BTC Eyes $120K With Bullish H&S Pattern: Technical Analysis

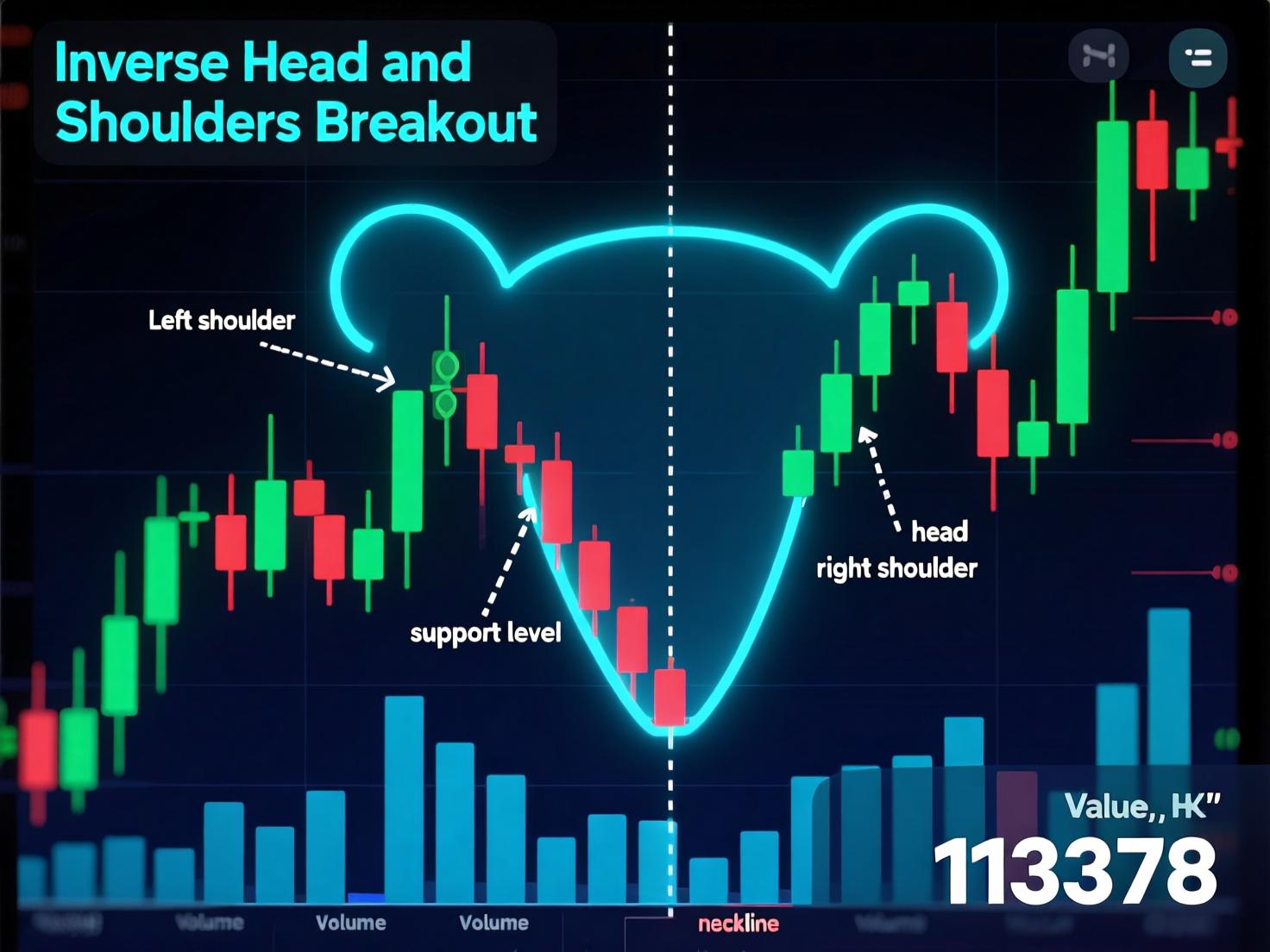

The Bitcoin inverse head and shoulders pattern is taking shape on shorter-duration charts, hinting that the recent pullback may be running out of steam. With neckline resistance nearby, traders are watching for confirmation that could power a push toward the psychologically important $120,000 mark.

What the setup signals

An inverse H&S is a classic bullish reversal: three troughs with a deeper middle “head,” flanked by two shallower “shoulders,” capped by a neckline that connects the interim highs. A decisive breakout and close above the neckline flips momentum from distribution to accumulation and often precedes a measured advance.

Spot price: ~$112,000 (+0.67% 24h) as of update time.

Context: Price action suggests the right shoulder is forming as buyers defend higher lows.

Key levels to watch

Neckline resistance: $113,378. A strong close above this area would activate the Bitcoin inverse head and shoulders pattern and confirm a trend reversal.

Invalidation: $107,300. A breakdown below the right-shoulder low would negate the setup and re-open downside risk.

Deeper support: 200-day SMA near $101,850. If invalidation occurs, this moving average becomes the next logical magnet.

How the Bitcoin inverse head and shoulders pattern sets a $120K target

The measured move in an inverse H&S typically equals the vertical distance from the head to the neckline, projected upward from the breakout point. On current geometry, that projection lands just shy of $120,000, aligning with a round-number objective and prior supply zones. If momentum accelerates after confirmation, overshoots are possible—but the measured target remains the base case.

What could invalidate the move

Failure to reclaim and hold above $113,378 would leave the structure unfinished. A daily (or multiple hourly) close beneath $107,300 would invalidate the Bitcoin inverse head and shoulders pattern, reinforce the broader bearish bias on higher timeframes, and shift focus to the 200-day SMA (~$101,850).

Macro backdrop and sentiment

Despite Friday’s softer jobs print—typically supportive of easier Fed policy—BTC didn’t immediately surge. That muted reaction underscores how technical triggers often dominate shorter-term flows. A clean breakout through the neckline, however, could pull in sidelined capital and squeeze shorts, restoring positive momentum toward the $120K target.

Trading considerations (not financial advice)

Breakout traders often look for:

A decisive close above the neckline with rising volume.

A throwback (retest of the neckline as support) that holds.

Clear risk parameters for example, invalidation just below the right-shoulder low.

Bottom Lines

Bitcoin’s shorter-term structure remains constructive, with an emerging inverse head-and-shoulders signaling buyers are regaining control. A decisive break and sustained hold above the $113,378 neckline would confirm the reversal, activating a measured move toward the $120,000 area where round-number psychology and prior supply converge. Until that confirmation, expect chop and reactive flows.

On risk: a failure to hold recent higher lows puts $107,300 in play; a sustained move below that level invalidates the setup and shifts focus to the 200-day SMA near $101,850. For traders, patience and disciplined sizing matter—let the Bitcoin inverse head and shoulders pattern confirm on rising volume, then manage pullbacks and retests with tight risk.

FAQs

1) What confirms the Bitcoin inverse head and shoulders pattern?

A . A strong close above the $113,378 neckline ideally with rising volume confirms the breakout and activates the measured move toward ~$120,000.

2) Where is the invalidation point for this setup?

A . A sustained move below $107,300 invalidates the structure and shifts focus to the 200-day SMA near $101,850.

3) How is the $120K target calculated?

A . By measuring the distance from the head to the neckline and projecting it upward from the breakout standard practice for the Bitcoin inverse head and shoulders pattern.

4) Does macro data still matter if the pattern confirms?

A . Yes. Liquidity, Fed expectations, and risk appetite can affect follow-through, but the trigger for entries/exits is usually the technical confirmation above the neckline.