Covered calls and ETFs: why bitcoin volatility fell in 2025

Bitcoin implied volatility in 2025 reflected a clear shift toward institutional maturity. Throughout the year, major market participants including spot bitcoin ETF managers and corporate treasuries increasingly relied on structured options activity to manage exposure. These players regularly sold covered calls to capture premium during rallies, effectively monetizing upside in a disciplined way. At the same time, they used protective puts to guard against deeper drawdowns, creating a more balanced and predictable flow across the options market.

This steady stream of institutional hedging and premium-selling introduced consistent options supply, which gradually pressured short-term volatility gauges. As a result, widely followed indicators such as Deribit’s DVOL and Volmex’s BVIV trended lower, highlighting a calmer market environment. The year ultimately underscored how institutional participation is reshaping bitcoin’s volatility dynamics.

BTC options in 2025: less drama, more yield

Both DVOL and BVIV began 2025 near ~70% IV and ended close to ~45%, with a trough around ~35% in September. Options desks point to systematic call overwriting on top of spot/ETF holdings as the main supply source dampening premiums. Definitions and methodology for these indices confirm they proxy 30-day expected volatility, comparable to equity-market VIX-style gauges. Coindesk+2Deribit Insights+2

“We definitely saw a structural decline in BTC implied vol as more institutional money came in and was happy to harvest yield by selling upside calls,” said Imran Lakha of Options Insights.

Bitcoin implied volatility 2025 and the rise of put skew

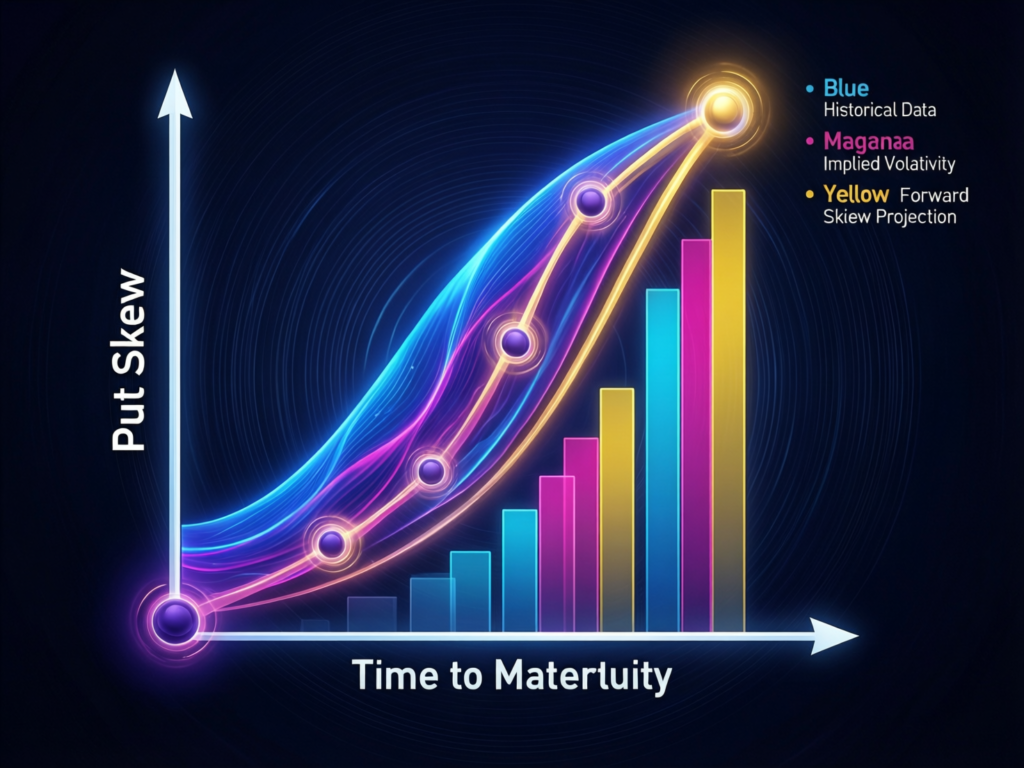

For most of the year, bitcoin implied volatility 2025 featured a persistent put premium (negative call skew) across expiries an institutional footprint consistent with “long-and-hedged” positioning rather than outright bearishness. This reversed prior years when longer-dated calls often carried a bullish skew.

Covered-call strategies went mainstream

The flow wasn’t just OTC: 2025 saw covered-call bitcoin ETFs including income-oriented productsbring the overwrite trade into traditional wrappers. That broadened access for yield-seeking investors and likely reinforced the supply of calls that suppressed IV through the year.

Jake Ostrovskis of Wintermute noted that more than 12.5% of mined BTC sits in ETFs and treasuries, where native yield is zero making overwriting a natural income lever and a structural source of IV pressure.

Trading and risk management in the bitcoin implied volatility 2025 environment

Lower implieds changed behavior: carry strategies (e.g., short vol/covered calls) looked attractive in range-bound tapes, while timing mattered around macro catalysts where IV briefly re-inflated before mean-reverting. Methodology resources from DVOL and BVIV clarify how these indices aggregate option smiles into a single 30-day gauge.

Context & Analysis

Some episodes (e.g., early October) saw IV pop on seasonal/catalyst risk before retracing—consistent with a market where structural call supply meets episodic demand for protection. Regulatory tweaks around ETF options limits were also flagged as potential longer-term IV dampeners by market researchers.

Bottom Lines

By late 2025, bitcoin’s price behavior had clearly shifted toward a more institutional profile fewer sharp swings and a stronger emphasis on steady carry. With overwriting strategies firmly integrated into ETF mandates and corporate treasury playbooks, upside call supply remained consistent. At the same time, hedgers were still willing to pay a premium for puts, creating a balanced options flow through year-end.

These factors kept implied volatility anchored in the mid-40% range throughout December. Whether this relative calm continues will depend on the broader macro backdrop and any surge in spot demand strong enough to outweigh the growing wall of options-driven supply.

FAQs

Q : Why did bitcoin volatility fall in 2025?

A : Institutional covered-call selling and broader hedging flows supplied options, compressing implied volatility.

Q : What is DVOL/BVIV?

A : DVOL (Deribit) and BVIV (Volmex) estimate 30-day implied volatility from BTC options, similar to a crypto-market VIX.

Q : Did the launch of covered-call bitcoin ETFs matter?

A : Yes. Income-focused bitcoin ETFs formalized call-overwriting for traditional investors.

Q : Is put skew bearish?

A : Not necessarily it often reflects long positions hedged with protective puts, common in institutional portfolios.

Q : Where did bitcoin implied volatility 2025 end the year?

A : Near the mid-40% range on DVOL/BVIV, after touching mid-30% lows in September.

Q : How can investors seek yield without selling BTC?

A : Some use covered-call ETFs or write OTM calls against ETF units, though risks include capped upside and assignment.

Q : Does lower IV mean lower risk?

A : It signals cheaper options and calmer expectations, but major shocks can still reprice volatility quickly.

Facts

Event

Institutional overwriting and hedging compressed BTC’s 30-day implied volatility in 2025Date/Time

2025-12-31T11:39:00+05:00Entities

: Bitcoin (BTC); Deribit (DVOL); Volmex (BVIV); Options Insights (Imran Lakha); Wintermute (Jake Ostrovskis); spot bitcoin ETFsFigures

~70% → ~45% 30-day IV (lows ~35% in Sep); >12.5% of mined BTC in ETFs/treasuries (commentary)Quotes

“We… saw a structural decline in BTC implied vol… selling upside calls.” Imran Lakha | “Call overwriting… driving steady pressure on IV from the supply side.” Jake Ostrovskis CoindeskSources

CoinDesk report; DVOL/BVIV index pages (see below). Coindesk+2Deribit Insights+2