Crypto Adoption in GCC Countries: Investor & Entry Guide

In 2026, crypto adoption in GCC countries is still emerging but accelerating, led by hubs like the United Arab Emirates and Saudi Arabia where digital wallets, remittances and institutional pilots drive most real usage. For US, UK and European firms, the practical way in is to pick a hub such as Dubai, Abu Dhabi or Manama, obtain a local virtual-asset license, align data/AML controls with home-country rules, and partner with regulated banks or PSPs.

Introduction

Crypto adoption in GCC countries in 2026 sits at a sweet spot: big enough to matter, small enough that smart early movers can still shape the market. The wider Middle East & North Africa region is already the seventh-largest crypto market globally, with around $330–340 billion in on-chain value between July 2023 and June 2024, roughly 7–8% of global transaction volume.

Within that, the Gulf Cooperation Council Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates has the combination everyone in New York, London and Frankfurt dreams of: high per-capita income, young digitally savvy populations, large remittance corridors and governments actively pushing cashless payments and open banking. Saudi Arabia and Qatar are among the fastest-growing crypto economies in MENA, even if overall penetration still lags the US and Europe.

In this guide we’ll walk through.

What crypto adoption actually looks like on the ground in 2026

How regulation differs between UAE, Saudi Arabia, Bahrain, Qatar, Kuwait and Oman

How big the GCC crypto and virtual-asset market could be by 2030

Why global investors and exchanges are piling in

A concrete entry playbook for US, UK and European firms

The main risks and a 2026–2030 action checklist

The lens throughout: what a regulated firm or serious investor in the United States, United Kingdom, Germany or wider European Union actually needs to know before committing capital, applying for a license or building infrastructure for GCC crypto and tokenized-asset plays.

Nothing in this article is legal, tax or investment advice. Always obtain specialist professional advice before making decisions.

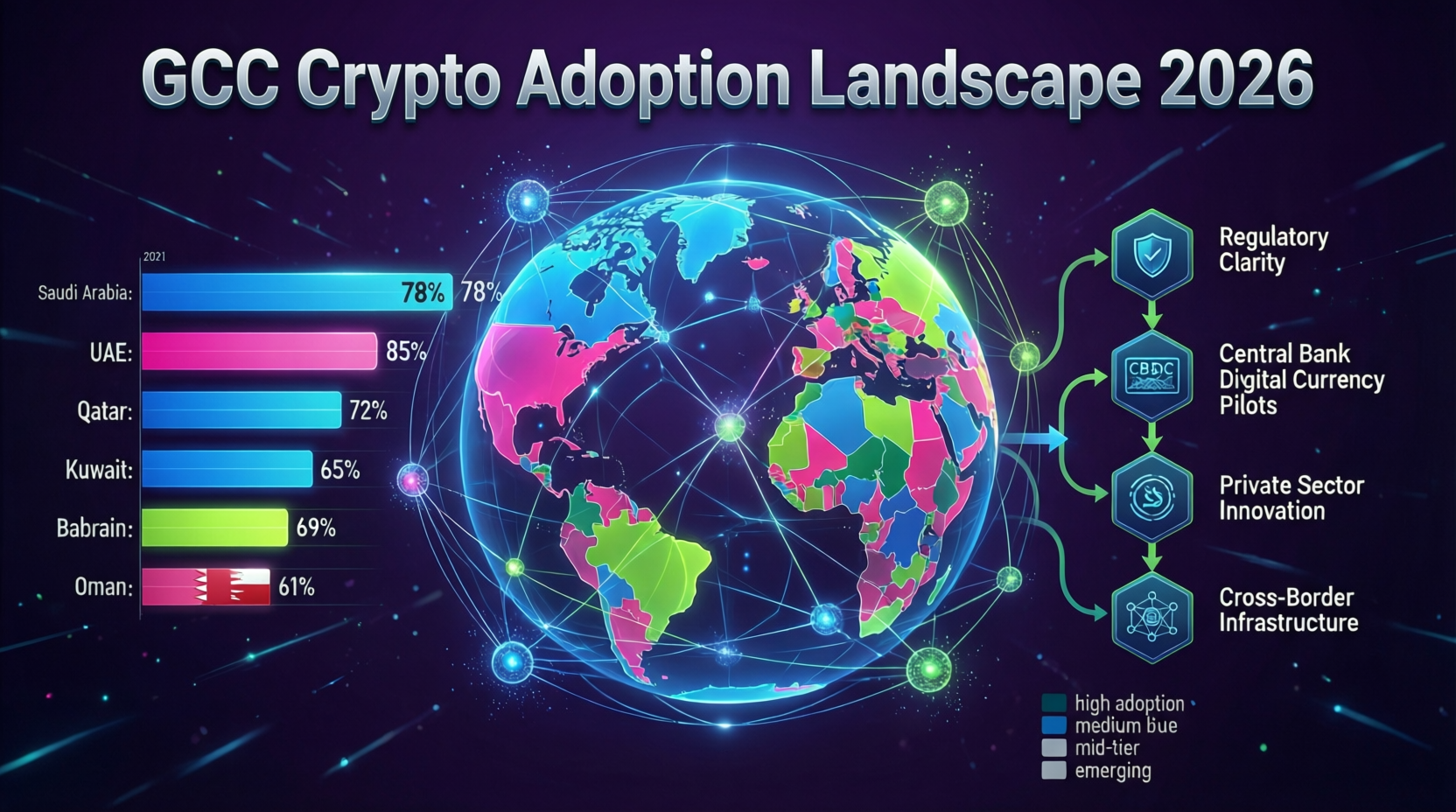

GCC Crypto Adoption Snapshot 2026

In 2026, crypto adoption in GCC countries is driven less by meme-coin speculation and more by digital wallets, remittances and institutional pilots anchored in the UAE and Bahrain. Adoption is still well below leading US/EU retail markets, but growth is steady and tied to broader digital-payments and open-banking reforms rather than a standalone crypto mania.

What “crypto adoption” looks like in the GCC in 2026

When you zoom in, “crypto adoption” in the GCC breaks into four layers.

Users retail and affluent users with exchange accounts, trading-app logins or on-chain wallets.

Transaction volume fiat on-ramps/off-ramps, spot trading, derivatives and stablecoin flows.

Merchant and real-world usage limited today, mostly niche online merchants, cross-border B2B and some pilot programmes.

Institutional flows family offices, asset managers, market-making desks and tokenization pilots.

Grassroots adoption in Riyadh, Jeddah, Doha or Kuwait City is still modest compared with Turkey or Nigeria, but institutional and HNWI activity is meaningful often routed through Dubai, Abu Dhabi or Manama accounts. Chainalysis data shows MENA as a mid-tier but resilient crypto region through 2024–2025, with Saudi Arabia one of the fastest-growing markets.

The real on-ramp is digital wallets and super-apps. Roughly 38 million people across the GCC used digital wallets in 2024, and wallet revenues are projected to grow at around 34% CAGR to about $900+ million by 2030, driven by contactless payments and “everyday” super-app usage.These same wallets and apps are where stablecoins, tokenized deposits and eventually retail-friendly crypto products are most likely to appear.

GCC crypto adoption statistics 2024–2026

A few directional signals rather than precise forecasts:

MENA digital payments overall were worth roughly $240–260 billion in 2025 and are projected to reach more than $450 billion by 2031, around 11% CAGR.

Digital wallets already account for about one-fifth of online spending in MENA, and mobile commerce could reach ~70% of online transaction value by 2025.

In the UAE alone, stablecoin volumes on exchanges hit about $9.8 billion in the first half of 2024, a 55% year-on-year increase.

Compared with the US or leading EU markets (where retail trading, DeFi and NFT usage are more mainstream), GCC activity skews towards stablecoins, cross-border flows and institutional trading. Retail penetration is lower but rising, particularly among younger, mobile-first users in Dubai, Abu Dhabi and Riyadh.

UAE and Saudi Arabia as adoption anchors

The centre of gravity is clear.

Dubai and Abu Dhabi

Under Virtual Assets Regulatory Authority (VARA) and the Abu Dhabi Global Market (ADGM) FSRA, the UAE has positioned itself as the region’s flagship virtual-asset hub, with clear licensing regimes for exchanges, brokers, custodians and tokenization platforms.

Saudi Arabia (Riyadh and Jeddah)

Saudi’s crypto stance is more cautious, but Vision 2030, rapid digital-payments growth and sandbox programmes under SAMA and the Capital Market Authority mean “institutional first, retail later” is very much in play.

Local banks, telcos and payment players are experimenting with:

Remittance corridors using stablecoins

Tokenized funds and securities for regional investors

Wallet-integrated trading features inside banking or telco apps

If you’re sitting in London or New York, think of Dubai/Abu Dhabi as the GCC’s answer to your home crypto hubs while Riyadh evolves into a heavyweight institutional market with strong retail rails but stricter rules on speculative trading.

Country-by-Country GCC Crypto Regulation Landscape

In 2026, GCC crypto regulation is fragmented by design: the UAE and Bahrain offer clear licensing regimes, Saudi Arabia is cautiously experimenting, Oman is moving from pilots to a framework, while Qatar and Kuwait maintain restrictive stances on trading and payments. For a Western firm, “GCC coverage” always means a multi-jurisdiction strategy, not one magic passport.

UAE: VARA, ADGM and free zones as virtual-asset hubs

Dubai and Abu Dhabi are where most Western boards feel comfortable starting.

VARA (Dubai) regulates virtual-asset activities across most of Dubai (outside DIFC) with 2023 regulations that define service categories (exchange, custody, brokerage, advisory, lending, etc.), marketing rules and penalties.

ADGM FSRA (Abu Dhabi) has had a virtual-asset framework since 2018 and continues to update guidance for example on staking providing a MiCA-style, activity-based framework for exchanges, custodians and brokers.

The Central Bank of the UAE coordinates on AML/CFT, KYC and payment-system oversight, especially where fiat on-ramps and stablecoins touch the banking system. (Mak it Solutions)

Licensing norms increasingly resemble European capital-markets and CASP frameworks. risk-based capital, segregation of client assets, robust governance and detailed technology/outsourcing reviews. For a MiCA-ready or FCA-regulated firm, the conceptual distance is smaller than you might expect.

Saudi Arabia, Bahrain, Oman: cautious but opening

Saudi Arabia

No explicit “crypto law” yet, but the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) run sandboxes and experimental permits for fintech and virtual-asset use cases. Banks generally cannot engage in crypto without specific approvals, and there are strong warnings against retail speculation.

Bahrain

The Central Bank of Bahrain (CBB) was an early mover with its Crypto-Asset Module, updated in 2023 to refine licensing for exchanges, brokers, custodians and advisory firms. Many regional and global platforms have historically picked Manama as a regulated base.

Oman

The Capital Market Authority / Financial Services Authority has consulted on a full Virtual Assets Regulatory Framework and issued instructions on registering Virtual Asset Service Providers (VASPs), with dedicated AML/CFT requirements.

For Western firms, Saudi, Bahrain and Oman are the “next-wave” jurisdictions: more bespoke structuring, but increasingly open if you can demonstrate robust compliance and a clear economic story.

Qatar and Kuwait: restrictions and red lines

Qatar and Kuwait remain the outliers.

Qatar

The Qatar Financial Centre regulator has explicitly prohibited virtual-asset services in the QFC, and the Qatar Central Bank has long restricted banks from trading crypto, though 2024 digital-asset regulations introduced a controlled framework outside the QFC.

Kuwait

Since mid-2023, Kuwait has enforced an almost total ban on crypto activities (payments, investments, mining, licensing), framed as an AML/CFT and consumer-protection measure.

Practically, this means no meaningful onshore licensing or marketing in Doha or Kuwait City. Foreign exchanges can be accessed by residents cross-border, but you cannot treat these markets like Dubai or Manama.

How GCC rules connect to GDPR, MiCA, UK and US standards

For a US or European firm, the bridge question is: how do GCC licenses map to my existing GDPR/MiCA/FCA/SEC world?

Data protection and residency

EU GDPR and UK-GDPR require lawful bases, minimisation and cross-border safeguards; GCC cloud strategies must respect local residency expectations (for example, health-data analogies to the National Health Service (NHS) or financial-data rules under BaFin).

MiCA alignment

The EU’s MiCA regime started applying to stablecoin issuers in June 2024 and to CASPs in December 2024, with ESMA guidance on investor protection and marketing.UAE and Bahrain rules increasingly echo MiCA concepts around white papers, custody, conflict-of-interest management and marketing fairness.

US-style controls

Infrastructure and SaaS providers touching GCC crypto flows still need SOC 2 and PCI DSS-style controls for sensitive payments data, alongside sector rules under SEC/CFTC where products are offered back into US markets.

Net message: if you already build to GDPR/DSGVO, UK-GDPR, MiCA and SOC 2, you’re more than halfway to what GCC regulators and banks expect on data, security and conduct.

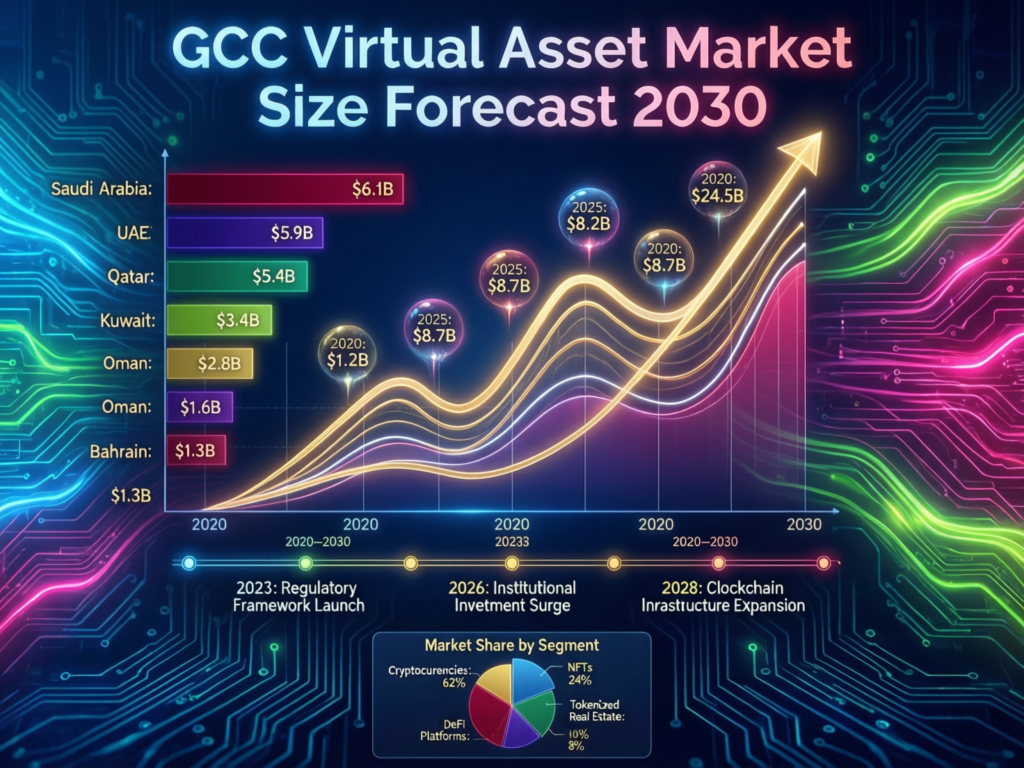

GCC Cryptocurrency Market Size 2026 and Forecast to 2030

By 2026, the GCC cryptocurrency market is a mid-sized but fast-growing niche nested inside a much larger digital-payments and open-finance story. Expect double-digit annual growth through 2030, especially in asset management, trading apps and tokenized-asset platforms.

GCC cryptocurrency market size 2026 and key segments

Think of the GCC “virtual-asset stack” as four overlapping segments rather than one monolithic market:

Spot and derivatives trading

Regional and global exchanges serving GCC users, often from UAE/Bahrain hubs.

Asset-management products

Crypto ETPs, funds, tokenized feeder funds and structured products targeting family offices in Dubai, Riyadh or Frankfurt.

Payments and remittances

Stablecoin rails and tokenized deposits supporting expat remittances and cross-border B2B flows.

Tokenized assets

Real-estate tokens, tokenized sukuk, carbon credits and private-market funds.

The wider MENA digital-payments market is projected to grow from roughly $275 billion in 2026 to over $460 billion by 2031, with about 11% CAGR. [VERIFY LIVE] (Mordor Intelligence) Even a small share of this shifting into crypto-native or tokenized instruments translates into a multi-billion-dollar GCC virtual-asset revenue pool by 2030.

GCC crypto asset management and trading apps

On the asset-management side, you see three broad plays:

Regional asset managers wrapping BTC/ETH or diversified baskets into Sharia-reviewed products

Global exchanges offering segregated institutional accounts, OTC and lending to GCC clients

Tokenized funds domiciled in ADGM, DIFC or Bahrain and distributed to wealth platforms in London and New York City

On the trading-app side, GCC mobile apps tend to

Bundle multi-asset trading (equities, FX, crypto) rather than pure-crypto

Integrate with local KYC rails, instant-payment schemes and sometimes national digital IDs

Offer Arabic-first UX and Sharia-screened product filters, unlike many US/EU apps

For Mak It Solutions clients, this is exactly where modern web development, mobile app development and business-intelligence stacks matter low-latency APIs, strong KYC flows and analytics dashboards tuned to VARA/CBB/FSRA reporting. (Mak it Solutions)

GCC virtual asset market forecast 2030 (base, bull, bear scenarios)

Without pretending to have a crystal ball, a reasonable 2026–2030 view might be.

Base case

GCC virtual-asset revenues track digital-payments growth: high single-digit to low double-digit CAGR, with market size by 2030 in the low- to mid-single billions of USD across trading, custody, tokenization and data/infra.

Bull case

Faster regulatory clarity, strong tokenized-sukuk and real-asset adoption, plus regional ETF approvals, push revenues into mid-teens CAGR and larger secondary-market volumes.

Bear case

Global regulatory shocks or regional policy reversals slow growth; virtual assets stay niche, focused on B2B rails and private markets.

Growth in digital-wallet usage (projected ~34% CAGR to 2030 in revenue terms) and the rise of GCC super-apps mean the rails for bull-case adoption are being built regardless.

Why Global Investors and Exchanges Are Targeting GCC Crypto Markets

Global investors and exchanges are targeting GCC crypto markets because they combine pro-digital policy in hubs like Dubai and Bahrain, deep regional wealth pools, and growing demand for Sharia-aligned digital assets and tokenization. For many CIOs, GCC exposure is now both a growth play and a diversification hedge versus purely Western regulatory risk.

Strategic role of Dubai, Abu Dhabi, Manama and Riyadh

Four hubs dominate most board decks.

Dubai (DIFC/DMCC + VARA regime)

Marketing-friendly, talent-rich, with a high density of exchanges, brokers, market-makers and Web3 startups.

Abu Dhabi (ADGM)

Institutional and prudentially focused, attractive to large exchanges (for example, ADGM-licensed global platforms) and asset managers.

Manama (Bahrain)

Lean CBB processes and an English-law environment make it a favourite for certain exchanges and payment-centric players.

Riyadh

Not yet a “crypto hub” in brand terms, but a critical capital source and home to some of the region’s most ambitious fintech and digital-banking programmes tied to Vision 2030.

For Western readers, think of these as GCC counterparts to London, New York and Frankfurt each with its own risk appetite, regulatory tone and investor base.

Sharia-compliant products, DeFi and tokenization

“Sharia compliance and cryptocurrencies in the GCC” is no longer just a yes/no fatwa question; it’s driving product design.

Distinguishing between volatile “coins,” asset-backed stablecoins, NFTs and tokenized sukuk

Structuring DeFi-style yield as profit-sharing or fee-based rather than pure interest

Tokenizing real estate, sukuk and fund units to improve liquidity and fractional access

Islamic-finance desks in London, Luxembourg and Frankfurt are already exploring tokenized sukuk and Sharia-screened funds that can be passported into GCC wealth platforms if the underlying plumbing (custody, KYC, reporting) meets both Sharia boards’ and regulators’ expectations.

GCC vs EU/UK/US.

Finally, there is regulatory diversification:

The EU’s MiCA and ESMA scrutiny are tightening how CASPs can market and structure products.

The UK’s FCA and Germany’s BaFin continue to enforce strict consumer-protection and market-abuse regimes.

US SEC/CFTC enforcement has created real uncertainty over token classifications and exchange models.

GCC hubs offer a different but increasingly credible rulebook: sandbox-heavy, principle-based, often more agile on innovation, while still converging toward global AML, FATF and prudential standards. Adding one or two GCC hubs can meaningfully diversify jurisdictional risk without abandoning Western compliance expectations.

How US, UK and European Crypto Firms Can Enter GCC Markets

A US or European crypto firm can enter GCC markets by choosing a suitable hub (often Dubai, Abu Dhabi or Bahrain), securing a virtual-asset license, aligning data/AML practices with both GCC and home-country rules, and partnering with local banks, PSPs and sometimes telcos. You should plan for a multi-year, multi-jurisdiction strategy rather than a quick regulatory “hack.”

Choosing the best GCC hub (Dubai vs Bahrain vs Riyadh vs Doha/others)

A simple mapping by business model.

Retail-facing exchanges and trading apps

Dubai (VARA) or ADGM, sometimes Bahrain, because of clearer retail conduct and marketing rules.

Institutional brokers, custodians and OTC desks

ADGM or Bahrain, with Saudi exposure via sandboxes and partnerships.

Wallets and payment-centric apps

UAE or Bahrain as primary license, plus on-the-ground partnerships with banks and fintechs in Saudi and Qatar.

Asset managers and tokenization platforms

ADGM, DIFC or Bahrain, depending on fund regulation and tax considerations.

Infrastructure/SaaS providers

Can often operate from UAE free zones with strong SOC 2/PCI DSS-style controls, supplying GCC-licensed VASPs and banks.

Doha and Kuwait are usually market-access targets (through cross-border services, where allowed) rather than your first licensing choices, given current restrictions.

Licensing pathways and passporting reality check

There is no true “GCC-wide passport” in 2026.

A VARA license covers Dubai (excluding DIFC); an ADGM license covers ADGM; a CBB crypto-asset license covers Bahrain; Saudi sandboxes are specific to projects and entities.

Cross-border marketing or servicing into other GCC states is tightly controlled, especially where local regulators fear retail mis-selling.

Some practical “soft passporting” exists via.

Regional marketing from one hub under local marketing rules

B2B service exports (liquidity, technology, risk management)

Onboarding foreign professional or institutional clients under exemptions

High-level steps you’ll typically follow.

Pre-feasibility

Map your activities vs each regulator’s list of virtual-asset services.

Jurisdiction and entity selection

Pick one or two hubs; decide on free-zone vs mainland vs dual structure.

Regulatory engagement

Sandbox/innovation office conversations, pre-application meetings.

Formal application

Business plan, risk framework, technology and outsourcing documentation, key-person approvals.

Build-out and go-live

Local hires, banking relationships, product localisation and phased launch.

Practical entry strategies for US, UK, German and EU firms

US firms

Access often starts with offshore or GCC-only products that exclude US persons while offering GCC investors exposure to global liquidity.

Tax considerations include treatment of GCC-sourced income, withholding on fund structures and how US reporting interacts with local substance requirements.

Many US managers begin with feeder funds or managed accounts for GCC family offices and sovereigns, then consider a UAE/Bahrain entity when volume justifies.

UK firms

FCA-regulated exchanges and brokers need to map UK conduct, promotions and prudential rules to VARA/ADGM/CBB regimes and ensure no “regulatory downgrade.”

A common pattern: keep core risk engine and IP in London, deploy regional front-ends and client-facing entities in Dubai or Manama, and leverage existing Open Banking and instant-payment know-how in markets like Manchester or London to play into GCC open-finance rails.

German/EU firms

Under MiCA and BaFin supervision, German and EU CASPs can leverage their CASP authorisations as evidence of robust controls when talking to GCC regulators.

Marketing to EU investors from GCC hubs (or vice versa) needs careful handling to avoid “regulatory tourism” accusations ESMA is already warning firms not to misuse MiCA status in promotions.

For “wie deutsche Investoren 2026 in GCC-Kryptomärkte investieren können”, the practical route is often MiCA-compliant products (ETPs, funds) with GCC allocation and co-managed vehicles domiciled in ADGM or Bahrain.

Across all regions, there’s a recurring trade-off: partner vs build. Joint ventures with regional groups, white-labelling your platform for a GCC bank, or using local nominees can accelerate time-to-market but you must still own the compliance narrative.

Risks, Compliance Challenges and 2026–2030 Action Plan

The main risks for foreign investors in GCC crypto are regulatory fragmentation, evolving rules, data-protection gaps, sanctions/AML complexity and Sharia-compliance questions. None are insurmountable but they demand structured planning, not opportunistic trading.

Regulatory, legal and data-protection risks

Key themes your risk committee will care about.

Fragmented licensing & shifting rules

Sandboxes by definition evolve; consultation papers in Oman, ADGM and elsewhere show that tokenization, staking and DeFi rules are still moving targets. (ADGM)

Data residency and cross-border flows

GCC regulators are increasingly explicit about where sensitive financial data must sit, mirroring EU GDPR and UK-GDPR logic but with local hosting preferences.

Sanctions, AML/CFT and travel rule

VASPs servicing GCC flows must juggle FATF expectations, local AML laws, travel-rule obligations and heightened screening across complex geopolitical corridors (US, EU, GCC, Africa, South Asia).

For infra/SaaS firms selling into GCC banks and VASPs, being able to say “we are already SOC 2 audited and PCI DSS compliant” saves weeks in due diligence. (PCI Security Standards Council)

Sharia-compliance, reputational risk and market volatility

Crypto and virtual assets in the GCC come with layered reputational considerations:

Different Sharia boards and fatwas across the region mean a product acceptable to one bank or regulator may be controversial elsewhere.

Conservative stakeholders may perceive retail meme-coins or high-leverage products as misaligned with social or ethical expectations even if legally permitted.

Markets are still relatively young, with concentrated liquidity and reliance on a handful of infrastructure providers, increasing counterparty risk.

Designing “compliance-by-design” tokenized products, especially in sectors like digital health (where NHS-style data sensitivity analogies apply) or regulated finance, is crucial to avoid brand and regulatory blowback.

2026–2030 action checklist for Western firms (CTA-focused)

If you’re a Western decision-maker, here is a pragmatic 2026–2030 roadmap:

Assess the opportunity (0–3 months)

Size the GCC opportunity for your specific model: exchange, wallet, asset manager, DeFi infra, data provider.

Benchmark against peers already in Dubai/ADGM/Bahrain.

Choose your hub(s) (3–6 months)

Shortlist one primary licensing hub (often Dubai or Bahrain) and one secondary market (for example, Saudi) for strategic partnerships.

Decide on free-zone vs mainland and how you’ll connect back to US/UK/EU entities.

Run a compliance and data gap analysis (3–6 months)

Map GCC AML, data and VA rules against your existing GDPR/UK-GDPR/MiCA/SEC/FCA stack.

Identify where you need extra controls, logging, localisation or residency.

Design the regulatory roadmap (6–12 months)

Agree which licenses you’ll apply for, in what order, and how you’ll staff local compliance.

Engage regulators early via sandboxes and innovation offices.

Launch pilots and limited-scope products (12–18 months)

Start with a narrow product set (for example, BTC/ETH + major stablecoins, or one tokenized fund) to test flows, on-ramps and reporting.

Use GCC pilots to refine tokenization or DeFi features before exporting lessons back to US/UK/EU markets.

Scale and diversify (18–36 months)

Add more assets, jurisdictions (for example, Saudi), and B2B services (white-label wallets, tokenization-as-a-service, analytics).

Continually refresh your Sharia, regulatory and data-protection positions.

Key Takeaways

GCC crypto adoption in 2026 is real but still early-stage, anchored in digital wallets, stablecoins, remittances and institutional flows rather than mass-market trading.

UAE and Bahrain are your primary licensing hubs; Saudi Arabia is the strategic capital and payments giant; Qatar and Kuwait remain restrictive.

The GCC virtual-asset opportunity sits inside a booming digital-payments and open-finance market, with double-digit growth potential through 2030.

Western firms that already build to GDPR/UK-GDPR, MiCA, SOC 2 and PCI DSS are well positioned to meet emerging GCC expectations on data, security and conduct.

Successful entry into crypto adoption in GCC countries in 2026 and beyond means choosing the right hub, structuring licenses carefully, and pairing strong compliance with best-in-class product and engineering—the space where Mak It Solutions typically plugs in as a build and integration partner.

If you’re a US, UK or EU decision-maker exploring GCC crypto or tokenization, this is the moment to move from desk research to a concrete roadmap. Mak It Solutions can help you model the opportunity, architect compliant trading or wallet platforms, and integrate with local payment rails and KYC providers across Dubai, Abu Dhabi, Riyadh and beyond.

Book a consultation with our team to map your GCC crypto strategy, or share a short brief and we’ll come back with a scoped, compliance-aware build plan tailored to your market entry timeline.( Click Here’s )

FAQs

Q : Is crypto legal for everyday users in all GCC countries in 2026?

A : No. In 2026, everyday users in the GCC face a patchwork of rules. In the UAE and Bahrain, regulated exchanges and wallets can onboard retail users under clear virtual-asset frameworks. In Saudi Arabia, individuals can access crypto via foreign platforms but local banks and intermediaries face tight controls and sandbox limits. By contrast, Qatar and Kuwait maintain strong restrictions or outright bans on many crypto activities, so residents there typically rely on offshore platforms at their own risk rather than local, licensed providers.

Q : Which GCC country is currently the easiest place to get a crypto exchange license?

A : For most firms, the “easiest” in practice balancing clarity, reputation and process is usually Dubai (via VARA) or Abu Dhabi (via ADGM), followed closely by Bahrain under the CBB’s Crypto-Asset Module. These jurisdictions have dedicated virtual-asset rulebooks, active regulators and established application processes, including for new entrants. “Easy,” however, doesn’t mean light-touch: you still need solid AML frameworks, technology documentation, key-person approvals and often a staged approval path from testnet/sandbox to full production.

Q : Can a GCC crypto license be used to serve customers in the US, UK or EU?

A : Not directly. A VARA, ADGM or CBB license primarily authorises activities in that jurisdiction and sometimes limited cross-border services to other markets that recognise those regimes. To serve US, UK or EU customers, you still need to comply with local rules MiCA and ESMA guidance in the EU, FCA rules in the UK, and SEC/CFTC or state regimes in the US. In practice, many firms run parallel structures: a GCC hub for regional clients and on-ramps, and separate licensed entities or partnerships handling Western customer acquisition and servicing.

Q : How are US dollar stablecoins used for remittances and payments in the GCC?

A : In and around the GCC, US dollar stablecoins are increasingly used as invisible plumbing rather than retail-facing “coins.” Exchanges, OTC desks and some remittance platforms use them for treasury movements, cross-exchange settlement and pilot remittance corridors, especially between the Gulf and South/Southeast Asia. In most cases, users see local-currency in/out and possibly a “USD balance” on their app, while stablecoins handle the bit in the middle. Over time, you can expect more regulated wallet and bank apps to hide stablecoin rails behind familiar digital-payment experiences.

Q : What tax and reporting obligations do European funds face when investing in GCC crypto projects?

A : European funds investing in GCC crypto projects need to handle two layers of rules: their home-state tax and reporting regimes (for example under German or Luxembourg fund law plus MiCA) and any local GCC rules on withholding tax, economic substance and reporting. Many managers use ADGM or Bahrain fund structures to co-invest alongside GCC capital while keeping investors in Germany, France or the Nordics inside familiar EU wrappers. As always, you need specialist cross-border tax advice to nail down questions like PE risk, treatment of tokenized returns and whether local participation exemptions or treaty relief apply.