Community DAOs in 2025

Community DAOs are no longer experimental side projects. In 2025, they coordinate treasuries, fund public goods, steer protocol roadmaps, and even shape ecosystem incentives. In plain terms, a Community DAO is a member-owned organization that uses tokens (or NFTs) to vote on proposals, allocate capital, and enforce rules through smart contracts. What’s changed is scale and maturity: from mobile-friendly delegation workflows to modular on-chain governance frameworks and gasless off-chain voting, DAO tooling has moved decisively into production. That shift gives real leverage to token holders—if they can organize effectively.

This guide explains how Community DAOs work in 2025, which governance models are winning, the tools and metrics that matter, and a pragmatic playbook to launch and evolve your own DAO. We’ll reference widely used resources like Ethereum’s DAO primer, Snapshot for off-chain votes, and OpenZeppelin’s Governor for on-chain execution to keep things concrete.

What is a Community DAO (and why 2025 is different)

A Community DAO is a collectively owned network that coordinates via transparent rules encoded on a blockchain. Members propose, deliberate, and vote; successful proposals are executed automatically (on-chain) or ratified (off-chain) and then implemented. Ethereum’s definition emphasizes mission-driven, collectively owned organizations no CEO or CFO with unilateral control while acknowledging that practical governance choices vary.

The big difference in 2025: mature frameworks (e.g., OpenZeppelin Governor) and gasless voting (e.g., Snapshot) make participation easier, while large protocol DAOs have normalized treasury management and grants at scale. ethereum.org+2OpenZeppelin Docs+2

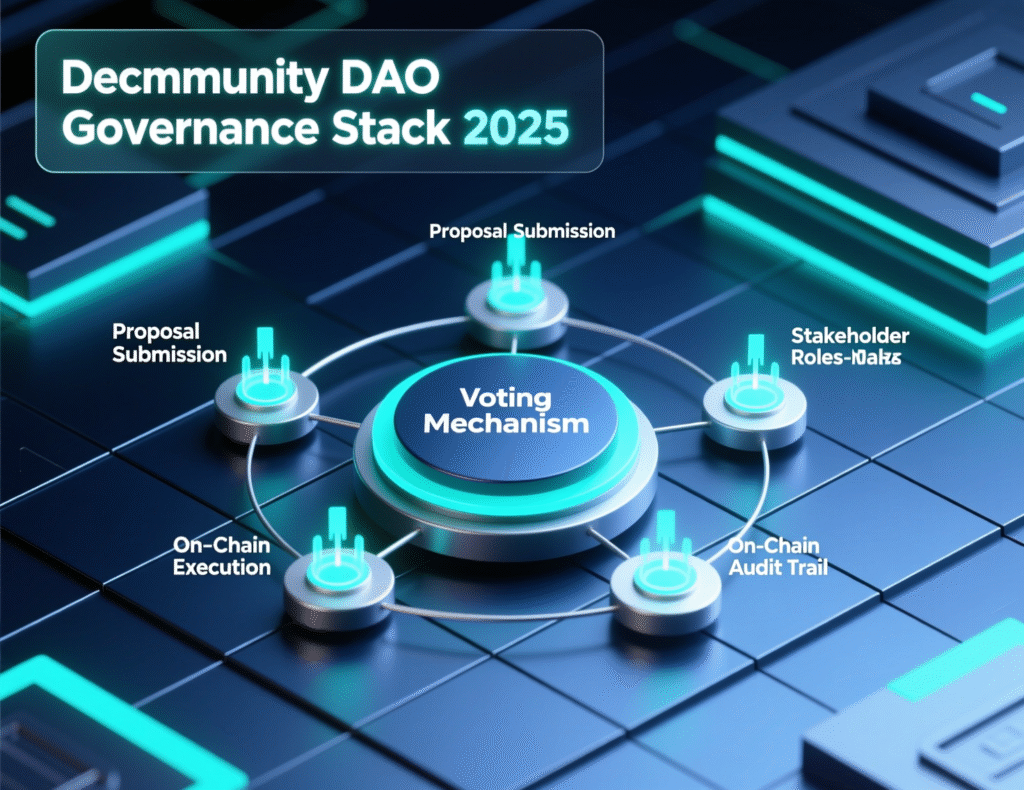

Core components of Community DAOs (2025 stack)

Membership & identity

Wallet-based membership via fungible tokens or NFTs; optional reputation or soul-bound badges.

Proposals & voting

Off-chain signaling (Snapshot) and on-chain execution (Governor) with configurable quorum, thresholds, and delays.

Delegation

Token holders delegate to active stewards for higher turnout and informed decisions.

Treasury & execution

Multisigs for operational safety; on-chain timelocks for proposal execution.

Governance process

Temperature check → formal proposal → vote → execution used across L1/L2 ecosystems (e.g., BNB Chain’s two-step flow).

On-chain vs. off-chain votes: the hybrid norm

Off-chain (Snapshot)

Gasless, fast, high accessibility; results are social consensus signals. GitHub shows Snapshot’s open-source client powering thousands of spaces.

On-chain (Governor)

Trust-minimized execution directly from the vote; parameters like quorum, voting delay, and vote type (simple/weighted) are modular. Latest docs (v5.x) formalize patterns learned since DeFi Summer.

2025 best practice

Use off-chain for signaling and lightweight grants; on-chain for parameter changes, emissions, and large transfers.

2025 governance patterns that actually work

Clear scopes and budgets

Create domain-specific working groups with capped budgets and renewal votes.

Active delegation markets

Encourage token holders to delegate to a diverse slate of stewards with public mandates.

Timelock + emergency brake

On-chain execution with a short delay and a credible pause mechanism.

Funding public goods with KPIs

Grants with milestones, clawbacks, and programmatic streaming.

Data-informed iteration

Run retrospectives every two or three quarters to tune quorum, thresholds, and delegation incentives.

Evidence matters

Academic work in 2025 highlights that DAOs relying only on off-chain voting may raise significantly less funding than on-chain counterparts, indicating that execution credibility affects capital formation. Hybrid designs close that gap.

Real-world examples (2025 snapshot)

Arbitrum DAO

Large L2 ecosystem DAO running continuous votes on Snapshot and on-chain execution for program allocations. Treasury updates and active proposals are posted publicly; as of late October 2025, the forum tracks ongoing votes and ETH allocations.

MakerDAO

After years of experiments, Maker’s Endgame restructuring underscores trade-offs between decentralization and coordination proof that design choices carry lasting consequences.

Tooling map for Community DAOs

Education & concepts

Ethereum.org (What is a DAO?)

Off-chain voting

Snapshot (gasless, customizable strategies)

On-chain execution

OpenZeppelin Governor (battle-tested modules; v5.x docs)

Governance frameworks

BNB Chain’s temp-check → final vote illustrates a clear two-stage pipeline.

Metrics that matter in 2025

Voter participation

% of supply voting; % delegated.

Proposal quality

Pass rate, time-to-decision, rework count.

Treasury health

Runway, diversification, and yield (vs. protocol risk).

Program impact

Milestone completion, KPI attainment, grants ROI.

Governance resilience

Concentration of voting power and “bus factor” of stewards.

Case study A: Grants DAO that scaled responsibly

A mid-cap protocol launched a Community DAO grants program with an initial $5M treasury slice. Using Snapshot for signaling and Governor for execution, they set milestone-based streaming (e.g., 20/40/40 disbursements) and published a delegate leaderboard. Within two quarters, participation rose from 7% to 18% and the pass rate stabilized near 60%, while clawback rules recovered ~8% of unspent funds. (Program structure inspired by common 2025 practices and tooling docs; verify specifics against your DAO’s data.)

Case study B: Ecosystem DAO with L2 incentives

An L2 ecosystem DAO allocated part of its treasury to liquidity incentives and public goods. Forum posts and weekly vote roundups kept token holders aligned, and a small treasury rebalancing into ETH stakers added low-touch yield. Clear scopes plus recurring delegate calls improved deliberation quality. (Example patterns reflected in Arbitrum DAO forum updates; adapt to your treasury policy.)

Risks & how to mitigate them

Voter apathy

Implement delegation, delegate incentives, and mobile voting touchpoints.

Power concentration

Cap program sizes; encourage delegate diversity; measure Gini/HHI of voting power.

Governance capture

Require supermajority for constitutional changes; use time-locks and multi-sig guardians.

Process bloat

Sunset committees; rotate stewards; adopt lean RFPs.

Legal ambiguity

Many jurisdictions still lack clear DAO statutes; Wyoming provides one (U.S.) model but do local counsel checks.

How to launch a Community DAO in 2025 (step-by-step)

Define mission & scope

1-2 sentences; list what the DAO does not do.

Choose token mechanics

ERC-20 governance token or NFT membership; decide supply, distribution, and delegation.

Select voting models

Start with Snapshot for temp-checks; use Governor for critical on-chain actions.

Codify a constitution

Quorum, thresholds, proposal lifecycle, steward mandates, and conflict-of-interest rules.

Bootstrap treasury

Seed with runway (stablecoins/ETH) and set diversification policy.

Stand up operations

Working groups with quarterly budgets; standard RFP templates; retro cadence.

Ship your first proposals

Temp-check → final vote → execution; publish weekly summaries and delegate notes.

Instrument analytics

Track participation, treasury health, program KPIs.

Iterate safely

Tune quorum/thresholds, rotate stewards, and refine grants as data accumulates.

To Sum Up

In 2025, Community DAOs give token holders tangible leverage: they can propose, deliberate, and execute changes with a blend of gasless voting and on-chain action. Success depends less on ideology and more on clear scopes, credible execution, and data-driven iteration. Start small, publish your rules, and design incentives that reward informed participation. Use proven tooling Snapshot for signaling, Governor for execution and keep your treasury policy boring and resilient. If you measure participation, impact, and risk continuously, your Community DAO can become a durable engine for collective decision-making and value creation.

CTA

Want a done-for-you governance rollout (constitution, tooling, and a first-quarter roadmap)? Reach out we’ll help you stand up a Community DAO that token holders actually want to join.

FAQs

Q : How do Community DAOs work?

A : Members hold governance tokens, propose changes, debate, and vote. Off-chain tools like Snapshot record votes cheaply; on-chain frameworks like OpenZeppelin’s Governor execute outcomes when quorums and thresholds are met. Most mature DAOs pair signaling votes with on-chain execution for high-impact decisions.

Q : How can I launch a Community DAO in 2025?

A : Define mission and scope, choose token mechanics, set proposal rules, and use Snapshot + Governor. Seed a small treasury, elect stewards, and publish a constitution before the first vote. Start with pilot grants and iterate quarterly.

Q : How does on-chain voting differ from Snapshot?

A : Snapshot is gasless and fast (great for temperature checks); on-chain votes execute code and transfers via timelocks. Many DAOs run both: off-chain for proposals that guide strategy, on-chain for parameter changes and large treasury moves.

Q : What risks do Community DAOs face?

A : Voter apathy, token concentration, slow decision cycles, and legal ambiguity. Mitigate with delegation, diverse stewards, sunset clauses, and jurisdiction-aware legal review. Wyoming’s statute is often referenced but not universal.

Q : Which tools should I use first?

A : Ethereum’s DAO primer for concepts, Snapshot for off-chain votes, OpenZeppelin Governor for on-chain execution, and a multisig for ops. Expand into analytics and grants tooling later.

Q : How do DAOs prevent governance capture?

A : Set supermajorities for constitutional changes, cap single-proposal budgets, encourage delegation pluralism, and publish conflicts of interest. Track concentration metrics (e.g., HHI) and adjust thresholds.

Q : How does delegation improve outcomes?

A : Delegation lets passive holders assign voting power to active, accountable stewards—improving turnout and proposal quality. Publish delegate platforms and hold periodic review votes.

Q : How much treasury should be on-chain?

A : Most DAOs keep strategic assets on-chain with time-locks, while using multisigs for operations. Diversification and runway policies reduce volatility. Forum transparency and periodic rebalancing are common in 2025.

Q : How do Community DAOs compare to corporations?

A : DAOs trade hierarchical speed for transparent, rule-based coordination. They excel at community funding and parameter tuning but require strong process design to avoid inefficiency.