Crypto Markets Today: Bitcoin Holds $103K as Altcoins Lag and Traders Hedge Downside

Bitcoin steadied above the six-figure mark, holding near $103,000 after briefly dipping below $100,000 on Wednesday. The quick rebound showed continued investor confidence, with buyers stepping in to defend the milestone level. Despite the recovery, trading volumes suggested a cautious tone as traders awaited stronger confirmation of support.

Meanwhile, altcoins lagged behind, extending the market’s recent trend of Bitcoin-led strength. The underperformance across major layer-1 and DeFi tokens pushed Bitcoin dominance back toward 60%, signaling capital rotation into more stable assets. High-beta coins remained under pressure as risk appetite cooled, highlighting a shift toward consolidation after the rally.

Market Snapshot

BTC

~$103,000, +~1.8% 24h; still below the Oct. 6 record near $126,000 and a subsequent lower high around $116,000.

Breadth

CoinDesk 20 up as BTC outperforms; dominance rebounds toward 60% from ~57% in September.

Altcoins

ENA (~$0.31) and APT (~$2.7) each fell more than 20% this week, slipping below support levels.

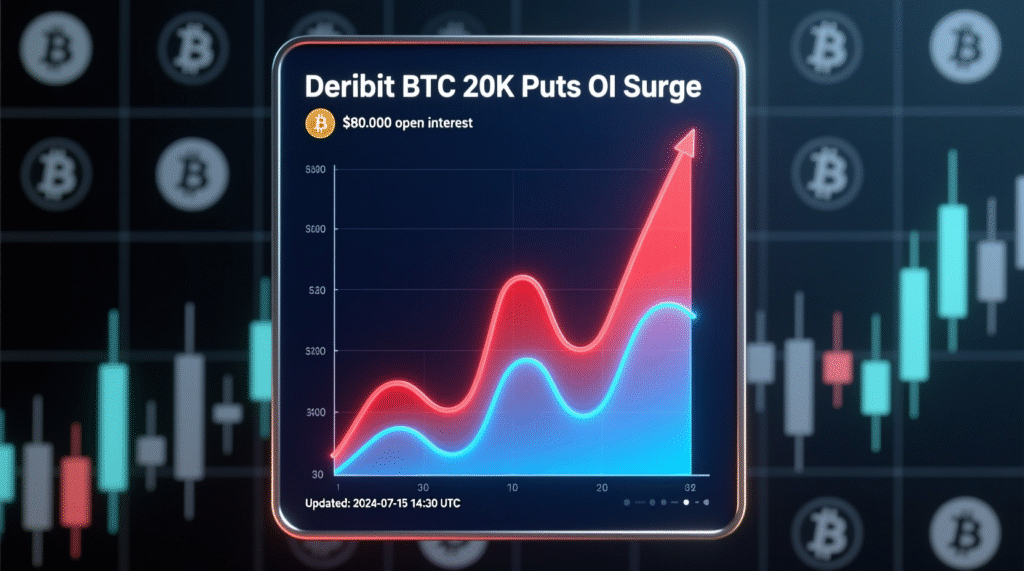

Derivatives Positioning: Caution Builds

Liquidations

Recent washout saw >$300M in positions cleared over 24 hours, part of a larger multi-day deleveraging stretch across majors.CoinDesk

Options hedges

Near-dated BTC/ETH options show downside nerves; BTC $80K puts have seen notable interest on Deribit as traders hedge further declines.

ZEC tilt

Zcash (ZEC) open interest remains elevated; funding rates have flipped negative consistent with hedging after a sharp rally.

CME futures:

Positioning light on BTC relative to recent months; ETH OI also eased from highs, mirroring softer risk appetite.

Hyperliquid Governance Sparks Debate

A fresh proposal HIP-5 on the Hyperliquid DEX would redirect up to 5% of protocol fees to a second assistance fund (AF2) to buy ecosystem tokens (e.g., PURR, Kinetiq, Felix) instead of using 99% of revenue solely for HYPE buybacks. Supporters see ecosystem growth and higher participation; critics warn of governance capture and bribery risks. The measure hasn’t gone to a formal vote.

Macro & Flows Backdrop

The latest rebound in the U.S. dollar and uncertainty over the Fed’s rate-cut trajectory have pressured crypto risk appetite in recent sessions, coinciding with the October peak-to-now drawdown in BTC.

Bitcoin holds $103K as altcoins lag: What It Means

BTC’s resilience above $100K alongside rising dominance suggests investors are consolidating risk into the market bellwether while trimming alt exposure. Historically, such regimes often precede periods of lower volatility and selective rotation but persistent hedging and negative funding on pockets like ZEC flag two-way risk in the near term.

Analysis

Alt underperformance amid defensive derivatives positioning implies near-term caution. If BTC sustains above $100K while dominance remains elevated, beta may stay compressed in altcoins. A decisive break below psychological levels would likely validate put-buyer hedges; conversely, easing macro headwinds and lighter CME OI could set the stage for a short-covering bounce.

Conclusion

Bitcoin held steady near $103,000 as altcoins continued to lag, keeping market leadership narrow and risk sentiment cautious. The focus remains on Bitcoin’s $100,000 pivot, a key psychological and technical level that could define near-term direction. Option activity around $80,000 puts suggests traders are maintaining downside hedges despite recent strength.

In the broader market, attention is turning to developments like Hyperliquid’s HIP-5 governance proposal, which could impact liquidity flows across smaller tokens. Until clear catalysts emerge, capital is likely to stay concentrated in Bitcoin, reinforcing its dominance as altcoins struggle to regain momentum.

FAQs

Q : Why is Bitcoin outperforming altcoins today?

A : Rising dominance suggests investors are consolidating into BTC as macro uncertainty and recent liquidations curb altcoin risk.

Q : Are traders really buying $80K BTC puts?

A : Yes Deribit flow shows notable interest in $80K strikes as downside hedges.

Q : What does ZEC’s negative funding imply?

A : It indicates a short bias in futures, often used as a hedge against long spot after a strong rally.

Q : How does Hyperliquid’s HIP-5 affect HYPE?

A : It would redirect up to 5% of fees to AF2 for ecosystem tokens, reducing daily HYPE buybacks by an estimated ~$150K.

Q : Is the sell-off driven by the Fed and the dollar?

A : Dollar strength and an uncertain rate-cut path contributed to pressure on crypto this week.

Q : Where are ENA and APT trading after the drop?

A : Both remain below recent supports after weekly declines of 20%+, consistent with today’s broader alt underperformance.

Q : Will altcoins recover if BTC stays above $100K?

A : Historically, stabilization above key levels can precede selective alt rotations, but hedging signals argue for caution near term.

Facts

Event

BTC stabilizes near $103K; altcoins lag; hedging risesDate/Time

2025-11-06T16:51:00+05:00Entities

Bitcoin (BTC); CoinDesk 20 Index; Ethena (ENA); Aptos (APT); Zcash (ZEC); Deribit; Hyperliquid (HIP-5, HYPE, AF2)Figures

BTC ~$103,000 (+~1.8% 24h); BTC dominance ~60%; liquidations >$300M (24h, recent); BTC $80K puts active; ZEC OI elevated, funding negativeQuotes

“Some BTC traders are buying $80,000 put options.” Deribit (via media reporting) Yahoo FinanceSources

CoinDesk markets update; Yahoo Finance/Deribit options note; CoinGlass liquidation recap; Barron’s BTC price context; The Defiant on HIP-5. The Defiant+4CoinDesk+4Yahoo Finance+4