Cathie Wood’s ARK Invest adds BitMine shares as it offloads $30M in Tesla stock

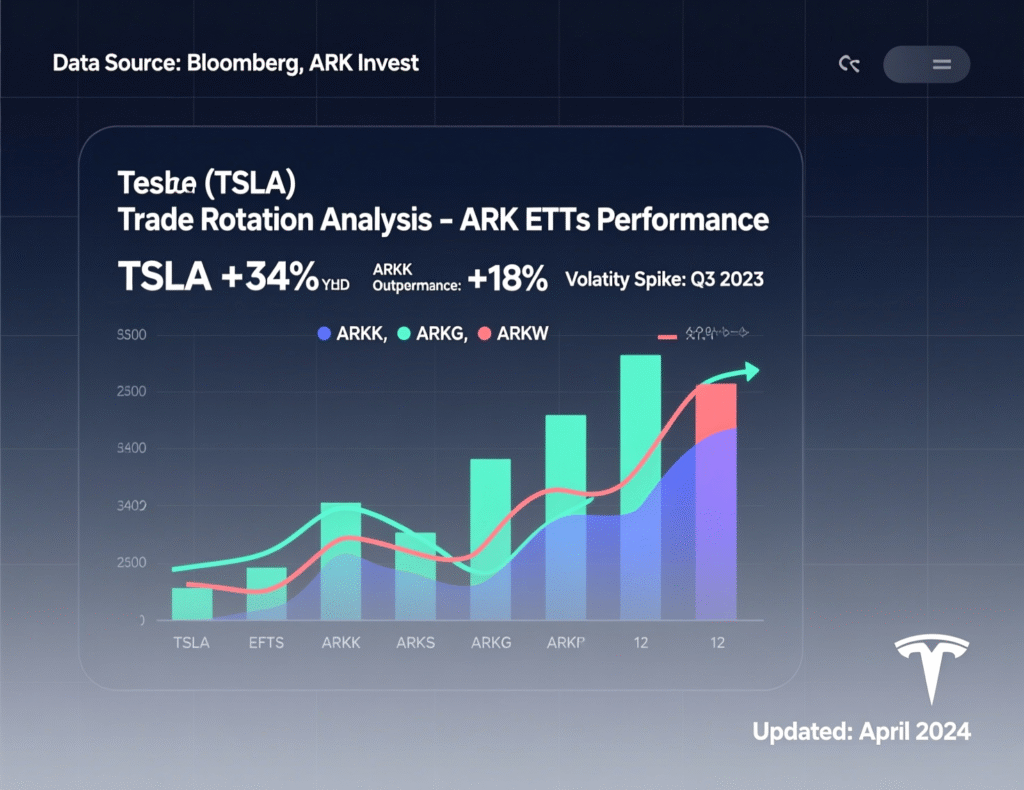

Cathie Wood’s ARK Invest has adjusted its portfolio, trimming exposure to Tesla while increasing positions in BitMine. The move marks a tactical rotation within ARK’s major funds, including the flagship ARK Innovation ETF (ARKK) and its thematic counterparts focused on fintech (ARKF) and next-generation internet (ARKW).

According to recent filings, ARK sold portions of its long-held Tesla stake, signaling a shift toward emerging growth names in the crypto-mining and AI-infrastructure space. BitMine’s inclusion across multiple ETFs suggests growing conviction in digital-asset infrastructure as a next-phase innovation theme. The rebalancing underscores Wood’s strategy of leaning into disruptive technology trends while taking profits on mature holdings that have already delivered substantial gains.

ARK Invest’s rotation: BitMine buys, Tesla sells

BitMine purchases

ARK reported buying BitMine (BMNR) shares across three ETFs. Public trackers and trade notes indicate staggered additions during the week.

Tesla sales

ARK sold about 71,638 TSLA shares, equating to roughly $30–32 million using the Nov. 7 closing price ($429.52). Investing.com

BitMine’s Ether treasury grows

BitMine Immersion (NYSE American: BMNR) disclosed ~3.4 million ETH holdings and $13.7B in combined crypto and cash, positioning it as a leading corporate Ether holder. Company communications and industry reports note the accumulation trend in recent weeks

Why ARK Invest adds BitMine shares

Analysts cite BitMine’s expanding Ether balance and treasury-style positioning as potential drivers for ARK’s interest. The company says its ETH represents just under 3% of total supply, with additional cash and “moonshot” assets on the balance sheet factors aligning with ARK’s high-conviction, innovation-themed approach.

Fund flows on the day ARK Invest adds BitMine shares

Daily trade rundowns show the BitMine additions coincided with Tesla trimming across ARKK and ARKW. Market data corroborate the TSLA closing level used to value the sales.

Musk’s $1T package backdrop

Tesla’s shareholder approval of Elon Musk’s potential $1 trillion compensation plan (Nov. 6) provides context for portfolio moves, as performance tranches hinge on ambitious milestones and long-term market capitalization targets.

Market impact and performance

BitMine (BMNR)

Shares rallied sharply in 2025; after-hours moves showed single-digit gains on the day referenced by ARK’s trades.

TSLA

Fell on the day of ARK’s trim; closing data confirm the pricing for the sale value range.

Context & Analysis

ARK’s incremental BitMine allocations mirror earlier “treasury crypto” theses popularized by corporate BTC holders, but with ETH. The simultaneous Tesla trims could reflect risk rebalancing around event risk (Musk package, price swings) and relative value versus crypto-exposed equities. (Clearly labeled as analysis.)

Conclusion

ARK Invest’s latest moves signal a strategic pivot, adding exposure to BitMine viewed as an Ether-treasury and crypto-infrastructure play while trimming its long-held Tesla position. The shift reflects a balanced approach between capturing new growth themes and managing portfolio risk after Tesla’s strong multi-year performance.

Investors are now watching closely to see whether ARK extends this rotation in the coming weeks. BitMine’s evolving ETH strategy, tied to Ethereum’s price cycles and broader crypto market trends, could shape how ARK positions its funds amid rising volatility and shifting sentiment across digital asset markets.

FAQs

Q : What did ARK buy and sell?

A : ARK bought BitMine (BMNR) shares across ARKK, ARKF, and ARKW, while selling approximately 71,638 Tesla (TSLA) shares.

Q : Why did ARK Invest add BitMine shares?

A : BitMine disclosed large ETH holdings and strong cash reserves, aligning with ARK’s innovation-focused investment strategy.

Q : How much ETH does BitMine hold?

A : BitMine holds about 3.4 million ETH, with total crypto and cash assets valued around $13.7 billion, per recent company disclosures.

Q : Did Tesla shareholders approve Elon Musk’s new pay package?

A : Yes, the potential $1 trillion compensation plan was approved on November 6, 2025.

Q : Was Tesla’s share sale by ARK significant?

A : The sale amounted to roughly $30–32 million based on the November 7 closing price, suggesting ongoing position management rather than a major exit.

Q : Where can I track when ARK Invest adds BitMine shares again?

A : You can monitor ARK’s daily trade updates on its official website and verify with reputable financial news outlets.

Q : Is BitMine facing unrealized losses on ETH?

A : Some reports indicate multibillion-dollar unrealized losses due to market volatility, though figures vary and should be confirmed with official filings.

Facts

Event

ARK buys BitMine shares; sells part of Tesla stakeDate/Time

2025-11-08T13:00:00+05:00Entities

ARK Invest; BitMine Immersion (BMNR); Tesla, Inc. (TSLA); Elon MuskFigures

~71,638 TSLA shares sold (~$30–32M using $429.52 close); BitMine ~3.4M ETH; total crypto + cash ~$13.7B. Investing.com+1Quotes

“Tesla shareholders approve $1 trillion pay plan” (context for rotation). ReutersSources

Reuters (Musk package) link; CoinDesk (BitMine holdings) link.