Cross-Chain Crypto Derivatives: The 2025 Pro Guide

Cross-chain crypto derivatives are where DeFi, derivatives trading and multi-chain infrastructure collide. In simple terms, they allow you to use collateral on one chain (say, Ethereum mainnet), open a perpetual futures position on another (for example, an L2 rollup), and settle profit and loss on a third, all while staying on-chain and in control of your keys.

In 2025, derivatives already account for roughly three-quarters of total crypto trading volume globally, with monthly crypto derivatives volumes in the trillions of dollars. On the DeFi side, perpetuals DEXs and synthetic asset protocols are rapidly catching up, with decentralized perps volumes growing strongly year-on-year.

This guide is written for

Advanced traders in the US, UK, Germany and wider EU who want on-chain leverage without giving up custody

Prop firms, family offices and funds in hubs like New York, Chicago, London, Frankfurt, Zurich and Singapore

Builders and infra teams integrating perps and synthetic assets into wallets, neo-brokers, structured-product apps or analytics platforms

We’ll unpack how cross-chain crypto derivatives work, how they compare to centralized futures venues, what the infra stack looks like, and how to evaluate platforms through a US/UK/EU regulatory lens before ending with a practical rollout plan.

What are cross-chain crypto derivatives and how do they work in DeFi?

Cross-chain crypto derivatives are futures, perpetuals and synthetic products whose collateral, margin and settlement can move across multiple blockchains, letting traders and builders use liquidity wherever it lives while staying on-chain. In practice, messaging and bridge layers shuttle position data and collateral between chains so your account feels unified even when the infra is multi-chain under the hood.

At a high level, a DeFi derivatives protocol exposes leveraged long/short exposure to an underlying (BTC, ETH, SOL, FX pairs, indices, etc.) while managing funding, liquidations and collateralization on smart contracts. The “cross-chain” part adds the ability to:

Post collateral on Chain A (for example, Ethereum, Arbitrum or Base)

Open or manage a position on Chain B (say, a Cosmos app-chain or Optimistic rollup)

Settle PnL or withdraw to Chain C (maybe Solana or another L2)

Crypto derivatives vs perpetual futures in DeFi

Classic crypto derivatives include dated futures, perpetual futures (“perps”) and options

Dated futures

Contracts with an expiry date and often cash-settled at a reference price.

Perpetual futures

No expiry date; a funding rate keeps the perp price anchored to the spot/index price.

Options

Asymmetric payoff contracts (calls/puts) with premia, strikes and expiries.

So when we talk about “crypto derivatives vs perpetual futures”, we’re really distinguishing between the broad set of derivative contracts and the specific, funding-rate-based perp contract that has become dominant in crypto. Perps dominate on-chain volume because they combine:

Continuous price discovery

Familiar CEX-like UX

Flexibility for hedging, leverage and market-making

In DeFi, on-chain leverage and margining work similarly to centralized exchanges (CEXs), but:

Your margin is held in smart contracts instead of a custodian

Liquidations are usually transparent and rules-based

Funding and fees are enforced on-chain, not via opaque internal books

This is why “on-chain leverage and margining” has become a core search term for prop desks and advanced retail traders migrating off CEXs.

How cross-chain derivatives move collateral, margin and PnL

A simplified cross-chain perp trade lifecycle could look like this:

Deposit collateral on Chain A

You deposit USDC on Arbitrum into a cross-chain derivatives protocol vault.

The protocol records your collateral balance and issues you a sort of “omnichain margin account” internally.

Open a perp on Chain B

From the same front-end, you open a 5x long ETH perpetual on an app-chain built with Cosmos SDK.

Cross-chain messaging (e.g. via LayerZero, Wormhole or Axelar) passes your order and account state from Arbitrum to the app-chain.

Manage position and settle PnL on Chain C

Price oracles feed prices into Chain B; funding is accrued, PnL updates.

When you close, you choose to withdraw profit to Base or Ethereum mainnet (Chain C), again via messaging + bridge layers.

From a UX point of view

In the US, traders expect tight integration with bank accounts, ACH or FedNow rails, and often “US-friendly” wallets that can handle CEX and DeFi flows.

In the UK and EU, bank links (SEPA, Faster Payments), Open Banking APIs and KYC vendors governed by GDPR/UK-GDPR are a bigger part of the onboarding story.

Good interfaces hide this complexity so cross-chain flows feel like moving balances between sub-accounts.

Who actually uses cross-chain crypto derivatives today?

Current users typically fall into three buckets:

Advanced retail traders in the US, UK, Germany, France, the Netherlands and elsewhere in Europe

Running directional, hedging or basis strategies with 2–20x leverage

Often multi-venue: CEX perps for major pairs, cross-chain perps DEXs for altcoins and strategy automation

Prop trading firms, family offices and crypto funds

In hubs like New York, Chicago, San Francisco, London, Frankfurt, Berlin, Zurich, Zug and Singapore

Arbitraging funding between CEXs and DEXs, running market-neutral perp vs spot or perp vs perp trades

Integrating cross-chain perps into internal risk dashboards and OMS/EMS stacks

Builders and infrastructure teams

Wallets and neo-brokers embedding perps and synthetic assets directly in-app

Structured product platforms tokenizing payoff strategies (for example, covered call vaults or basis trades)

Analytics and compliance tools monitoring exposure and liquidations across chains

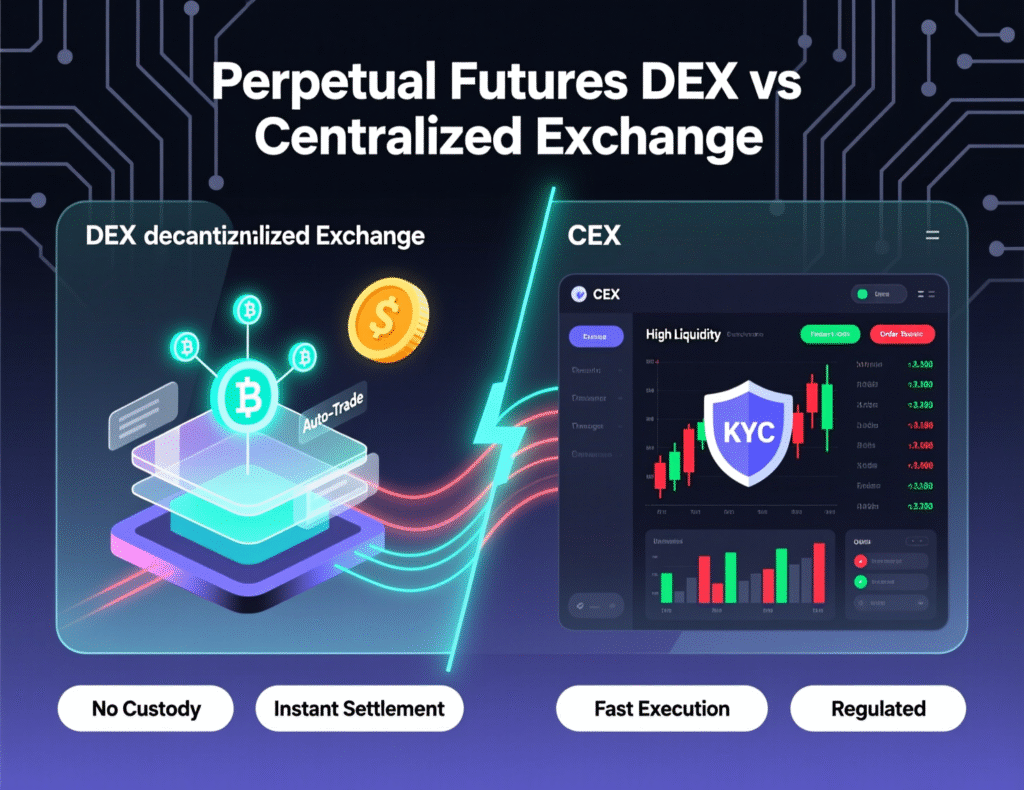

Cross-chain perpetual futures DEXs vs centralized futures exchanges

Cross-chain perpetual futures DEXs offer on-chain leverage, transparent liquidations and self-custody across multiple chains, while CEX futures still win on onboarding simplicity and sometimes liquidity but add custodial and jurisdictional risk. In other words, DEXs optimize for transparency and control; CEXs still dominate raw scale.

What is a cross-chain perpetual futures DEX?

A cross-chain perpetual futures DEX is a decentralized exchange that lets you trade perp contracts while:

Holding your collateral in your own wallet

Relying on smart contracts for matching, pricing and liquidations

Using cross-chain routing to accept collateral and route orders across multiple networks

These are sometimes called decentralized perpetual futures exchanges or simply perps DEXs. Under the hood you’ll see three main models:

Orderbook DEXs (e.g. Hyperliquid, Injective) with on-chain settlement and off- or hybrid order-matching

AMM-style perps (e.g. MYX Finance, Kine, Polynomial vaults) using virtual AMMs or liquidity pools

Hybrid designs that blend orderbooks, RFQs and AMM-style LPs

Cross-chain routing allows these DEXs to tap liquidity across Ethereum, L2s like Arbitrum/Optimism/Base, and app-chains in the Cosmos ecosystem, often via messaging protocols like LayerZero, Wormhole or Axelar.

Cross-chain crypto futures trading: fees, leverage & liquidity vs CEX futures

Fee structures & leverage

Perp DEX taker/maker fees often sit in the 5–10 bps range each way, plus funding.

CEX futures (Binance, Bybit, OKX, etc.) can be slightly cheaper for high-volume accounts with tiered discounts.

Leverage caps on CEXs can reach 50–100x on major pairs; most reputable DeFi derivatives protocols keep effective leverage lower (often ≤20x for BTC/ETH, less for alts). [

Liquidity & depth

CEX perps still dominate: centralized perps recorded tens of trillions of dollars in annual volume in 2024, while decentralized perps crossed around the low-trillions mark but are growing faster.

The DEX share of futures volume has climbed from low single digits to low double digits in a few years, with platforms like Hyperliquid driving that shift.

Front-end UX & access

CEXs

Well-polished web/mobile apps, FIX/REST/WebSocket APIs, fiat rails, and integrated KYC.

Perp DEXs

Increasingly slick web UIs and APIs, but with wallet UX, network selection and bridge flows still more complex.

Regulatory onboarding differs sharply:

US traders

Face strict KYC, geo-fencing and futures licensing; access to high-leverage offshore CEXs is increasingly curtailed by enforcement.

EU/UK traders

Can often use EU-licensed CEXs or MiCA-ready venues; DeFi use is more “self-directed” but still subject to local tax and consumer law.

Traders still prefer Binance, Bybit, CME or Coinbase Derivatives when:

They need very deep liquidity in BTC/ETH

They require regulated US products (e.g. CME futures)

Their firm can’t access DeFi directly due to policy or mandates

But the gap is narrowing as perps DEXs offer greater cross-chain routing, better margin capital efficiency and institutional-style APIs.

GEO lens US, UK, Germany & EU access to decentralized perpetual futures exchanges

United States

Many perp DEXs brand their front-ends as “non-US only” and geo-block US IPs.

Using VPNs to circumvent these restrictions can create CFTC/SEC enforcement risk, particularly for firms with US entities.

Some US-friendly options involve onshore, registered entities offering on-chain settlement with regulated front-ends.

United Kingdom

The FCA has banned the sale of certain crypto derivatives and ETNs to UK retail consumers since 2021, a stance that is still being actively debated.

As a result, several perp platforms label their UI as “professional clients only” for UK users and rely on appropriateness tests and reverse solicitation language.

Separate developments around crypto ETNs for retail are evolving, but they don’t automatically reopen the door for retail margined perps.

Germany & wider EU

MiCA

Introduces an EU-wide framework for crypto-asset service providers (CASPs), impacting how MiCA-compliant cross-chain derivatives platforms in Europe position themselves.

BaFin

Guidance emphasizes investor protection, proper licensing, and limits on marketing leverage to retail, especially for complex derivatives.

Many EU traders in Berlin, Paris or Amsterdam therefore access perps DEXs in a more self-directed way, while MiCA-licensed venues gradually appear.

Cross-chain derivatives infrastructure: bridges, L2s and messaging layers

Cross-chain derivatives rely on secure bridges, messaging layers and L2s that pass price, margin and position data between chains so traders can post collateral in one place and trade or settle in another. The infra stack is where most of the real risk and complexity lives.

Bridges, messaging and oracles powering cross-chain derivatives

Key primitives include.

Cross-chain messaging

Protocols like LayerZero, Axelar and Wormhole let applications send verified messages between chains orders, balance updates, liquidation instructions and more.

Bridges & liquidity networks

Move collateral itself (USDC, ETH, stables, LSTs) between chains. Some derivatives protocols run internal credit systems so collateral doesn’t need to move for every trade.

Oracles

Price feeds (spot, index), funding rates, volatility indices. Latency and manipulation resistance are critical; slow or compromised oracles are a common exploit vector for DeFi derivatives.

Most of this infra is ultimately running on cloud platforms (AWS, GCP, Azure), even if nodes are geographically distributed. This reality sometimes clashes with decentralization narratives, but it’s central to latency, redundancy and compliance, especially for institutional users.

Cross-chain margin & collateral management on L2s and app-chains

Design patterns you’ll see:

Single-collateral vs multi-collateral

Single-collateral (e.g. USDC-only) simplifies risk management.

Multi-collateral (USDC, USDT, ETH, LSTs) improves UX but complicates liquidation math.

Cross-margin vs isolated margin

Cross-margin: one pool backs all positions across instruments and potentially across chains.

Isolated margin: each market, sub-account or chain instance has ring-fenced risk.

Rollups like Arbitrum, Optimism and Base are popular execution layers for derivatives: low fees, high throughput, good tooling, and easy access for US and EU wallets. App-chains in Cosmos and high-performance chains like Solana are increasingly hosting specialized derivatives workloads.

For users funding in USD, GBP and EUR:

US traders often on-ramp via ACH or cards into a US-friendly wallet, then bridge to L2s.

UK traders rely on Faster Payments and Open Banking, while EU traders use SEPA transfers and EUR-denominated stablecoins.

Some platforms let you hold base collateral in EUR or GBP stablecoins while trading USD-quoted perps.

Security, data & trust: audits, PCI DSS, SOC 2 and GDPR/DSGVO

Serious perp DEXs and infra teams combine:

Independent smart contract audits (ideally multiple)

Continuous monitoring and bug bounty programs

Formal incident response and disclosure processes

Where user data and payments are involved, standards like:

SOC 2 (for security, availability and process controls)

PCI DSS (if handling card data)

HIPAA (if you’re dealing with health-related RWAs, e.g. NHS-linked receivables)

start to matter for institutional due diligence.

For users in Germany and the wider EU, GDPR/DSGVO governs how personal data is stored, processed and shared including KYC data and Open Banking access logs. In the UK, UK-GDPR and FCA rules play a similar role.

If you’re integrating perps or synthetic assets into a wallet or neo-broker, making your SOC 2 posture, GDPR controls and data minimization strategy clear is often as important as your funding rate APY.

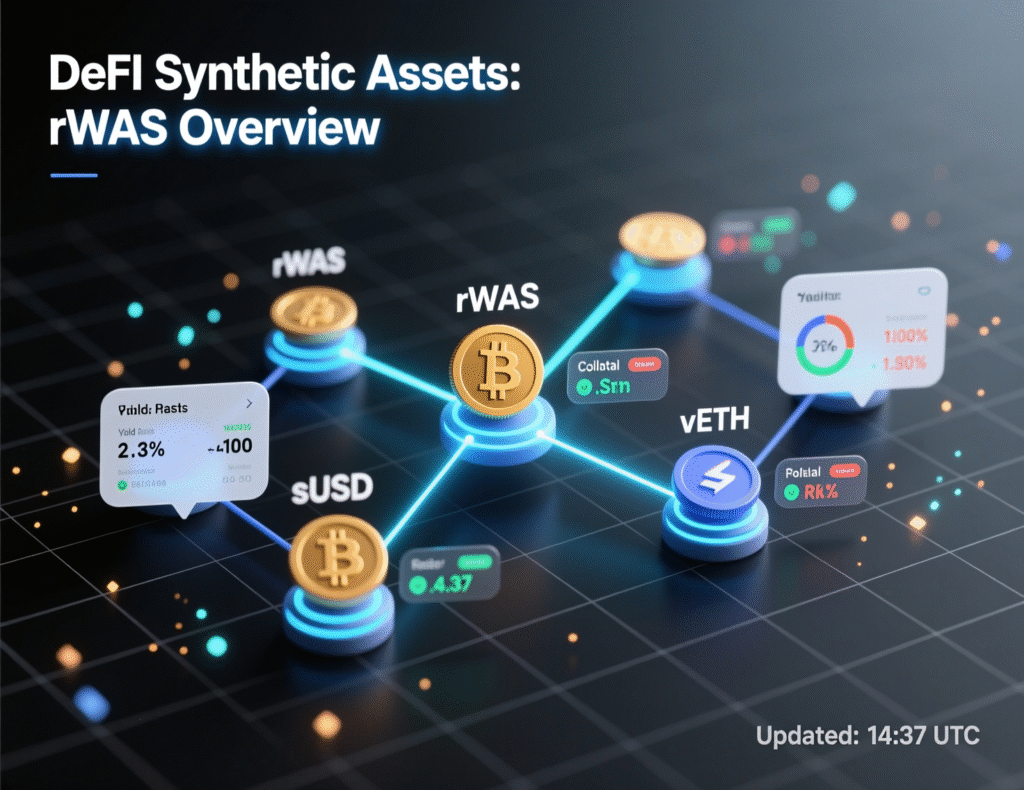

DeFi synthetic assets & cross-chain synthetic exposure to RWAs

DeFi synthetic assets mirror the price of stocks, indices, FX or commodities using collateral and smart contracts, and cross-chain design lets users access that exposure from multiple networks without holding the underlying asset. Think “CFDs, but on-chain and composable.”

DeFi synthetic assets vs perpetual futures vs dated futures

DeFi synthetic assets are tokens whose price is designed to track something else:

Synthetic US stocks or ETFs (e.g. Apple, S&P 500)

Synthetic FX (e.g. synthetic EUR/USD, GBP/USD)

Synthetic commodities (gold, oil)

Protocols like Synthetix and Kwenta pioneered this model on Ethereum and L2s, letting users mint and trade synths backed by over-collateralized positions.

How does this compare to perps and futures?

Synths

Typically no funding payments; you hold a token that passively tracks an index via oracles and collateral rebalancing.

Perps

Leverageable contracts with funding fees and flexible sizing.

Dated futures

Expiries and potential term-structure trading.

Use cases.

Traders or protocols may prefer synthetic exposure when they want simple, spot-like behavior that’s tokenizable and composable in DeFi.

They may choose perps when they want dynamic leverage, hedging, or to play funding spreads.

When comparing crypto synthetic assets vs CFDs, the main difference is custody and counterparty: CFDs are off-chain, bilateral contracts; synths are on-chain and composable.

Risk profiles differ.

Funding fees (perps) can be a cost or revenue stream depending on direction.

Oracle risk affects both synths and perps.

Collateral volatility and under-collateralization can result in protocol-level shortfalls.

Cross-chain synthetic assets and tokenized RWAs

“Cross-chain synthetic assets” are synths that can be minted, held or traded across multiple networks using messaging/bridge infra. They often sit alongside tokenized real-world assets (RWAs) in DeFi, such as:

Synthetic Apple (AAPL) stock

Synthetic EUR or GBP

Synthetic gold or oil

Tokenized US Treasuries, green bonds or invoices

Synthetix, Kwenta and other protocols are gradually going multi-chain across Ethereum, Optimism, Base and alternative ecosystems, with governance and risk parameters tuned per-chain.

For European investors, synthetic ETFs, FX and commodities funded with EUR collateral can provide:

Exposure without opening foreign brokerage accounts

Programmatic access from a DAO or treasury

Easier integration with EUR-denominated reporting and MiCA-compliant CASPs

Regional examples: synthetic US stocks, FX and commodities

United States

Trading synthetic US equities may be viewed differently from holding the underlying, but SEC and IRS still care about economic exposure, taxability of PnL and marketing of securities-like products.

Many US users access synthetic exposure via offshore or DeFi protocols at their own risk; tax reporting for DeFi synthetic assets is an evolving area.

United Kingdom

The FCA’s tough stance on retail crypto derivatives and CFDs means London-based wealth managers are cautious about tokenized derivatives, often limiting them to professional clients.

An example: a London wealth manager exploring NHS-linked healthcare receivables RWAs needs to align with both FCA product governance rules and UK-GDPR for patient-related data.

Germany / EU

BaFin and MiCA shape how tokenized RWAs and synthetic assets are classified and marketed, especially where they resemble securities or derivatives.

Use cases include synthetic exposure to European green bonds, infrastructure projects, or receivables from public bodies like healthcare systems.

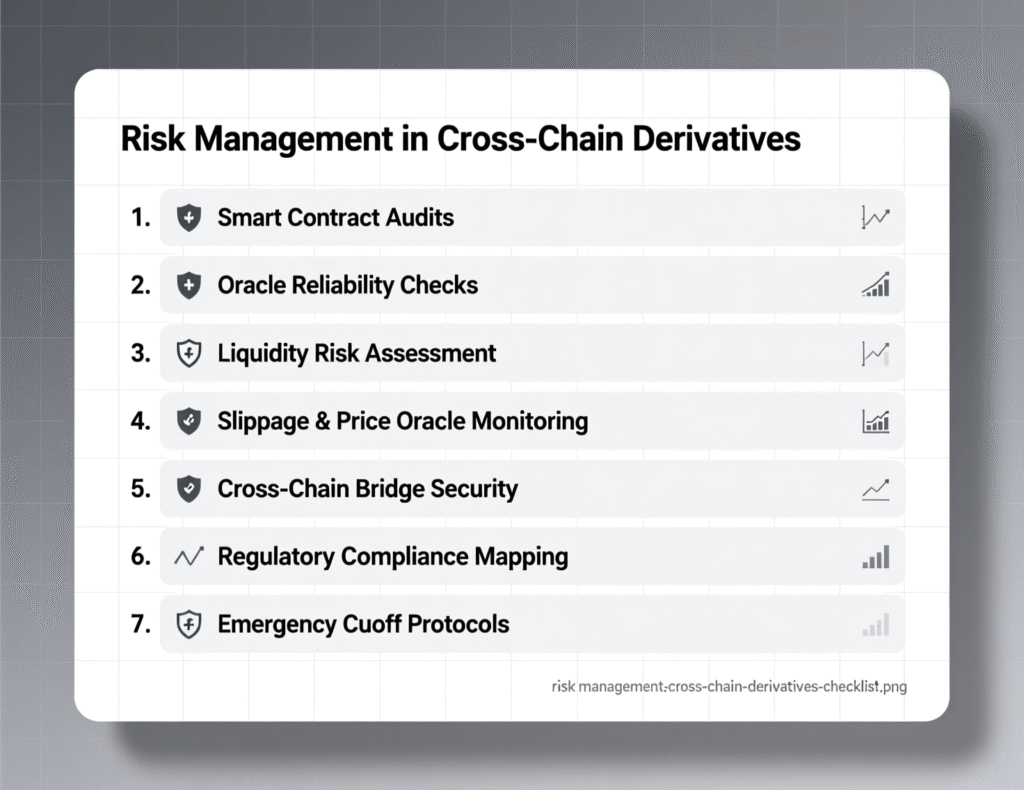

Risk, regulation & compliance for cross-chain DeFi derivatives

The biggest risks in cross-chain derivatives are smart contract exploits, bridge failures and regulatory misalignment; managing them means understanding local rules in the US, UK and EU and choosing platforms with strong security and governance. This section is informational only and not legal or tax advice.

United States SEC vs CFTC, tax and reporting for DeFi derivatives

In the US,

The CFTC tends to view many crypto derivatives (futures, perps, some options) as falling under its commodities derivatives mandate.

The SEC targets products that look like securities or security-based swaps, and is building a dedicated crypto task force.

Key points for US traders.

Offshore perps and synthetic venues may violate US derivatives or securities rules if soliciting US customers.

The IRS generally taxes realized PnL and funding income/expenses; professional traders may have different elections and reporting regimes.

US-facing front-ends often enforce KYC/AML, sanctions screening and geo-fencing.

United Kingdom & EU/Germany FCA, BaFin, MiCA and investor protection

United Kingdom

The FCA’s policy statement PS20/10 effectively bans marketing, distribution and sale of certain crypto derivatives and ETNs to UK retail clients.

Crypto firms must navigate tight financial-promotions rules, appropriateness tests and anti-scam expectations. UK-based “crypto prop” operations often run via professional structures offshore.

Germany & EU

MiCA

Requires many crypto-asset services (including some derivatives-like products) to be provided by authorized CASPs, with strict disclosure, whitepaper and governance standards.

BaFin

Interprets complex leveraged products conservatively, requiring licensing and limiting how they’re marketed to retail customers.

For a Berlin-based DAO or Frankfurt prop desk, that means:

Careful separation between protocol governance and front-end operations

Legal advice on whether activity triggers MiFID II/MiCA licensing

Internal policies on interacting with non-EU DeFi derivatives venues

Smart contract, bridge and liquidation risk how to protect yourself

To use cross-chain bridges and perps safely, stick to audited protocols with battle-tested bridges, conservative leverage, clear liquidation rules and robust insurance or risk funds. Most historic DeFi “blow-ups” share similar patterns:

Bridge hacks

Compromised validators, keys or relayers draining bridged collateral.

Oracle manipulation

Thin or manipulated markets used to trigger bad liquidations.

Cascading liquidations

Under-collateralized markets, sudden volatility and not enough backstop liquidity.

Practical controls for individuals:

Treat cross-chain perps as high risk: cap position size vs your net worth.

Diversify collateral across reputable stablecoins and blue-chip assets rather than one token.

Use hardware wallets and, if size justifies it, multi-sig or smart-account setups.

Prefer platforms with transparent insurance/risk funds and documented liquidation waterfalls.

Institutional players in New York, London, Frankfurt, Zurich and Paris typically:

Run counterparty and smart contract due diligence (including third-party audits)

Set hard limits per venue, per asset and per strategy

Mirror on-chain positions in their risk systems & VaR models

Maintain playbooks for stress events (de-pegs, oracle outages, bridge pauses)

How to evaluate a cross-chain crypto derivatives platform

The best cross-chain crypto derivatives platforms combine deep liquidity, fair funding, robust security and clear regulatory posture for your jurisdiction, whether you trade from the US, UK, Germany or elsewhere in Europe. Here’s a pre-signup checklist.

Checklist for individual traders

For advanced retail traders.

Liquidity & depth

Check orderbook depth or pool size for your main pairs using public analytics (Coingecko, CoinMarketCap, etc.).

Look at cross-chain routing quality—are fills consistent across chains or do you see frequent reverts?

Funding, fees & order types

Compare maker/taker fees, funding rates and slippage to your current CEX.

Ensure you have access to stop-loss, take-profit and bracket orders—especially important on volatile perps.

Geo availability & fiat on-ramps

Confirm whether the platform is US-friendly or explicitly excludes US residents.

For UK/EU, check if there are regulated partners for fiat on-ramps (SEPA, Faster Payments).

Consider using a best US-friendly wallet for cross-chain perp trading with built-in safeguards and compliance features.

Checklist for prop desks, asset managers and fintechs

Commercial/institutional due diligence should include:

Legal entity & licensing

Is there a regulated entity (BaFin-licensed, MiCA-ready, FCA-registered partner) behind the front-end, or is it a pure DAO?

Where is IP and decision-making actually located (e.g. Zug, Singapore, Dubai)?

Banking & custody connectivity

Does the platform integrate with banks or custodians in London, Frankfurt, Berlin, Amsterdam, Luxembourg or Zurich?

Can you connect institutional wallets or qualified custodians that meet your internal policies?

Reporting & surveillance

Exportable fills, PnL and funding records that align with your back office.

Hooks for trade surveillance tools (spoofing detection, wash trade flags).

Ability to support tax and regulatory reporting in the US, UK and EU.

At this layer, Mak It Solutions can help you design data pipelines, reporting layers and BI dashboards over your cross-chain trading data see our for an example of the analytics stack we typically build.

Checklist for builders and infra teams

If you’re integrating perps or synthetic assets into your own product:

APIs, SDKs & SLAs

REST/WebSocket APIs with good documentation, sandbox environments and versioning.

SDKs in your main languages (TypeScript, Python, etc.) and clear uptime/latency SLAs.

Cross-chain infra support

Native integrations with LayerZero, Axelar and Wormhole if you need omnichain positions.

Clear plans for migrating to future infra (e.g. new L2s or restaking-based security).

Hosting, ops & governance

Where are off-chain components hosted (AWS, GCP, on-prem)?

Is there a SOC 2 or equivalent posture for off-chain components?

How transparent is tokenomics, DAO voting and upgrade governance—especially if you plan to launch your own synthetic markets on top?

If you’re building your own derivatives protocol or gateway, Mak It Solutions can support the SaaS, cloud and analytics side from multi-tenant control panels to real-time risk dashboards.

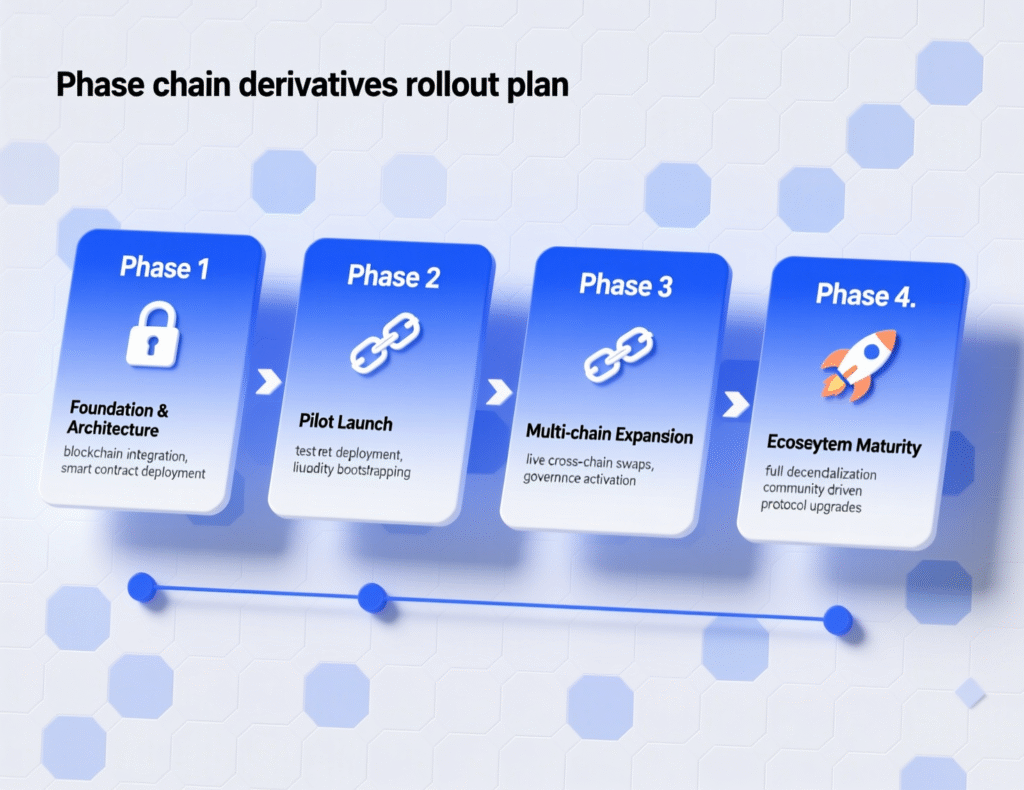

From research to first trade: your cross-chain derivatives rollout plan

Education, sandboxing and paper trading

Start by learning mechanics with minimal capital at risk.

Use testnets, demo accounts or tiny trade sizes to learn how cross-chain crypto futures trading works: deposits, network switching, bridging, opening/closing perps, and interpreting funding rates.

Map which perp DEXs and synthetic protocols are legally accessible from your location (US, UK, Germany, your specific EU country).

Document your personal or organizational risk limits: max leverage per asset, per-venue limits, red lines on certain chains or tokens.

scaling exposure, adding synthetic assets and RWAs

Once you’re confident in workflows and risks:

Gradually increase exposure, but keep leverage disciplined—especially on smaller altcoin perps.

Add more chains (e.g. Arbitrum, Base, Optimism, Cosmos app-chains) and collateral types as your processes mature.

Introduce synthetic assets and RWAs where they add real diversification: FX hedges for EUR-based treasuries, synthetic gold, or tokenized Treasuries.

Example evolution paths

US advanced retail trader (Austin/New York)

Start

BTC/ETH perps on a US-friendly CEX; small positions on a major L2 perps DEX.

Later

multi-chain perps plus selected synthetic indices or volatility tokens.

London prop desk

Start

CME, Cboe and regulated crypto perps; DeFi tracking only.

Later

Controlled allocation to MiCA-aligned perps DEXs via an offshore entity, cross-chain funding in USD/EUR, synthetic ETFs for basis trades.

Berlin-based DAO treasury

Start.

Spot blue chips, staking and simple DeFi.

Later.

Modest hedging perps on EU-accessible perps DEXs, synthetic EUR/USD for FX risk, green-bond RWAs for yield.

How your product or team fits into the cross-chain crypto derivatives stack

Whether you’re a wallet, DEX, infra platform, analytics vendor or compliance tool, there’s a clear position for you as the “control center” for cross-chain perps and synths:

Wallets and neo-brokers can become one-stop interfaces for cross-chain collateral, trades and reporting.

Infra providers can be the plumbing layer secure messaging, observability, governance and key management.

Analytics and BI teams can provide real-time risk dashboards for traders and treasuries.

Compliance tools can monitor cross-chain flows vs KYC data, MiCA/FCA rules and internal policies.

If you’re planning to build in this space, Mak It Solutions can help with cloud-native architecture, mobile app UX, and real-time analytics for your derivatives stack see our and pages for how we typically work with fintech and crypto teams.

FAQs

Q : Can I trade cross-chain crypto derivatives directly from a US, UK or EU bank account?

A : In most cases you don’t trade directly “from” a bank account, even if you live in the US, UK or EU. Instead, you move funds from your bank via card, ACH, SEPA or Faster Payments into a CEX or regulated on-ramp, then into a wallet that connects to perps DEXs or synthetic protocols. Some MiCA-ready EU platforms and UK-regulated fintechs offer “one-click” flows that feel like direct bank-to-derivatives access, but under the hood there’s always a compliant custody and KYC layer. Always check whether a venue explicitly supports your jurisdiction and whether you’re treated as a retail, professional or institutional client.

Q : How do cross-chain perp DEXs handle liquidations during extreme market volatility?

A : Cross-chain perp DEXs typically define liquidation thresholds and penalties in their smart contracts and enforce them based on oracle prices. When markets move quickly, bots or keepers monitor positions and submit liquidation transactions once the account’s margin ratio falls below the requirement. On top of this, many platforms maintain insurance or risk funds to cover bad debt if liquidations can’t keep up. In extreme volatility, protocols may temporarily widen spreads, change risk parameters, or halt certain markets. The key for traders is to understand each protocol’s liquidation rules, oracle setup and emergency governance powers before using high leverage.

Q : What are the tax implications of trading DeFi synthetic assets and perps in the US, UK and Germany?

A : Tax treatment is highly jurisdiction-specific, but a few patterns are common. In the US, the IRS generally treats realized PnL and funding payments as taxable events, broadly similar to other derivatives or property transactions, with potential differences for professional traders. In the UK, HMRC usually taxes crypto trading profits as capital gains or income depending on your activity level and structure. In Germany, certain long-term spot holdings can be tax-advantaged, but frequent derivatives or synthetics trading tends to be taxable as ongoing income or gains. You should always confirm your exact obligations with a qualified tax professional familiar with digital assets in your jurisdiction.

Q : How do I choose between a centralized exchange and a cross-chain decentralized perpetual futures exchange?

A : Start by asking what matters most: UX, leverage limits and raw liquidity, or self-custody, transparency and composability. Centralized exchanges usually win on onboarding, fiat rails and depth, especially for BTC/ETH and major altcoin pairs. Cross-chain perps DEXs are more attractive if you want self-custody, programmable access (bots, smart contracts) and integrated DeFi strategies using the same collateral. Many advanced traders blend both: they use CEXs for large, short-duration trades, and DeFi derivatives protocols for structured strategies, synthetic exposure and hedging alongside other on-chain positions. Your regulatory profile (US, UK, EU) and firm policy will often be the deciding factors.

Q : What should a prop trading firm or DAO checklist look like before deploying capital to cross-chain crypto derivatives?

A : A serious prop desk or DAO will treat cross-chain derivatives as a new asset class with its own risk policy. That means vetting legal and regulatory exposure in the US, UK and EU; selecting jurisdictions and entities through which to trade; performing smart contract and bridge due diligence; and defining strict limits by venue, asset and leverage. Operationally, you’ll need processes for key management, multi-sig governance, KYC/AML compliance where applicable, and independent reconciliation and PnL reporting. Many firms also insist on SOC 2 reports, robust APIs, and clear incident-response playbooks from any platform they allocate to, especially when running leveraged strategies or using RWAs as collateral.

Key Takeaways

Cross-chain crypto derivatives let you post collateral on one chain while trading and settling perps and synthetic assets on others, using bridges and messaging layers for state sync.

Perps DEXs are gaining share but CEXs still dominate overall crypto derivatives volume; DEXs win on self-custody and composability, CEXs on liquidity and onboarding.

Infrastructure choices LayerZero, Axelar, Wormhole, L2s and app-chains directly affect latency, liquidation safety and UX for cross-chain margining.

Synthetic assets and RWAs add spot-like exposure to stocks, FX and commodities, but bring new oracle, collateral and regulatory risks, especially under MiCA, FCA rules and US SEC/CFTC oversight.

Risk management is non-negotiable: bridge exploits, oracle issues and leverage mis-use can wipe out accounts; institutions and serious individuals implement strict limits and governance.

Evaluation checklists differ by persona: traders focus on fees, liquidity and availability; firms and DAOs add legal, compliance, data and reporting requirements; builders care about APIs, SLAs and governance.

If you’re exploring cross-chain crypto derivatives whether as a trader, prop desk or builder you don’t need to navigate the infra and risk alone. Mak It Solutions helps teams design cloud-native architectures, analytics stacks and user experiences tailored to derivatives and DeFi.

Ready to move from whiteboard to production? Book a consultation with our team, request a scoped estimate, or share your current stack so we can help you design a safer, more scalable cross-chain derivatives platform. ( Click Here’s )