BTC’s ‘Indecision’ Problem: Here’s What the Market Is Trying to Tell Us

Bitcoin’s latest monthly candle has left traders uncertain about where the market heads next. The chart formed what analysts describe as an “indecision” candle a pattern marked by big intramonth price swings that ultimately close near the opening level. This shows neither bulls nor bears had clear control during the month.

What makes this moment more intriguing is that the hesitation comes right at record highs. Normally, such levels signal strong bullish momentum and confidence. Instead, Bitcoin’s sideways close suggests investors are pausing to reassess after a strong run-up, waiting for clearer cues before committing to the next move. CoinDesk

Price action summary

October’s range spanned roughly $103,600–$126,000, yet the month ended with only a modest decline classic stalemate behavior between bulls and bears. That pause comes as spot BTC hovers around $108k intraday on Nov. 3, 2025 (UTC+05:00).

Why BTC indecision at record highs matters

Indecision at peaks often precedes either a consolidation before continuation or a topping process. Context helps: BTC’s current advance since early 2023 has been a “stair-step” rally, but momentum is cooling. The monthly MACD histogram is making smaller peaks and failed to confirm price’s new high textbook bearish divergence that can precede trend fatigue.

Signals behind BTC indecision at record highs

MACD divergence

Price made a new high while MACD did not. Divergences warn of weakening momentum.

Dollar backdrop

DXY has steadied and even rebounded in recent weeks; a stronger dollar often pressures BTC and other risk assets.

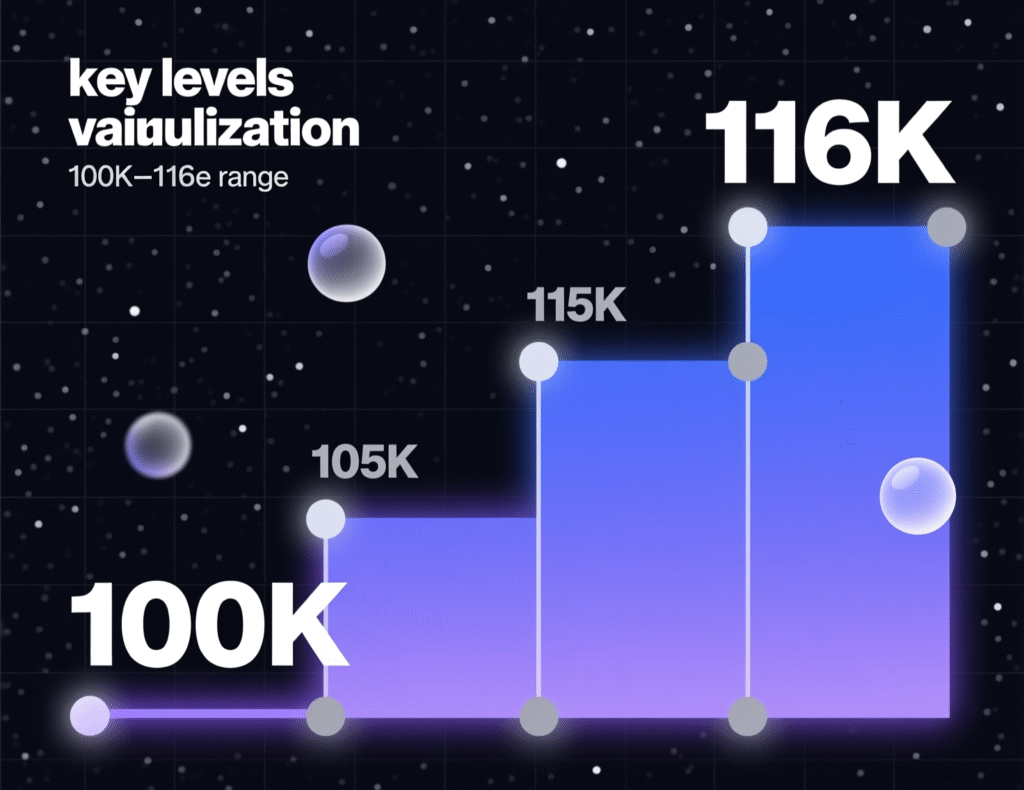

Key levels

Upside validation likely requires a convincing push above ~$116,000; breakdown risk grows on sustained moves toward ~$100,000.

Market levels to watch (technical)

Bull trigger

Reclaim and hold above ~$116,000 on convincing momentum/volume.

Initial support

~$100,000 zone (psychological, recent monthly range lower band).

Context charts

Live BTCUSD and DXY references for trend confirmation.

Context & Analysis

The pattern echoes late-cycle behavior seen at prior peaks, notably in 2021, where price strength outpaced momentum. Divergence isn’t destiny false signals occur, especially in strong trends but combined with a firmer dollar and proximity to long-term resistance (trendline from 2017/2021 tops), risk/reward skews more two-sided near term.

Conclusion

Bitcoin appears to be catching its breath near record highs. A decisive weekly or monthly close above roughly $116,000 would strengthen the case for continued upside momentum, signaling that the bull trend remains intact.

However, repeated failures to hold above that level could invite a sharper pullback, possibly toward the $100,000 zone, before the next leg higher unfolds. In this environment, patience and confirmation are key traders are watching for clear direction as indecision dominates at the top of the range.

FAQs

Q1 : What does ‘BTC indecision at record highs’ mean?

A : It describes a wide-range monthly candle that closes near its open at record levels, signaling a stalemate between buyers and sellers.

Q2 : Is a MACD bearish divergence a sell signal by itself?

A : Not necessarily. Divergences warn momentum is fading but often need confirmation from price/volume or subsequent closes.

Q3 : Which levels matter now?

A : ~$116,000 as upside validation; ~$100,000 as initial downside support from October’s range.

Q4 : How does the U.S. dollar affect Bitcoin?

A : A stronger DXY tends to pressure risk assets, including BTC, by tightening global financial conditions.

Q5 : Where can I track the live BTC chart?

A : TradingView’s BTCUSD page provides real-time charts and indicators.

Q6 : Has this pattern appeared before?

A : Similar momentum divergences were noted near the 2021 peak, though outcomes can vary. Historical context helps but doesn’t guarantee future direction.

Facts

Event

Monthly “indecision” candle and momentum divergence on Bitcoin at record highsDate/Time

2025-11-03T17:07:00+05:00Entities

Bitcoin (BTC); U.S. Dollar Index (DXY); CoinDesk; TradingViewFigures

October range ≈ $103,600–$126,000; validation level ≈ $116,000; spot ≈ $107,900 intraday (UTC+05:00). CoinDeskQuotes

“BTC’s monthly chart shows indecision at record highs… the monthly MACD histogram… creates a bearish divergence.” Omkar Godbole (analysis). CoinDeskSources

CoinDesk article; TradingView BTCUSD; MarketWatch DXY; Investopedia MACD. Investopedia+3CoinDesk+3TradingView+3