ChainLink Jumps 14% as Whales Accumulate $116M Worth of LINK Tokens Since Crash

Chainlink (LINK) whales have accumulated over $116 million worth of tokens as the broader crypto market rebounds from last week’s deleveraging. On-chain data indicates large holders are steadily withdrawing LINK from exchanges, signaling confidence in the asset’s long-term value. This accumulation trend comes as investors rotate back into key infrastructure projects following Bitcoin’s recovery.

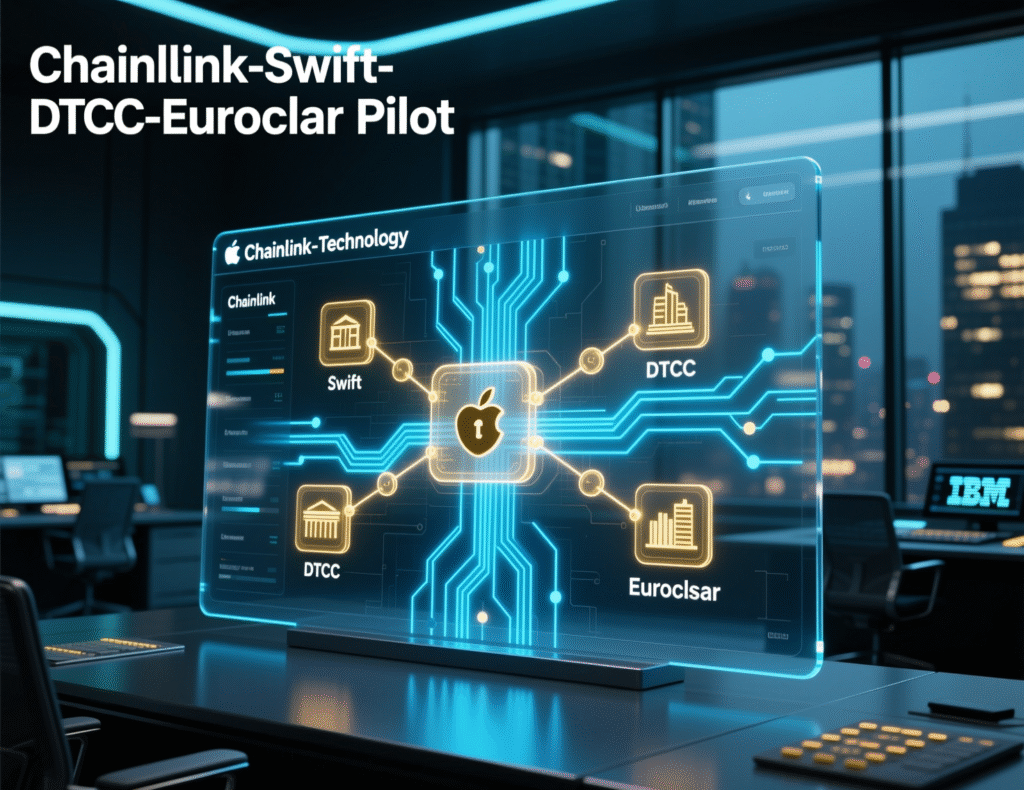

At the same time, Chainlink Labs has spotlighted new partnerships with banks and financial institutions exploring tokenized asset solutions. These pilots aim to expand Chainlink’s use cases beyond traditional price oracles, positioning the network as a foundational layer for real-world asset connectivity and market infrastructure. The combination of whale activity and institutional collaboration reinforces LINK’s growing role in bridging blockchain and mainstream finance.

LINK rallies as large holders move off exchanges

LINK rose ~13.6% over 24 hours on Monday, leading a broader crypto bounce (CD20 +4.2%). Lookonchain tracked 30 newly created wallets withdrawing 6,256,893 LINK (~$116.7M) from Binance since Oct. 11, a flow pattern often read as accumulation by high-net-worth entities or institutions.

Partnerships and product milestones support sentiment

Chainlink’s Q3 2025 review outlined collaborations or pilots with Swift, Depository Trust & Clearing Corporation (DTCC), Euroclear, and a U.S. Department of Commerce initiative to bring government data on-chain. The update positions Chainlink as a full-stack infrastructure layer for tokenized assets, spanning interoperability, identity, and compliance tooling. Chainlink Blog

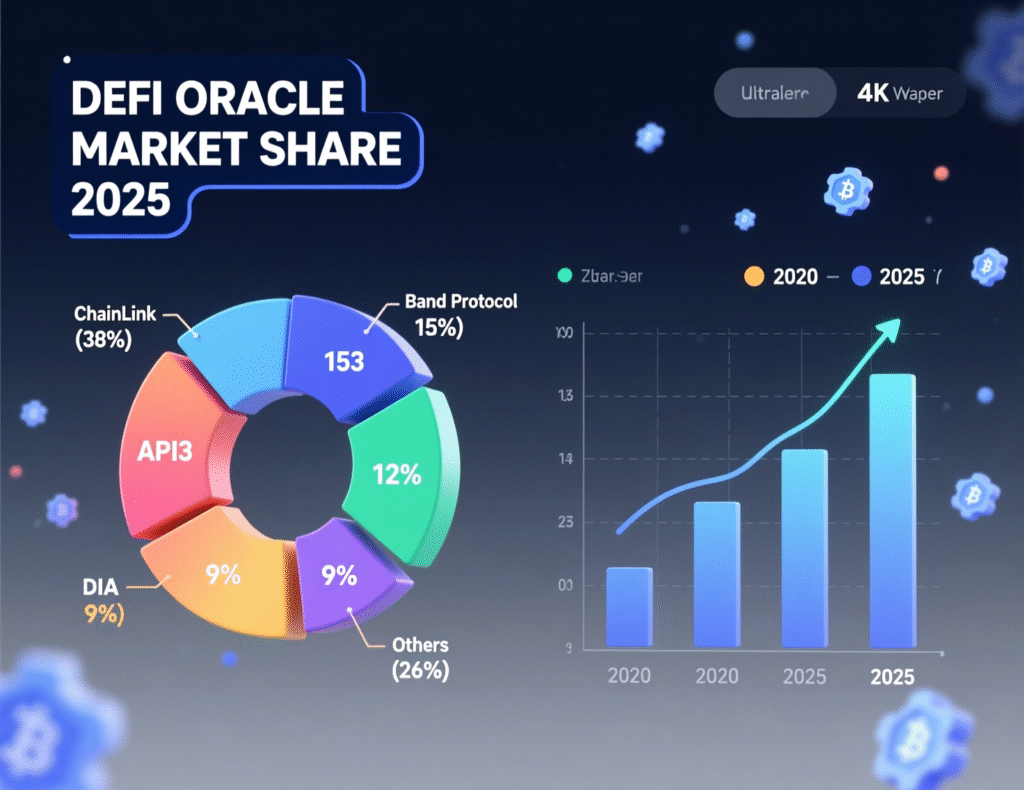

Market share: Chainlink widens oracle lead

According to DeFiLlama, Chainlink secures around $60–62B in value across protocols about 62% of oracle market share far ahead of Chronicle (~$10B TVS). Continued dominance suggests network effects around security, uptime, and institutional trust.

Why “Chainlink whales accumulate $116M LINK” matters

Moving coins off exchanges can reduce immediate sell pressure and signal longer-term holding. Coupled with high-profile pilots in traditional finance, the flow data adds a fundamental narrative utility and institutional adoption—to the technical rebound.

Interpreting “Chainlink whales accumulate $116M LINK” in context

Whale activity does not guarantee sustained price gains, but when aligned with enterprise integrations and market-share leadership, it strengthens the risk-reward case some investors see in LINK’s role within RWA/tokenization infrastructure.

Context & Analysis

Short-term performance in crypto often pivots on liquidity and positioning. The Oct. 11 sell-off flushed leverage, setting up asymmetric rebounds when fresh buyers emerge.Whale withdrawals since that date, alongside Chainlink’s engagement with Swift/DTCC/Euroclear and U.S. government data pilots, help explain why LINK outperformed into Monday. Still, macro risk (rates, liquidity) and sector-specific overhangs can quickly reverse momentum.

Conclusion

LINK’s latest rally reflects a strong mix of on-chain accumulation and growing enterprise adoption, supported by Chainlink’s continued dominance in oracle services. Large holders keeping tokens off exchanges suggest confidence in long-term growth, while network fundamentals remain robust.

Looking ahead, the key catalysts include real-world rollouts from the Q3 pilot programs, which could validate enterprise integrations. Market watchers are also eyeing updates to Chainlink’s total value secured (TVS) and share metrics on DeFiLlama for confirmation of momentum. Sustained whale accumulation and rising institutional traction could further strengthen LINK’s position within the decentralized data and tokenization ecosystem.

FAQs

Q : What triggered Monday’s LINK rally?

A : A combination of whale withdrawals since Oct. 11 and sentiment around new institutional pilots.

Q : How much LINK did whales accumulate?

A : About 6.26M LINK (~$116.7M) across 30 new wallets since Oct. 11.

Q : Does Chainlink still dominate oracles?

A : Yes roughly 62% market share and about $60–62B TVS, according to DeFiLlama.

Q : What are Chainlink’s key Q3 partnerships?

A : Collaborations with Swift, DTCC, Euroclear, and a U.S. Department of Commerce pilot for on-chain government data.

Q : Is whale accumulation a buy signal?

A : It can indicate confidence but isn’t a guarantee; monitor exchange inflows and core fundamentals.

Q : Where can I verify the whale data?

A : Refer to the original Lookonchain post and the on-chain transaction links it cites.

Q : Is “Chainlink whales accumulate $116M LINK” sustainable?

A : Sustainability hinges on ongoing institutional adoption and whether whales keep their tokens off exchanges.

Facts

Event

LINK jumps as whales withdraw ~6.26M tokens from exchanges; Q3 partnerships bolster fundamentals.Date/Time

2025-10-20T19:00:00+05:00Entities

Chainlink (LINK); Chainlink Labs; Swift; DTCC; Euroclear; U.S. Department of Commerce; Lookonchain; CoinDesk 20 Index (CD20).Figures

6,256,893 LINK; ~$116.7M; +13.6% (LINK 24h); +4.2% (CD20); ~$60–62B TVS; ~62% market share; Chronicle ~$10B TVS.Quotes

“30 new wallets have withdrawn 6,256,893 $LINK ($116.7M) … since the 10/11 market crash.” Lookonchain (X post). X (formerly Twitter)Sources

CoinDesk (LINK +13.6%, context) + URL; Lookonchain (wallet flows) + URL; Chainlink blog (Q3 review) + URL; DeFiLlama (oracle TVS) + URL. defillama.com+3CoinDesk+3X (formerly Twitter)+3