Crypto Bulls See $1.7B Liquidations as Bitcoin Swiftly Nears $80K

Bitcoin approached the $80,000 mark on Friday as a sudden risk-off sentiment swept through the crypto market. The sharp sell-off pushed BTC below $85,000, triggering a cascade of forced liquidations across major tokens. Investors faced heightened uncertainty as market participants rushed to reduce exposure, amplifying intraday volatility across key cryptocurrencies. Ethereum (ETH) and Solana (SOL) were particularly affected, seeing significant price swings in a short period.

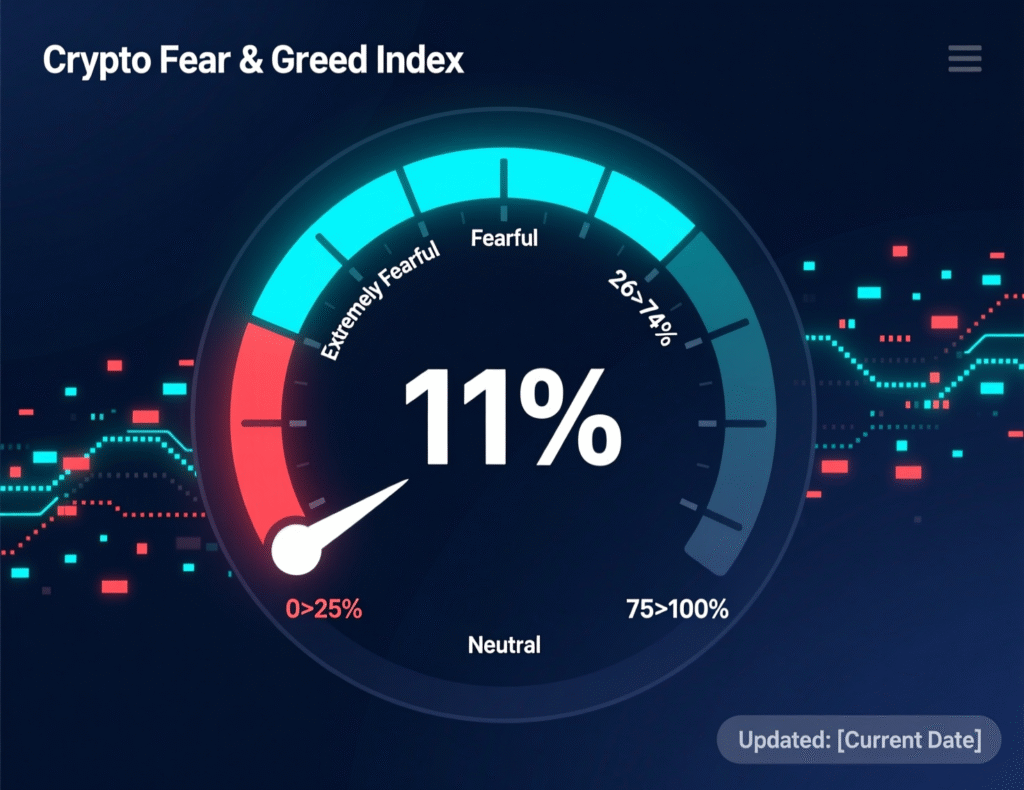

Market sentiment deteriorated sharply, with fear levels spiking to “extreme fear” according to sentiment indicators. Traders and analysts noted that the swift decline reflected broader risk-off trends, as capital exited riskier assets amid mounting macroeconomic concerns. The intense market turbulence highlights the fragile nature of crypto valuations during periods of heightened uncertainty.

BTC, ETH lead declines as pressure intensifies

Bitcoin slipped under $85,000 for the first time since April and briefly traded in the low $80Ks during a swift intraday downdraft. Ether fell toward $2,750, with altcoins like Solana, XRP and BNB posting steep single-day losses as liquidity thinned. The pullback puts November on track for the worst monthly drawdown since the 2022 crypto winter, erasing much of BTC’s year-to-date gains.CoinDesk+2Reuters+2

Liquidations mount: Bitcoin nears $80K amid liquidations

Leveraged positioning unwound rapidly. Across venues, close to $2 billion in crypto positions were liquidated over 24 hours, with BTC and ETH longs shouldering the majority of the losses. Such cascades can accelerate downside as stops and margin calls force additional selling into already thin order books.

Exchange microstructure and risk: Bitcoin nears $80K amid liquidations

High leverage and fragmented liquidity amplified slippage. CoinDesk reported a flash print to ~$80K on the Hyperliquid exchange, illustrating how liquidation flows can interact with order depth to produce outsized moves on certain venues before prices stabilize.

Sentiment collapses into “extreme fear”

The Crypto Fear & Greed Index fell to 11, signaling capitulation-like conditions among retail traders. Such readings often coincide with elevated realized volatility and widening intraday ranges, particularly when macro risk assets are also under pressure.

Macro backdrop turns risk-off

The sell-off in digital assets aligned with broader risk aversion across markets on Friday, as volatility picked up and high-beta assets weakened. Crypto’s sensitivity to liquidity conditions and dollar strength left leveraged longs vulnerable as funding and basis compressed.

Context & Analysis

The combination of elevated leverage, thinning weekend liquidity risk, and a rapid sentiment reset increases the probability of overshoots in both directions. Historically, “extreme fear” readings have sometimes preceded short-term bounces, but durability depends on macro liquidity and whether forced selling subsides.

Conclusion

Bitcoin is trading in the low-to-mid $80,000 range as liquidations ease only gradually. Near-term market direction now depends on how quickly leverage positions reset and whether investors regain confidence. Traders remain cautious, closely monitoring price action for signs of stability.

Market participants are also watching whether order books refill and if sentiment begins to recover from “extreme fear.” The pace at which risk appetite returns will likely determine short-term momentum, with renewed buying interest needed to support prices. Until then, volatility could remain elevated as the crypto market digests recent shocks.

FAQs

Q : What pushed Bitcoin lower today?

A : A cascade of long liquidations amid risk-off conditions and thin liquidity accelerated the drop.

Q : Did Bitcoin hit $80K on any venue?

A : Yes. CoinDesk reported a flash move to ~$80K on Hyperliquid before prices stabilized.

Q : How much was liquidated?

A : Nearly $2B across crypto in 24 hours, led by BTC and ETH long positions.

Q : What is the sentiment gauge showing?

A : The Crypto Fear & Greed Index printed 11, indicating extreme fear.

Q : Is this the worst month since 2022?

A : Market commentators note November’s drawdown rivals 2022’s declines as BTC fell under $85K; final monthly ranking depends on month-end levels.

Q : Where could I monitor live liquidation risk?

A : Use dashboards that track 24h liquidations, open interest, and funding across major exchanges.

Q : Does “Bitcoin nears $80K amid liquidations” mean more downside is certain?

A : Not necessarily; extreme fear sometimes precedes rebounds, but outcomes depend on leverage reset and macro risk conditions.

Facts

Event

Steep crypto sell-off with cascading liquidationsDate/Time

2025-11-21T18:10:00+05:00Entities

Bitcoin (BTC), Ethereum (ETH), Solana (SOL); CoinDesk; Hyperliquid; Alternative.me (Fear & Greed Index)Figures

BTC sub-$85K; intraday low near $80–82K on specific venues; ~$2B total liquidations (24h); Fear & Greed Index = 11 (Extreme Fear)Quotes

“Bitcoin slid below $85,000 … shaping up to be the worst monthly drawdown since the 2022 crypto winter.” CoinDesk report. CoinDeskSources

CoinDesk (market wrap) CoinDesk; CoinDesk (Hyperliquid flash move) CoinDesk; Yahoo Finance (liquidations) Yahoo Finance; Binance/Alternative.me (Fear & Greed) Binance