Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

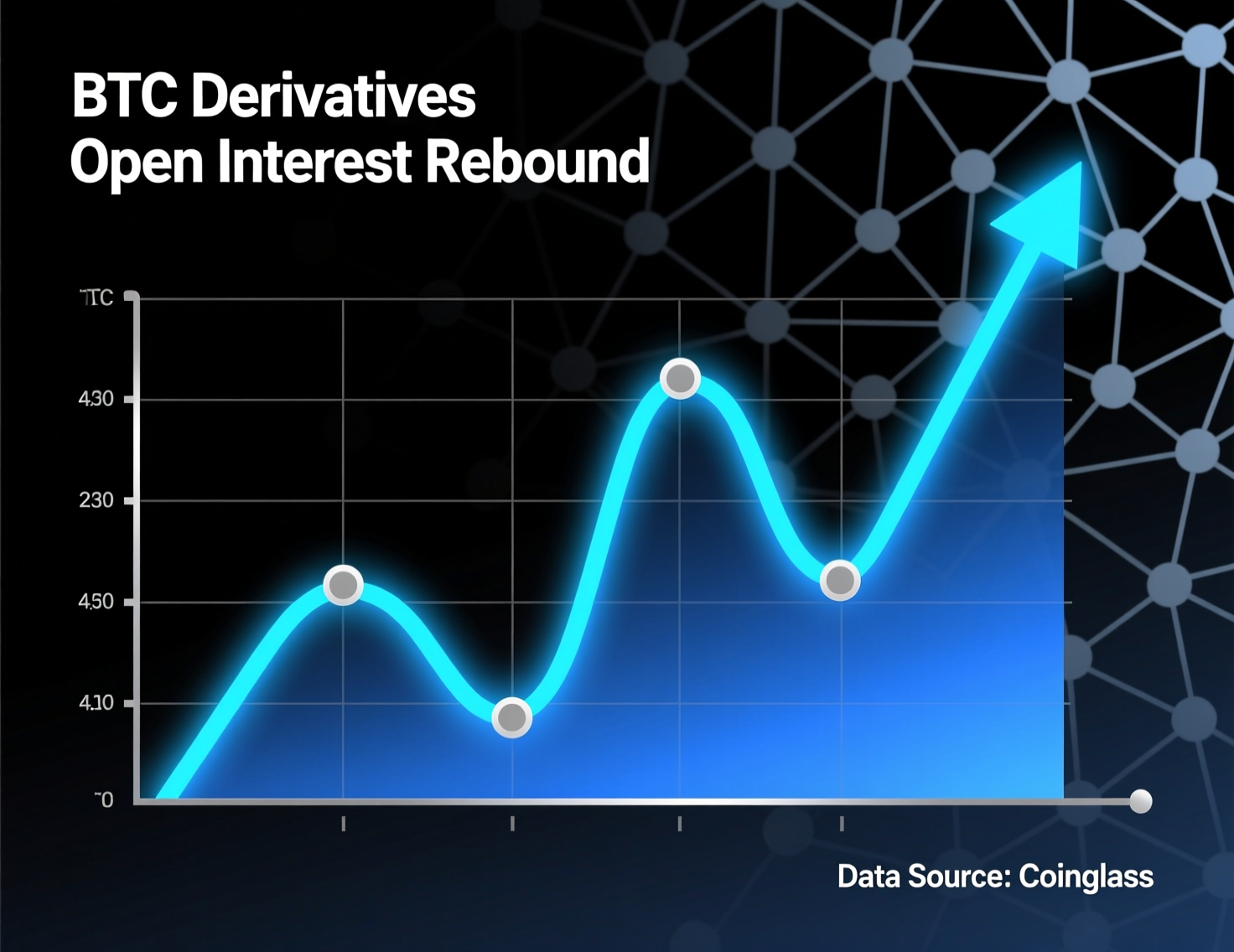

After a weekend leverage flush that wiped out nearly $500 billion from crypto valuations, markets showed signs of stabilization on Monday. Bitcoin derivatives open interest began to recover, suggesting that traders were cautiously returning to the market after widespread liquidations. The sharp deleveraging appeared to reset overheated positions, allowing spot prices to consolidate at firmer levels.

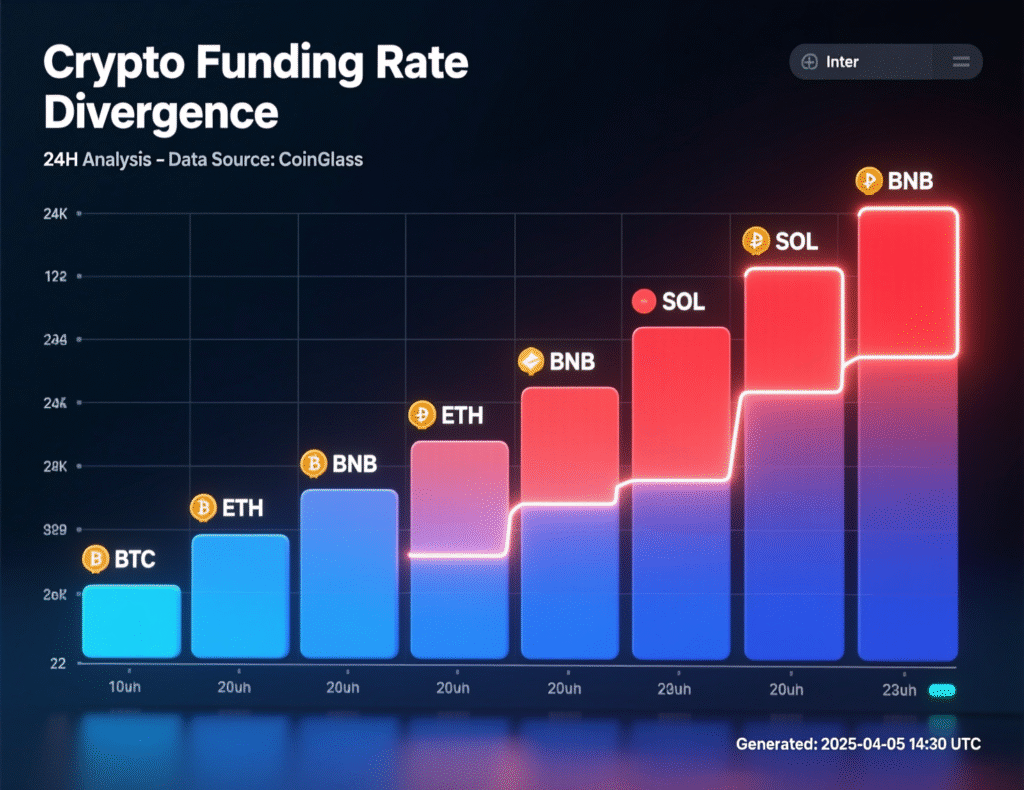

Options data also turned more optimistic, with implied volatility easing and risk appetite gradually returning. Traders selectively re-entered long positions, though funding rates varied across exchanges, revealing uneven sentiment among participants. The mixed signals suggest the market is in an early phase of rebuilding confidence following one of the sharpest short-term unwinds in recent months.

Drivers of the bitcoin derivatives open interest rebound

BTC futures open interest, which slid from ~$33B to ~$23B over the weekend, recovered to about $26B by Monday. The 3-month annualized basis also bounced to ~6–7% from ~4 5%, both suggesting improved risk appetite in futures term structure.

Spot–derivatives interplay reflected a cautious reset: CoinMarketCap’s dashboard showed a broad-market uptick with BTC dominance near the upper-50s %, consistent with capital rotating first into large caps before filtering to altcoins. CoinMarketCap

What the bitcoin derivatives open interest rebound signals

The recovery in open interest and term basis typically denotes renewed willingness to hold leveraged long exposure. Yet, funding rates were uneven near +10% on Bybit and Hyperliquid but negative on Binance implying fragmented positioning and potential basis-trade opportunities across venues.

Options tilt: Calls favored, skew edges higher

BTC options showed a shift toward upside bets: the 24-hour put/call volume mix moved >56% to calls, while 1-week 25-delta skew rose to ~2.5% from flat levels, indicating greater demand for calls versus puts. Third-party dashboards tracking 25-delta skew also showed early-October firmness consistent with this move.

Liquidations and market breadth

After an estimated ~$19B in weekend liquidations the largest in this cycle 24-hour liquidations around Monday totaled roughly $620M, skewing toward shorts as prices rebounded. Leaders by notional included ETH, BTC and SOL. These figures line up with CoinGlass-referenced tallies reported by multiple outlets.

On the altcoin side, Synthetix (SNX) surged over 120% on the day amid hype around a trading competition and “perpetual wars” narrative versus rival venues, making it Monday’s standout.

Context & Analysis

Funding divergence often precedes mean-reversion in basis/funding or a continuation if one venue’s positioning forces further unwinds. Elevated call demand with modest positive skew can signify traders paying for upside convexity amid ongoing macro uncertainty. That said, uneven funding and recent auto-deleveraging episodes warrant tighter risk controls.

Conclusion

The first trading session after the selloff signaled early signs of stabilization, as open interest and futures basis rebounded while options markets showed a tilt toward bullish sentiment. Some altcoins also outperformed, indicating a selective return of risk appetite among traders.

However, the recovery remains uneven across venues. Funding rates are still fragmented, and realized volatility stays elevated, reflecting lingering uncertainty in market direction. Until these cross-market indicators align more consistently, traders are likely to keep position sizes conservative and focus on managing exposure rather than chasing short-term momentum.

FAQs

Q : What caused the market to recover after the crash?

A : Renewed risk appetite in futures (higher OI/basis), call-heavy options flow, and short-side liquidations supported prices.

Q : How significant is the bitcoin derivatives open interest rebound?

A : OI rebounded to around $26B from $23B, reversing part of the weekend drop from roughly $33B.

Q : Why are funding rates diverging across exchanges?

A : Positioning differences and liquidity conditions cause positive funding on some venues and negative on others.

Q : What does a positive 25-delta skew mean?

A : Calls are relatively pricier than puts, often signaling demand for upside exposure.

Q : How large were liquidations in the last 24 hours?

A : About $620M, with shorts taking a larger hit during the rebound.

Q : Which altcoins outperformed?

A : Synthetix (SNX) surged over 120%, driven by trading competition hype and perp-DEX narratives.

Q : Is the recovery durable?

A : Signals improved, but divergent funding and high volatility call for caution in leverage and sizing.

Facts

Event

Post-crash crypto rebound; derivatives metrics stabilizeDate/Time

2025-10-13T21:30:00+05:00Entities

Bitcoin (BTC); Ethereum (ETH); Synthetix (SNX); Binance; Bybit; HyperliquidFigures

OI ≈ $26B; 3-mo basis ≈ 6–7% (annualized); 24h liquidations ≈ $620M; weekend liquidations ≈ $19B; BTC dominance ~58% area. (USD, %) CoinMarketCap+3CoinDesk+3ChainCatcher+3Quotes

“Funding rates remain uneven… Bybit and Hyperliquid hover near +10%, but Binance turns negative.” CoinDesk markets brief. CoinDeskSources

CoinDesk (markets brief) https://www.coindesk.com/markets/2025/10/13/crypto-markets-today-bitcoin-and-altcoins-recover-after-usd500b-crash ; CoinGlass Liquidation Data https://www.coinglass.com/LiquidationData