Crypto Adoption in Saudi Arabia: Regulation, Risk & ROI

In 2025, crypto adoption in Saudi Arabia sits in the mid-teens as a share of the population, with especially strong uptake among under-35s and digitally savvy professionals, even as regulation remains cautious and bank-led. Crypto is not fully banned, but banks and fintechs face strict SAMA and CMA oversight, so the safest entry route for US, UK and EU firms is via compliant infrastructure, sandboxes and local partnerships rather than aggressive retail-only offerings.

Introduction

Crypto adoption in Saudi Arabia is no longer a side story; it’s becoming one of the key digital asset narratives in the Gulf Cooperation Council (GCC). Compared with the UAE’s headline-grabbing licensing regimes, crypto adoption in Saudi Arabia is more tightly controlled, but the underlying demand curve is steep and rising.

By 2024, global crypto ownership was estimated at around 562 million people, with Saudi Arabia near the top tier at roughly 15% of the population holding crypto.When you overlay this with Vision 2030, Riyadh’s fintech hub ambitions, and a young, smartphone-first population, the picture for 2025 is clear: crypto is legal to hold and use in tightly constrained channels, adoption is growing fastest among under-35s, and the market is opening for structured Web3, tokenisation and institutional digital asset plays.

For US, UK, German and wider EU investors, this matters now. Saudi Arabia is the largest economy in the GCC, a leading MENA fintech market, and per Chainalysis the fastest-growing crypto economy in MENA by on-chain activity.The question is no longer if to engage with the Saudi digital asset ecosystem, but how to do it compliantly.

Crypto Adoption in Saudi Arabia in 2025

How widely is crypto used in Saudi Arabia in 2025?

In 2025, crypto adoption in Saudi Arabia sits around the mid-teens as a share of the population, putting it in the mid- to high single digit range compared with global averages but among the top countries worldwide.Triple-A’s 2024 report estimates Saudi crypto ownership at roughly 15% of the population, significantly above the ~7–10% global baseline.

Chainalysis data shows Saudi Arabia as MENA’s fastest-growing crypto economy, with on-chain activity up around 150% year-on-year between 2023 and 2024.This aligns with regional analysis that highlights Saudi and the UAE as core drivers of an estimated $330–$340 billion regional crypto transaction volume over a 12-month period.

Usage skews toward

Retail users and traders: high activity in spot trading, short-term speculation and stablecoin flows.

Long-term holders (“HODLers”): smaller but growing, particularly among professionals in Riyadh and Jeddah who treat Bitcoin and large-cap assets as diversification plays.

Early DeFi users: still niche versus centralized exchanges, but rising as stablecoins and on-chain yield become more accessible via global apps.

Who is driving crypto adoption youth, expats, or institutions?

Saudi crypto adoption is led by youth and Gen Z, amplified by expat flows and early institutional experiments, rather than by traditional banks. For investors searching “Saudi Arabia crypto ownership rate youth” or “Saudi Arabia crypto user statistics 2024–2025,” three groups matter:

Youth & Gen Z Saudis

More than a third of global crypto owners are aged 24–35, and Saudi follows the same pattern.

Smartphone-first habits, always-on social media, and exposure to US/UK and Dubai-based influencers are normalising crypto as just another fintech app.

Vision 2030’s push for a cashless, digital-first economy with a national target of 70% non-cash transactions, already hit ahead of schedule means younger Saudis are comfortable with wallets, QR codes and instant payments.

Expat Communities

Millions of expats in Riyadh, Jeddah and Dammam use digital rails for remittances and cross-border value storage, often via global exchanges rather than local banks.

Stablecoins and BTC/USDT pairs are popular as informal hedges against FX risk and as fast settlement tools.

Institutions & Corporates (early stage)

Local banks and financial institutions are not yet running open retail crypto desks, but they do participate in CBDC experiments and tokenisation pilots, e.g., via Project mBridge under the BIS.

Saudi fintechs especially in payments, BNPL and cross-border services—are testing blockchain rails within SAMA and CMA sandboxes.

How are Saudis using crypto and DeFi today?

Most Saudis who hold crypto today use it for trading, short-term speculation and cross-border value transfer, with a smaller but growing minority using DeFi and stablecoins for yield and saving.

Key usage patterns across the Saudi Arabia digital asset ecosystem:

Trading & Speculation

Bitcoin remains the most traded asset; recent surveys show BTC as the top coin among Saudi users.

Activity largely happens on offshore exchanges and regional platforms with Arabic UX and SAR rails, plus P2P/OTC channels where banking rails are constrained.

Remittances & Saving

Expats and some Saudi nationals use BTC and stablecoins as an alternative remittance rail, especially to countries with weaker banking infrastructure.

Dollar-linked stablecoins (USDT/USDC-type assets) are used as quasi-USD savings and for managing FX exposure on global platforms.

DeFi Adoption & Stablecoins

DeFi usage is still modest compared with centralized exchanges but growing, particularly for

On-chain lending and borrowing with majors like USDT/USDC.

Yield strategies via liquidity pools and staking, often accessed via global protocols with Arabic-language content.

Overall, the Saudi Arabia DeFi adoption and usage curve lags UAE by regulation but is catching up via more sophisticated retail users, global exchanges and institution-friendly products.

Why Saudi Crypto Adoption Is Surging Despite Cautious Regulation

Vision 2030 and the digital finance transformation

Saudi crypto adoption is growing because of Vision 2030’s digital finance priorities, not in spite of regulation. The Financial Sector Development Program (FSDP) aims to build a cashless, innovation-friendly financial system, explicitly promoting fintech, digital payments and capital market depth.

Key Vision 2030 financial sector transformation levers

Cashless economy targets

Digital payments have already hit ~70% of consumer transactions, ahead of 2025 goals.

Fintech growth

Saudi fintech market size hit roughly $40 billion in 2024 and is forecast to grow at ~13–14% CAGR into the 2030s.

Regulatory sandboxes & FinTech Strategy

SAMA’s Regulatory Sandbox and the CMA FinTech Lab allow controlled testing of new digital asset and Web3 use cases.

For global players, the takeaway is simple: Vision 2030 created the rails (APIs, instant payments, cloud-ready infrastructure); crypto and digital assets are emerging as high-beta experiments on those rails.

Sharia-compliant crypto and digital assets

For Saudi investors especially family offices, sovereign capital and conservative high-net-worth investors Sharia compliance is not a “nice to have”; it is the core product requirement.

Key Sharia concerns in crypto

Gharar and speculation

Excessive uncertainty and pure gambling-style trading are problematic.

Riba (interest)

Fixed, guaranteed interest on loans/deposits clashes with Islamic finance rules.

Asset-backing and real-economy linkage

Preference for tokens backed by real assets, rights, or profit-sharing structures.

How Sharia-compliant crypto and digital assets are being structured:

Asset-backed tokens

Real estate, commodities or sukuk-style cash flows tokenised on permissioned or public chains.

Profit-sharing and pool-based yields

Products that avoid guaranteed interest and instead share profits from underlying ventures.

Screened token lists

Several Islamic finance groups maintain “halal coin” lists (e.g., BTC, ETH in certain structures), giving comfort to practicing investors.

For Western firms, the strategic angle is clear: if you want Saudi institutional money, build or align with Sharia-compliant structures especially for stablecoins, tokenised funds and real-asset tokenisation.

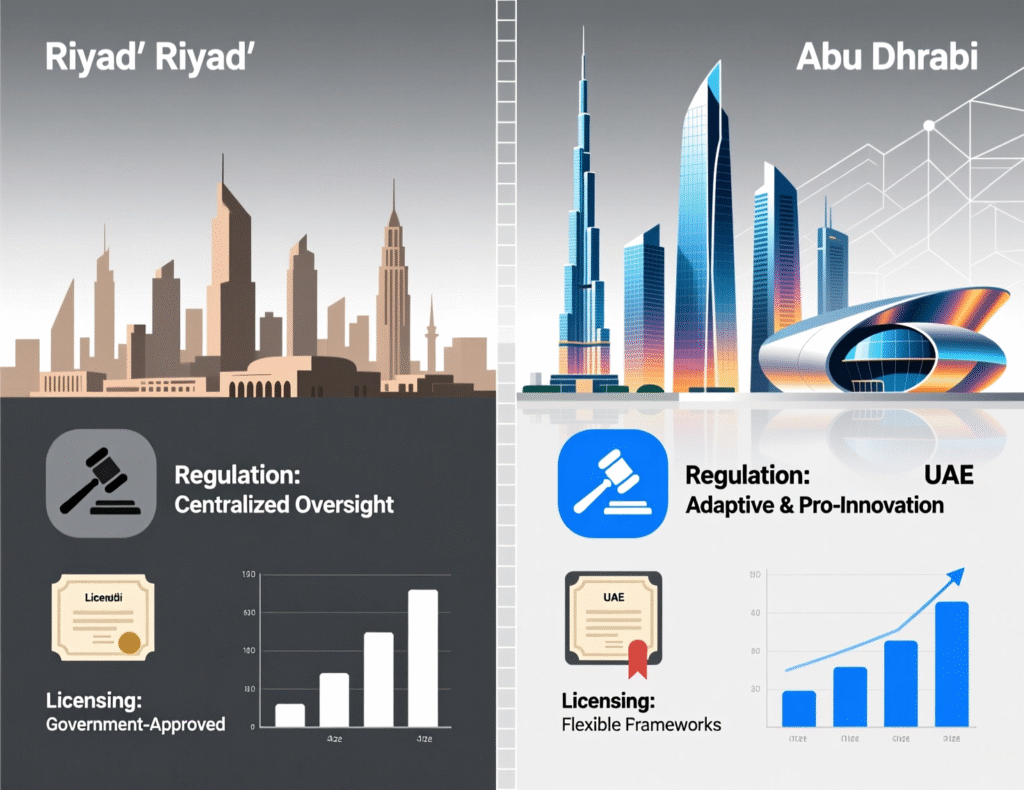

Saudi Arabia vs UAE and other GCC markets in 2025

Compared with Dubai and Abu Dhabi, Saudi Arabia is more cautious and slower on public licensing but has a far larger domestic demand base.

UAE (Dubai VARA, Abu Dhabi ADGM/FSRA)

Clear, granular virtual asset service provider (VASP) licensing regimes across trading, custody, brokerage and staking.

Strong marketing freedom (within rules), attracting hundreds of Web3 startups.

Saudi Arabia (SAMA + CMA)

Official warnings and statements that virtual currencies are not legal tender and are not yet fully regulated.

Banks generally prohibited from crypto transactions unless explicitly approved by SAMA, pushing activity into sandboxes and controlled pilots.

Micro-answer

Compared with the UAE, Saudi Arabia is tougher on retail access and marketing, and slower on issuing licences. But its Vision 2030 agenda, population scale and fintech spending make it a critical, fast-maturing demand centre for crypto, Web3 and digital asset infrastructure across the GCC.

Is Crypto Legal in Saudi Arabia? Rules, Licensing & 2025 Outlook

SAMA, the Capital Market Authority and virtual asset rules

As of 2025, crypto is not outright banned for individuals in Saudi Arabia, but it is not recognised as legal tender and is subject to strict limitations for banks and regulated firms. SAMA and the Capital Market Authority (CMA) have repeatedly warned that trading digital currencies like Bitcoin falls outside the formal regulatory perimeter and carries high risk.

Regulator landscape

SAMA (Saudi Central Bank)

Oversees banks, payments, remittances and the SAMA Regulatory Sandbox.

Prohibits banks from dealing in crypto unless specific approval is granted, effectively restricting on-shore fiat-to-crypto ramps.

CMA (Capital Market Authority)

Oversees securities, investment funds and capital markets.Operates a FinTech Lab and Experimental Permit regime for digital investment platforms, tokenisation pilots and Web3-adjacent capital markets experiments.

Micro-answer

In 2025, Saudi Arabia has no fully fledged, public VASP licensing regime like Dubai’s VARA. Individuals can typically hold and trade via offshore platforms at their own risk, but banks, EMIs and fintechs must operate under strict SAMA/CMA oversight, usually via sandboxes or tailored approvals rather than general crypto licences. This is a fast-evolving area firms must track updates closely and obtain local legal advice.

AML/KYC, FATF Travel Rule and cross-border risk

Saudi Arabia is a FATF-aligned jurisdiction and has been under scrutiny for how it supervises virtual assets and VASPs.

Key compliance expectations.

Full KYC/EDD

Exchanges, custodians and fintechs serving Saudi clients are expected to apply risk-based KYC, sanctions screening and ongoing monitoring.

FATF Travel Rule

International VASPs routing transactions to/from Saudi users need to support Travel Rule-compliant data exchange for qualifying transfers, aligning with FATF Recommendation 15.

Cross-border correspondent risk

US, UK, EU and GCC correspondent banks increasingly treat crypto-exposed flows as higher risk, requiring strong controls and enhanced transaction monitoring.

For GCC-wide and Western banks, Saudi crypto flow is now a board-level financial crime, sanctions and reputational risk topic, not just a niche IT question.

What US, UK and EU firms must know before serving Saudi clients

For US-, UK- and EU/Germany-based firms, Saudi crypto regulation and compliance requirements sit on top of your home-jurisdiction rules. Minimum viable compliance usually means:

US-based exchanges / broker-dealers

Register and operate under relevant federal/state regimes (FinCEN MSB, state money transmitter licences, SEC/CFTC where applicable).

Maintain OFAC-aligned sanctions screening, including GCC-specific risks.

Treat Saudi flows as higher-risk cross-border business and document this in your BSA/AML program.

UK-based fintechs / brokers / EMIs

Comply with FCA crypto-asset financial promotion rules and register for AML supervision if in scope.

Apply UK-GDPR for personal data, even when handling Saudi KYC information.

Ensure your marketing into Saudi does not breach Saudi restrictions on unlicensed financial promotions.

EU/Germany-based custodians and brokers

Align with MiCA for EU-wide crypto-asset and stablecoin rules as they phase in.

For Germany, comply with BaFin’s crypto custody / Verwahrstellen requirements, often the strictest in the EU.

Map GDPR/DSGVO to Saudi data localisation rules when hosting or processing KYC/transaction data. makitsol.com+1

Minimum viable compliance checklist before serving Saudi users:

Perform a Saudi-specific regulatory gap analysis (SAMA, CMA, AML, sanctions, data residency).

Decide whether to ring-fence Saudi clients under a specific entity or licence.

Ensure Travel Rule compliance and GCC sanctions screening.

Draft Saudi-specific risk disclosures and T&Cs.

Engage local legal/regulatory advisors and consider sandbox participation before scale-up.

Investment, Web3 and Blockchain Opportunities Linked to Saudi Crypto Growth

Where can US, UK and European investors play?

Micro-answer

For US, UK and EU investors in 2025, the most realistic Saudi crypto plays are infrastructure, compliance and institution-friendly Web3 services—not aggressive retail trading apps.

At a high level, viable entry points into the Saudi Arabia digital asset ecosystem include:

Retail-facing exchanges and brokerages (with local partners)

Build white-label or co-branded front-ends for Saudi users, but route custody and order-matching through regulated entities in Dubai (VARA) or Abu Dhabi (ADGM/FSRA).

Use Saudi partners for KYC, on-the-ground support and sandbox participation.

Institutional-grade custody, compliance and analytics

Chainalysis-style blockchain analytics, transaction monitoring and Travel Rule solutions tailored to Saudi banks, payment institutions and regulators.

Qualified custodians offering segregated, audited crypto custody for family offices in Riyadh, London and Frankfurt.

Infrastructure & tokenisation platforms

Web3 infrastructure on AWS, Azure and Google Cloud regions in Dammam, Bahrain, Dubai and Doha, balancing latency and data residency. makitsol.com+1

Tokenisation stacks for real estate, sukuk and private credit, aligned with Sharia-compliant structures.

Saudi blockchain startup ecosystem, sandboxes and Riyadh as a fintech hub

Saudi Arabia’s fintech and blockchain startup ecosystem has moved from early experimentation to scale-up mode:

Over 1,600 startups are active, with Riyadh ranked among the top startup hubs in MENA.

Vision 2030’s FinTech Strategy explicitly aims to make Riyadh a global fintech hub, with FSDP targets to triple the number of fintechs and sharply increase digital payments.

SAMA and CMA sandboxes allow 6–24 month pilots for digital asset, tokenisation and CBDC-adjacent projects before full regulatory decisions.

For VCs and corporates in New York, London or Berlin, this means that Riyadh, Jeddah and Dammam now host investable Web3-adjacent plays in payments, cross-border trade, identity, regtech and tokenised finance even if direct retail crypto exchanges remain constrained.

Saudi vs UAE for Web3 and digital asset headquarters

For many firms, the practical GEO strategy is:

Base the primary licence and HQ in Dubai (VARA) or Abu Dhabi (ADGM/FSRA) for clear VASP rules, open marketing and access to global talent.

Serve Saudi Arabia via cross-border structures, local partnerships, and sandbox pilots expanding to a local presence once rules stabilise.

Choose UAE HQ when you.

Need fast time-to-market, broader product scope (e.g., derivatives, staking), and global brand visibility.

Want to address multiple GCC markets (Saudi, Qatar, Bahrain, Oman, Kuwait) from one hub.

Choose or add Saudi presence when you.

Need deep access to Saudi public sector, banks or sovereign capital.

Are building solutions tightly coupled to Saudi payment systems, data localisation or Sharia-aligned real-asset tokenisation.

Market Access Models for Foreign Exchanges and Fintechs

Direct licensing, joint ventures or local partnerships?

Foreign players essentially have three market access models for Saudi crypto-adjacent business

Wholly foreign-owned entity (FFO)

Pros: maximum control over tech, risk and branding.

Cons: slower approvals; more scrutiny from SAMA/CMA; higher capital and substance expectations.

Joint venture with Saudi bank or fintech

Pros: instant credibility, regulatory comfort, easier access to payment rails and KYC infrastructure.

Cons: revenue sharing, more complex governance, potential constraints on product roadmap.

White-labelling via local partner

Pros: fastest way to test the market; local partner holds licences and user relationships.

Cons: limited brand visibility; dependence on partner’s compliance and infrastructure quality.

For a US-based exchange, a JV or white-label arrangement through a UAE-licensed entity plus Saudi partner is often optimal. For a UK-based EMI or broker, integrating into Saudi payments and cards ecosystems via local PSPs can be more realistic than direct crypto licences. For Germany-based crypto custody / Verwahrstellen, institutional partnerships with Saudi banks and sovereign entities are the natural path.

Technical and data architecture for Saudi-facing services

Architecturally, the Saudi market expects you to respect both local data expectations and EU/UK data protection rules for cross-border services:

Data residency

Host sensitive KYC and transactional data in compliant regions (e.g., Google Cloud Dammam, AWS Bahrain/UAE, regional sovereign clouds) when serving regulated entities. makitsol.com+1

GDPR/DSGVO + UK-GDPR alignment

For EU and UK firms, treat Saudi user data as international transfers; implement SCCs, DPIAs and data minimisation. makitsol.com+1

Cross-border analytics

Use pseudonymisation and role-based access for transaction monitoring and analytics in US/EU data lakes.

High-availability & sovereignty

Design for hybrid/multi-cloud: “global for analytics, local for regulated data,” a pattern already popular with GCC CIOs. makitsol.com+2makitsol.com+2

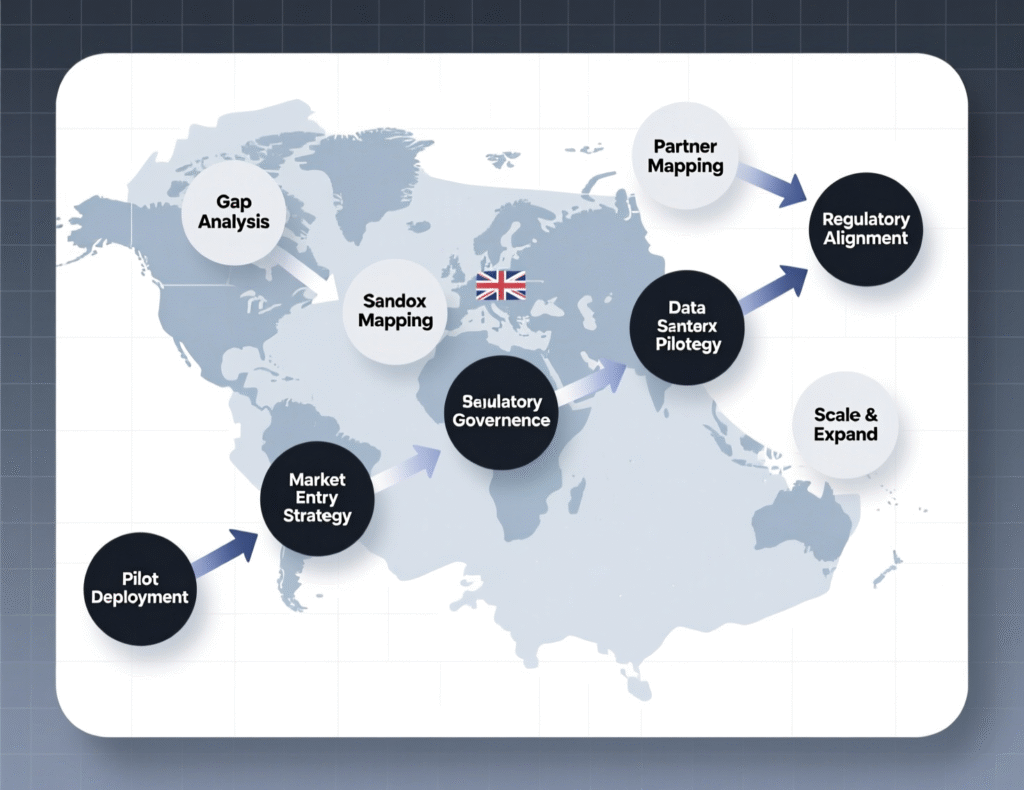

Step-by-step roadmap to entering the Saudi crypto market

Micro-answer

The safest entry path into Saudi crypto is to start with a compliance and regulatory review, work with a strong local partner, prove your model in a sandbox or limited pilot, then formalise licensing and scale once rules are clearer.

A practical 7–8 step roadmap

Market & product fit assessment

Define what you actually want to offer Saudi clients (infrastructure, custody, analytics, retail brokerage, etc.).

Regulatory gap analysis

Map your model against SAMA, CMA, AML, sanctions, data and advertising rules, plus US/UK/EU obligations.

Partner mapping

Shortlist Saudi banks, fintechs, system integrators and law firms who can anchor a JV or sandbox application.

Technical architecture design

Decide cloud regions, data residency, security, identity and Travel Rule architecture.

Sandbox or pilot application

Apply to SAMA’s Regulatory Sandbox or CMA’s FinTech Lab with a realistic, measurable pilot scope.

Internal approvals & governance

Secure board-level sign-off, update risk appetite statements, and align internal policies for Saudi exposure.

Limited go-live

Launch with a narrow set of Saudi clients (e.g., one bank, one corporate cohort, or a small retail segment).

Scale-up & licence optimisation

Use pilot data and regulator feedback to refine your licensing strategy, product mix and regional footprint (Saudi vs UAE vs wider GCC).

Risks, Red Flags and How to Stay Compliant in 2025

Regulatory gaps, grey areas and enforcement trends

Saudi Arabia still lacks a fully transparent VASP regime, which creates grey areas for foreign firms. Some key risks

Sudden circulars and clampdowns

Regulators can tighten or relax rules with limited public consultation, impacting banking access and marketing overnight.

Bank de-risking

Local and correspondent banks may block or heavily scrutinise transfers linked to crypto exchanges, even if technically permitted.

Regulation by sandbox

Many digital asset activities are effectively allowed only via sandbox approvals rather than permanent licences, which complicates scaling.

Continuous regulatory monitoring and local counsel are non-negotiable for any serious US/UK/EU firm.

Managing AML, sanctions and reputational risk for Western institutions

Boards and regulators in the US, UK and EU increasingly expect a structured Saudi crypto risk narrative:

Embed FATF and FSB guidance on virtual assets into your group risk appetite.

Map Saudi exposure at the client, product and transaction level, including indirect exposure via partners and correspondents.

Use enhanced transaction monitoring and on-chain analytics to flag higher-risk flows and counterparties.

Commission independent AML and sanctions audits for your digital asset business, with specific coverage of GCC flows, BaFin/FCA expectations and US OFAC risk.

Handled correctly, Saudi exposure can be positioned to regulators as measured, well-controlled participation in one of MENA’s fastest-growing digital finance markets, rather than a speculative gamble.

Building a compliant Saudi crypto strategy with expert partners

Most successful entrants follow a partnered approach.

Specialist law firms and Big Four-type consultancies (PwC-style) handle regulatory mapping, licensing and tax structuring.

Regional regulatory advisors help interpret SAMA and CMA expectations and navigate sandboxes and stakeholder engagement.

Technology partners (cloud, security, analytics) help design resilient, compliant infrastructure.

If you’re a US exchange, a London-based fintech or a German Verwahrstelle, building a Saudi crypto strategy with expert partners typically means running a joint discovery workshop, mapping risks and opportunities, then executing a phased implementation with measurable compliance milestones.

Should You Act on Saudi Crypto in 2025?

Quick checklist is Saudi a fit for your strategy?

Saudi Arabia won’t be right for everyone. A simple triage for.

US VCs and family offices

✅ Longer time horizon (5–10 years)

✅ Interest in infrastructure, regtech, and Sharia-compliant tokenisation

✅ Willingness to co-invest with local capital and adapt governance to Saudi norms

UK fintechs and neobanks

✅ Strong compliance culture around FCA, UK-GDPR and financial promotions

✅ Existing presence or appetite for GCC (Dubai, Abu Dhabi, Doha)

✅ Ability to segment and ring-fence Saudi users

German/EU custodians and institutional platforms

✅ BaFin/MiCA-ready frameworks already in place

✅ Appetite to support Sharia-compliant structures and multi-jurisdictional governance

✅ Capacity to invest in local partnerships and sovereign-grade security/infrastructure

How to move from research to an actionable Saudi crypto roadmap

If you’re reading a detailed guide like this, you’re probably beyond the “curious” stage. The immediate next steps usually look like.

Internal briefing

Align senior stakeholders on the Saudi opportunity, risks and timeline.

Workshop or discovery sprint

With an advisory partner like Mak It Solutions plus legal/tax counsel, frame your product, GEO and compliance options.

Partner scouting

Identify candidate banks, fintechs and infrastructure partners in Riyadh, Dubai and Abu Dhabi.

Pilot design

Pick one concrete use case (e.g., institutional custody, analytics for Saudi banks, or tokenised sukuk pilot) and design it for sandbox or limited launch.

From there, you can decide whether to double down on Saudi Arabia as a core Gulf Cooperation Council crypto market, or keep it as a tightly scoped, compliance-led experiment.

Key Takeaways

Saudi crypto adoption is real and growing, with ownership around the mid-teens as a share of the population and some of the fastest on-chain growth in MENA.

Regulation is cautious and bank-led, with SAMA and CMA using sandboxes and warnings rather than a broad VASP regime very different from Dubai’s VARA or Abu Dhabi’s ADGM.

Sharia-compliant crypto and digital assets are a major opportunity, particularly for tokenised sukuk, real estate and institutional products aligned with Islamic finance.

Best entry plays for US/UK/EU firms are infrastructure, custody, analytics and compliant Web3 services, not high-leverage retail speculation.

Market access should be phased, starting with regulatory and technical design, then local partnerships and sandbox pilots before seeking broader authorisations.

Robust AML, sanctions and data protection frameworks aligned with FATF, GDPR/DSGVO, UK-GDPR and US rules are essential to keep regulators and boards comfortable.

If you’re exploring how to access crypto adoption growth in Saudi Arabia from the US, UK or EU, this is the moment to turn research into a concrete roadmap. Mak It Solutions can help you design the architecture, compliance controls and product strategy you’ll need across Saudi Arabia, the UAE and wider GCC.

Share your current platform and target markets, and we’ll help you shape a practical, regulator-ready Saudi crypto entry plan from sandbox-grade MVPs to multi-cloud, institution-grade infrastructure. ( Click Here’s )

FAQs

Q : Is crypto trading allowed for foreigners living and working in Saudi Arabia?

A : Foreigners and Saudi nationals are broadly treated the same: cryptocurrencies are not legal tender and are formally outside the core regulatory framework, but individuals are generally not criminalised for holding or trading via offshore platforms at their own risk. Banks and payment institutions, however, face strict SAMA rules and may block transfers to unlicensed exchanges. In practice, many residents use regulated platforms in the UAE or global exchanges, often funding them via intermediaries or alternative settlement methods. Always check current rules and seek local legal advice before scaling activity.

Q : Which global crypto exchanges are most commonly used by Saudi residents in 2025?

A : Public data rarely names specific exchanges by market share, but survey and traffic patterns suggest that large global exchanges and a handful of regional platforms with Arabic interfaces and SAR pairs dominate Saudi retail trading. Many users also interact with UAE-licensed exchanges in Dubai or Abu Dhabi that target GCC users. However, these platforms typically operate without a dedicated Saudi licence, so users rely on cross-border access and must accept potential banking friction or policy shifts. Firms should avoid publicly promoting unlicensed platforms into Saudi without legal review.

Q : How does Saudi Arabia’s approach to stablecoins compare to the EU’s MiCA and the UK’s rules?

A : Saudi Arabia has not yet introduced a MiCA-style stablecoin regime, nor the detailed categorisation you see in the EU or UK. MiCA sets out specific requirements for e-money tokens and asset-referenced tokens, while the UK is building a regime for fiat-backed stablecoins in payments. In Saudi Arabia, stablecoins are usually treated as part of the broader “virtual asset” risk bucket—discouraged for banks and payment firms outside sandboxes, but tolerated for individuals on offshore platforms. For institutional use, the safer route is to structure Sharia-compliant, asset-backed tokens and work via sandboxes or UAE hubs until clearer local rules emerge.

Q : What tax and reporting issues should US and European investors consider when backing Saudi crypto or Web3 projects?

A : From a Saudi perspective, there is no dedicated “crypto tax” yet, but projects may fall under existing zakat, VAT and corporate tax rules depending on structure. For US and European investors, the main issues are home-country obligations: US investors must treat gains and token allocations under IRS rules, while UK and EU investors face capital gains/corporation tax and potential CFC or PFIC complications for certain vehicles. In addition, cross-border investments into Saudi Web3 ventures may trigger reporting under CRS, FATCA and local economic substance rules, especially when routed via UAE or other hubs. A coordinated tax, legal and structuring plan is essential before writing significant cheques.

Q : How can German and EU-regulated custodians serve Saudi clients without breaching GDPR/DSGVO data protection rules?

A : German and EU-regulated custodians can serve Saudi clients if they treat Saudi personal and transactional data as international transfers under GDPR/DSGVO. That typically means

Using approved transfer mechanisms (SCCs or equivalent) for data leaving the EEA.

Implementing strong pseudonymisation, encryption and access controls, especially for monitoring and analytics.

Being transparent with clients about where data is stored and processed (e.g., EU plus GCC cloud regions).

In many cases, the best pattern is to host primary KYC and core transaction data in EU or GCC data centres, with only derived, minimised data exposed to global teams, aligning both EU rules and Saudi expectations on data sovereignty.