Cardano (ADA) Weekly Update Price Analysis This Week as ADA Holds the $0.36 Support (Jan 24, 2026)

This week’s Cardano (ADA) weekly update finds ADA trading around $0.36, down roughly 9% over the last 7 days and underperforming the broader crypto market. On major spot exchanges, price has mostly moved in a $0.35–$0.40 band, with short-term support in the $0.35–$0.36 zone and resistance clustered near $0.38–$0.40.

The move has been shaped by risk-off sentiment, softer DeFi flows, and periods of negative funding in derivatives, even as narratives around Cardano’s Midnight privacy network, ecosystem upgrades, and ETF inclusion keep long-term interest alive.

Key Data Snapshot

Data as of: 24 January 2026 (UTC), rounded from major aggregators

Current price: ≈ $0.36 per ADA (around $0.359–$0.360 on CoinMarketCap / CoinGecko / TradingView)

24h change: ≈ -0.3% (near flat day-on-day)

7d change: ≈ -9.4%

Estimated 7d high / low: ≈ $0.40 / $0.35 (approximation based on ADAUSD charts; not an official on-chain stat)

Market cap: ≈ $13.0B (CMC ≈ $12.9B, CoinGecko ≈ $13.2B)

24h volume: ≈ $360–380M

Main data sources: CoinMarketCap, CoinGecko, TradingView

Market data for Binance-Peg Cardano (ADA)

Binance-Peg Cardano is a crypto asset in the CRYPTO market.

The current price is 0.358669 USD, with a change of -0.00 USD (-0.00%) from the previous close.

Today’s intraday high is 0.369772 USD and the intraday low is 0.353161 USD.

This Week in Cardano (ADA) Quick Summary

ADA spent the week grinding lower and then chopping sideways around the $0.36 area, extending a roughly -9% weekly loss. The broader crypto market also pulled back, but Cardano underperformed most large caps, reflecting a mix of macro risk-off mood, profit-taking, and coin-specific selling pressure.

Under the surface, the fundamental story stayed busy. Charles Hoskinson continued to spotlight Cardano’s Midnight privacy network and a broader ecosystem overhaul, while ADA appeared with a small allocation in a proposed S&P Crypto 10 ETF filing another small step toward potential institutional visibility. For now, though, price remains locked in a cautious consolidation zone.

Cardano (ADA) Price Action & Key Levels

Weekly performance

ADA trades close to $0.36, with 24-hour price action contained between roughly $0.353–$0.369.

Over the last 7 days, ADA is down about -9.4%, compared with an estimated -6% drop for the overall crypto market over the same period, per CoinGecko.

The estimated 7-day range on major exchanges has been roughly $0.35–$0.40, with sellers repeatedly fading bounces as price approaches the upper band.

Short-term technical view

Short-term charts still show a weak downtrend inside a range, with.

Support: local support around $0.352–$0.355, a zone where recent intraday sell-offs have stalled and liquidity has absorbed downside attempts.

Resistance: nearby resistance around $0.38–$0.40, an area where rallies have been rejected and where many traders cluster their breakout alerts.

Volatility: 30-day volatility remains moderate (around 5–6%), pointing to compression rather than a blow-off move often a prelude to a bigger directional break, but never a guarantee.

Put together, ADA sits in a classic “wait-and-see” zone: neither a clean breakdown nor a confirmed recovery.

News & Narratives That Moved ADA This Week

Midnight & ecosystem push:

Hoskinson has been actively promoting Cardano’s Midnight privacy network and signaling an aggressive push to overhaul top dApps to improve competitiveness, liquidity, and listings. This supports the long-term innovation narrative even as the ADA price chops sideways.

Short-term sell-off & consolidation.

Several market notes frame ADA’s recent move as a short-term sell-off followed by consolidation, with sellers defending rebounds and open interest stabilizing in the mid-hundreds of millions of dollars more consistent with digestion than a fresh wave of risk-on exposure.

Macro jitters & trade tensions.

Early in the week, ADA slipped below $0.36 as headlines around EU–US trade tensions cooled risk appetite and nudged traders toward defensive positioning across risk assets.

ETF angle.

A more niche but notable development was ADA’s inclusion at 0.5% weighting in the proposed Cyber Hornet S&P Crypto 10 ETF. If such products gain approval and traction, they could modestly improve ADA’s institutional visibility over time.

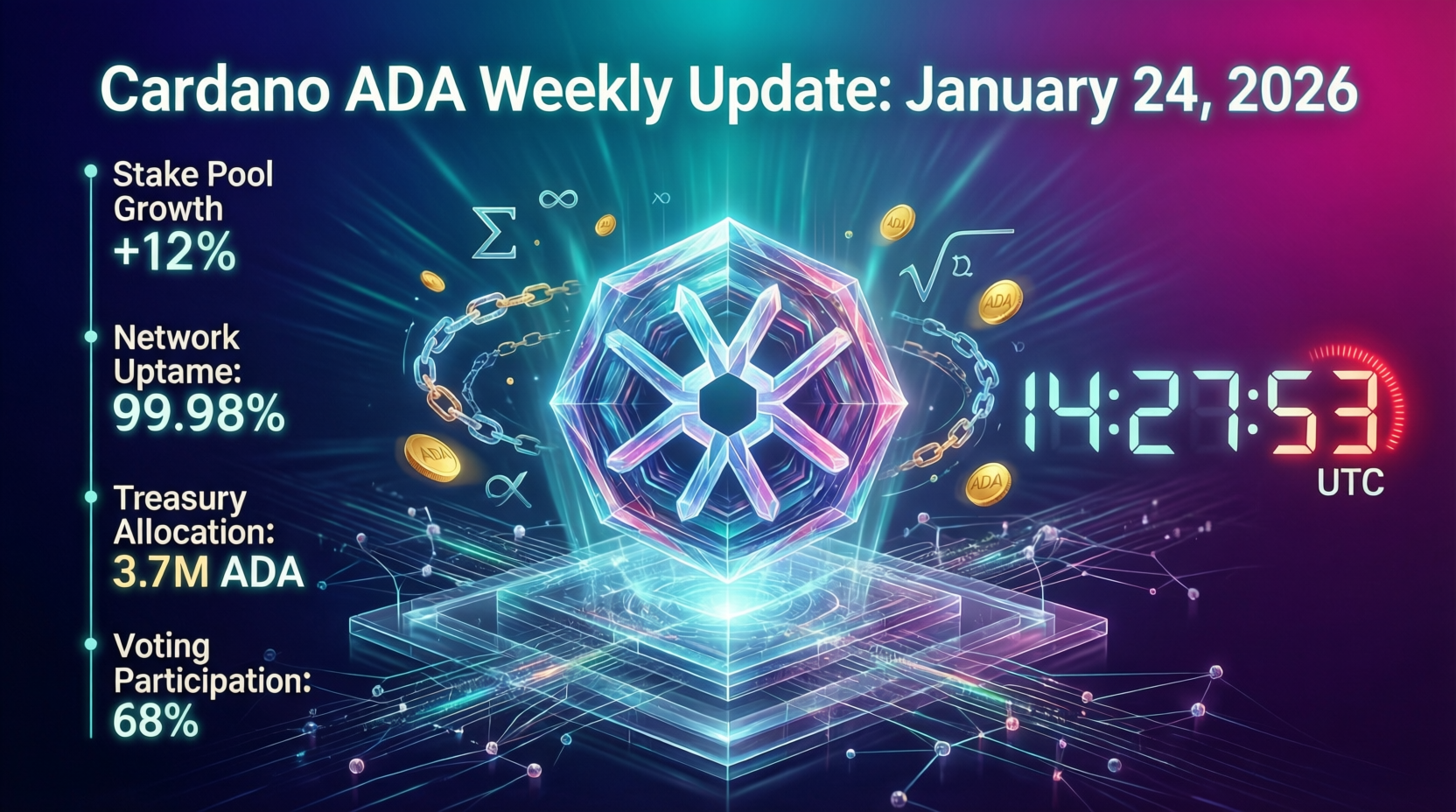

On-Chain, Derivatives & Sentiment

On-chain and DeFi data paint a mixed, slightly soft picture:

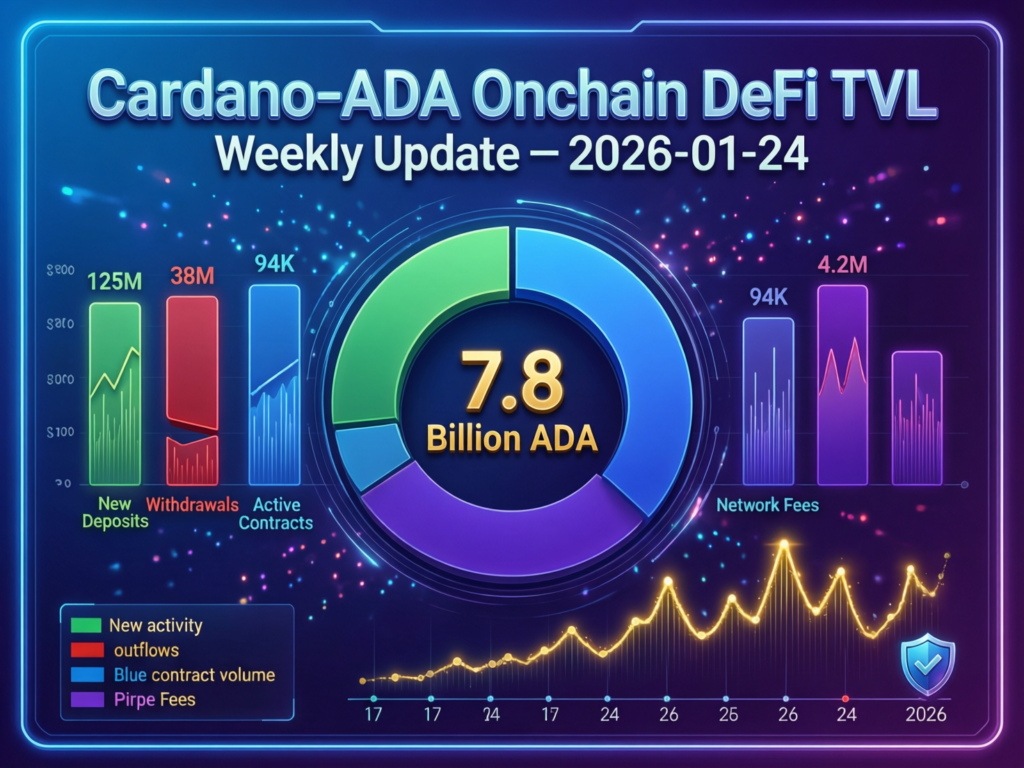

TVL & DeFi flows

Cardano DeFi total value locked (TVL) and weekly DEX volumes have fallen week-on-week, with TVL down by nearly 50% and perps volume off by close to half clear signs of softer speculative activity in the ecosystem.

Active addresses

24-hour active addresses sit around 17k, suggesting a lean but persistent core user base that continues to transact on-chain even in a choppy market.(DeFiLlama)

Derivatives

Funding rates flipped negative at several points during the week, and derivatives trackers highlight a cautious stance, with some traders effectively paying to stay short ADA over the short term.(FXStreet)

Overall, sentiment screens bearish-to-neutral weak but not yet in full capitulation.

Cardano vs Bitcoin & the Wider Crypto Market

According to CoinGecko and TradingView, ADA’s roughly -9% weekly performance trails both Bitcoin and broader large-cap indices, which are down by mid-single digits over the same period.

That underperformance extends a multi-month trend in which ADA has lagged other major L1s. Investors remain cautious about Cardano’s pace of real-world adoption compared to rivals like Ethereum and Solana, even as the roadmap continues to evolve.

What This Cardano (ADA) Weekly Update Means for Traders & Long-Term Holders

For short-term traders

Keep an eye on $0.35–$0.36 as the near-term support band where buyers have repeatedly stepped in.

Immediate resistance sits around $0.38–$0.40; repeated failures there keep the short-term structure heavy.

Negative or flipping-negative funding suggests traders lean cautious/bearish, so sudden squeezes in either direction are possible if positioning becomes crowded.

With volatility relatively modest, a strong catalyst (macro news, a major Cardano announcement, or concrete ETF progress) may be needed to fuel a sustained breakout.

For long-term holders

The fundamental roadmap including Midnight, scalability upgrades, and upcoming governance phases remains central to the long-term thesis, but the market is clearly in a “prove it” mode.

DeFi and on-chain activity are subdued; a durable recovery in TVL, volumes, and unique addresses would be a key sign that adoption is turning a corner.

Regulatory clarity, especially around ETFs and securities classification, will influence how large institutions approach ADA exposure in the next cycle.

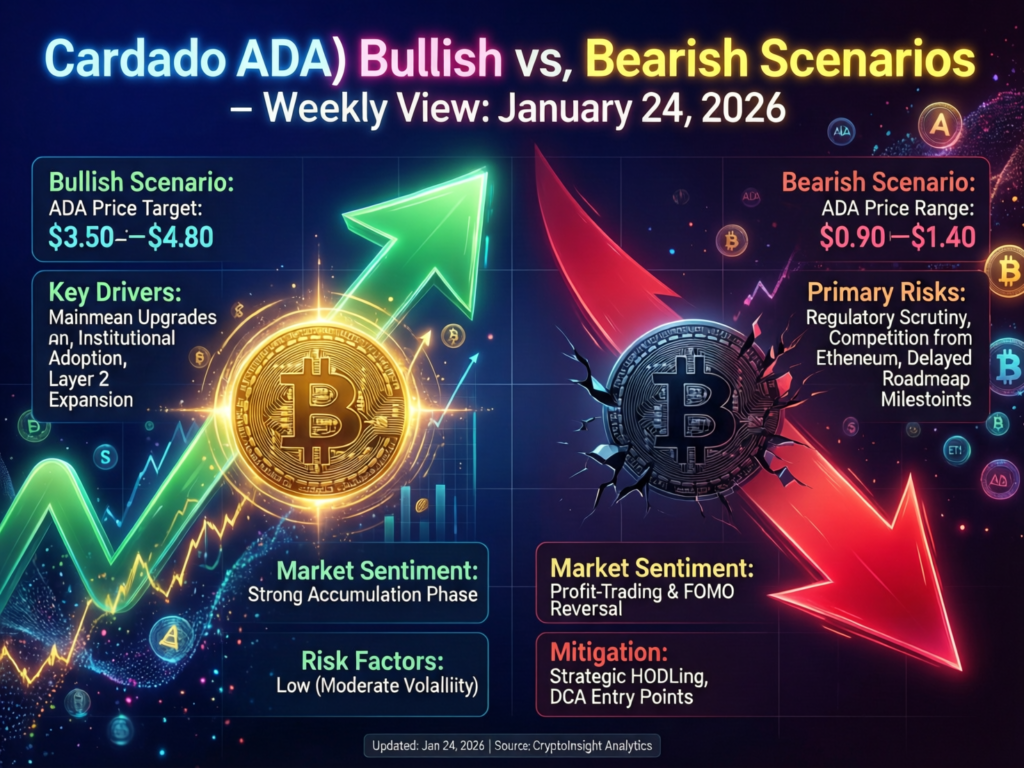

Risks, Scenarios

Bullish scenario

ADA defends the $0.35–$0.36 support band, breaks and holds above $0.40, and positive catalysts (ecosystem upgrades, ETF progress, or macro relief) push price into higher consolidation zones over the coming weeks.

Neutral scenario

Price stays range-bound between $0.35–$0.40, with choppy intraday moves and no decisive trend until a stronger macro or project-specific driver emerges.

Bearish scenario

A clean break of the $0.35 area on strong volume could open the door to deeper retracements, especially if DeFi activity and sentiment continue to weaken.

Final Words

This Cardano (ADA) weekly update shows ADA still locked in a cautious range, holding the $0.35–$0.36 support band while struggling to reclaim $0.38–$0.40. Price action, softer DeFi flows, and negative funding point to a market that remains skeptical yet not fully capitulated, with traders waiting for a clearer catalyst.

For short-term participants, respecting these levels and managing risk is key until volatility expands. Long-term holders will likely focus less on this week’s pullback and more on delivery of the Midnight network, stronger on-chain activity, and regulatory clarity while remembering that ADA, like most altcoins, remains a high-risk, high-volatility asset.

FAQs

Q : Why did Cardano (ADA) drop this week?

A : ADA fell roughly 9% over the past 7 days as risk assets sold off and traders reacted to negative derivatives signals and macro headlines, including EU–US trade tensions. Short-term sellers repeatedly faded rallies near $0.38–$0.40, keeping price pinned closer to the $0.36 area.

Q : What are the key Cardano (ADA) support and resistance levels right now?

A : Recent analyses highlight $0.352–$0.355 as important short-term support, with increased downside risk if that zone breaks convincingly. On the upside, resistance is seen around $0.38–$0.40, where ADA has struggled to sustain any breakout attempts this week.

Q : How does ADA’s performance this week compare to the broader crypto market?

A : Based on CoinGecko and TradingView, Cardano is down about -9% over the last 7 days, while the overall crypto market is closer to -6% meaning ADA underperformed majors like Bitcoin and Ethereum over the same period.

Q : What on-chain or DeFi metrics should ADA holders watch right now?

A : TVL on Cardano, DEX volumes, and active addresses are key gauges of real usage. Current data shows weaker DeFi flows and around 17k active addresses over 24 hours, signaling a cautious but active core user base. A sustained move higher in these metrics would be a constructive sign for the medium term.

Q : Is Cardano (ADA) still considered a high-risk investment after this week’s moves?

A : Like most altcoins, ADA remains high-risk and volatile, even with relatively modest day-to-day swings this week. Price is still far below its 2021 all-time high, and outcomes depend heavily on execution of the roadmap, broader crypto regulation, and macro conditions factors that can change quickly.