BTC, ETH, XRP, SOL Face Slow Bottoming Process After $16B Liquidation Shock

The crypto market’s steep decline has wiped out around $16 billion in long liquidations, reflecting widespread leverage unwinds across major assets. Analysts note that such heavy flushes often signal the early phase of a structural reset rather than the end of a correction.

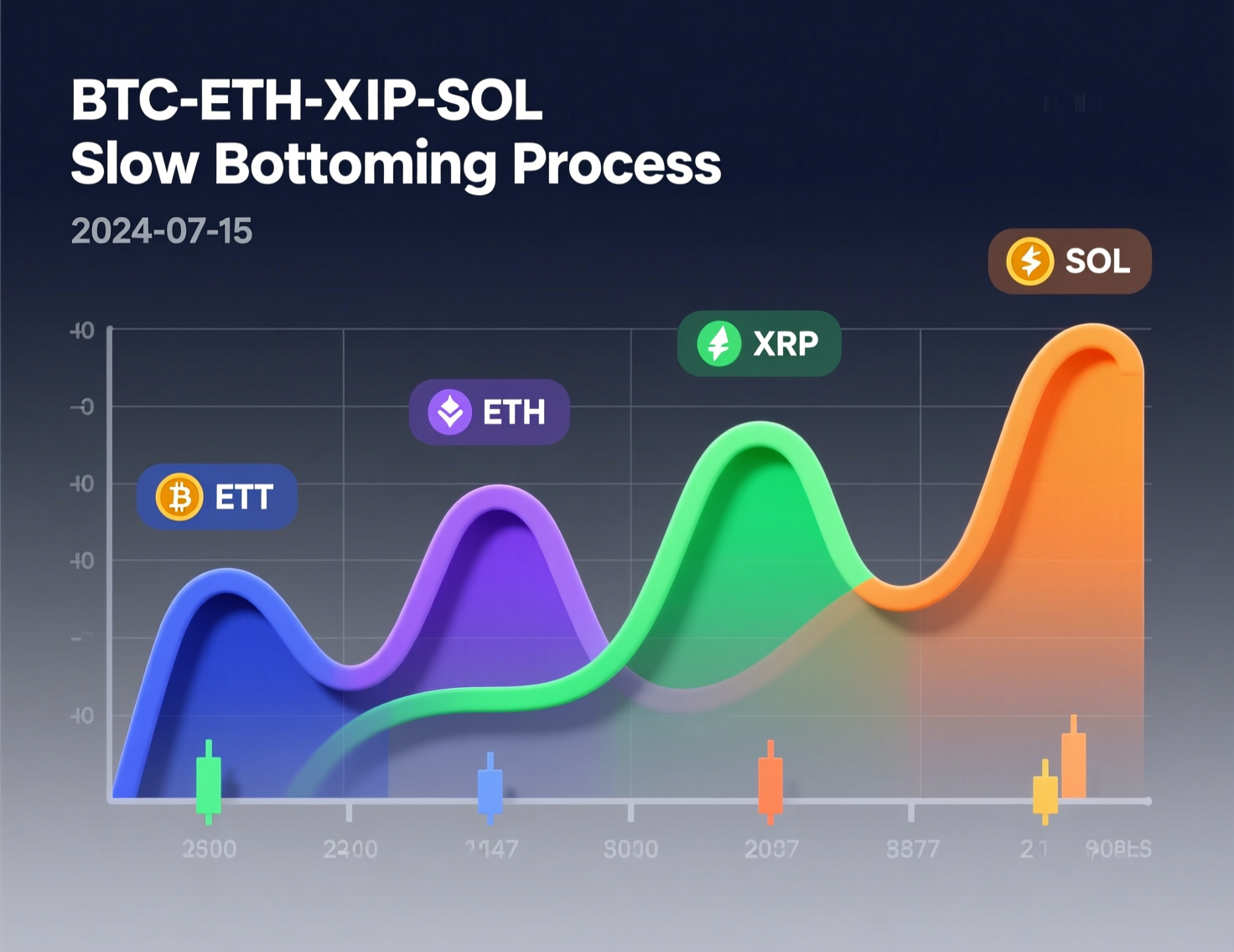

Market behavior around BTC, ETH, XRP, and SOL suggests a slow bottoming process is underway instead of a quick V-shaped rebound. Maker activity and liquidity depth indicate that buyers are cautiously rebuilding positions, typical of post-drawdown consolidation phases before any sustained recovery momentum forms. CoinDesk+1

What happened and why it matters

A renewed bout of U.S.–China trade tension centered on fresh tariff threats spilled over into digital assets, extending Friday’s risk-off move in U.S. hours into Asia trading. As prices fell, cascading margin calls forced out leveraged longs across majors and altcoins. Reuters and other outlets tied the risk sell-off to escalations on tariffs, with Bitcoin and Ethereum sliding alongside equities.

The multi-step bottoming sequence

Industry participants describe a familiar playbook after large liquidations

Bleed & maker pause

During the crash, order-book depth thins as market makers step back to manage risk; altcoins overshoot to multi-month lows.

Data feeds stabilize

Once matching engines/feeds normalize, liquidity providers resume, initially focusing on spot–perp arbitrage, which caps sharp rebounds.

Stabilization & unwind

Makers that absorbed forced sells later reduce longs into strength, often capping rallies near “local maxima.”

Flooring & repricing

With weekend ETF closures and thinner liquidity, price discovery slows and a base forms over days rather than hours.

Zaheer Ebtikar (Split Capital) summarized this sequence, noting makers first arb away spot–perp dislocations, then unwind as equilibrium returns.

Macro overhang: tariffs and risk appetite

The latest tariff rhetoric revived a macro shock that rattled broader markets and crypto alike. Any fresh escalation could delay basing, while de-escalation could shorten the process. Keep an eye on cross-asset risk signals and liquidity prints.

BTC ETH XRP SOL slow bottoming process: what to watch

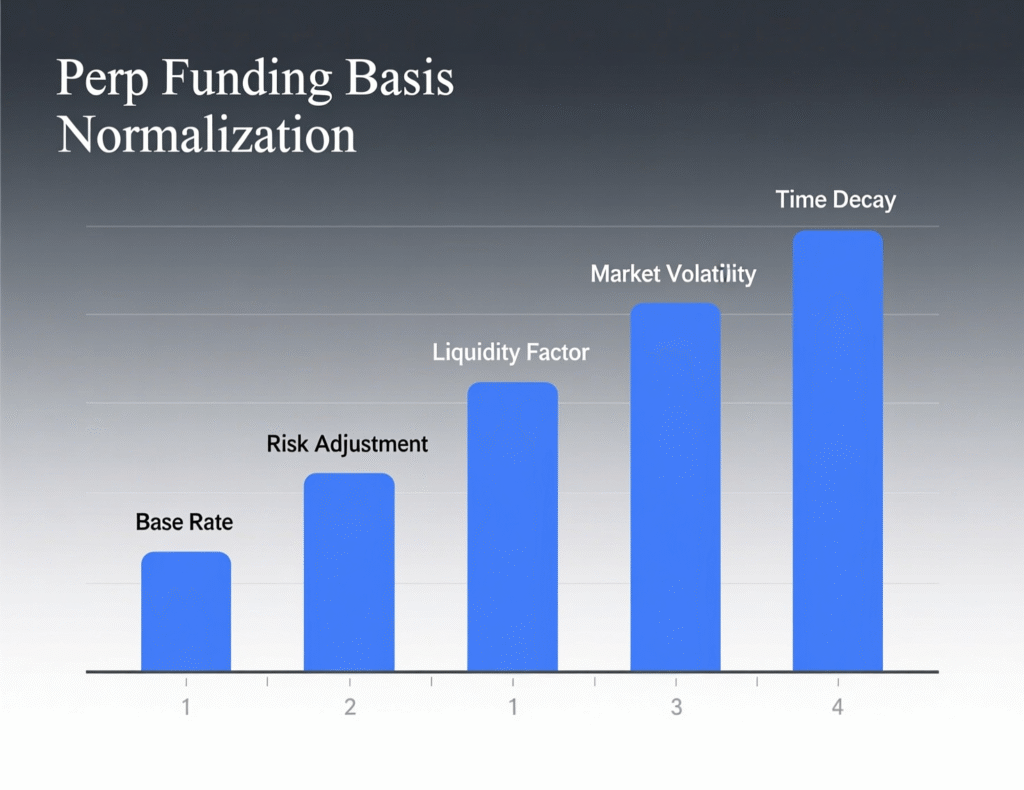

Basis & funding

Narrowing negative funding and normalized basis suggest stress is fading; persistent extremes imply more time needed.Order-book depth

Recovering top-of-book liquidity usually precedes durable bounces.ETF flows (weekdays)

Spot ETF creations/redemptions can speed absorption once open. Weekends are slower by design.

Context & Analysis

Reported liquidation tallies vary, with CoinDesk emphasizing ~$16B in forced long unwinds, while some outlets cite ~$19B across time windows and venues. Differences reflect methodology (venues covered, look-back period, real-time vs. post-hoc aggregation). Treat figures directionally and focus on structure signals (funding, basis, depth).

Conclusion

With massive forced unwinds and thin weekend liquidity, the crypto market is expected to stabilize slowly rather than stage an immediate rebound. The scale of liquidations has left traders cautious, favoring gradual accumulation over aggressive dip-buying.

Any renewed tensions in U.S.–China trade relations could further delay recovery momentum, pressuring sentiment across major tokens like BTC, ETH, XRP, and SOL. Such macro uncertainty may extend the current consolidation phase, reinforcing the likelihood of a slow bottoming process before broader risk appetite returns.

FAQs

Q : What caused the sell-off?

A : Renewed U.S.–China tariff risks sparked risk-off sentiment across markets, cascading into crypto leverage washouts.

Q : How big were the liquidations?

A : Estimates cluster around ~$16B in longs, though some sources cite up to ~$19B depending on coverage and time window.

Q : Will there be a quick rebound?

A : Unlikely. Maker absorption and weekend liquidity constraints generally slow recovery momentum.

Q : What is the role of market makers now?

A : They arbitrage spot–perpetual gaps and later unwind into strength as price equilibrium returns.

Q : Which signals suggest a floor?

A : Improving market depth, normalized funding and basis rates, and smaller liquidation prints point to stabilization.

Q : Does macro still matter?

A : Yes, further tariff escalation could heighten volatility and postpone a sustained market base.

Q : Is the “BTC ETH XRP SOL slow bottoming process” the same for all coins?

A : No, assets with tighter supply dynamics may find stability faster than others.