Crypto Adoption in North Africa: Data-First Guide

Crypto adoption in North Africa is unusually high for a region where cryptocurrencies are formally restricted or banned, with Morocco, Egypt and Algeria all appearing in recent global grassroots adoption indices. For US, UK and EU investors and compliance teams, this makes North Africa a small but strategically important corridor where inflation, FX controls and remittances drive real demand but where sanctions, AML/CFT and regulatory risk are elevated.

Introduction

Crypto adoption in North Africa looks like a paradox: Morocco, Egypt and Algeria feature in global grassroots crypto rankings even though all three have formally restricted or banned unregulated digital asset activity. On-chain data shows that MENA has become one of the world’s more dynamic crypto regions by transaction volume, with North Africa acting as a “banned but active” corridor where usage has shifted into P2P and OTC channels rather than disappearing.

This guide is written for teams in New York, London, Berlin, Frankfurt and across the wider EU who need to understand how people in Morocco, Egypt and Algeria actually use crypto, what the data says about adoption, and where the legal and compliance tripwires lie. We’ll walk through regional and global rankings, macro drivers like inflation and remittances, concrete country profiles, and the implications for OFAC, FinCEN, FCA, BaFin and MiCA-focused programmes leaning on Chainalysis, TRM Labs and other live datasets throughout.

Regional Snapshot Where North Africa Sits in Global and MENA Crypto Adoption

North Africa Within the MENA Crypto Market

North Africa is a smaller slice of the MENA crypto market by raw volume, but it is growing quickly and punching above its economic weight. Chainalysis estimates that MENA received roughly $338.7 billion in on-chain value between July 2023 and June 2024 around 7.5% of global crypto transaction volume placing the region seventh worldwide by size.

Within that, Gulf hubs such as the UAE and Saudi Arabia dominate institutional flows and DeFi activity, helped by clearer regulatory regimes like Dubai’s VARA framework. Morocco, Egypt and Algeria, by contrast, are characterised by higher retail intensity, greater reliance on centralized exchanges and P2P platforms, and more restrictive domestic rules. For a desk in London or New York, the implication is simple: don’t expect Dubai or Riyadh levels of sophistication or licensing in North Africa but do expect meaningful grassroots flows.

What Global Crypto Adoption Indices Reveal About Morocco, Egypt and Algeria

Global crypto adoption indices consistently show that North Africa is over-represented relative to GDP. In the 2024 Chainalysis Global Crypto Adoption Index, Morocco sits in the top 30 globally and is highlighted as a regional leader, while Egypt ranks in the mid-40s for grassroots adoption. Third-party analyses based on the same dataset show Algeria and Egypt clustered around the 40–45 range, underlining that both countries feature in the global middle tier despite tight legal stances.

Morocco’s position has strengthened further: local and regional coverage citing the 2025 Global Crypto Adoption Index puts the country in roughly the mid-20s globally, ahead of Egypt and other African peers, with around 4–5% of the population estimated to have held crypto at some point. Triple-A’s ownership estimates, meanwhile, suggest that global digital currency penetration averages about 6.8–6.9%, or roughly 560 million people, giving a useful benchmark for comparing North African penetration rates.

For a risk or strategy team in Frankfurt, the headline is that Morocco and Egypt behave more like mid-tier emerging-market adopters than fringe outliers, with Algeria also present in the data despite its blanket ban.

Data Signals US, UK and EU Teams Should Watch

The most useful signals for Western investors and compliance teams are composition and channel metrics rather than just headline volume:

Retail share vs institutional share

Chainalysis finds that MENA overall is heavily skewed toward larger-ticket transactions, with more than 90% of value in transactions above $10,000; however, North African flows show a higher grassroots component linked to remittances and savings.

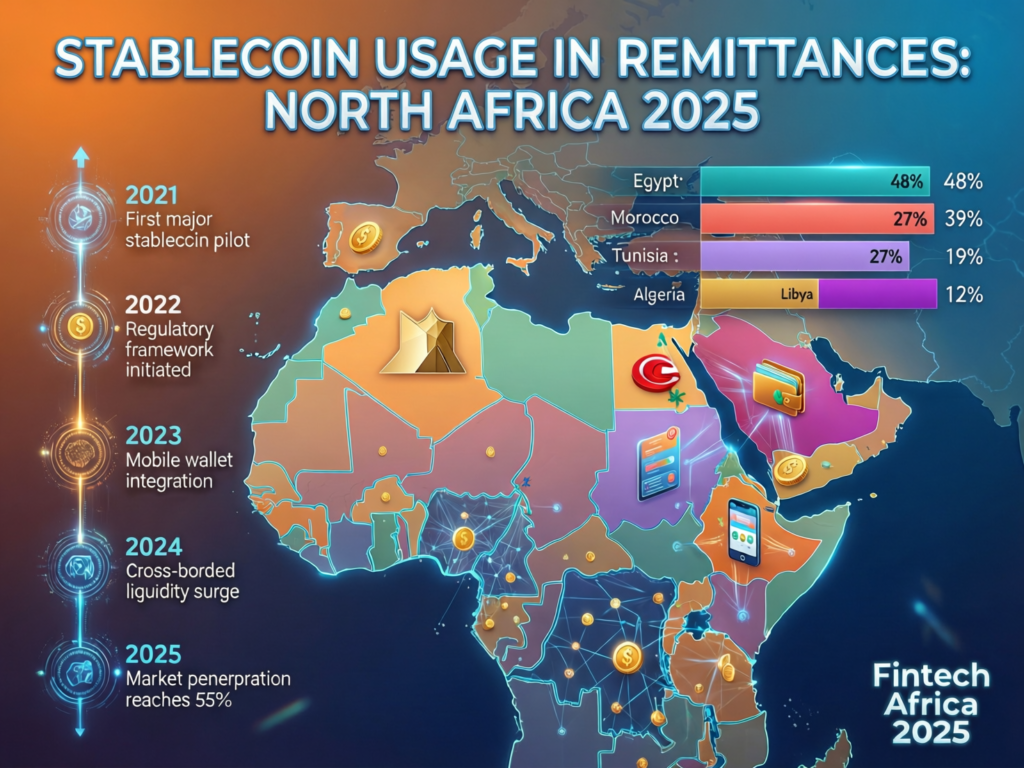

Stablecoin share

TRM Labs reports that stablecoins account for about 30% of global crypto transaction volume in 2025, with particularly strong usage in inflation-hit emerging markets.

P2P and OTC intensity

North Africa’s bans and banking restrictions drive users off formal ramps and into Telegram groups, OTC desks and P2P marketplaces, which can be under-represented in centralized exchange-centric datasets.

Cross-border corridors

MENA transaction volumes reached a record monthly peak of roughly $87.7 billion in December 2024, with strong remittance and trade corridors linking North Africa to Europe and the Gulf.

For a payments or exchange team in New York or London, these indicators feed directly into decisions on which corridors to prioritise, how to treat Moroccan, Egyptian or Algerian IPs in onboarding rules, where to establish banking relationships in Europe or the Gulf, and how to calibrate Chainalysis- or TRM-powered risk scoring models.

What’s Driving Crypto Adoption in North Africa?

Inflation, FX Controls and Dollar Shortages

The core driver of crypto adoption in North Africa is macro: chronic inflation, FX controls and recurring dollar shortages push households and SMEs toward crypto—especially dollar-pegged stablecoins as a parallel rail for USD exposure and a hedge against local currency risk.

Egypt offers the starkest case. Repeated devaluations of the Egyptian pound and pressure on foreign reserves have made it difficult for Cairo- and Alexandria-based businesses to access hard currency through banks, prompting some to hold USDT or USDC balances or route trade and freelancer payments via stablecoins. In Morocco, the dirham is more stable but still constrained by FX rules, leading to similar behaviour in Casablanca and Rabat among traders, importers and higher-income retail users.

For US or EU desks used to thinking of crypto as a speculative asset, North Africa looks more like a shadow FX and deposits system informal, volatile and risky, but sometimes the only accessible dollar proxy.

Remittances, Financial Inclusion and the Unbanked

Remittances from Europe and North America into North Africa are both a lifeline and a structural driver of crypto usage. TechCrunch’s coverage of earlier Chainalysis data highlighted that MENA remittance corridors were a key factor in the region’s rapid growth, with users sending hundreds of billions in crypto between mid-2021 and mid-2022.

Diaspora workers in Paris, Brussels, London or New York can increasingly send funds via exchanges or stablecoin remittance platforms instead of traditional money transfer operators, especially when fees for small tickets into rural Morocco or provincial Egypt remain high. The World Bank has repeatedly warned that remittance costs into low- and middle-income countries still hover well above the UN’s 3% SDG target, nudging users into informal or digital channels.

Because large segments of the population remain unbanked or underbanked particularly in rural Algeria and interior regions of Morocco and Egypt crypto wallets and P2P cash-out agents can function as de-facto transaction accounts. For European and US institutions, that combination of financial inclusion upside and KYC/AML opacity is a classic “high-impact, high-risk” profile.

Youth, Digital Work and the Informal / Underground Economy

North Africa is young, mobile-first and deeply plugged into digital work. A sizeable cohort of people under 30 earn income via freelancing, gaming, affiliate marketing or online commerce, often getting paid in USDT, BTC or other tokens when PayPal or card rails are unavailable.

TechCrunch notes that crypto adoption across MENA has “skyrocketed” as young, digitally native users experiment with new financial tools, including in countries with hostile regulation.GIS Reports describes how, in Morocco and neighbouring states, a “rapidly growing crypto economy” has emerged underground, with clandestine transactions spreading despite a formal ban.

Informal trading networks, from street-level OTC brokers in Algiers to Telegram-based P2P groups in Dakhla or Alexandria, extend the reach of this underground economy. Traditional datasets under-count these flows, which is precisely why on-chain forensics and careful qualitative context are so important for teams in Berlin or Washington D.C. building risk models.

How People in Morocco, Egypt and Algeria Actually Use Crypto

Everyday Bitcoin and Stablecoin Use From Savings to Micro-Payments

In daily life, North African users lean heavily on stablecoins and use bitcoin more selectively. TRM Labs finds that stablecoins now represent about 30% of global crypto transaction volume, and that their role is especially pronounced in emerging markets facing inflation and currency volatility exactly the profile of Egypt and parts of Morocco.

On the ground, that translates into several patterns.

Savings and emergency buffers middle-income households park small amounts of salary in USDT/USDC to preserve dollar value between paydays.

Bill payment and micro-commerce informal intermediaries accept stablecoins from diaspora senders, pay electricity or tuition bills locally, and take a spread.

Local swaps into cash OTC brokers in cities like Casablanca or Algiers quote daily USDT–fiat rates, functioning like ad-hoc FX bureaus.

Selective BTC usage bitcoin is often held for longer-term speculation or used in higher-value transfers rather than everyday cash management.

For a London- or New York-based compliance officer, this means that “retail volume from North Africa” is often a mix of quasi-FX and quasi-remittance activity, rather than purely speculative trading.

Remittance Hubs, OTC Desks and P2P Marketplaces

Where banks restrict card purchases or wires to exchanges, local infrastructure steps in. Across Morocco, Egypt and Algeria, users rely on a patchwork of.

Telegram and WhatsApp groups coordinating P2P swaps.

OTC brokers who accept cash and settle to wallets.

Global P2P platforms that match diaspora senders with local cash-out agents.

Open-source references, including the widely cited Wikipedia survey of crypto legality, emphasise that in “banned” markets, P2P platforms and informal OTC desks tend to become the dominant access points as centralized exchanges and card rails are cut off. That’s exactly what many US or EU VASPs will see in their Chainalysis address clustering and travel-rule data: wallets linked to P2P platforms acting as bridges between European banks and cash economies in Rabat, Cairo or Algiers.

“Banned but Booming” Why Usage Persists Despite Restrictions

Formal bans in Morocco (2017), Egypt and now Algeria have not eliminated demand; they’ve displaced it. In Morocco, the central bank acknowledges that although cryptocurrencies are banned, underground usage has continued to grow, prompting work on a draft law to regulate crypto assets and a potential CBDC. Algeria has gone further, criminalising most crypto activity with fines and potential jail time under a 2025 law.

Yet research and policy reports still point to notable grassroots usage in both countries, with GIS Reports highlighting “clandestine” crypto activity in Morocco and Algeria despite prohibitions.

For Western counterparties, the paradox is clear: users still seek FX access, remittances and inflation hedges, but they increasingly do so through opaque P2P and OTC channels. That raises AML/CFT, sanctions and fraud risk not just for local users, but for banks in Paris, London or Frankfurt that ultimately clear fiat legs of these flows.

Country Deep Dives Morocco, Egypt, Algeria

Morocco From 2017 Ban to Draft Law and High Global Ranking

Morocco banned cryptocurrencies in 2017, but adoption never really stopped. Chainalysis data and multiple secondary analyses show the country consistently ranking among the top global adopters, often leading North Africa by a wide margin.

In 2024 and 2025, Bank Al-Maghrib shifted from outright prohibition toward regulated integration. The central bank has prepared a draft law on crypto assets, now working through the adoption process, and is actively exploring a CBDC in collaboration with the IMF and World Bank, including for cross-border payments with Europe.

For institutional desks in New York or London, Morocco’s message is “watch this space”: it combines high grassroots adoption, improving regulatory clarity and growing interest in cross-border CBDC rails, making it a likely candidate for more formalised, data-rich corridors with the EU over the next few years.

Egypt Inflation, Remittances and a Cautious Regulatory Stance

Egypt’s legal stance remains cautious, influenced partly by religious rulings and concerns about speculation, but the macro reality keeps retail adoption alive. Earlier Chainalysis reports put Egypt among the top 30 global adopters, and the 2024 index lists it around the mid-40s; both highlight the importance of remittances from the Gulf and Europe.

Cairo and Alexandria are focal points for activity: freelancers, importers and families receiving support from relatives working in London, Berlin or the Gulf often meet their dollar needs via BTC and stablecoins when official FX channels are strained. The Central Bank of Egypt has issued repeated warnings, but its collaboration with Bank Al-Maghrib and the World Bank on CBDC cross-border pilots shows a gradual move toward more structured digital payments.

For US and EU fintechs serving Egyptian diaspora customers, the key is to separate legitimate remittance-like flows from higher-risk patterns linked to capital flight or sanctions exposure.

Algeria Strict Prohibition and New Penalties vs Real Usage

Algeria is the region’s most openly hostile jurisdiction toward crypto. Recent legislation bans buying, selling, holding, mining and promoting digital assets, with penalties reportedly including fines of several thousand dollars and potential jail terms. The Wikipedia survey of global crypto legality also classifies Algeria as outright illegal.

Despite this, external datasets that draw on on-chain activity still show Algerian users present in global adoption rankings, albeit at modest levels. That disconnect between strict law and persistent grassroots usage makes Algeria a high-risk jurisdiction for sanctions, AML/CFT and reputational exposure, especially for European banks and UK institutions subject to EU AMLD and FCA oversight.

Regulation, Bans and Compliance Risk for US, UK and EU Firms

Legal Status Overview Is Crypto “Legal” in Morocco, Egypt and Algeria?

In simple terms, unregulated crypto activity is still not legal in North Africa’s big three markets. Morocco’s authorities treat crypto transactions as violating FX and financial regulations, even as a dedicated crypto assets law and CBDC plans move forward. Egypt maintains a restrictive stance, with central bank warnings and laws that can be used to sanction unauthorized virtual currency activity. Algeria enforces a near-total ban, backed by explicit criminal penalties.

From a Western compliance perspective, it’s helpful to think in a simple grid.

| Country | Formal Status (retail) | Practice on the Ground | Risk Notes |

|---|---|---|---|

| Morocco | Banned / unregulated illegal | High grassroots usage; draft law, CBDC work | Regulatory flux, P2P/OTC heavy |

| Egypt | Restricted / discouraged | Persistent usage via remittances, inflation | FX controls, religious sensitivities |

| Algeria | Fully banned | Smaller but notable underground usage | High sanctions/AML/CFT risk |

This gap between law and practice is exactly what risk teams in New York or Frankfurt need to model when assessing exposure.

Why North Africa Matters to US, UK and EU Investors and Compliance Teams

For Western investors and compliance teams, North Africa is a classic “small but strategic” corridor. It may not move global market prices, but it sits at the intersection of.

Material BTC and stablecoin flows connecting to EU and Gulf banking rails.

High-risk patterns linked to informal FX, sanctions evasion and capital controls.

Users who are often financially excluded from traditional channels.

This means that flows involving Moroccan, Egyptian or Algerian counterparties can trigger multiple regimes at once: US OFAC and FinCEN expectations for convertible virtual currency activity, UK FCA rules on crypto financial promotions and AML supervision, and EU frameworks like MiCA, AMLD and GDPR/DSGVO.

Frameworks to Watch OFAC, FinCEN, FCA, BaFin, MiCA, GDPR/DSGVO

Several regulatory pillars shape how US, UK and EU entities should treat North Africa-linked crypto flows.

OFAC (US)

OFAC’s virtual currency guidance makes it clear that sanctions obligations apply to digital assets just as they do to fiat, and expects screening, blocking and reporting of sanctioned exposures.

FinCEN (US)

FinCEN’s CVC guidance treats many crypto businesses as money services businesses (MSBs), requiring AML programmes, SARs and KYC controls that explicitly cover P2P and OTC models. (FinCEN.gov)

FCA (UK)

Since October 2023, the FCA’s financial promotions regime applies to qualifying cryptoassets sold to UK consumers, including by overseas firms, with enforcement already targeting non-compliant exchanges. (FCA)

MiCA & BaFin (EU/DE)

The EU’s Markets in Crypto-Assets Regulation creates a harmonised licensing regime for crypto-asset service providers, with ESMA and national regulators like BaFin supervising conduct and disclosure.

GDPR/DSGVO & UK-GDPR

Any on-chain analytics or travel-rule tooling that touches EU or UK residents must respect data-protection principles, which matters when combining Chainalysis risk scores with customer PII.

For teams building internal tooling say, a risk dashboard integrated into a bespoke web platform built with partners like Mak It Solutions these frameworks should drive both product requirements and technical architecture (logging, access controls, data minimisation, etc.).

Looking Ahead CBDCs, New Rules and Europe–North Africa Payment Flows

CBDC Pilots Between Morocco, Egypt and Europe

If Morocco and Egypt push ahead with CBDC pilots linked to European banks, expect a gradual shift from today’s opaque, P2P-dominated corridors to more formalised, data-rich payment channels. Reuters reports that Bank Al-Maghrib is exploring CBDC for peer-to-peer and cross-border payments with the help of the IMF and World Bank, and is collaborating with Egypt’s central bank on cross-border CBDC remittances.

That doesn’t automatically kill crypto remittances. More likely, it will.

Reduce the share of flows routed via informal OTC.

Increase expectations for travel-rule-style data even on CBDC rails.

Make high-quality blockchain analytics tools more important as regulators demand granular risk assessments.

How EU MiCA, UK Reforms and US Policy Could Redirect Flows

Policy changes in London, Brussels and Washington will also reshape North Africa-linked flows:

EU MiCA could encourage more EU-licensed VASPs to open regulated ramps for North African users, especially in cities like Paris, Berlin and Frankfurt with large diaspora communities, while forcing unlicensed players to exit.

UK reforms around financial promotions and cryptoasset regulation will likely tighten rules on marketing to users in Rabat or Cairo via UK-based apps or influencers.

US policy (FinCEN, OFAC, SEC/CFTC) continues to emphasise sanctions, AML/CFT and consumer protection, which will impact how US-regulated exchanges handle North African IP ranges, counterparties and fiat on-ramps.

For a German bank overseen by BaFin, this could mean more emphasis on integrating on-chain data into traditional KYC/transaction-monitoring systems exactly the sort of custom analytics and integration work firms like Mak It Solutions handle across cloud, mobile and data stacks for financial clients in the USA, UK and EU.

Strategic Scenarios for Investors, Fintechs and Banks

Over the next 3–5 years, it’s useful to think in three scenarios.

Status quo underground

Bans remain in place; P2P and OTC keep growing.

Crypto acts as a parallel FX/remittance rail; risk stays high but manageable with good analytics.

Western players focus on monitoring exposure rather than actively expanding in-region.

Partial legalisation and licensing

Morocco passes its crypto law; Egypt clarifies licensing; some regulated VASPs emerge.

CBDC pilots co-exist with regulated stablecoin and BTC flows.

Opportunities open for MiCA-licensed EU VASPs, UK fintechs and US exchanges to serve North African users within clearer guardrails.

CBDC-led hybrid world

Cross-border CBDC corridors between Rabat, Cairo and Europe go live.

Some remittance flows move to CBDC rails, but crypto remains for savings, DeFi and higher-risk use cases.

Investors and banks need integrated views across CBDC, stablecoins and traditional rails, with data-heavy compliance and analytics platforms.

For VCs in Paris, fintechs in London or banks in Berlin and New York, the main question is which scenario to plan for and how quickly to invest in the necessary data, risk and engineering capabilities around crypto adoption in North Africa.

Concluding Remarks

If you’re responsible for risk, strategy or market entry, a simple watch-list can help you track whether North Africa is moving closer to “status quo underground” or “CBDC-led hybrid”:

P2P and OTC share of flows rising P2P volumes into Morocco, Egypt or Algeria can signal tightening enforcement on formal ramps.

Stablecoin mix changes in the share of USDT/USDC vs BTC and local tokens reveal how users are hedging inflation and FX risk.

Regulatory announcements draft crypto laws, licensing regimes, CBDC pilots and enforcement actions in Rabat, Cairo and Algiers.

Sanctions and terrorism-financing updates new OFAC or EU listings that reference North Africa or related intermediaries.

European and UK policy shifts MiCA implementation, FCA enforcement against non-compliant promotions, and data-protection guidance affecting on-chain analytics.

How Chainalysis Data Helps US, UK and EU Teams Quantify North Africa Risk

Given the mix of bans, underground usage and evolving regulation, high-quality data is non-negotiable. Chainalysis’ Geography of Cryptocurrency Report, MENA-specific briefings and the Global Crypto Adoption Index provide a consistent, comparable view of Morocco, Egypt and Algeria across time broken down by retail vs institutional flows, service types and corridor patterns.

For teams in the USA, UK or EU, plugging these datasets into internal dashboards, risk engines or compliance workflows (often via custom analytics and integrations on top of cloud or SaaS platforms) makes it possible to:

Score North Africa-linked wallets and services with more nuance;

Prioritise investigations into higher-risk corridors;

Design market-entry strategies that respect local law while meeting OFAC, FinCEN, FCA, BaFin, MiCA and GDPR obligations.

Key Takeaways

North Africa is a banned but active crypto corridor where Morocco and Egypt rank surprisingly high in global grassroots adoption indices, with Algeria also present despite strict prohibitions.

Macro stress inflation, FX controls and dollar shortages plus remittance dependence and a young digital workforce drive demand for BTC and, especially, dollar-pegged stablecoins.

Usage is heavily skewed toward P2P and OTC channels, meaning Western banks and VASPs mostly see North African exposure indirectly via European and Gulf intermediaries.

Legal regimes in Morocco, Egypt and Algeria remain restrictive, but Morocco is moving toward a regulated framework and CBDC pilots in cooperation with the IMF, World Bank and Egypt’s central bank.

US, UK and EU compliance teams must map North Africa-linked flows to OFAC, FinCEN, FCA, MiCA, AMLD and GDPR frameworks, using on-chain analytics to close data gaps created by underground markets.

Strategic planning around crypto adoption in North Africa should consider three plausible futures: status-quo underground usage, partial legalisation with licensed VASPs, and a CBDC-led hybrid world where crypto remains important but more tightly supervised.

If your team in New York, London, Berlin or elsewhere in the EU is wrestling with how to treat North Africa in your crypto risk map, this is the moment to turn high-level concern into structured analysis. Start by benchmarking your exposure to Moroccan, Egyptian and Algerian flows, then align your controls with OFAC, FinCEN, FCA, BaFin and MiCA expectations.

Mak It Solutions can help you stitch Chainalysis or similar datasets into custom dashboards, compliance workflows and internal tools across web, mobile and cloud so your view of crypto adoption in North Africa is data-driven rather than anecdotal. When you’re ready, request a scoped assessment of your existing infrastructure and get a concrete roadmap for integrating North Africa–sensitive crypto analytics into your stack.( Click Here’s )

FAQs

Q : Which North African country leads in grassroots crypto adoption today?

A : Morocco currently leads North Africa in grassroots crypto adoption, appearing in the top global tiers of the Chainalysis Global Crypto Adoption Index and often ranking well ahead of regional peers. Egypt also ranks in the global middle tier, while Algeria appears further down the list but still registers notable usage despite its ban. Rankings can shift each year, so US, UK and EU teams should track the latest Chainalysis reports rather than relying on a static picture.

Q : How do remittance flows from Europe influence crypto usage in Morocco and Egypt?

A : Remittances from Europe especially from France, Spain, Germany and the UK—are a major driver of crypto usage in Morocco and Egypt. When bank transfers or money transfer operators are slow or expensive, diaspora workers increasingly route funds via BTC and stablecoins, cashing out through P2P platforms or OTC brokers back home. This dynamic is particularly relevant for EU-regulated institutions in Paris, Brussels, Berlin or London, which often sit on the fiat side of these corridors even if they never directly touch local North African exchanges.

Q : What risks do European banks face when their customers send funds to North African crypto platforms?

A : European banks face several intertwined risks: sanctions exposure if flows intersect with OFAC-listed entities; AML/CFT risk from P2P and OTC intermediaries with weak or no KYC; and regulatory scrutiny under MiCA and EU AMLD if they service unlicensed VASPs. There is also reputational risk if retail customers in Berlin, Frankfurt or Paris use EU accounts to fund activity that violates local law in Morocco, Egypt or Algeria. The solution is not an automatic blanket block, but a risk-based approach informed by wallet screening, corridor analysis and clear onboarding policies.

Q : How can UK or EU fintechs assess whether to onboard customers from Morocco, Egypt or Algeria?

A : UK and EU fintechs should start with a formal country-level risk assessment that combines external data (Chainalysis indices, TRM reports, local legal summaries) with their own business model and risk appetite. They then need to map these findings onto FCA, MiCA and AMLD requirements deciding, for example, whether to allow users with North African residency but EU bank accounts, and under what KYC, source-of-funds and transaction-monitoring conditions. Regular reviews are essential, given that Morocco in particular is moving toward a more formal regulatory framework.

Q : What kind of on-chain red flags should US compliance teams watch for in North Africa linked wallets?

A : US compliance teams should watch for patterns typical of high-risk corridors: repetitive small-ticket flows through P2P platforms that aggregate into larger transfers; exposure to mixers or high-risk exchanges; clustering with addresses linked to sanctions-designated entities; and frequent interactions with OTC brokers operating in banned or heavily restricted jurisdictions like Algeria. Combining Chainalysis or TRM risk scores with internal customer data within a FinCEN-compliant AML programme helps distinguish legitimate remittance-like behaviour from activity that may require SARs, blocks or full exits.