BofA survey dollar bearish bets and what it means for bitcoin amid rising volatility risks

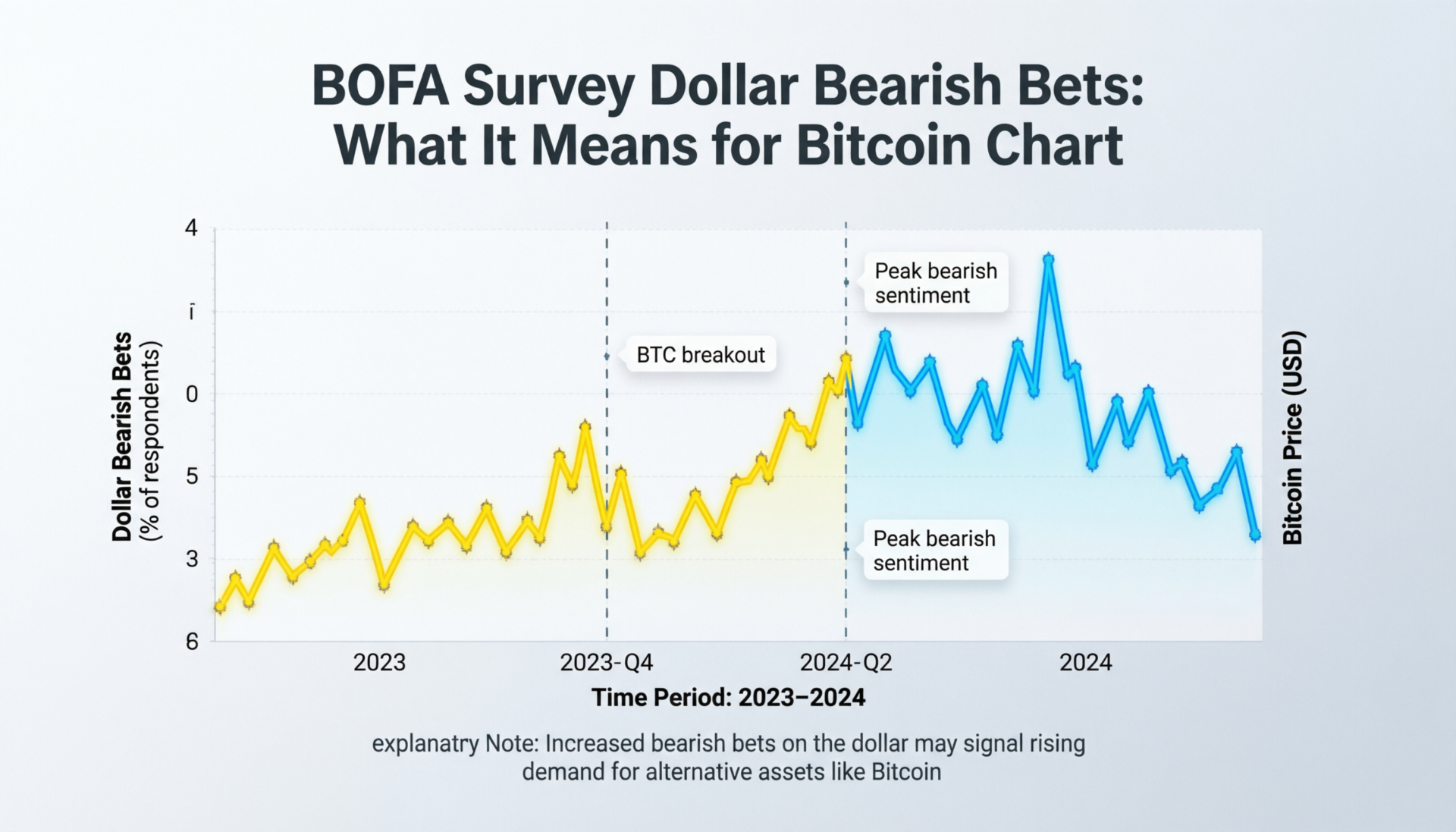

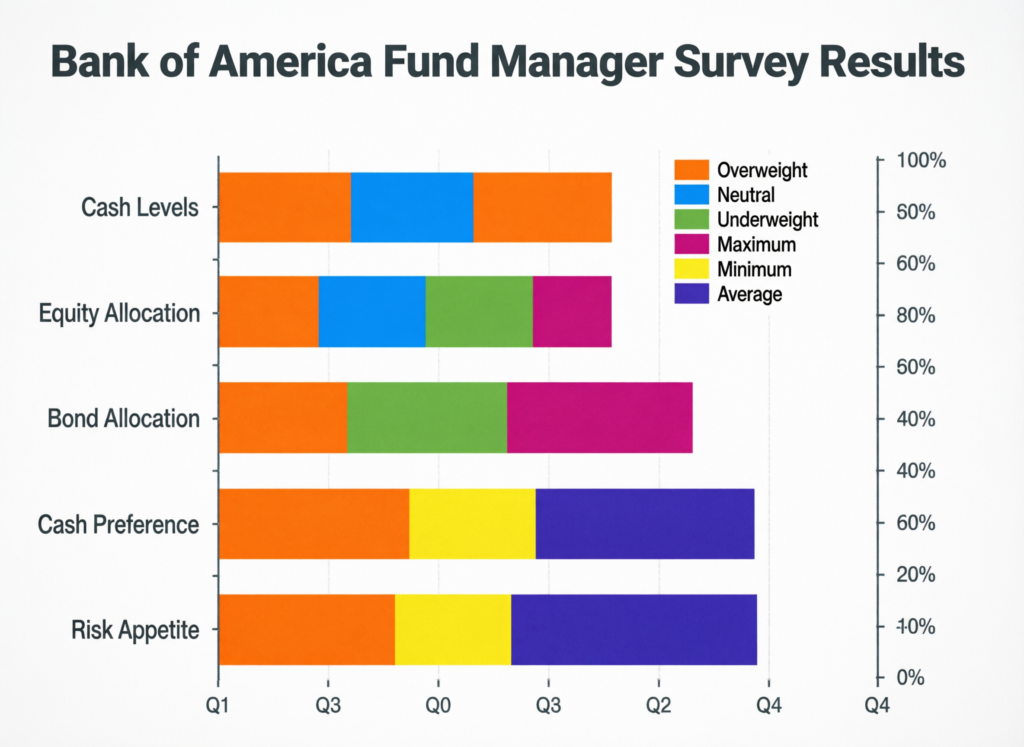

Bank of America’s February fund-manager survey shows investors have turned more bearish on the U.S. dollar than at any point since at least early 2012—an extreme positioning that can spill over into crypto markets. In this setup, BofA survey dollar bearish bets and what it means for bitcoin comes down to whether bitcoin behaves like a classic “weak-dollar risk asset,” or whether its more recent tendency to move with the dollar keeps holding.

What’s driving the record bearish USD positioning

BofA’s February survey shows net investor exposure to the dollar at a record underweight, reflecting expectations that U.S. economic and labor-market softening could push the Federal Reserve toward rate cuts.

Broader coverage of the same survey theme also points to macro and policy uncertainty as contributing to bearish dollar sentiment.

BofA survey dollar bearish bets and what it means for bitcoin: the “old rule”

For much of bitcoin’s history, BTC tended to move opposite the U.S. Dollar Index (DXY): a softer dollar can ease global financial conditions and make dollar-priced assets feel cheaper to non-U.S. buyers conditions often associated with stronger risk appetite.

If that historical pattern dominated today, record bearish USD positioning could be read as a potential tailwind for bitcoin.

The twist: bitcoin and the dollar have recently moved together

CoinDesk reports that since early 2025, BTC has shown an unusually positive relationship with the dollar at times, with a reported 90-day correlation reaching 0.60 on Monday (in the context of both DXY and BTC being down over the period cited)

BofA survey dollar bearish bets and what it means for bitcoin if the positive link holds

If BTC continues to trade with the dollar rather than against it.

Further DXY declines could coincide with more BTC weakness (the opposite of the traditional narrative).

A dollar rebound especially one driven by short covering—could coincide with BTC catching a bid.

Why crowded dollar shorts can increase BTC volatility

When positioning is heavily one-sided, even a modest move against the crowd can trigger forced buying to limit losses classic short-squeeze dynamics that can create abrupt price swings. InvestingLive’s Eamonn Sheridan flagged that record short positioning raises volatility risk and can produce sharp short-covering rallies.

Context & Analysis (labeled)

The key market question is regime: whether bitcoin trades primarily as a liquidity-sensitive risk asset (often helped by easier financial conditions) or as an asset currently tied to the same macro shocks moving the dollar. Extreme dollar positioning can raise the odds of large, fast USD moves either way raising the chance BTC experiences volatility even if the “directional” narrative is less clear than usual.

Market snapshot (as cited in the source text)

At the time cited by CoinDesk, DXY was 97.13 (up 0.25% on the day) and bitcoin traded around $68,150 (down 1%)

Concluding Remarks

BofA’s record bearish dollar positioning sets up a volatility-prone environment: if the classic inverse USD–BTC relationship returns, dollar weakness could help bitcoin; if the newer positive correlation persists, the bigger risk may be that both slide together while a surprise dollar rebound (short squeeze) could become an unexpected catalyst for BTC upside.

FAQs

Q : What did the BofA February survey show about the dollar?

A : The February fund manager survey by Bank of America (BofA) showed investor positioning in the U.S. dollar at a record underweight, the most negative stance since at least early 2012.

Q : Why do record dollar shorts matter for Bitcoin?

A : Extremely crowded USD short positions raise the risk of a short squeeze. If traders rush to cover bearish dollar bets, the dollar can rally sharply, increasing cross-asset volatility that often spills over into Bitcoin (BTC) trading.

Q : Is a weaker dollar always bullish for Bitcoin?

A : Not always. Historically, a weaker dollar often supported BTC. However, in more recent periods BTC has sometimes moved positively with the dollar, meaning a falling USD does not automatically imply BTC strength.

Q : What is the reported BTC–DXY correlation in the story?

A : According to CoinDesk, the 90-day correlation between BTC and the dollar index (DXY) reached 0.60, the highest since April 2025, based on the article’s cited market data.

Q : How could a dollar short squeeze affect BTC?

A : If BTC continues trading in sync with the dollar, a squeeze-driven USD rebound could occur alongside BTC rising, rather than pressuring it lower.

Q : BofA survey dollar bearish bets and what it means for Bitcoin what’s the main risk?

A : The main risk is regime confusion. If BTC’s positive correlation with the dollar persists, a deeper dollar decline could coincide with BTC weakness, breaking the traditional “weak dollar = strong BTC” assumption.

Facts

Event

BofA February survey shows record bearish (underweight) investor positioning in the U.S. dollar; implications for bitcoin depend on whether BTC trades inversely or positively vs DXY.Date/Time

2026-02-17T13:23:08+05:00 (last verified)Entities

Bank of America (BofA); U.S. dollar; U.S. Dollar Index (DXY); Bitcoin (BTC); Federal Reserve; InvestingLive; Eamonn Sheridan.Figures

90-day BTC–DXY correlation reported at 0.60; DXY 97.13 (+0.25%); BTC $68,150 (-1%).Quotes

“Record short positioning raises the risk of volatility in major USD pairs…” Eamonn Sheridan, InvestingLive.Sources

CoinDesk; Reuters; Financial Times; InvestingLive.