Crypto conferences Dubai 2025 & Middle East guide

The standout crypto conferences Dubai 2025 line-up for international investors includes TOKEN2049 Dubai, Blockchain Life, Future Blockchain Summit x Fintech Surge, HODL Summit, Crypto Expo Dubai and Binance Blockchain Week, plus Bitcoin MENA and Global Blockchain Show in Abu Dhabi. These events cluster mainly between March May and October–December 2025, so US, UK and EU visitors can stack multiple conferences in a single trip while staying aligned with visa rules, tax-deductible business travel and regional meetings with funds, VCs and service providers.

Introduction

If you’re researching crypto conferences Dubai 2025, you’re looking at one of the densest Web3 calendars on the planet. TOKEN2049 Dubai, Blockchain Life, Future Blockchain Summit x Fintech Surge, HODL Summit, Crypto Expo Dubai and Binance Blockchain Week together attract tens of thousands of traders, founders, VCs and service providers into a relatively small slice of the year.

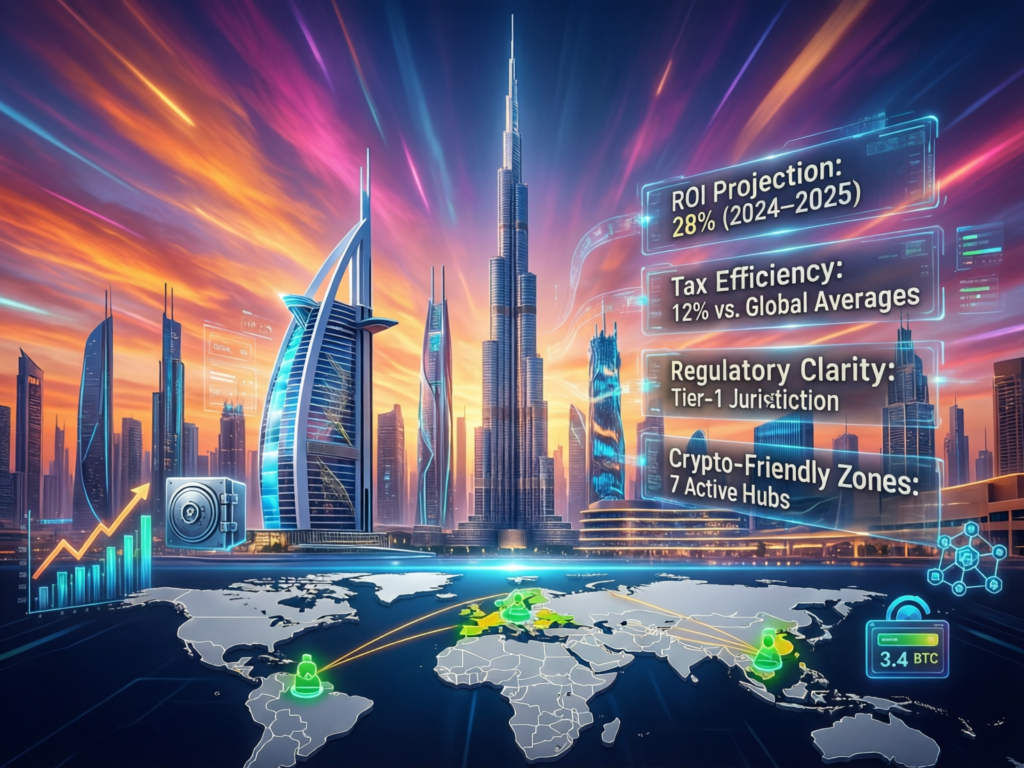

In 2024, Dubai World Trade Centre (DWTC) events alone brought in around 2 million visitors and generated over AED 22 billion (≈USD 6B) of economic output, a good indication of how seriously the city treats large-scale conferences. At the same time, Abu Dhabi is positioning ADGM and ADNEC as an institutional crypto and fintech hub, while Bahrain and Saudi Arabia build their own fintech and Web3 plays aligned with EU MiCA, UK-FCA and BaFin standards.

From New York, London, Berlin to Dubai.

This guide is written for US, UK and EU investors flying from hubs like New York, London, Manchester, Berlin, Frankfurt, Paris, Zurich or Amsterdam who want to turn a Gulf crypto conference into a high-ROI business trip. Direct and one-stop flights into Dubai and Abu Dhabi make it realistic to do a 4–10 day loop that includes multiple shows, plus side meetings with funds, exchanges, regulators and service providers.

Whether you’re

a high-volume trader or prop-desk lead

a DeFi / Web3 founder

a VC, family office or fund partner

or a law firm, SaaS, analytics or marketing agency

…this guide helps you pick, stack and justify the right events for your role.

The Top Crypto Conferences in Dubai 2025 at a Glance

At a glance, the flagship crypto and Web3 events in Dubai & Abu Dhabi 2025 include.

TOKEN2049 Dubai late April at Madinat Jumeirah; intense markets & macro focus with 15,000+ attendees.

World Blockchain Summit Dubai mid-May at Madinat Jumeirah; dealflow-heavy summit for founders and VCs.

Crypto Expo Dubai mid-June, expo-style show (2025 edition marketed at Grand Hyatt Dubai) focused on retail investors, brokers and brokers’ service providers.

Future Blockchain Summit x Fintech Surge – October at Dubai Harbour, alongside GITEX Global.

Blockchain Life 2025 + Blockchain Life Week late October at Festival Arena, Dubai Festival City, plus 10 days of side events across the city.

HODL Summit Dubai end of October 2025, part of a Dubai–Riyadh roadshow.

Binance Blockchain Week Dubai 2025 3–4 December at Coca-Cola Arena.

Bitcoin MENA & Global Blockchain Show Abu Dhabi 8–9 December (Bitcoin MENA, ADNEC) and 10–11 December (Global Blockchain Show, Space42), ideal for stacking with Dubai events.

Always double-check live event sites before booking, as dates, venues and formats can change.

TL;DR List of Top Crypto Conferences in Dubai & the Middle East (2025)

If you just want the short version: Dubai is best for dense Web3 weeks; Abu Dhabi for institutional and Bitcoin-heavy shows; Bahrain and Riyadh for targeted fintech and Web3 expansion.

Top Dubai Crypto Conferences 2025 for International Investors

Here’s a persona-based shortlist (months are indicative; always re-check)

TOKEN2049 Dubai Madinat Jumeirah (late April)

Best for: high-volume traders, quant funds, prop desks, liquidity providers and macro-driven investors who want big-picture narratives plus deep order-book conversations.

World Blockchain Summit Dubai Madinat Jumeirah (mid-May)

Best for: seed–Series B founders, Layer-1/L2, DeFi and infra teams looking for curated investor meetings and serious B2B conversations.

Crypto Expo Dubai Grand Hyatt / similar venues (mid-June)

Best for: brokers, exchanges, payment gateways and service providers (KYC/AML, marketing, SaaS, analytics) chasing large volumes of retail and broker leads via booths and expo-style stands.

Future Blockchain Summit x Fintech Surge Dubai Harbour (12–15 Oct)

Best for: Web3 infra, CBDC/DeFi, fintech and open-banking projects that want overlap with GITEX Global and the broader MENA tech ecosystem.

Blockchain Life 2025 Festival Arena, Dubai Festival City (28–29 Oct) + Blockchain Life Week (24 Oct–2 Nov)

Best for: founders, market-makers, tier-1 exchanges and serious retail who want a full “Web3 week” in Dubai with parties, side events and sponsor activations across Marina, JBR and Downtown.

HODL Summit Dubai end of October

Best for: founders and investors who like summit-style formats with pitch stages and curated deal rooms, then want to follow the series on to Riyadh.

Binance Blockchain Week Dubai Coca-Cola Arena (3–4 Dec)

Best for: ecosystems aligned with Binance, chain foundations, serious traders and institutions tracking liquidity, derivatives and exchange-centric innovation.

Must-Know Middle East Bitcoin & Crypto Shows Beyond Dubai

Beyond Dubai, three clusters matter if you’re travelling from the US, UK or EU.

Abu Dhabi Bitcoin MENA & Global Blockchain Show (ADNEC / Space42)

Bitcoin MENA (8–9 Dec, ADNEC): Bitcoin-centric, with mining, policy and institutional panels in a quieter, more curated setting than Dubai’s mega-shows.

Global Blockchain Show Abu Dhabi (10–11 Dec, Space42): large expo with an expected 5,000–7,000+ Web3 attendees and strong institutional and policy presence.

Bahrain Fintech + Crypto-Adjacent

Fintech Forward 2025 (8–9 Oct, Exhibition World Bahrain): the Kingdom’s flagship fintech forum with strong CBB and Bahrain FinTech Bay backing; tokenisation and digital assets are increasingly on the agenda.

Riyadh / Saudi Arabia Emerging Web3 & Fintech Hub

HODL Summit Riyadh 2025 (Nov): continuation of the HODL series, aligning with Saudi’s push towards 525+ fintechs by 2030.

Additional Web3-leaning events often cluster around fintech and tech weeks in Q4.

At-a-Glance Calendar.

For most visitors from New York, London or Berlin, the best time to attend crypto and Web3 events in the Gulf is February–April and October–December, when daytime highs sit closer to the mid-20s °C (~70–80°F) rather than summer’s 40°C+.

A simple way to stack your 2025 trip

Spring (Apr–Jun)

Fly into Dubai for TOKEN2049 and World Blockchain Summit, stay on for Crypto Expo Dubai and side meetings in DIFC.

Autumn (Oct–Nov)

Combine Future Blockchain Summit x Fintech Surge, GITEX Global and Blockchain Life Week in Dubai, then hop to Riyadh (HODL Summit, Money20/20 MEA) or Bahrain (Fintech Forward).

Early Winter (Dec)

Do Binance Blockchain Week in Dubai, then drive or fly 1 hour to Abu Dhabi for Bitcoin MENA and Global Blockchain Show in the same week.

Why Dubai and Abu Dhabi Became the MENA Crypto Conference Hub

Dubai and Abu Dhabi are currently the only places combining regulatory clarity, large venues, airline hubs and capital at this scale for Web3 events.

VARA, ADGM and CBB.

Dubai’s Virtual Assets Regulatory Authority (VARA) runs a dedicated regime for virtual asset service providers (VASPs) covering exchanges, brokers, custodians and more, including marketing rules that directly impact conference sponsorship and roadshows.

Abu Dhabi’s ADGM / FSRA offers an institutional-grade digital asset framework inside a common-law financial centre familiar to US, UK and EU firms, while Bahrain’s Central Bank (CBB) has an established crypto-asset module and backs events like Fintech Forward.

For European projects operating under MiCA/MiCAR and supervised by regulators like ESMA and BaFin, the Gulf’s regimes feel conceptually familiar: licensing, CASP-style categories, custody rules and strong AML expectations.UK-regulated firms dealing with the FCA’s evolving cryptoasset regime also find the UAE’s risk-based but pro-innovation stance attractive for regional expansion.

Infrastructure, Venues and Flight Hubs

On the ground, the venue and transport matrix is hard to beat.

Madinat Jumeirah resort-style complex where TOKEN2049 and World Blockchain Summit are hosted; great for high-end LP dinners and side meetings.

Dubai Harbour & DWTC home to Future Blockchain Summit x Fintech Surge and GITEX Global, spanning tens of thousands of square metres across multiple halls.

Festival Arena, Grand Hyatt, Coca-Cola Arena flexible spaces ideal for expo-heavy shows like Blockchain Life, Crypto Expo Dubai and Binance Blockchain Week.

ADNEC & Space42 (Abu Dhabi) conference-grade venues about 1 hour from Dubai, plugged into Abu Dhabi’s financial and government districts.

Dubai and Abu Dhabi are served by dense direct connections from New York, London Heathrow, Manchester, Berlin, Frankfurt, Paris, Zurich and Amsterdam, making them easier for team travel than many Asian or LatAm hubs.

Why Founders, Funds and Service Providers Prioritise Dubai Over Other Regions

Founders, funds and service providers pick Dubai and Abu Dhabi over scattered global events because

Capital density

DIFC alone grew revenues ~37% in 2024 and hosts hundreds of regional funds, PE, VC and fintech firms.

Event economics

DWTC’s 2024 events generated over AED 22.35 billion in economic output, signalling strong government and private-sector support for large-scale conferences.

Regional LP and sovereign access

ADGM and DIFC give you proximity to Gulf family offices, sovereign wealth funds and banks looking at tokenisation, DeFi and Web3 infra.

Operational base

It’s increasingly common to combine a conference trip with company setup in DIFC or ADGM, plus working sessions with tech and analytics partners (for example, engaging Mak It Solutions on cloud, AI or data analytics for your trading stack).

Deep Dive: Top Dubai & Abu Dhabi Crypto Conferences 2025 (by Profile & Month)

TOKEN2049 Dubai & Bitcoin-Focused Events

If your main question is “Which Dubai crypto conferences 2025 are best for serious trading and markets?” start here:

TOKEN2049 Dubai (late April, Madinat Jumeirah)

Top-tier speaker lineup, heavy presence from derivatives venues, market-makers, macro funds and high-frequency traders. With 15,000+ attendees, it’s more about price-discovery conversations and liquidity deals than retail hype.

Binance Blockchain Week Dubai (3–4 Dec, Coca-Cola Arena)

Big venue, big exchange. If you’re running a prop desk in New York or Frankfurt, this is where you meet listing, liquidity and institutional coverage teams in one place.

Bitcoin MENA (8–9 Dec, ADNEC Abu Dhabi)

Best for miners, Bitcoin-only funds and macro allocators who want quieter BTC-centric conversations, plus easy access to ADGM’s institutional ecosystem.

For US and EU prop shops, a smart combo is TOKEN2049 (April) + Binance Blockchain Week + Bitcoin MENA (Dec), with a stop in Abu Dhabi to meet ADGM-regulated counterparties.

Blockchain Life, Future Blockchain Summit & HODL

Builders should prioritise events where product, infra and ecosystem roadmaps dominate:

Blockchain Life 2025 + Blockchain Life Week (late Oct)

Dubai’s most intense “Web3 week” for founders, chain teams and infra providers. Expect more than 15,000 attendees, 130+ countries, hackathons, VIP dinners and a constant stream of investor coffees across Dubai Marina and Downtown.

Future Blockchain Summit x Fintech Surge (12–15 Oct, Dubai Harbour)

Co-located with GITEX, this show is ideal if you’re building tokenised finance, DeFi, CBDC, payments or open-banking-powered products for EU/UK/MENA banks and fintechs.

HODL Summit Dubai (30–31 Oct)

Founder-friendly summit with a “pitch-competition” culture, where you can meet both investors and potential enterprise clients, then follow the series to Riyadh.

Founders coming from London or Berlin often time these weeks around their product roadmap – for example, launching a new mobile app or DeFi analytics feature with support from partners like Mak It Solutions, then using Dubai’s conferences as a user-acquisition and partnership sprint.

For VCs, Funds and Service Providers: Crypto Expo Dubai & World Blockchain Summit

If you’re treating 2025 conferences as pipeline and dealflow machines, focus on.

Crypto Expo Dubai (mid-June)

Expo-style format ideal for compliance, marketing, SaaS, data and legal providers serving exchanges and brokers. Booths and speaking slots convert well if you have a crisp offer (e.g., on-chain analytics, AML, or regulatory reporting for VARA/ADGM-regulated entities)

World Blockchain Summit Dubai (14–15 May, Madinat Jumeirah)

Curated summit with around 5,000 attendees across sessions, expo and investor meetings. Strong for late-seed to Series B dealflow across Web3 infra, gaming, DeFi and real-world asset tokenisation.

Global Blockchain Show Abu Dhabi (10–11 Dec)

For global Web3 funds this is a chance to meet Middle Eastern LPs, exchanges and institutional allocators in a more policy-heavy Abu Dhabi context.

This is also where service providers from the US, UK and Germany can justify sponsorships: your brand sits in front of exactly the VARA/ADGM-regulated clients you want, and you can run targeted follow-up with support from a data partner like Mak It Solutions to score and prioritise leads.

Major Middle East Crypto & Bitcoin Conferences Beyond Dubai

Bitcoin MENA & Global Blockchain Show at ADNEC

Choose Abu Dhabi over Dubai when you want.

A calmer, more institutional vibe with big banks, sovereigns and policy-makers

Closer proximity to ADGM and ADQ, plus Abu Dhabi Finance Week-style networks

Bitcoin-centric or enterprise-blockchain content

Bitcoin MENA (8–9 Dec, ADNEC) brings BTC funds, miners and macro allocators together with MENA institutions. Global Blockchain Show Abu Dhabi (10–11 Dec, Space42) then layers on DeFi, Web3 infra and tokenisation – effectively creating a four-day “Abu Dhabi Crypto Week” that pairs perfectly with Dubai’s December events.

Riyadh and Saudi Arabia

Saudi Arabia’s Vision 2030 and fintech strategy aim to create hundreds of fintechs and significant additional economic value by 2030, with strong pushes into open banking and digital payments.

For Web3, watch for

HODL Summit Riyadh 2025 (Nov) continuation of the HODL series focused on Web3, DeFi and institutional adoption.

Ethereum and Web3 summits such as ETH Riyadh, often co-located with major Q4 tech and security conferences.

Riyadh is especially interesting if your client base includes Saudi banks, payment firms or open-banking-powered fintechs. Conferences there can be paired with meetings on banking app development, open-banking APIs and analytics, something Mak It Solutions already supports across GCC digital projects.

Bahrain, Qatar and Wider Gulf.

For niche but high-signal exposure

Fintech Forward 2025 (Exhibition World Bahrain)

Bahrain’s flagship fintech conference, strongly backed by the CBB and Bahrain FinTech Bay good for tokenisation, regtech and digital payments.

Fintech Revolution & FinTech Bay Summits

Smaller but high-leverage events where you can have long conversations with regulators, banks and early-stage fintechs.

Qatar’s Hayya-era events

Doha is pushing sports- and event-led tourism, with upgraded Hayya visas and growing fintech activity; you’ll mostly see digital asset content embedded inside broader fintech and innovation shows.

Visas, Legality, Regulation and Tax for US, UK and EU Attendees

(This section is general information, not legal or tax advice; always verify with official sources and your own advisors.)

Visa Basics for Dubai, Abu Dhabi and the Gulf

Most US, UK and EU passport holders can obtain a visa on arrival or e-visa for the UAE, Saudi Arabia, Bahrain and Qatar, subject to change and security checks.

Common patterns (check live before you fly)

UAE (Dubai & Abu Dhabi) Many EU states plus the UK qualify for visa on arrival for roughly 30–90 days; US citizens generally also get a visa on arrival for short business visits.

Saudi Arabia e-visas and visa-on-arrival now cover all EU countries plus the US and UK; visitors can often qualify using existing US/UK/Schengen visas.

Bahrain & Qatar mix of visa-free, e-visa and visa-on-arrival, with Hayya e-visas used heavily for sports and events in Doha.

A potential game-changer is the planned GCC “Schengen-style” multi-country tourist visa, targeted for launch around Q4 2025, which would let visitors move across UAE, Saudi, Bahrain, Qatar, Oman and Kuwait on a single visa.

Is Crypto Legal in Dubai and the Middle East for Foreign Investors?

You can generally attend conferences, network and explore deals safely as a foreign investor, but you must respect local licensing rules and your home-country regulations.

In Dubai, VARA regulates virtual asset services; only licensed entities should market trading platforms, custody or token offerings to the public.

In Abu Dhabi, ADGM’s FSRA runs a digital asset framework tailored to institutional and wholesale markets.

In Bahrain, CBB’s crypto-asset rules sit under its wider banking and fintech regime.

For EU firms, MiCA now imposes CASP licensing and marketing rules that can apply even when activity takes place abroad but targets EU users; UK and German firms face similar scrutiny from the FCA and BaFin.

Bottom line: attend and explore freely, but channel any live offers or fundraising through licensed entities and proper legal advice.

US, UK and German Attendees at MENA Crypto Conferences

Most countries let you treat genuine business travel and conference costs as deductible but rules differ by jurisdiction.

US (IRS)

Travel and convention expenses can be deductible if the trip is primarily for business and the conference benefits your trade or business; special rules apply to conventions held outside North America.

UK (HMRC)

Travel, accommodation and subsistence for wholly business-related travel is generally allowable, but mixed personal trips must be apportioned.

Germany (BMF rules / BRKG)

Business-related travel expenses, meals and accommodation can often be claimed as income-related expenses (Werbungskosten), again with strict documentation.

Keep.

invoices for tickets and sponsorships

flight and hotel receipts

notes on meetings, deals, airdrops or token grants you agreed on-site

Then work with your tax advisor to handle capital gains, staking income and airdrops under IRS, UK-HMRC, German or EU rules.

Flights, Hotels and Neighbourhoods Near Key Venues

Best Time of Year to Attend Crypto Conferences in Dubai & Abu Dhabi

Practically, you’ll want to avoid peak summer (June–August) unless you must. In winter, Dubai and Abu Dhabi daytime highs often sit around the low- to mid-20s °C (70s °F), which is ideal for walking between venues and side events.

Most flagship crypto conferences in 2025 sit in

Spring (Mar–Jun)

TOKEN2049, World Blockchain Summit, Crypto Expo Dubai

Autumn (Oct–Nov)

Future Blockchain Summit x Fintech Surge, GITEX, Blockchain Life Week, HODL

Early Winter (Dec)

Binance Blockchain Week, Bitcoin MENA, Global Blockchain Show

Be aware of Ramadan, which shifts each year and can affect event timing, alcohol service and evening schedules check dates when booking.

Madinat Jumeirah, Dubai Harbour, DWTC, ADNEC and Saadiyat

Rough area guide (from a London/NYC business-travel perspective)

Around Madinat Jumeirah & Jumeirah Beach

Great if your main shows are TOKEN2049 or World Blockchain Summit; plenty of 5-star resorts plus more affordable hotels in nearby Al Barsha.

Dubai Harbour / Marina / JBR

Ideal for Future Blockchain Summit and many side events; young, vibrant, lots of serviced apartments and mid-range hotels.

DWTC / Sheikh Zayed Road / Downtown –

Best if you’re also doing GITEX or meetings in DIFC; strong business hotel stock and easy metro access.

Festival City (Blockchain Life)

Convenient if you want to roll out of your room and into the hall, though many attendees still stay around Downtown or Marina for nightlife.

Abu Dhabi – ADNEC & Saadiyat

For Bitcoin MENA and Global Blockchain Show, staying near ADNEC or on Saadiyat Island gives you easy access plus nicer resort options for LP and client dinners.

If you’re bringing a product or data team, you can also use the trip for a short offsite, which is where partners like Mak It Solutions often join clients in Dubai or Riyadh to align on analytics, cloud and mobile roadmaps.

Combining Conferences with Company Setup in DIFC or ADGM

A popular 2025 play.

Fly in for a flagship conference (e.g., TOKEN2049 or Blockchain Life).

Book 2–3 days of meetings with law firms, corporate service providers and regulators in DIFC (Dubai) or ADGM (Abu Dhabi) to explore incorporation or licensing.

Use your extra time to lock in tech and analytics partners for example, scoping cloud, AI and data pipelines with Mak It Solutions for your VASP, exchange or DeFi platform.

This kind of “conference + strategy sprint” is often easier to justify to boards and LPs than a single event ticket on its own.

How to Choose the Right Conference and Maximise ROI (Traders, Builders, VCs & Service Providers)

Trader, Builder, VC, Service Provider or Enterprise

Use this quick mapping.

Traders / Prop Desks / Funds

TOKEN2049, Binance Blockchain Week, Bitcoin MENA, plus side-events during Blockchain Life Week.

Builders / Web3 Founders

Blockchain Life, Future Blockchain Summit x Fintech Surge, HODL Dubai & Riyadh, Global Blockchain Show.

VCs / Family Offices / LPs

World Blockchain Summit, TOKEN2049, Global Blockchain Show, Fintech Forward Bahrain.

Service Providers (legal, SaaS, analytics, marketing)

Crypto Expo Dubai, World Blockchain Summit, Future Blockchain Summit, Binance Blockchain Week sponsor areas.

When in doubt, scan sponsor logos and agendas if your ideal clients dominate those, the show is probably worth it.

Tickets, Sponsorships, Flights and Lead Targets

Ballpark numbers from London, New York or Berlin for a 5-day Dubai + Abu Dhabi trip in conference season:

Return flights: USD 700–1,500 for economy, USD 2,500+ for business, depending on season.

Hotels: roughly USD 180–450 per night for strong business hotels close to key venues.

Tickets.

Attendee passes: around USD 400–2,000+ depending on tier and event

Sponsorships / booths: from USD 10k into the six-figure range at the very top shows

Given DWTC’s events alone drive multi-billion-dollar economic impact and tens of thousands of tech and Web3 delegates annually, the ecosystem density is clearly there.

Define ROI before you fly

Traders target incremental basis points of performance, new liquidity relationships or improved execution routes.

Founders decide how many investor meetings, pilots or signed LOIs would make the trip a win.

Service providers set lead and pipeline targets (e.g., 50–100 qualified conversations, 10–15 serious proposals, 3–5 closed-won deals within 6–9 months).

Using a proper data and BI setup back home for example, with an analytics environment supported by Mak It Solutions makes it much easier to prove ROI from conference campaigns to CFOs and LPs. (

Shortlist, Book and Prep Your Dubai/MENA Crypto Trip

Here’s a simple three-step plan.

Build your shortlist

Pick 1–2 anchor events (e.g., TOKEN2049 + Blockchain Life Week) that match your persona, then add 1–2 secondary shows in Abu Dhabi, Riyadh or Bahrain if they align with your roadmap.

Plan the route and meetings

Lock in flights into Dubai, add a side-trip to Abu Dhabi or Riyadh, and pre-book 15–30 meetings with funds, clients and partners using conference apps and your existing network.

Instrument the ROI

Set up tracking for leads, meetings and deals; align with your internal data or CRM team (or a partner such as Mak It Solutions) so the revenue from these trips actually shows up in dashboards your leadership trusts.

Key Takeaways

Dubai and Abu Dhabi are the primary MENA crypto conference hubs, with dense 2025 calendars anchored by TOKEN2049, Blockchain Life, Future Blockchain Summit, Binance Blockchain Week, Bitcoin MENA and Global Blockchain Show.

Regulatory clarity from VARA, ADGM and CBB, plus MiCA-style rules in the EU and robust FCA/BaFin oversight, makes it possible to run serious institutional and Web3 business out of the Gulf while serving US, UK and EU users.

US, UK and EU visitors typically benefit from visa-on-arrival or e-visa schemes to UAE, Saudi Arabia, Bahrain and Qatar, with a unified GCC visa on the horizon but requirements must always be checked live.

Conference costs are often tax-deductible business expenses if properly documented under IRS, HMRC or German rules, though mixed personal trips need careful apportionment.

Stacking events across Dubai, Abu Dhabi, Riyadh and Bahrain lets you compress months of BD into a single regional swing, especially if you combine conferences with company-setup or product-sprint meetings.

A structured data and analytics approach to conference ROI supported by partners like Mak It Solutions can turn Gulf crypto trips from “nice to have” into a repeatable, budget-justified growth engine.

If you’re planning a Dubai or wider MENA crypto trip in 2025, this is the moment to get your conference calendar, meeting list and ROI tracking in order. Share your shortlist with Mak It Solutions, and we can help you map the right events to your product roadmap, then design the data, cloud and mobile stack you’ll need to turn conference leads into measurable growth.

Ready to lock in your 2025 plan? Book a strategy session via Mak It Solutions and we’ll help you choose the right shows, design a measurable funnel and make your Gulf crypto trip count.(Click Here’s )

FAQs

Q : Are Dubai crypto conferences worth it if I’m new to trading or Web3?

A : Yes, as long as you treat them as learning and networking rather than a get-rich-quick scheme. New traders from the US, UK or Germany can attend educational tracks, workshop sessions and beginner-friendly side events at shows like Crypto Expo Dubai, Blockchain Life and Future Blockchain Summit. Many venues also host compliance, MiCA/FCA and BaFin-style regulatory panels, which are invaluable if you plan to scale in Europe.

Q : How far in advance should I buy tickets and book hotels for Dubai crypto events?

A : For flagship weeks like GITEX + Future Blockchain Summit or Blockchain Life Week, book flights and hotels at least 2–3 months in advance, especially if you want to stay near Dubai Harbour, DWTC or Festival City. Tickets for major events often go through price tiers, so buying early not only saves money but also gives you time to set up meetings and side-event invites.

Q : Can US, UK and EU businesses treat Dubai and Abu Dhabi crypto conferences as tax-deductible expenses?

A : In many cases, yes if the trip primarily serves your trade or business. The IRS, HMRC and German tax rules all allow deduction of business travel and convention expenses under specific conditions, including that the event is relevant to your business and you document your schedule and costs. Always check with your own tax advisor, especially for trips that mix business with holiday time.

Q : Do major Dubai and Middle East crypto conferences offer virtual or hybrid ticket options?

A : Some do. Events like Future Blockchain Summit, GITEX and certain Binance or HODL series have historically offered streaming, on-demand content or virtual tickets, particularly for keynotes and main-stage sessions. However, the real value for most investors, founders and service providers still comes from in-person hallway chats, dinners and closed-door meetings.

Q : How many days should I plan for if I want to attend multiple Gulf crypto conferences in one trip?

A : For a Dubai-only trip, 4–5 days is usually enough to cover a 2-day conference plus side events and meetings. If you plan to stack Dubai + Abu Dhabi (Bitcoin MENA, Global Blockchain Show) or add Riyadh or Bahrain, aim for 7–10 days so you’re not rushed and can handle travel days, jet lag and unplanned opportunities.