolonged downtrends; use risk controls.

Q : Does the Crypto Fear & Greed Index predict short-term price moves?

A : No. It’s descriptive, not predictive; combine it with price action and flows for context.

Facts

Event

Crypto sentiment falls to “Extreme Fear” (index 10)Date/Time

2025-11-15T00:00:00+05:00Entities

Alternative.me (Crypto Fear & Greed Index); Bitcoin (BTC); Bitwise (Cryptoasset Sentiment Index); U.S. spot bitcoin ETFsFigures

Index = 10; BTC < $96,000; Record ETF one-day outflow ≈ $1.14bn (Feb. 2025)Quotes

“Positive divergence” Andre Dragosh, Bitwise (via X); “Falling wedge, positive divergence” Sven Henrich (NorthmanTrader)Sources

Alternative.me Crypto Fear & Greed Index (https://alternative.me/crypto/fear-and-greed-index/); CoinMarketCap Bitcoin price (https://coinmarketcap.com/currencies/bitcoin/)