Crypto Remittances for Middle East Workers in 2025

Crypto remittances let Gulf migrant workers send money home using Bitcoin or stablecoins instead of banks or cash remittance shops, often with lower fees and near-instant settlement to India, Pakistan, the Philippines and other destinations. In many GCC–Asia and GCC–Africa corridors, total costs can fall to around 1–3% when workers use regulated apps, low-fee networks and competitive local cash-out options, compared with 5–10%+ for some bank and MTO routes. As long as workers use licensed platforms, complete KYC and cash out through trusted local partners, crypto remittances can be a legal, safer alternative to traditional transfers in the UAE, Saudi Arabia, Qatar, the US, UK, Germany and the wider EU.

Introduction

On a Friday evening in Dubai, Ali finishes his shift, walks past a crowded remittance shop, and sends money to Karachi from his phone instead. His cousin receives rupees in minutes via a local wallet no long queues, no paper forms, and fees closer to 1–2% instead of 5–10%.

That’s the promise of crypto remittances for millions of workers in the UAE, Saudi Arabia, Qatar and across the GCC sending money home to India, Pakistan, Bangladesh, the Philippines, Egypt and beyond. Our focus here is migrant workers and their families plus NGOs, employers and fintech teams in the US, UK, Germany and the EU who are evaluating safer, low-fee cross-border options.

We’ll walk through what crypto remittances are, how they compare with banks and Western Union–style providers, where the real savings come from, the legal and safety rules, and how to pick the right apps and platforms across the GCC, US, UK and Europe.

How workers send money home

What are crypto remittances for Middle Eastern migrant workers?

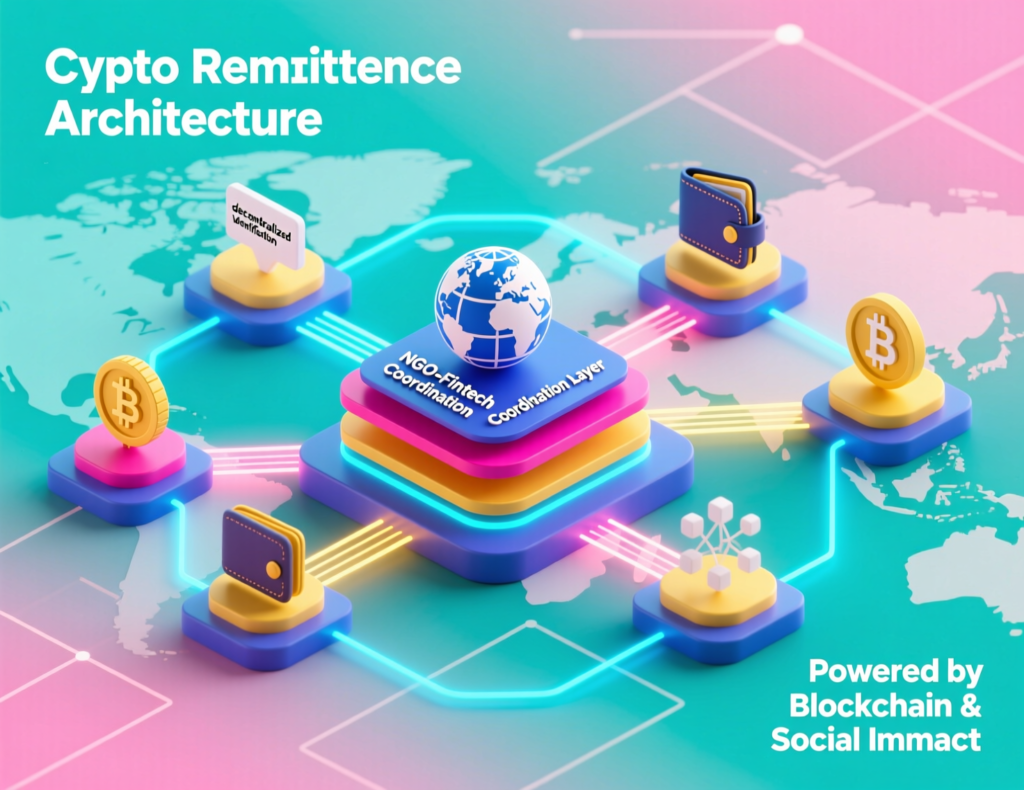

Crypto remittances are cross-border money transfers where the value moves over cryptocurrencies (like Bitcoin) or stablecoins (like USDT or USDC) instead of traditional bank or remittance rails. For migrant workers in Dubai, Abu Dhabi, Riyadh, Jeddah or Doha, this usually means.

Converting a portion of their salary into crypto on a licensed exchange

Sending that crypto across borders in minutes

Having family in Karachi, Lahore, Dhaka, Manila or Cairo convert it back to local currency

Instead of relying on SWIFT messages and multiple correspondent banks, the value moves on a public blockchain or second-layer network (e.g., Bitcoin Lightning). That’s why many workers casually talk about “sending with Bitcoin” or “using dollar stablecoins” rather than “doing an international transfer”.

Why are migrant workers in the UAE and Saudi Arabia turning to crypto instead of traditional remittance shops?

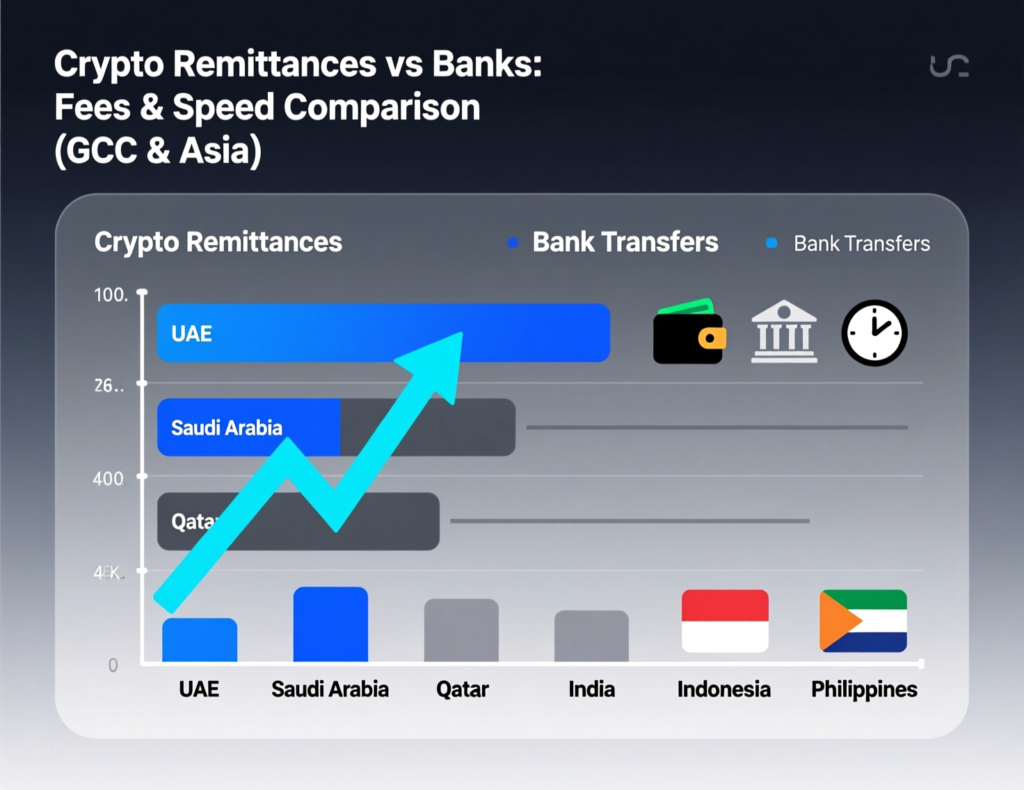

Many GCC workers are frustrated with high fees, bad FX rates, long queues and cut-off times at traditional remittance shops. Global average remittance costs are still around 6–7% of the amount sent, with banks often charging close to 12%, while digital-only providers average about 4%.

Crypto remittances feel attractive because they’re 24/7, mobile-first and often cheaper especially when using low-fee stablecoin or Lightning payments instead of expensive on-chain transfers. For a worker getting paid in cash in Riyadh or a semi-banked worker in Doha, a crypto app can be easier to access than a full bank account, especially if they rely on virtual cards or salary cards. At the same time, workers often feel they get better FX rates and faster delivery to local wallets like GCash, Easypaisa, JazzCash or bKash.

UAE/Saudi/Qatar to India, Pakistan, Bangladesh, Philippines and Egypt

The GCC is one of the world’s most important remittance hubs. Global remittances to low- and middle-income countries reached about $650–660 billion in 2023, and countries like India, Pakistan, Bangladesh, the Philippines and Egypt are consistently among the top recipients. A large share of India’s remittances roughly one-third originates from the GCC.

Traditionally, workers in Dubai, Abu Dhabi, Riyadh, Jeddah, Doha and Kuwait City use cash-based money transfer operators (MTOs) or banks, paying:

5–8% total cost for smaller transfers via Western Union/MoneyGram

3–5% for digital players like Wise or some local fintechs

More if unfavorable FX rates and receiving-side fees are included

With crypto remittances, total cost (exchange + network + cash-out + FX) can drop nearer 1–3% for many GCC–Asia corridors especially when.

The sender uses low-fee exchanges in the UAE or Saudi Arabia

The transfer uses a cheap blockchain (e.g., a stablecoin on a low-fee network or Lightning)

The receiver uses competitive P2P or local exchanges in Karachi, Lahore, Manila or Cairo

(Exact numbers vary by corridor, liquidity and provider always compare your options.)

How crypto and Bitcoin remittances work vs traditional transfers

How Bitcoin remittances work on exchanges, wallets and Lightning

Most crypto remittances follow a simple on-ramp → transfer → off-ramp flow:

On-ramp (funding)

In the UAE or Saudi Arabia, a worker opens an account with a regulated platform such as BitOasis, Rain or Pyypl that supports KYC and local payment methods.

In the US, UK or Germany, they might use Coinbase, Binance, Crypto.com, N26, Revolut or Bitpanda, funding via ACH, UK Faster Payments or SEPA.

Buy crypto or stablecoins

They purchase BTC or a stablecoin (USDT/USDC) that has good liquidity on both sides of the corridor.

Transfer

They send the crypto to their family’s wallet address, Lightning invoice, or to a trusted P2P counterparty in the destination country.

Off-ramp (cash-out)

Family uses a local exchange or P2P marketplace (often via Binance P2P or local platforms) to sell the crypto for local currency and receive funds into a bank account or mobile wallet.

Compared with SWIFT, which can involve several correspondent banks and settle in 1–3 days, Bitcoin or stablecoin transfers can settle in minutes, with near-instant settlement on Lightning.

Why crypto remittances can be faster and cheaper than bank transfers for GCC–Asia corridors

Crypto remittances can be faster and cheaper than bank transfers because they strip out many intermediaries and messaging fees. A traditional SWIFT transfer often includes bank charges, foreign exchange spreads and correspondent fees, leading to total costs near 8–10% in some corridors.

In contrast.

On-chain Bitcoin fees can be a few dollars per transaction when the network isn’t congested.

Lightning Network and some stablecoin networks can reduce per-payment fees to a few cents or less, even for cross-border transfers.

Crypto rails also work 24/7, weekends and holidays, so workers in Riyadh or Doha can send on Friday and families in Lahore or Manila can receive funds almost immediately, even when banks are closed.

Bitcoin vs stablecoin remittances for migrant workers

For migrant workers, Bitcoin and stablecoins each play a role in digital asset cross-border payments:

Bitcoin (BTC)

Pros

Deep global liquidity, censorship-resistant, Lightning for instant and cheap payments.

Cons

Price volatility can be high; value can move 5–10% in a short time.

Stablecoins (USDT, USDC, etc.)

Pros

Pegged to the US dollar, so workers and families can avoid significant price swings; ideal for stablecoin remittances for migrant workers who just want dollars-in, rupees/pesos-out.

Cons

Depend on issuers, chains and regulators; not risk-free.

For most workers sending to Pakistan, India or the Philippines, stablecoins on low-fee networks are often the most practical form of low-fee international money transfer with crypto, while BTC (especially Lightning) is useful for tech-savvy users or when stablecoin access is restricted.

Send money with Bitcoin or stablecoins from the Gulf

How do Middle Eastern workers actually send money home with Bitcoin or stablecoins, step by step?

Here’s a clear, real-world flow that many UAE/Saudi/Qatar workers follow.

Get verified on a regulated app

BitOasis, Rain, Pyypl or similar, using passport, residence ID (iqama/Emirates ID) and sometimes proof of address.

Fund the account

Use a bank transfer, salary card or cash deposit via approved partners.

Buy BTC or a stablecoin

For example USDT, for the amount you want to send.

Send crypto to your family’s wallet

Or to a trusted P2P buyer in their country.

Family sells the crypto

On a local exchange or P2P platform and withdraws to their bank account or mobile wallet.

Keep records

Everyone keeps screenshots and transaction records in case of disputes, tax questions or compliance checks.

For NGOs, employers or fintech startups, a similar flow can be embedded into mobile apps or payroll systems, with a backend that integrates regulated exchanges and crypto on-ramp and off-ramp for remittances. Teams can work with partners like to design secure, compliant web and mobile payment flows integrated with existing HR or ERP systems. (makitsol.com)

What is the cheapest way to send money home with Bitcoin from the Gulf?

The cheapest way to send money with Bitcoin or stablecoins from the Gulf usually combines:

A low-fee exchange in the UAE/Saudi (BitOasis, Rain or similar)

A low-fee network (Lightning or a stablecoin on a cheap chain)

A competitive P2P or local exchange on the receiving side

Workers should compare

Maker/taker trading fees (around 0–0.5% is common for retail)

Network fees (on-chain BTC vs Lightning vs stablecoin networks)

FX spreads between USD, AED/SAR/QAR and INR/PKR/PHP

Minimum transfer sizes (very small transfers under $50 may be cheaper via local digital MTOs)

Many families find that for transfers above $100–200, crypto remittances start to beat Western Union/MoneyGram and sometimes even Wise, especially for corridors where banking access or FX spreads are weak. Always test with a small amount first, then scale up.

How families in Pakistan, India and the Philippines safely cash out crypto into local currency

Families in Pakistan, India and the Philippines have several safer options to cash out crypto remittances.

Local exchanges

Pakistan: Local platforms and regional exchanges (subject to local rules and availability)

India: Domestic exchanges and INR P2P desks

Philippines: Exchanges that integrate with GCash or bank accounts

P2P marketplaces

Binance P2P and other platforms allow families to sell BTC or stablecoins directly to vetted buyers who pay via bank transfer or local wallets.

Mobile wallets and ATM cards

Some exchanges issue debit/ATM cards or connect directly to mobile wallets like GCash, Easypaisa, JazzCash or bKash, making it easy to withdraw cash or pay bills.

Families should avoid unregistered, “hawala-style” crypto brokers who operate entirely in cash and offer no receipts or KYC; these increase risks of scams, confiscation and AML investigations. Using licensed platforms, documented P2P trades and clear records is safer for everyone.

Best crypto remittance apps and platforms in UAE, Saudi Arabia, US, UK and Germany

BitOasis, Rain, Pyypl and others

In the GCC, a few regulated platforms stand out for Bitcoin remittance UAE and broader regional corridors:

BitOasis

Licensed as a Virtual Asset Service Provider (VASP) by Dubai’s VARA, serving retail and institutional clients across the region.

Rain

Licensed by the Central Bank of Bahrain (CBB) and approved to operate in Bahrain and the UAE (via ADGM/FSRA), with a focus on MENA customers.

Pyypl

A virtual card and payment app popular with unbanked or cash-paid workers, offering multi-country transfers and Visa card rails.

These platforms typically support Arabic and English, with growing support for Urdu, Hindi and Tagalog, daily and monthly limits, and fees that beat traditional MTOs especially for mid-sized transfers. For technology teams, they can be integrated into custom portals or apps using modern web development and mobile app development services from partners like Mak It Solutions. (makitsol.com)

Using global exchanges and P2P platforms (Binance, Coinbase, Bitso) from US, UK and Europe

For migrant workers and diaspora in New York, Houston, London, Manchester, Berlin or Munich, global exchanges and P2P platforms are often the starting point:

US

ACH and wire transfers into Coinbase, Binance, Crypto.com and similar platforms

UK

UK Faster Payments into FCA-registered exchanges and fintechs (Revolut, Bitpanda, Binance International where allowed).

Germany/EU

SEPA and SEPA Instant via N26, Bitpanda, Kraken and others, often with low or zero deposit fees

These platforms make it easier to implement blockchain remittance solutions from the US/UK/Germany to Egypt, Turkey, Pakistan or the Philippines including flows like “how to send remittances with Bitcoin from USA to Egypt” or “from Germany to Turkey” with crypto as the transport layer and local P2P exchanges as the off-ramp.

Licences, low fees, limits and customer support in your language

When choosing a crypto remittance app, workers, NGOs and fintechs should evaluate.

Licensing & registration

US

FinCEN-registered Money Services Business (MSB) plus state money transmitter licences.

UK

FCA registration and compliant cryptoasset financial promotions.

Germany/EU

Authorised by BaFin and operating under the MiCA framework.

GCC

Approved by VARA, ADGM/FSRA, UAE SCA, SAMA, CBB or other national regulators.

Transparent fees & FX

No hidden spreads or surprise charges

Reasonable limits

Suitable for small and medium transfers, not just high-net-worth users

Multilingual support

Arabic, English, Urdu, Hindi, Tagalog, Bengali

Security standards

PCI DSS for card data, SOC 2–style controls and strong AML screening

For companies building their own apps, checking cloud, data and localization factors matters too see Mak It Solutions’ work on Middle East cloud providers and GCC data localization laws for examples of how compliance, data residency and infrastructure choices come together. (makitsol.com)

Is crypto remittance legal and safe in UAE, Saudi, US, UK, Germany and the EU?

FinCEN, FCA, BaFin, MiCA, VARA, ADGM/FSRA, SAMA and CBB

In most major markets, crypto remittances are legal when handled by regulated providers that follow AML, KYC and consumer-protection rules:

US

FinCEN classifies most exchanges and crypto remittance platforms as MSBs that must register and comply with the Bank Secrecy Act, plus any state-level licences.

UK

The FCA supervises crypto asset businesses for AML/CTF and enforces strict financial promotion rules for crypto marketing.

Germany/EU

BaFin regulates crypto custody and services, and from late 2024, MiCA provides an EU-wide framework for crypto asset issuers and service providers.

GCC

Dubai’s VARA, Abu Dhabi’s ADGM/FSRA, the UAE SCA, SAMA in Saudi Arabia, CBB in Bahrain and other local regulators have frameworks or sandboxes for virtual asset service providers, including licences that explicitly allow payment and remittance services with virtual assets.

For workers, the practical takeaway is simple: only use apps that clearly display their licences and regulators in the app, website or terms.

AML, KYC and Travel Rule checks migrant workers should expect

Crypto remittance providers are required to implement AML, KYC and Travel Rule checks similar to banks:

Identity verification (KYC)

Passport, national ID, residence permit, sometimes selfie or liveness checks

Proof of address

Utility bill, tenancy contract, banking letter

Source of funds

Basic questions or documents about salary, employer or business income

Transaction monitoring

Automated systems look for suspicious patterns and report them as needed

These checks can feel annoying, but they protect workers from fraud, reduce the risk of funds being frozen, and ensure the provider can legally operate in the US, UK, Germany, UAE, Saudi, Qatar and the EU.

Tax, volatility and scam risks for families receiving crypto remittances

Crypto remittances come with risks that families should understand.

Tax

In the US (IRS), UK (HMRC) and Germany, crypto disposal can trigger taxable events; in many cases, personal remittances are not taxed as income, but gains on crypto may be. VERIFYLIVEVERIFY LIVE

Families should speak with a qualified tax adviser in their country; this article is not legal or tax advice.

Volatility

Use stablecoins where possible and convert to local currency quickly; avoid “holding” remittance funds in volatile assets unless you fully understand the risk.

Scams and phishing

Only download apps from official stores, never share seed phrases and double-check wallet addresses.

If something sounds “too good to be true”, it usually is.

NGOs and fintechs can reduce these risks by building clear UX, warnings and education flows into their apps an area where a specialist team in front-end development and mobile UX can make a big difference. (makitsol.com)

When crypto remittances make sense and when to use banks or apps like Wise instead

Crypto remittances vs Western Union, MoneyGram, Wise and banks

Crypto remittances aren’t always the best option. A few scenarios.

Small transfers (<$200)

Traditional MTOs or Wise/Revolut may be cheaper once you include all crypto fees, particularly where P2P spreads are high.

Medium transfers ($200–$1000) from GCC to South Asia

Crypto remittances with stablecoins can often beat Western Union/MoneyGram and sometimes Wise on total cost and speed, especially on weekends and holidays.

Large, infrequent transfers (>$2000)

Banks or Wise can be competitive, especially for well-served corridors like London → Berlin or New York → Mumbai, and may feel safer for conservative users.

Global reports show that digital remittance providers already beat banks on cost (approx. 4% vs 12% in recent years), but the G20 goal of pushing average costs under 1% by 2027 is likely to be missed one reason crypto and stablecoins are getting attention as alternatives.

Unbanked, cash-paid and digitally savvy migrant workers

Crypto remittances tend to work best for.

Unbanked or cash-paid workers in Dubai, Doha or Riyadh who can use salary cards, top-up kiosks or virtual Visa apps like Pyypl.

Semi-banked workers in Jeddah or Abu Dhabi who have basic bank accounts but want cheaper, faster international transfers.

Digitally savvy diaspora in London, Berlin or New York who are comfortable with exchanges and P2P platforms and already hold some crypto.

For workers who prefer walking into a physical branch and speaking to someone face-to-face, traditional MTOs or fully digital but fiat-based apps (Wise, Remitly, etc.) may still be a better fit.

Implementation checklist for NGOs, employers and fintechs supporting migrant workers

If you’re an NGO, employer or fintech building solutions for migrant workers, here’s a compact implementation checklist.

Regulated partners

Choose exchanges/payment providers licensed by FinCEN, FCA, BaFin, VARA, ADGM/FSRA, SAMA, CBB or equivalent.

Security & compliance

Ensure PCI DSS for card data, SOC 2–level controls, FATF Travel Rule support and strong sanctions screening.

Payment rails

Integrate SEPA Instant, UK Faster Payments, ACH and GCC instant payment schemes like Sarie and UAE’s instant payments, plus mobile wallets on the receiving side.

Multi-cloud & data residency

Design compliant architectures across AWS/Azure/GCP and regional clouds, respecting GDPR, UK-GDPR, GCC data localization rules Mak It Solutions covers this deeply in its multi-cloud and GCC data localization guidance.

UX & language

Mobile-first flows with Arabic, English, Urdu, Hindi, Tagalog, Bengali, plus accessibility for low-literacy users.

Specialist partners like Mak It Solutions can help you combine secure SaaS architectures, modern web/mobile development and data/BI pipelines to deliver auditable, regulator-ready crypto remittance products. (makitsol.com)

Concluding Remarks

Used correctly, crypto remittances offer Gulf workers and global diaspora lower fees, faster transfers and more flexibility than many traditional options. They enable secure digital asset cross-border payments between UAE/Saudi/Qatar and key corridors like India, Pakistan, Bangladesh, the Philippines and Egypt including weekends and holidays.

The main risks are regulatory changes, price volatility, scam risks and compliance obligations in the US, UK, Germany, GCC and destination countries. Best practices include using regulated providers, favouring stablecoins for remittances, cashing out quickly and keeping records for tax and AML purposes.

Key takeaways

Crypto remittances can meaningfully reduce total costs for GCC–Asia and GCC–Africa corridors, especially for medium transfers and weekend payments.

Stablecoins and Lightning-based payments are usually more practical than raw on-chain BTC for day-to-day worker remittances.

Regulation is tightening: choose platforms licensed by FinCEN, FCA, BaFin, VARA, ADGM/FSRA, SAMA, CBB and EU national regulators.

NGOs, employers and fintechs should embed compliance, UX education and robust security standards (PCI DSS, SOC 2, Travel Rule) from day one.

Cloud, data and analytics architecture decisions matter just as much as the choice of exchange or wallet get them right early.

If you’re planning a crypto remittance product for GCC workers or want to reduce fees on your existing corridors, you don’t have to figure it all out alone. Share your main routes (for example, Dubai–Karachi, Riyadh–Manila, London–Cairo) current providers and approximate volumes, and we can help you model fee savings, compliance requirements and technical options.

Visit Mak It Solutions and reach out to the Editorial Analytics Team and consulting engineers to discuss a tailored roadmap for your crypto- or stablecoin-powered remittance stack from architecture and vendor selection to implementation and ongoing optimisation. ( Click Here’s )

FAQs

Q : Are crypto remittances actually cheaper than Western Union for small transfers under $200?

A : Sometimes but not always. For small transfers under $200, the network fee + exchange fee + P2P spread for crypto can add up to a few dollars, which may be similar to or higher than digital MTOs in some corridors. Western Union or Wise may still be cheaper for very small amounts, especially where they offer promotional pricing to South Asia. For medium transfers ($200–$500), crypto remittances using stablecoins or Lightning often start to beat traditional MTOs, particularly on GCC–Asia routes.

Q : Can undocumented or unbanked workers in the Gulf legally use crypto remittance apps?

A : Most regulated crypto apps in the UAE, Saudi Arabia, Qatar and Bahrain require KYC documents such as a passport and residence permit (iqama/Emirates ID). Undocumented workers typically cannot pass KYC and therefore can’t legally use these apps, even if they can download them. Some solutions for unbanked workers focus on salary cards, top-up vouchers or virtual Visa cards but still require minimum KYC levels by law. If someone offers “no-ID needed” cross-border crypto transfers in cash, that’s a red flag and may violate AML rules.

Q : Which stablecoin is best for remittances to Pakistan or the Philippines (USDT, USDC or others)?

A : The “best” stablecoin is usually the one with strongest liquidity and easiest cash-out options in the destination country. In many South Asian corridors, USDT has deep P2P liquidity, while USDC is popular with some regulated exchanges and DeFi users. For families in Pakistan or the Philippines, the practical test is: which coin has tight spreads and reliable buyers on P2P platforms and local exchanges? Workers should also consider the issuer’s reputation, regulatory status and any restrictions on specific networks.

Q : How are crypto remittances reported for tax purposes in the US, UK and Germany?

A : In the US, UK and Germany, tax authorities generally treat crypto as a form of property or asset, so disposing of it can trigger capital gains or losses. In many cases, the remittance itself isn’t taxed as income, but any gain between buying and selling the crypto may be taxable, even if the intention was just to send money home. Senders and receivers should keep transaction records (dates, amounts, prices) and consult a qualified tax adviser in their jurisdiction. This article is informational only and not tax advice.

Q : What happens if a crypto remittance transaction is delayed, frozen or sent to the wrong address?

A : If a transaction is delayed or frozen, regulated exchanges may be performing extra AML or sanctions checks; contact their support and provide any requested documents. If you have sent funds to the wrong address and it’s a valid crypto address, transfers are usually irreversible unlike bank chargebacks. In that case, only the owner of that wallet can send the funds back. To reduce risk, always send a small test amount first, verify addresses carefully (QR scans help), and enable safety features like address books and whitelists where available.