Coinbase holds edge in US crypto race even as rivals’ public listings reshape landscape

Coinbase has maintained a strong lead in the U.S. crypto market after another earnings beat, supported by growing trading volumes and its earlier advantage as the only publicly traded American crypto exchange. Its established brand, regulatory standing, and deep liquidity continue to attract both retail and institutional investors.

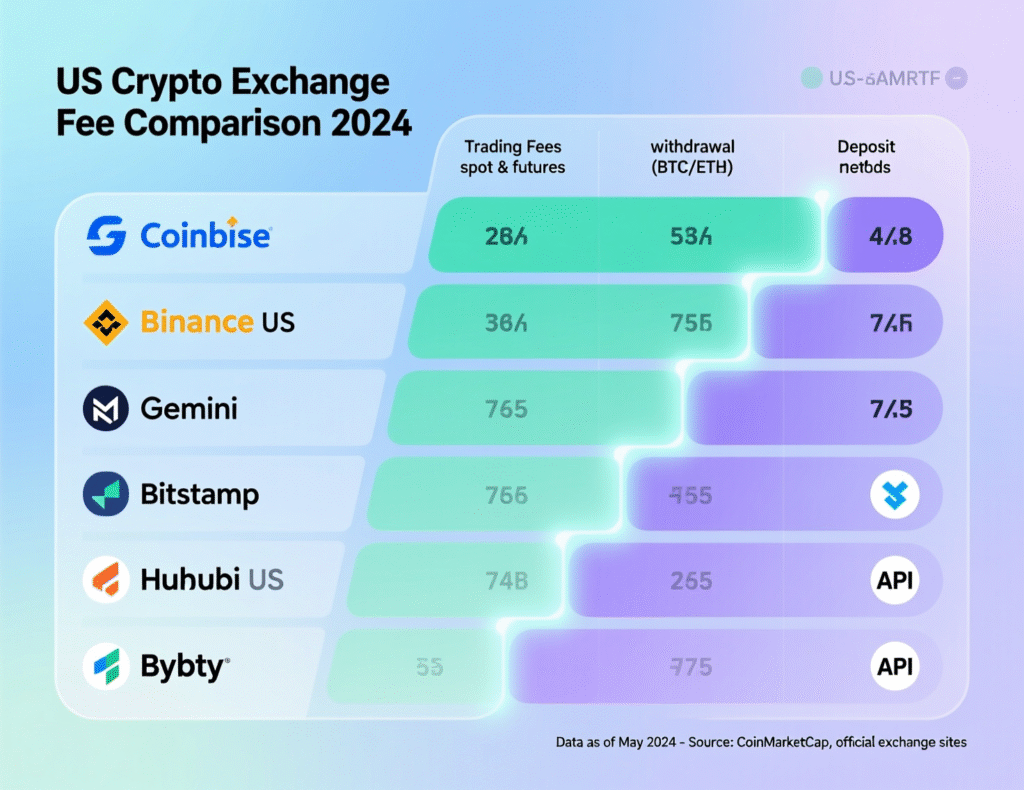

However, competition is set to intensify as rival exchanges Bullish and Gemini enter the public markets. With improving U.S. crypto regulations and policy support encouraging broader participation, analysts believe Coinbase may face increasing pressure to reduce its premium trading fees. The company’s ability to sustain profitability and defend market share will depend on product innovation, global expansion, and how well it adapts to this more competitive environment.Reuters+2Investing.com+2

Market picture and earnings

Coinbase reported Q3 results that surpassed Wall Street expectations as crypto volatility lifted trading activity. External tallies put revenue near $1.87 billion with net income around $433 million, underscoring improved profitability versus last year. Shares rose following the print.

Regulatory clarity in the U.S. a key driver of institutional participation—has supported volumes across exchanges. Analysts note that while clearer rules are constructive for the sector, they also open the door to more competitors, likely pressuring Coinbase’s pricing over time.

New public rivals reshape the field

Bullish (BLSH)

Went public in August 2025 on the NYSE and quickly reached a multibillion-dollar valuation after a strong debut.

Gemini (GEMI)

Listed on the Nasdaq in September 2025, raising about $425 million in its IPO.

These listings broaden the investable options for institutions and signal a maturing market structure in the U.S., upping competitive pressure on Coinbase across fees, liquidity, and product scope.

Pricing, share, and strategy

Brokerage commentary suggests Coinbase’s “premium” pricing could face compression as deeper liquidity and comparable regulated venues come online. Coinbase management and analysts also highlight strategic levers product expansion, institutional services, and selective M&A to defend share and margins in a more crowded field.

Where Coinbase holds edge in US crypto race today

Brand and compliance

Early regulatory engagement and public-company disclosures remain differentiators for large institutions.

Ecosystem breadth

Subscriptions, staking-adjacent services, and custody help diversify beyond trading.

Capital access

A longer public track record may support M&A as consolidation opportunities arise.

Can Coinbase holds edge in US crypto race withstand IPO-driven rivalry?

With Bullish and Gemini now public, Coinbase’s moat will be tested on pricing, liquidity, and institutional tooling. Expect tighter spreads and fee competition especially on high-volume pairs as rival order books deepen.

Context & Analysis

Public listings by Bullish and Gemini expand the investable universe for equity investors and could normalize valuations and fee structures across the category. Over the next year, watch for price compression on headline taker fees, differentiated enterprise offerings for institutions, and potential consolidation areas where Coinbase’s balance sheet and brand may provide advantages.

Conclusion

Coinbase continues to lead the U.S. crypto market after another strong earnings performance, but its dominance is being tested as newly public competitors rapidly scale. The company’s early advantage from regulatory clarity and brand trust still holds weight, yet the landscape is shifting fast.

The coming phase is expected to bring tougher fee competition, deeper product offerings, and strategic acquisitions across the sector. Analysts say this will determine whether Coinbase can convert its first-mover edge into lasting market share or if emerging exchanges will close the gap through innovation and pricing power.

FAQs

Q : Why does Coinbase still lead the U.S. crypto market?

A : Its early public listing, brand recognition, and diversified services give it an institutional edge, though rivals are catching up.

Q : Which rivals are now publicly traded?

A : Bullish (NYSE: BLSH) listed in August 2025; Gemini (Nasdaq: GEMI) listed in September 2025.

Q : Will fees drop as competition increases?

A : Analysts expect pricing pressure on Coinbase as liquidity and regulated alternatives expand.

Q : Did Coinbase beat Q3 estimates?

A : Yes, revenue was around $1.87 billion with sharply higher net income, topping forecasts.

Q : What does regulatory clarity mean for exchanges?

A : It supports volumes and institutional adoption but invites more competitors into the market.

Q : Is Coinbase pursuing acquisitions?

A : Analysts see room for M&A as the market matures, with Coinbase positioned to participate.

Q : Does this article’s topic include “Coinbase holds edge in US crypto race”?

A : Yes, this piece explains how Coinbase holds its edge in the U.S. crypto race while outlining new competitive pressures.

Facts

Event

Coinbase beats Q3 estimates; rivals’ IPOs intensify U.S. crypto competitionDate/Time

2025-10-31T15:11:00+05:00Entities

Coinbase Global Inc. (COIN); Bullish (BLSH); Gemini (GEMI)Figures

Coinbase revenue ~$1.87bn; net income ≈ $433m (Q3 2025) (units: USD)Quotes

“Regulatory clarity … will likely lead to additional competition,” — Morningstar analysts (as reported). Reuters+2nasdaq.com+2Sources:

Reuters main story; Reuters on Bullish IPO; Reuters on Gemini IPO (see below)