Crypto Adoption in Emerging Markets

Crypto adoption in emerging markets has shifted from a niche story to a front-page economic narrative. As inflation, currency volatility, and high remittance fees persist, digital assets—especially dollar-pegged stablecoins are becoming everyday financial tools. According to Chainalysis, countries like India, Nigeria, Indonesia, Vietnam, and the Philippines are consistently among the top adopters, reflecting strong grassroots usage rather than only institutional speculation.

Meanwhile, the World Bank reports that India, Mexico, China, the Philippines, and Pakistan were the top remittance recipients in 2024, underscoring the link between migration, money flows, and crypto adoption in emerging markets.

This article breaks down the real-world drivers: remittances, inflation hedging, merchant payments, and DeFi access; the role of stablecoins; regulatory considerations; and how builders and policy teams can support responsible crypto adoption in emerging markets.

The Global Picture: Who’s Adopting and Why

Top markets by grassroots adoption

In Chainalysis’ 2024 Global Crypto Adoption Index, India ranks #1, Nigeria #2, Indonesia #3, Vietnam #5, and the Philippines #8, with Pakistan and Türkiye also in the top 15. These results emphasize retail-level activity people using crypto despite lower income levels.

Ownership is broadening

TripleA estimates ~562 million crypto owners worldwide in 2024 (~6.8% of population), with Asia leading growth. While methodologies vary, the directional trend supports accelerating crypto adoption in emerging markets.

Why adoption concentrates in these markets

Remittances

Migrant workers send billions home. Crypto rails can compress settlement times and reduce FX slippage; even small savings matter at scale.

Inflation & currency risk

Households in high-inflation countries increasingly hold USD-linked stablecoins as a digital “escape hatch.” LATAM is a prime example.

Financial access

Where bank penetration is low but mobile penetration is high, wallets and exchanges can onboard users faster than traditional institutions.

DeFi as a service layer

Lending, savings, and on-chain dollars become accessible to long-tail users without extensive paperwork.

The Quiet Infrastructure of Everyday Crypto

Stablecoins sit at the center of crypto adoption in emerging markets because they combine crypto’s open rails with the familiar value of the U.S. dollar.

Scale of use

One industry dataset (Visa/Allium, via FXCintel) estimates $5.7T in stablecoin transaction value in 2024, with $4.6T already in H1 2025 though a large share is trading liquidity, not retail spend. Methodologies differ, but the pipes are clearly carrying heavy flow.

Market structure

DeFiLlama shows stablecoin market cap exceeding $230B in March 2025; USDT and USDC together represent the bulk of supply.

Macro linkages

BIS research finds stablecoin flows correlate with short-term U.S. Treasury dynamics an emerging channel between crypto and traditional money markets.

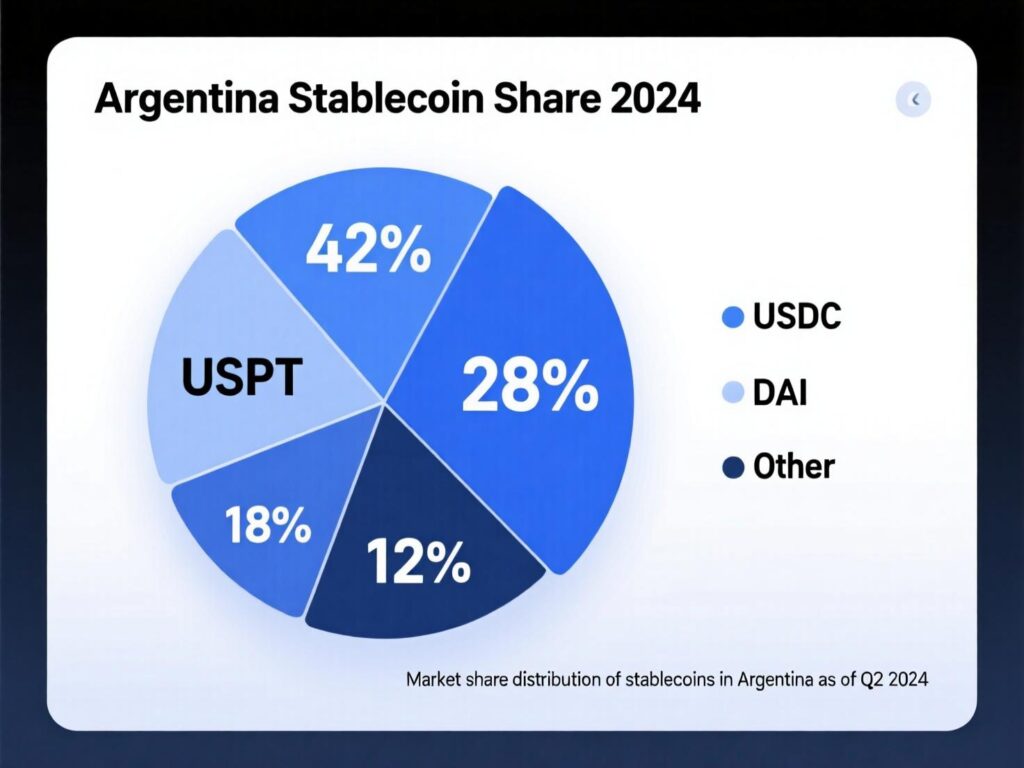

Case in point: Argentina

In 2024, stablecoins represented ~61.8% of Argentina’s crypto transaction volume far above the global average reflecting both inflation pressures and dollar demand.

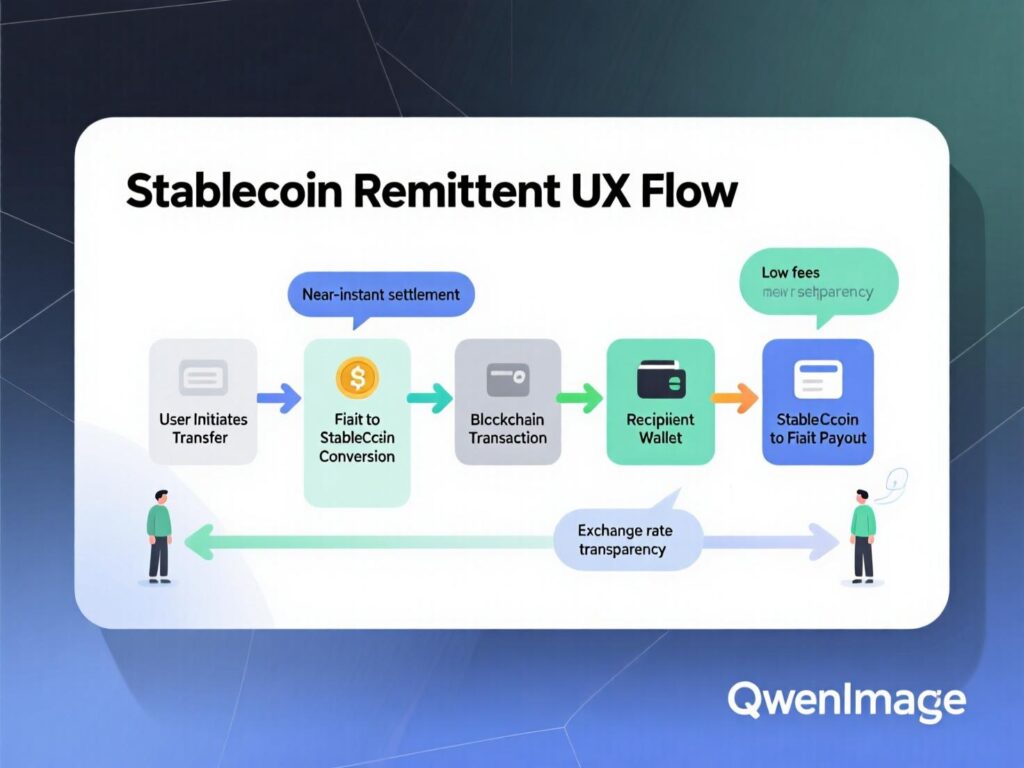

Remittances: Cutting Cost and Friction

Remittance corridors are central to crypto adoption in emerging markets.

Volume & beneficiaries

The World Bank lists India ($129B), Mexico ($68B), China ($48B), the Philippines ($40B), and Pakistan ($33B) as the top remittance recipients for 2024 precisely the markets where on-chain dollars and cash-out networks matter most.

Costs are still high

Depending on the basket and corridor, the global average for sending $200–$500 ranges roughly from ~4% to 6%+, with large dispersion across methods and regions (e.g., Q4 2024 average cost for sending $500 = 4.11%; other metrics show higher costs for different baskets). Crypto rails can help compress spreads and settlement time when last-mile cash-out is available.

What works

Stablecoin remittances to mobile wallets with competitive FX and local cash-out partners.

Aggregators connecting licensed MTOs and crypto off-ramps to stay within compliance while reducing cost.

From FX Headaches to Dollar Receivables

For import-dependent SMEs in crypto adoption in emerging markets, pricing in local currencies can be risky. Accepting stablecoins for B2B invoices or e-commerce can:

Hedge currency risk during volatile windows.

Lower cross-border settlement lags.

Improve reconciliation with programmable invoices and on-chain proofs.

Playbook

Quote in stablecoins, 2) collect on-chain, 3) auto-swap to local fiat at cash-out, 4) book tax records with API integrations. This is where PSPs and compliance-ready off-ramps are critical.

DeFi & Savings: Access Without Gatekeepers

A growing slice of crypto adoption in emerging markets involves simple on-chain savings in tokenized dollars plus lending/borrowing. Risks remain (smart-contract, counterparty, FX/peg), but DeFi exposes users to global liquidity. Policymakers are warming to “real-world asset” tokenization debates, and IMF/BIS analyses increasingly examine the macro footprint of stablecoins and crypto markets.

Country Snapshots (Quick Takes)

India

Adoption

#1 in the 2024 index; massive retail activity.Drivers

Remittances, tech-savvy youth, and developer base.Implication

Builders should localize for UPI-like UX and low-cost on-ramps/off-ramps to sustain crypto adoption in emerging markets.

Nigeria

Adoption:

#2 globally as of 2024; strong retail usage, FX constraints, and entrepreneurial crypto culture.Implication:

Dollar-stable rails with compliant off-ramps remain the killer app.

The Philippines

Adoption

Top-10; remittance corridors and mobile-first consumer base.Implication

Wallets integrated with local agents and banks will drive durable crypto adoption in emerging markets.

Argentina

Adoption

High stablecoin share driven by inflation and devaluation.Implication

USD-denominated savings and merchant settlement use cases are sticky.

Risks & Constraints to Watch

Regulatory volatility

Policy stances change; licensing, FX rules, and KYC/AML regimes evolve quickly. IMF/FSB guidance highlights the need for risk-based frameworks rather than blanket bans.Off-ramp dependence

Without local banking partners and agent networks, crypto rails can stall at the last mile.Peg & counterparty risk

Stablecoin reserves, disclosures, and market structure matter for resilience. Market-cap concentration in USDT/USDC heightens single-point risk.Scams & consumer protection

Education and wallet safeguards must come standard.

How Builders Can Accelerate Responsible Growth (Actionable)

Design for compliance from day-zero

KYC tiers, source-of-funds checks, TRM/Chainalysis screening, and corridor-specific policies.

Prioritize stable UX

Abstract addresses; human-readable payments; fiat-like receipts.

Integrate local payout rails

Bank transfers, cash agents, and mobile money; publish transparent FX.

Add safeguards

Circuit-breakers for depegs; status pages; clear disclosures.

Measure real impact

Time-to-settle, FX slippage vs. bank/MTOs, complaint rates, and net savings to users.

Mini Case Studies

Case Study 1 Argentina: From Inflation to Stablecoins

With inflation in triple digits through 2024, Argentines increasingly held USDT/USDC for daily transactions and savings. Chainalysis shows stablecoins ~61.8% of transaction volume nearly 40% above the global average pointing to “digital dollars” as a practical hedge.

Case Study 2 India/Philippines: Remittance UX Matters

High-volume remittance corridors demand rapid settlements and lower spreads. World Bank data confirms both nations among the top global recipients in 2024, making them prime candidates for compliant stablecoin remittance pilots linked to bank and mobile-money cash-out. World Bank Blogs

Outlook

The next phase of crypto adoption in emerging markets will be defined by stablecoin infrastructure, licensed off-ramps, and sensible regulation. Data already shows top ranked adoption in countries where remittances, inflation, and mobile-first behavior intersect. As settlement rails mature, we’ll see crypto recede into the background just cheaper, faster, programmable money powering global commerce. Builders and policymakers who collaborate now can shape an inclusive financial stack that serves millions.

CTA: Want a localized SEO/content plan or a corridor-specific go-to-market for crypto adoption in emerging markets? Reach out we’ll map keywords, competitors, and conversion funnels per country.

FAQs

Q : How does crypto help reduce remittance costs in emerging markets?

A : Crypto rails can compress FX spreads and reduce intermediaries, especially using stablecoins. Savings vary by corridor and cash-out method; some users report meaningful time and cost reductions versus bank/MTO options, but outcomes depend on local partners and compliance.

Q : How risky are stablecoins for everyday users?

A : Risks include depeg events, counterparty reserve quality, and platform security. Choosing reputable issuers, diversified wallets, and reliable off-ramps helps. Check disclosures and avoid holding all funds on exchanges.

Q : How can merchants accept crypto without price volatility?

A : Use dollar-stablecoins with instant conversion to local fiat via PSPs. Automate invoicing and reconcile with accounting integrations to minimize FX risk.

Q : How do regulators view crypto in emerging markets?

A : IMF/FSB guidance supports risk-based regulation KYC/AML, market integrity, and consumer protection rather than blanket bans. Local rules vary widely and can change.

Q : How does DeFi serve underbanked users?

A : It provides access to savings and credit products without traditional gatekeepers, but introduces smart-contract and custody risk. Start small, diversify, and prefer audited protocols.

Q : How can startups launch compliant remittances on stablecoins?

A : Partner with licensed MTOs/EMIs, implement KYC/AML screening, integrate bank/mobile-money payout rails, and publish fees/FX transparently.

Q : How do I pick a wallet in emerging markets?

A : Favor wallets with strong security, human-readable addresses, on/off-ramps, and local language support. Test small transfers first.

Q : How will crypto adoption in emerging markets evolve in 2026?

A : Expect deeper stablecoin liquidity, more bank-linked off-ramps, and clearer licensing. Real-world payments and SME invoicing will grow alongside remittances.

Q : How can governments protect consumers without stifling innovation?

A : Mandate disclosures, reserve audits for stablecoins, licensing for VASPs, and sandbox regimes for pilots. Encourage interoperability and data portability.