Confidential Smart Contracts: The 2025 Guide for Private dApps

Confidential smart contracts are smart contracts where inputs, state and sometimes logic are kept private while still being verifiable on-chain through cryptography and secure hardware. They let you build private dApps that satisfy regulators and enterprise security teams without giving up the benefits of public blockchains.

Introduction

If you’ve ever tried to pitch a DeFi or healthcare dApp to a bank CISO or hospital privacy officer, you’ve probably hit the same wall: “Everything is public on-chain – we can’t do that.” Confidential smart contracts exist to break that deadlock.

Instead of broadcasting every trade, medical record, or supply chain event in plaintext, confidential smart contracts keep sensitive data encrypted while still proving that the rules were followed. For teams in New York, London, Berlin or Zurich who must comply with GDPR, HIPAA, MiCA or PCI DSS, they’re becoming the only realistic way to bring Web3 into regulated environments.

In this guide, we’ll unpack what confidential smart contracts are, how technologies like zero-knowledge proofs (ZK), trusted execution environments (TEEs), FHE and MPC fit together, and how to architect GDPR-, SOC2- and MiCA-ready private dApps that can actually make it to production.

What Are Confidential Smart Contracts?

Confidential smart contracts are smart contracts that preserve privacy by keeping inputs, state and/or business logic hidden while still providing cryptographic proofs that the contract executed correctly. In contrast, traditional Web3 contracts on Ethereum or other public chains expose almost everything to everyone by default.

At a high level, a confidential smart contract typically:

Encrypts user inputs and sometimes contract state

Executes computation inside a ZK circuit or a trusted execution environment (TEE)

Publishes a proof (or attestation) that the correct rules ran on valid data

Exposes only the minimum metadata needed for consensus, compliance and analytics

This lets you build zero-knowledge smart contracts and trusted execution environment (TEE) smart contracts that behave like normal DeFi or dApp logic – only without leaking sensitive information.

Confidential vs. Traditional Smart Contracts

Traditional smart contracts (like most Ethereum mainnet contracts) are transparent by design:

Inputs, state and events are all written to a public ledger

Anyone can replay the state transitions

Privacy is limited to techniques like pseudonymous addresses or crude obfuscation

Confidential smart contracts flip that model:

Inputs and sometimes state are encrypted or processed inside TEEs

Only proofs or commitments are stored on-chain

Auditors, regulators or counterparties can see evidence of correctness without seeing raw data

For example, a confidential lending protocol can prove a borrower meets KYC and credit criteria via a zero-knowledge proof, instead of storing their identity and credit score on-chain.

Why Transparency Breaks for Finance, Healthcare & Enterprise

Radical transparency is great for open DeFi experiments but completely breaks in regulated sectors:

Finance (US/EU)

Banks and broker-dealers must protect client order flow, PII and trade positions under rules enforced by the SEC, CFTC, FCA and BaFin. Exposing all flows on a public mempool can leak trading strategies and invite frontrunning.

Healthcare

HIPAA and similar laws in Europe strictly govern how protected health information (PHI) is stored and shared. Recent ransomware waves have already pushed regulators to tighten security expectations for ePHI.

Enterprise & public sector

Large manufacturers, logistics providers and tax/public service agencies cannot put supplier prices, payroll, or citizen data directly on a transparent chain.

At the same time, regulators increasingly expect stronger technical controls. For instance, US proposals to update the HIPAA Security Rule emphasize encryption, multifactor authentication and better risk assessments in response to large healthcare breaches affecting tens of millions of patients.

Confidential smart contracts create a middle path: you keep the auditability and composability of Web3 while meeting privacy and risk requirements.

Key Benefits for Teams in the US, UK, Germany & EU

For teams in heavily regulated markets, the benefits are very tangible.

US (New York, San Francisco, Austin)

Build confidential DeFi protocols for Tier 1 banks, ACH/real-time payment rails, or tokenized deposits that can satisfy expectations from the SEC, OCC, CFPB and state regulators.

UK (London, Manchester)

Implement confidential smart contracts for Open Banking APIs, FCA-regulated fintechs and NHS pilots that align with UK-GDPR and NHS data-sharing rules.

Germany & EU (Berlin, Frankfurt, Amsterdam, Paris, Dublin)

Design DSGVO-compliant confidential smart contracts that respect data residency, and MiCA-ready private dApps for crypto-asset service providers supervised by BaFin, ESMA, EBA and local data-protection authorities.

As global blockchain market value grows from roughly tens of billions of dollars in 2024 toward hundreds of billions by the early 2030s, regulated use cases are expected to represent a large share of that growth.

Core Technologies Behind Confidential Smart Contracts

Confidential smart contracts use cryptography (zk, FHE, MPC) and secure hardware (TEEs) so nodes can verify execution without exposing sensitive data. In practice, most production architectures mix multiple primitives depending on the threat model, latency and regulatory constraints.

Zero-Knowledge Proofs and zk-SNARKs for Private dApps

Zero-knowledge proofs let one party prove a statement is true (e.g., “this transaction is valid”, “this user passed KYC”) without revealing the underlying data. zk-SNARKs and zk-STARKs are popular constructions used in many zero-knowledge smart contracts.

Common patterns for private dApps

Private balances & transfers

Users hold encrypted notes or UTXOs; the contract verifies spends with zk proofs (e.g., Aztec-style confidential transfers).

Anonymous credentials & identity

Prove you are over 18, a resident of an EU country, or a bank customer without revealing who you are.

Confidential DeFi logic

Validate leverage limits, collateral ratios or credit scores using zero-knowledge smart contracts, so no one sees raw risk models.

The trade-off: zk systems provide strong, trust-minimised privacy but can be heavy on prover time and gas costs, especially for complex circuits on L1. That’s why many teams push zk computation into rollups or off-chain provers.

TEEs, FHE and MPC: When to Use Which Privacy Primitive

Different privacy primitives shine in different contexts:

Trusted Execution Environments (TEEs)

Examples: Intel SGX, AMD SEV, AWS Nitro Enclaves.

Code and data run inside a hardware-isolated enclave; you get attestations that the expected code ran.

Great for high-throughput workloads, low latency and complex logic (e.g., risk engines, pricing models).

Used in confidential EVM runtimes such as Oasis Sapphire.

Multi-Party Computation (MPC)

Multiple parties jointly compute a function over their inputs, without revealing those inputs to each other.

Strong choice for key management (MPC custodians), cross-institution analytics or auctions.

Fully Homomorphic Encryption (FHE)

Allows arbitrary computation on encrypted data without decryption.

Today, still expensive and used mainly in niche, high-sensitivity workloads (e.g., privacy-preserving ML across hospitals).

In practice

Use TEEs for most enterprise “lift-and-shift” Web2 → Web3 workloads where hardware trust is acceptable.

Use zk-SNARKs/STARKs for censorship-resistant, trust-minimised DeFi and identity protocols.

Use MPC for distributed key management and cross-organisation analytics.

Use FHE when regulators or threat models absolutely forbid data decryption, even in secure enclaves, and you can live with higher costs.

On-Chain Privacy-Preserving Computation & Programmable Privacy

On-chain privacy-preserving computation is the ability to compute on encrypted or shielded data while still using a public blockchain for settlement and consensus. Programmable privacy for Web3 goes a step further: you can decide what is private vs public, who can see what, and when data can be revealed.

Modern privacy L1/L2s increasingly offer.

Fine-grained programmable privacy

Developers choose per-function or per-field which data is public, shielded or selectively disclosed.

Hybrid execution models

Some logic runs in TEEs, some in zk circuits, some publicly.

View keys & regulated disclosure

Allow auditors, regulators or partners to decrypt specific data under policy while keeping everyone else blind.

This is the foundation for building confidential DeFi protocols, HIPAA-compliant private dApps and enterprise data rooms on shared infrastructure instead of siloed, duplicated databases.

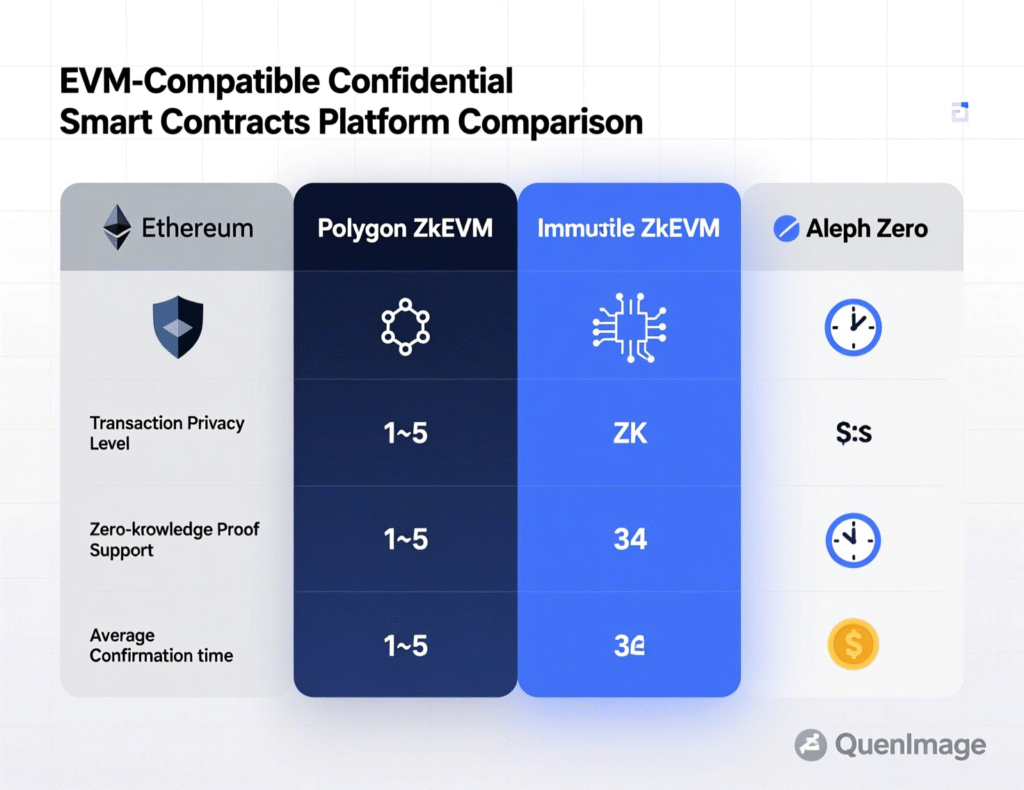

EVM-Compatible Confidential Smart Contracts and Leading Platforms

Most developers start with EVM-compatible confidential smart contracts on networks like Oasis, Aleo or Aztec to reuse Solidity tools while adding strong privacy. In practice, your platform choice will influence your threat model, transaction costs, and how easily you can integrate with existing Web3 ecosystems.

Oasis Sapphire, Aztec, Aleo, Dusk & Other Privacy L1/L2s

A few leading ecosystems to watch.

Oasis Network Sapphire ParaTime (Confidential EVM):

Fully EVM-compatible confidential runtime where smart contracts run inside TEEs.

Supports “smart privacy” contracts can be 100% confidential, 100% public or mixed.

Attractive for enterprise and DeFi teams who want Solidity plus TEEs on a production chain.

Aleo

L1 built around zero-knowledge by design; developers write private applications using the Leo language and zero-knowledge smart contracts.

Targets private payments and applications where compliance and privacy can co-exist.

Aztec Network

Privacy-first zkRollup on Ethereum.

Provides programmable privacy with a custom VM, enabling private state and composable private/public functions.

Dusk Network

Privacy blockchain focused on compliant security tokens and institutional finance.

Uses zero-knowledge cryptography to blend confidentiality with regulatory reporting.

For US and UK banks that want Ethereum adjacency, Aztec and Oasis Sapphire often feel closest to their existing ecosystems. In Germany and broader EU, Dusk and permissions built on top of these networks can align more naturally with MiCA and local securities rules.

Designing EVM-Compatible Confidential Smart Contracts

When designing EVM-compatible confidential smart contracts, treat privacy as a first-class design dimension:

Model your privacy domains

Which data is user-private (e.g., medical details), counterparty-private (e.g., RFQs), consortium-private (e.g., supply chain prices), or public?

Map to privacy mechanisms

User-private → encrypted inputs + zk proofs or enclave execution

Counterparty-private → sealed bid auctions via MPC or TEEs

Consortium-private → permissioned or semi-permissioned privacy L2s

Reuse familiar tooling

Most confidential EVMs still support Solidity, Truffle/Hardhat foundry workflows, and standard audit practices, so your DevSecOps story can align with existing pipelines.

For example, a New York-based fintech could deploy a confidential DeFi credit line contract on Sapphire that:

Executes loan pricing logic in a TEE,

Publishes zk proofs of risk constraints, and

Exposes only aggregate utilization metrics publicly.

Running on AWS, Azure & Hybrid Architectures for Enterprise

Enterprise teams rarely move “all on-chain”. Instead, they create a hybrid stack:

Cloud infrastructure:

Confidential nodes and relayers run on AWS or Azure with hardened Kubernetes clusters, private subnets and HSMs or KMS for keys.

HashiCorp Vault integrates with both to centralize secrets and support MPC or threshold signing.

On-prem & regulated hosting:

For German banks supervised by BaFin, nodes may run in German data centers with EU-only regions to satisfy data residency expectations.

UK NHS pilots may require NHS-approved cloud environments and strict DPIAs.

A common pattern: privacy L1/L2 nodes run in the cloud, while sensitive off-chain data stores and analytics live in VPCs or on-prem, syncing via privacy-preserving bridges. SOC2 controls can document this separation-of-duties model.

DeFi, Healthcare and Enterprise Use Cases

Private dApps keep user data, trade flows and business logic encrypted while still providing auditable proofs for regulators and partners. Regulated enterprises need confidential smart contracts because transparent Web3 cannot safely carry card data, PHI or sensitive trade flows, but regulators still expect traceability and control.

Confidential DeFi Protocols for Banks and Fintechs

For banks and fintechs, confidential DeFi protocols allow:

Private order books and RFQs, with post-trade settlement proofs

Shielded lending and collateralization where positions are confidential but solvency is provable

On-chain payment rails that preserve PCI DSS requirements by keeping primary account numbers (PANs) and sensitive auth data off-chain or strongly tokenized

In New York or London, a Tier 1 bank might deploy a confidential liquidity pool where institutional orders are encrypted, but the protocol publishes zk proofs that all trades clear within pre-agreed risk parameters. In Frankfurt, a bank could issue tokenized bonds on a privacy L2 compliant with MiCA, exposing required disclosures to BaFin and ESMA while keeping detailed investor data shielded.

Privacy-Preserving Healthcare dApps (HIPAA, NHS, EU Health Data)

Healthcare is under intense cyber pressure; some reports show a several-hundred-percent increase in ransomware attacks on providers in recent years, including incidents affecting more than 100 million patient records.

Confidential smart contracts can help:

US (HIPAA)

Store PHI off-chain in encrypted data lakes.

Use HIPAA-compliant private dApps to manage consent, access logs and data sharing via on-chain proofs rather than raw records.

UK (NHS/NHSX)

Pilot privacy-preserving dApps for referrals, waiting list management or controlled research data sharing where NHS trusts retain custody but share verifiable proofs.

EU national health systems

Use DSGVO-aligned architectures where all personal data lives inside EU regions, while a public or consortium chain provides proofs of access, consent and anonymised statistics.

B2B & Supply Chain dApps for Sensitive Enterprise Data

In manufacturing, logistics and cross-border trade, confidential smart contracts enable:

Private price discovery between suppliers and OEMs while sharing zk proofs of volume discounts or ESG metrics

Cross-border data rooms where customs, insurers and banks can verify shipment status without seeing every commercial detail

Shared ledgers between competitors that show only aggregated or differentially private metrics

An automotive OEM in Munich might collaborate with parts suppliers via a confidential supply chain dApp that publishes proofs of origin and CO₂ footprints to regulators while keeping per-unit pricing confidential.

Compliance, Regulation and Data Protection for Confidential Smart Contracts

Compliance-focused confidential smart contracts keep personal data off-chain or encrypted, expose only proofs and metadata, and align with GDPR/MiCA, HIPAA and PCI DSS via strict data minimisation and access controls. Regulated enterprises prefer them because they make it easier to document how privacy-by-design principles are technically enforced.

GDPR, UK-GDPR, DSGVO and MiCA for European Private dApps

Under GDPR, UK-GDPR and German DSGVO, controllers must minimise personal data, secure it appropriately and only process it with a lawful basis. For MiCA, EU CASPs must follow detailed rules for governance, transparency and safeguarding client assets.

Confidential smart contracts help by.

Keeping PII off-chain in EU/UK data centers, storing only hashes, commitments or pseudonymous identifiers on-chain

Using privacy-preserving computation so data processing follows purpose-limitation and minimisation principles

Allowing selective disclosure to regulators like BaFin, ESMA or the FCA via view keys or special audit circuits

For example, a Berlin-based MiCA-regulated crypto-asset service provider can implement a private dApp where KYC results are hashed and proved via zk, but raw documents never touch a public ledger.

HIPAA, PCI DSS, SOC2 and SEC/FCA/BaFin Expectations

Regulators increasingly expect concrete technical safeguards, not just policies.

HIPAA

Requires safeguards for PHI confidentiality, integrity and availability; recent proposals push for stronger cybersecurity, including encryption and MFA.

PCI DSS

Demands strict controls around cardholder data, with updated standards (v4.0) emphasising continuous testing and risk-based approaches.

SOC2

Focuses on security, availability, processing integrity, confidentiality and privacy for SaaS and service providers.

Confidential smart contracts can be framed as:

A technical measure for encryption in transit and at rest

A way to limit access to least privilege while still enabling multi-party workflows

A transparent but privacy-preserving audit log for regulators like the SEC, FCA or BaFin

Reconciling Right-to-Erasure, AML/KYC and Immutable Ledgers

The “right to be forgotten” appears to conflict with immutable ledgers. Design patterns to reconcile this include:

Off-chain storage + on-chain pointers

Delete or anonymise off-chain records while leaving non-identifying hashes on-chain.

Key revocation

Encrypt data with per-user keys; deleting the key renders data practically inaccessible, implementing functional erasure.

Tokenization of identity

Store revocable credentials or pseudonymous identifiers that can be invalidated without rewriting chain history.

For AML/KYC, you can still store proofs that screening was performed (e.g., against sanction lists) without publishing personal identities. Regulators get evidence; counterparties and the public do not.

Architecture Patterns for SOC2- and MiCA-Ready Confidential Smart Contracts

A typical confidential smart contract architecture combines a privacy L1/L2, off-chain key management, audited smart contracts, and regional data residency controls. From a governance perspective, this maps nicely onto SOC2 and MiCA obligations.

Reference Architecture for US Banks and Fintechs

For confidential smart contracts for US banks and fintechs, a reference stack might look like.

Settlement layer

Ethereum mainnet or a permissioned chain.

Privacy layer

Oasis Sapphire or a zkRollup handling confidential execution.

Off-chain services

Risk engines, KYC providers, fraud detection running in TEEs or hardened Kubernetes clusters on AWS.

Key management

HSMs, cloud KMS and/or MPC wallets for signing and encryption keys.

Controls

SOC2-aligned logging, segregation of duties, continuous monitoring, mapped directly into internal GRC tools.

In New York or San Francisco, you might also integrate with FedNow/ACH rails via traditional banking APIs, using confidential smart contracts purely for internal market infrastructure and tokenization.

Patterns for UK Open Banking, FCA and NHS Use Cases

In the UK, two patterns stand out

Open Banking / PSD2

Use confidential smart contracts to orchestrate payments initiation, consent management and fee splitting without exposing user PII or account numbers on-chain.

Expose only what’s needed for FCA supervisors or partner banks via view keys and audit dashboards.

NHS & public sector pilots:

Store medical data within NHS-approved environments; track consent, research access and federated analytics via private dApps on a privacy L2.

In London, for example, a fintech could build confidential smart contracts for UK Open Banking APIs that reconcile payments between banks, PSPs and merchants while satisfying UK-GDPR and FCA operational resilience expectations.

Designs for BaFin-Regulated German Banks and EU CASPs

For German banks and EU CASPs.

Deploy privacy L1/L2 nodes in German or EU-only cloud regions to respect data residency.

Use DSGVO-compatible pseudonymisation, ensuring that only regulated entities can reverse pseudonyms via separately controlled mapping tables.

Architect MiCA-ready private dApps that handle custody, token issuance and order matching with clear segregation between public transparency and confidential client data.

A Frankfurt-based bank might run Dusk Network nodes plus an internal Oasis Sapphire deployment, using one for token issuance and the other for complex confidential workflows under BaFin oversight.

How Developers Choose Between ZK, TEEs and FHE for Private dApps

Use TEEs for high-throughput enterprise workloads, zk-SNARKs for trust-minimised DeFi and identity, and FHE for niche cases where encrypted computation is crucial despite performance costs. Ultimately, the choice depends on your threat model, performance constraints and compliance story.

Threat Models and Performance Considerations

When choosing primitives, start with.

Who do you distrust?

Cloud providers? Validators? Other consortium members? End users?

What can go wrong?

Side-channel attacks, hardware backdoors, key theft, collusion?

What are your latency & throughput requirements?

Millisecond trading vs batch analytics.

Rules of thumb

TEEs offer near-Web2 performance but assume you trust hardware vendors and can monitor for side-channel vulnerabilities.

ZK systems reduce trust in hardware and operators but add prover overhead and more complex circuit design.

FHE keeps keys fully client-side and allows rich computation on ciphertexts, at the cost of high computational overhead currently best for narrow, high-value flows.

Developer Experience: Languages, Tooling and DevOps

Developer experience matters.

Languages

Solidity (Oasis Sapphire, some L2s), Leo (Aleo), Rust (many privacy chains), custom DSLs for circuits.

Tooling

Familiar tools like Hardhat, Foundry and Truffle for EVM; chain-specific CLIs and circuit compilers for zk.

DevOps

CI/CD pipelines that run zk proof generation tests, enclave attestation checks and security scanning; observability stacks that respect privacy by logging only metadata.

In practice, many teams prototype with EVM-compatible confidential contracts, then consider more advanced zk or FHE only where absolutely required.

Oasis vs Aleo vs Aztec vs Dusk

When comparing Oasis vs Aleo vs Aztec vs Dusk for private dApps in the US, UK and EU:

Oasis Sapphire

Best when you want Solidity, confidential EVM and TEEs; strong enterprise and AI/Web3 crossover story.

Aleo

Best when you’re comfortable with a new language (Leo) and want end-to-end zk privacy at L1.

Aztec

Best for Ethereum-aligned DeFi and programmable privacy with a zkRollup model; ideal for London or New York-based DeFi teams.

Dusk Network

Best for securities and institutional finance in Europe, including security token markets compliant with EU rules.

Your stack might use more than one: a US fintech could use Aztec for DeFi rails and Oasis for confidential business logic involving US-only customer data.

Roadmap for Shipping Your First Confidential Smart Contract

Start by mapping sensitive data and regulators, pick an EVM-compatible privacy L1/L2, build a small PoC with real compliance constraints, then harden it with audits, monitoring and legal review. Don’t try to “boil the ocean” with a massive multi-year program; ship one concrete, compliant private dApp first.

Scoping Use Cases and Regulatory Requirements

Begin with a discovery sprint:

Identify data classes

PII, PHI, card data, trade secrets, model IP.

Map regulators & frameworks

SEC/CFTC/OCC/CFPB, FCA, BaFin, local DPAs, GDPR/UK-GDPR/DSGVO, HIPAA, PCI DSS, SOC2.

Choose a narrow use case

E.g., confidential settlement, anonymised research data sharing, private RFQ workflows.

Teams often find that 80–90% of their desired on-chain data can actually live off-chain, with only proofs and metadata on-chain. [VERIFY LIVE]

Proof-of-Concept to Production in US, UK and EU Markets

Then, move along a staged path

PoC

Internal network or testnet; mocked or synthetic data; focus on proving end-to-end flow works with confidential smart contracts.

Pilot / sandbox

Work with a bank, insurer or hospital sandbox (FCA sandbox, BaFin innovation hub, US bank innovation programs) to test with real but constrained data.

Production

Formal audits (smart contracts, TEEs, infrastructure).

Threat modelling and privacy impact assessments.

Governance and incident response playbooks.

For example, an NHS-adjacent startup in London might run a private dApp pilot with one trust, using Oasis Sapphire or Aztec for privacy and conducting a DPIA plus NHS security review before going wider.

Build vs. Partner

Finally, decide whether to build in-house or partner:

Build in-house if you already have cryptography talent, smart contract engineers and a mature DevSecOps team.

Partner with a specialist vendor (platform or consulting partner like Mak It Solutions) if you:

Need to accelerate time-to-market

Lack deep ZK/TEE/FHE expertise

Want a pre-vetted reference architecture and compliance documentation

Mak It Solutions can help you design and ship confidential smart contracts across DeFi, healthcare and enterprise stacks, integrating with your existing and investments, and aligning with and governance processes you already have in place.

FAQs

Q : Are confidential smart contracts legal under GDPR, UK-GDPR and DSGVO?

A : Yes, confidential smart contracts can be compatible with GDPR, UK-GDPR and DSGVO if they are designed around data minimisation and privacy-by-design principles. The key is to keep personal data off-chain or strongly pseudonymised, use encryption and access controls, and treat the chain mainly as a record of proofs and metadata. You still need a clear lawful basis, DPIAs and data-processing agreements with any nodes or infrastructure providers that qualify as processors or joint controllers. If you combine these with regional hosting (EU/UK data centers) and transparent governance, privacy regulators are much more likely to view confidential smart contracts as an enhancement rather than a risk.

Q : Can confidential DeFi protocols still meet AML and KYC requirements for banks?

A : Confidential DeFi protocols can support AML and KYC by separating identity verification from on-chain activity. Typically, customer identity checks happen off-chain via regulated KYC providers or bank processes, and the confidential smart contract only receives a signed credential or zk proof that checks passed. The protocol can enforce screening rules and transaction limits based on those proofs without ever publishing PII on a public ledger. Regulators and banks can still access detailed audit trails under appropriate legal processes, while the broader market only sees anonymised, aggregate data. This approach aligns with how many AML programs already use tokenization and reference IDs instead of raw identities.

Q : How do confidential smart contracts handle the “right to be forgotten”?

A : Confidential smart contracts usually address the “right to be forgotten” through a mix of off-chain storage and cryptographic erasure. Instead of storing raw personal data on-chain, you store it in encrypted off-chain systems and keep only hashes or commitments on-chain. When a user exercises their erasure rights, you delete or anonymise the off-chain records and, if needed, destroy the encryption keys so any remaining ciphertext becomes practically unusable. While the on-chain record remains immutable, it no longer points to identifiable data, which is often sufficient to satisfy GDPR and similar laws when combined with proper governance and documentation.

Q : What are the main performance trade-offs of using zk-based smart contracts for private dApps?

A : zk-based smart contracts introduce overhead in proof generation and verification compared to transparent contracts. Complex circuits, like full financial risk models or large machine-learning workloads, can be expensive to prove and may require batching or off-chain provers. Gas costs can increase, especially on L1 chains, although zkRollups, specialised hardware and protocol optimisations continue to narrow the gap. In return, you get strong trust-minimisation and privacy without relying on hardware trust or central operators. For many DeFi and identity use cases, developers accept slightly higher latency or gas in exchange for these security properties, especially when most user interaction happens on a fast L2.

Q : Do I need a separate permissioned blockchain, or can I build compliant private dApps on public networks?

A : You don’t always need a separate permissioned chain. Many teams successfully build compliant private dApps on public networks by using privacy L2s, confidential EVMs and strict off-chain governance. Public or shared infrastructure lets you tap into existing liquidity, tooling and security while still keeping sensitive data encrypted and region-bound. However, highly sensitive environments (e.g., central bank infrastructure, defence, certain health systems) may still prefer permissioned or consortium networks for additional operational control. In practice, a hybrid approach is common: a consortium or enterprise privacy L2 anchored to a widely-trusted public L1 for final settlement and censorship resistance.

Key Takeaways

Confidential smart contracts keep inputs and state private while still providing verifiable proofs, enabling regulated DeFi, healthcare and enterprise dApps.

ZK, TEEs, MPC and FHE each address different threat models; most real systems mix them depending on performance and trust requirements.

EVM-compatible confidential platforms such as Oasis Sapphire, Aztec, Aleo and Dusk let teams reuse Solidity and Web3 tooling while gaining programmable privacy.

GDPR/UK-GDPR/DSGVO, MiCA, HIPAA, PCI DSS and SOC2 can all be supported with architectures that keep PII and PHI off-chain or encrypted, using on-chain proofs for auditability.

US, UK and EU institutions increasingly expect privacy-by-design, making confidential smart contracts a practical path to real-world Web3 adoption.

A pragmatic roadmap starts with mapping data and regulators, choosing a privacy L1/L2, running a narrow PoC, and hardening it through audits, monitoring and legal review.

If you’re exploring confidential smart contracts for a bank, hospital system, or enterprise platform in the US, UK or EU, this is the moment to move from slides to a working PoC. The underlying platforms, regulations and market demand have finally aligned.

Mak It Solutions can help you scope a realistic use case, select the right privacy stack (ZK, TEEs, MPC), and design a SOC2- and MiCA-ready architecture that your security and compliance teams can sign off on. Reach out to our team to discuss a scoped estimate or to plan a discovery workshop tailored to your sector and region. ( Click Here’s )