Coinbase says stablecoins not draining bank deposits, calls it a ‘myth’

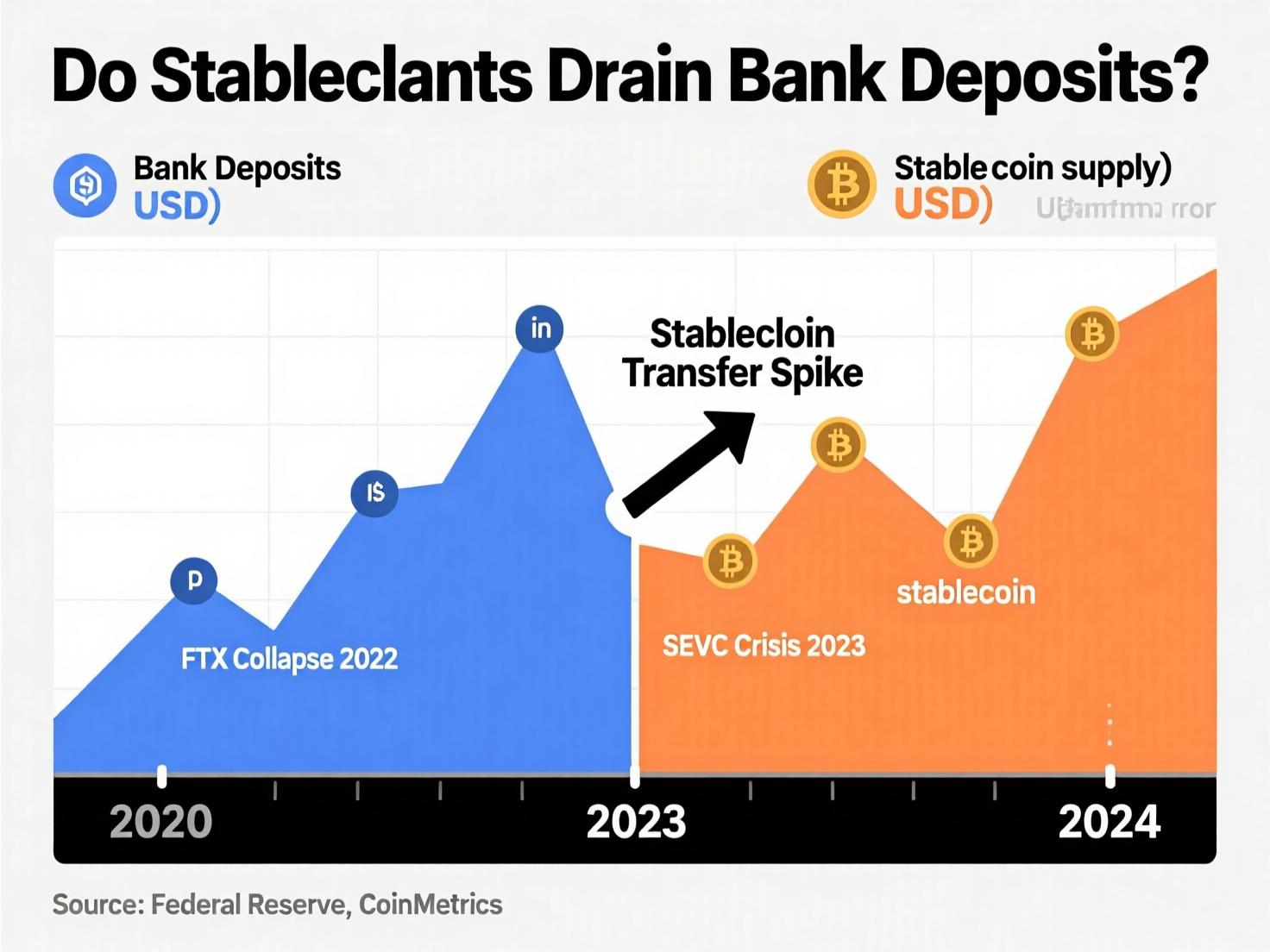

Coinbase, in a new policy blog and research note, pushes back against the claim that stablecoins are draining deposits from U.S. banks. The company argues that the concern is more of a narrative than a proven risk, pointing out that there is no strong data showing stablecoins as a significant threat to bank funding.

According to Coinbase, the key issue is being framed incorrectly. Instead of asking whether stablecoins pull deposits away from banks, it’s more accurate to see them as global payment tools rather than savings vehicles. The research highlights that most stablecoin activity takes place outside the U.S., serving as fast and efficient payment rails, not substitutes for traditional bank accounts. This perspective challenges fears of domestic banking instability linked to stablecoin growth.

Do stablecoins drain bank deposits? What Coinbase argues

Coinbase’s post calls the “deposit erosion” thesis a myth, saying community-bank data show no meaningful link between stablecoin adoption and deposit outflows. It also challenges a widely cited estimate of multi-trillion-dollar potential outflows, noting the projection far exceeds near-term market size forecasts. “The math doesn’t add up,” the company wrote.

Evidence roundup: do stablecoins drain bank deposits?

In its paper, Coinbase points to IMF work estimating roughly $2T of stablecoin transactions in 2024, with flows concentrated outside the U.S. (e.g., Asia and Pacific). Because leading stablecoins are dollar-pegged, Coinbase argues the usage reinforces dollar dominance without materially shrinking domestic deposits.

The $6.6T question

Banks and some policymakers have warned that stablecoins could prompt as much as $6.6 trillion in deposit flight under certain conditions. Coinbase disputes that framing, saying stablecoins are payments instruments rather than yield-bearing deposit alternatives.

Markets signal complementarity, not displacement

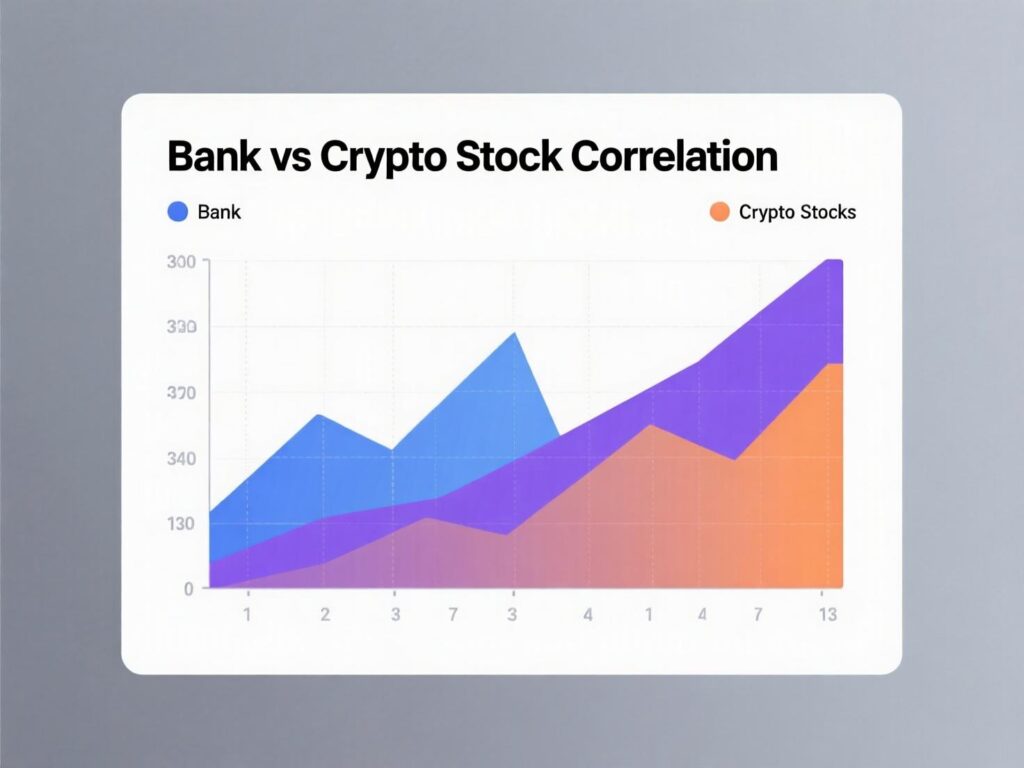

Coinbase’s analysis of bank and crypto equities around passage of the GENIUS Act finds positive, statistically significant correlations between large U.S. banks and Coinbase/Circle, which it interprets as evidence the sectors can grow together.

Regulation backdrop and industry pushback

The newly enacted GENIUS Act sets 1:1 reserve rules and other standards for U.S. payment stablecoins. Banking groups are urging Congress to close what they call an “interest payment” loophole via exchanges or affiliates, warning of deposit flight; crypto trade groups oppose the change. U.S. Department of the Treasury+1

Costs, credit, and card fees

Coinbase also reframes the debate around payments economics, arguing stablecoins compete with card rails and related swipe fees rather than with bank deposits—a view it says explains the intensity of industry resistance. (This claim is Coinbase’s interpretation.)

Context & Analysis

Analysis: The core disagreement is partly definitional: banks emphasize potential yield-seeking migration from deposits, while Coinbase emphasizes payments utility and offshore usage. IMF research supports the view that international stablecoin flows are substantial, though the long-run impact on U.S. funding structures depends on whether stablecoins evolve into interest-bearing products at scale. Policymakers will likely focus on closing incentives that mimic deposits while preserving low-cost, cross-border payment benefits.

Conclusion

The debate over whether stablecoins erode bank deposits largely depends on how they are ultimately used and regulated. Coinbase maintains that current usage centered on payments and occurring mostly offshore does not pose a threat to U.S. credit creation or the stability of the banking system.

Looking ahead, the policy question shifts to how lawmakers will respond. Congress and regulators may choose to tighten rules under the GENIUS Act, particularly around indirect yield, or instead embrace stablecoin payments as a tool to modernize money movement in the U.S. The outcome will shape both innovation and financial stability.

FAQs

Q . Do stablecoins drain bank deposits?

A . Coinbase says no; it argues most usage is offshore and payments-focused, with no proven causal link to U.S. deposit outflows.

Q . What is the $6.6T deposit-flight figure?

A . A Treasury-linked estimate cited by media and banks; Coinbase disputes its assumptions and scale.

Q . How does the GENIUS Act affect stablecoins?

A . It creates a federal framework, including 1:1 reserve requirements and other standards for issuers.

Q . Where are stablecoins mostly used today?

A . IMF analysis indicates substantial 2024 flows outside the U.S., notably in Asia and the Pacific.

Q . Are banks pushing for changes to the new law?

A . Yes. Banking groups want Congress to close perceived “interest” loopholes involving exchanges and affiliates.

Q . What does market data say about banks vs. crypto firms?

A . Coinbase reports positive correlations between large banks and Coinbase/Circle equities around the GENIUS Act window.

Q . Do stablecoins help or hurt the U.S. dollar?

A . Coinbase argues dollar-pegged stablecoins support dollar dominance by extending usage overseas.