Crypto Predictions for 2030

The next five years will decide crypto’s place in mainstream finance. Exchange-traded funds (ETFs) opened the floodgates in 2024–2025, central banks are racing on digital currencies, and tokenization of real-world assets (RWAs) is quietly moving trillions on-chain. In this guide to crypto predictions 2030, we cut through noise with data, institutional signals, and policy trajectories no clickbait.

You’ll learn where Bitcoin and Ethereum could realistically land, how stablecoins and CBDCs will reshape payments, why tokenization is the killer use case, and the risks that could blindside portfolios. If you’re building or investing, the following crypto predictions 2030 framework is designed to be actionable, global, and resilient under multiple macro scenarios.

Key context: The U.S. SEC approved spot Bitcoin ETFs in January 2024 and spot Ether ETFs in July 2024, a pivotal bridge for institutional capital.

Macro Forces Setting the Stage for 2030

ETF rails are permanent.

U.S. spot BTC and ETH ETFs normalized compliant exposure for pensions, RIAs, and treasurers, catalyzing steady inflows and professional custody. Expect more multi-asset crypto ETPs globally by 2030.Policy convergence.

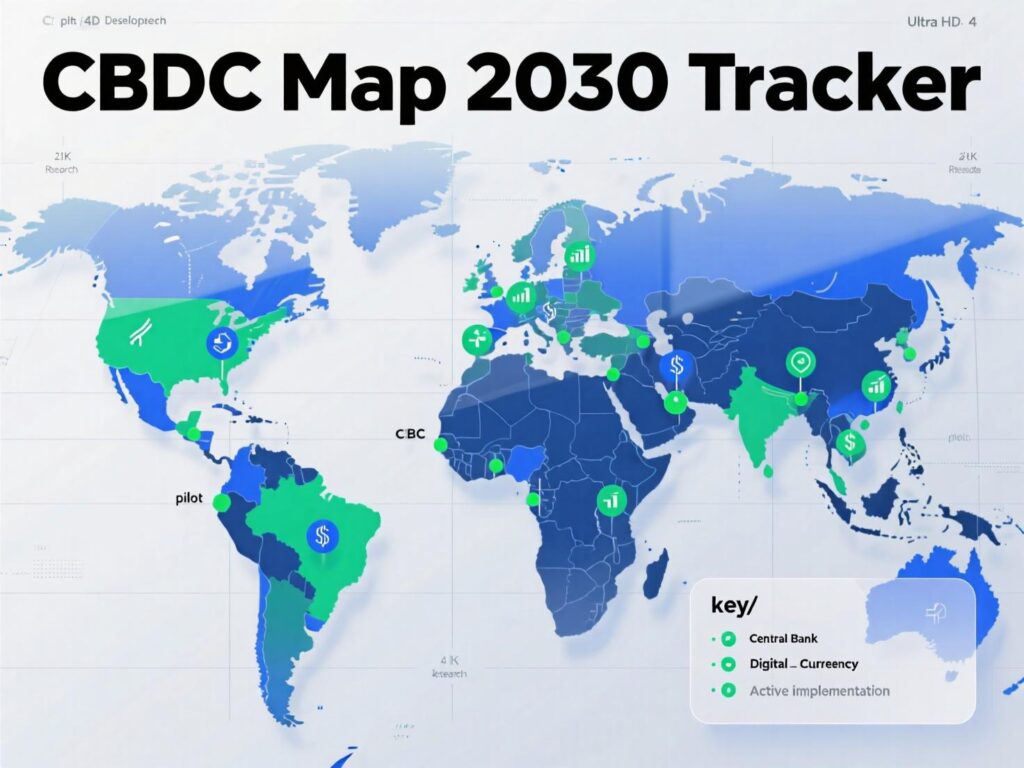

Over 130+ jurisdictions representing ~98% of global GDP are actively exploring CBDCs; nearly half are in pilot or launch phases. This accelerates digital-asset plumbing and standards across borders. Atlantic CouncilInstitutional risk-on.

2025 set multiple Bitcoin all-time highs above $120k, signaling institutional risk appetite and macro sensitivity to rates.User base momentum.

Global crypto owners surpassed 560M in 2024 and continue climbing in emerging markets; Chainalysis shows strong grassroots adoption across Central & Southern Asia.

Bitcoin & ETFs

Prediction 1 – Bitcoin becomes a strategic sleeve (1–3%) in diversified portfolios.

Spot ETFs provide compliant wrappers; U.S. banks and custodians are re-entering bitcoin custody, bringing comfort to risk committees. By 2030, we expect default model portfolios to include a small BTC sleeve, similar to gold.

Prediction 2 – Halving cycles soften, macro cycles dominate.

As ETF participation grows and custody professionalizes, volatility compresses. Bitcoin’s price will track liquidity cycles and real yields more than retail euphoria. Reuters/Bloomberg reporting on 2025’s highs underscores this macro linkage.

Prediction 3 – On-chain settlement & treasuries.

More corporates will park a sliver of treasury in BTC via ETFs for “digital gold” optionality, while using stablecoins for working capital. Expect treasury policies especially in tech/fintech to explicitly permit crypto exposure by 2030.

Ethereum, Scaling & Smart-Contract Platforms

Prediction 4 – Ethereum leads institutional rails.

Rollups, data-availability innovations, and compliance layers make ETH the default settlement network for tokenized funds and RWAs. BlackRock’s tokenized BUIDL fund on Ethereum crossed $2B+ AUM in 2025, an emblem of institutional comfort with public chains.

Prediction 5 – Multi-chain, not maxi.

By 2030, L2s and alt L1s specialize: payments, gaming, capital markets, and identity. Bridges consolidate; security budgets and MEV management become competitive differentiators. Institutions demand audited, permissioned lanes that still settle to public L1s.

Prediction 6 – DePIN and data markets mature.

Decentralized compute, storage and bandwidth projects win steady B2B demand (AI/edge use cases), with enterprise contracts settling on public/permissioned hybrids.

Stablecoins (the Killer App for Payments)

Prediction 7 – $1–4T stablecoin market.

Citi’s 2025 research pegs a $1.6T base case for stablecoin supply by 2030 (bear: $0.5T, bull: $3.7T). Cross-border B2B, remittances, and marketplace payouts are the wedges. Merchants adopt stablecoin flows for speed and fee efficiency.

Prediction 8 – Compliance-first rails.

Travel Rule adherence, KYT analytics, and blacklist/whitelist mechanics are default. Treasury, payroll, and invoices shift to 24/7 stablecoin rails, especially in emerging markets with FX frictions.

CBDCs & Digital Cash

Prediction 9 – CBDCs cover most major economies.

By 2030, dozens of countries will have launched or be piloting CBDCs, many in retail-intermediated designs. Interoperability and privacy tiers (small anonymous, large KYC’d) become common. The Atlantic Council tracker shows the velocity and breadth today.

Prediction 10 – Hybrid ecosystems.

CBDCs coexist with bank deposits and regulated stablecoins. Programmability is carefully sandboxed (escrow, conditional payments) with strict guardrails.

Tokenization & Real-World Assets (RWAs)

Prediction 11 – Tokenized assets reach multi-trillion scale.

Independent estimates range from ~$4T (Citi GPS base case for financial/private markets) to ~$16T (BCG/ADDX for illiquid assets) by 2030. Even the conservative path is massive relative to today.

Prediction 12 – Funds and treasuries get the first big wins.

Tokenized Treasury funds (e.g., BlackRock BUIDL) show real revenues and operational efficiency (instant settlement, on-chain distributions). Expect tokenized MMFs, bond funds, and private credit to dominate 2026–2030 flows.

Mini-Case Study – BlackRock BUIDL (2024–2025):

Launched March 2024 on Ethereum with Securitize; by early 2025, AUM surpassed $2B with on-chain dividend payouts proof that blue-chip asset managers can operate on public rails without breaking compliance.

DeFi, Regulation & “CeDeFi”

Prediction 13 – Regulated DeFi is standard.

KYC-gated pools and permissioned LP vaults align with securities laws. Compliant front-ends and wallet-based identity (verifiable credentials, ZK proofs) enable “composable finance” while satisfying AML expectations.

Prediction 14 – CeFi + DeFi convergence.

Broker-dealers, ATSs, and exchanges embed on-chain order routing; tokenized securities proposals on major exchanges foreshadow a blended market by late-decade.

Wild Cards That Could Turbocharge or Derail These Outcomes

Macro shock:

Rapid rate spikes or a deep recession could compress risk premiums.Cyber events:

Critical bridge or stablecoin failure.Policy swings:

Sudden bans or tax shocks in large economies—but 2024–2025 trend lines show a tilt toward engagement and integration rather than exclusion.

How to Build a 2030-Ready Crypto Strategy

(This section powers the HowTo schema.)

Clarify mandate & risk limits (Week 1).

Define allocation ranges (e.g., 0–5% digital assets), custody model, and compliance checklist.

Choose compliant wrappers (Week 2).

For core exposure, prefer spot BTC/ETH ETFs; add stablecoins for operations (cash management, cross-border).

Layer growth bets (Weeks 3–4).

Small sleeves in L2s, DePIN, and RWA protocols with strict position sizing.

Tokenization pilots (Quarter 2).

Test on-chain treasuries or receivables; measure settlement speed and ops savings vs. legacy rails.

Compliance stack (ongoing).

Implement KYT, Travel Rule, and wallet-screening tools; document procedures for audits.

Quarterly review.

Rebalance to policy bands, monitor ETF flows, stablecoin velocity, and CBDC pilots in your markets.

The Bottom Line

By 2030, crypto is no longer an “alternative” it’s embedded infrastructure. The crypto predictions 2030 that matter most for builders and allocators are practical: regulated access through ETFs, settlement via stablecoins, monetary infrastructure via CBDCs, and multi-trillion tokenization of assets riding public-chain security. Allocate deliberately, prioritize compliance-first rails, and pilot tokenization use cases now.

Call to action: Want a punchy crypto predictions 2030 content package or an allocation brief for your team? Reach out and we’ll tailor this framework to your sector and risk profile.

FAQs

1) How will Bitcoin be owned in 2030—directly or through ETFs?

A . Both, but ETFs dominate institutions due to mandates and custody simplicity. Spot approvals in 2024/2025 set the precedent for retirement plans and advisor platforms. ETFs lower operational risk; direct self-custody remains for power users.

2) How big could stablecoins get by 2030?

A . Citi’s base case is $1.6T with upside to $3.7T. Growth comes from B2B payments, remittances, and treasury ops. Compliance, reserves transparency, and interoperability are key risk drivers.

3) How do CBDCs affect crypto?

A . CBDCs digitize fiat rails; they don’t replace crypto. Expect coexistence with regulated stablecoins and public-chain settlement. Interoperability frameworks will determine user experience.

4) How can enterprises use tokenization before 2030?

A . Start with tokenized treasuries and private funds (faster settlement, programmable distribution). BlackRock’s BUIDL is a live case. Private credit and receivables follow as policy clarifies.

5) What’s a realistic Bitcoin outlook for 2030?

A . Institutional adoption and macro drivers argue for sustained relevance; 2025 ATHs show depth of demand, but volatility remains. Position sizing and rebalancing matter more than point targets.

6) How does DeFi become mainstream by 2030?

A . Through regulated front-ends, KYC’d pools, and verifiable-credential wallets. Expect “CeDeFi” integrations with banks and exchanges. Compliance abstractions reduce user friction.

7) How should I start a 2030-ready portfolio?

A . Define risk bands, use ETFs for core, stablecoins for ops, and selective exposure to L2s/RWAs with a quarterly risk review. Keep a written policy; revisit after material rule changes.

8) What are top risks to these crypto predictions 2030?

A . Policy shocks, cyber incidents (bridges), and macro surprises (rates, liquidity). Diversification and controls are essential. Maintain multi-custody and disaster-recovery plans.

9) How can tokenization lower costs?

A . Instant settlement and programmable distributions reduce reconciliation and intermediaries; pilots show tangible ops savings. Benefits vary by asset class and jurisdiction.