BNB Weekly Update (Jan 3, 2026): Binance Coin Price Analysis, Key Levels & Market Outlook

Binance Coin (BNB) starts the first week of 2026 trading around $875, putting in a modest but steady move higher after the late-2025 crypto shakeout.This BNB weekly update walks through current price action, key support and resistance levels, derivatives positioning, and the main narratives shaping Binance Coin right now.

In short, BNB is trading in a mildly bullish consolidation zone: price is hovering between roughly $838.51 and $886.29, up about 4.1% over the last 7 days, with short-term support around $840–$860 and resistance near $885–$900.Anticipation around the upcoming Fermi upgrade, ongoing speculation about a future Coinbase listing, and a stabilizing broader crypto market are the main drivers for now.

As of Jan 3, 2026 (10:03 UTC), BNB is trading around $875, up roughly 4.1% over the past week, with a 7-day range between about $838.51 and $886.29.Price action is slightly bullish but still range-bound, with.

Support: roughly $840–$860

Deeper support: $818–$835

Resistance: $885–$900, then $920–$950 above that

The market is focused on BNB Chain’s Fermi upgrade in mid-January, a roadmap pointing toward 20,000 TPS, plus the longer-term possibility of a Coinbase listing, all against a backdrop of a consolidating crypto market led by Bitcoin near $90,000.

BNB Key Data Snapshot (Jan 3, 2026, 10:03 UTC)

Data as of: Jan 3, 2026, 10:03 UTC

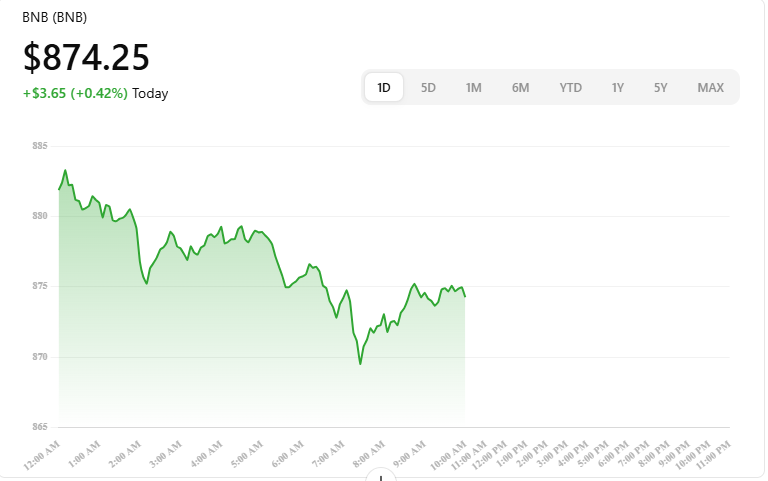

Current price: ≈ $875 per BNB (spot quotes vary slightly by exchange)

Live ticker snapshot: BNB at $874.25, with a move of $3.65 from the previous close; intraday high $890.28, intraday low $865.38

24h change: ~+0.7–0.8%

7d change: +4.1% (CoinGecko 7-day performance)

7d high / low: $886.29 / $838.51

Market cap: ≈ $120.5B, keeping BNB firmly in the top-5 crypto assets by size3

24h volume: ≈ $1.8B–$2.4B depending on data source

Derivatives note

Open interest is slightly down week-on-week while funding remains positive, hinting at active positioning without extreme leverage.

Main data sources

Binance, CoinGecko, CoinMarketCap, CMC AI and major news outlets.

This Week in Binance Coin (BNB) Quick Summary

Binance Coin enters the first week of 2026 holding near $875, with a ~4% weekly gain and a relatively tight range between $838 and $886.That’s a constructive move given that the broader crypto market is still digesting the late-2025 drawdown and trading in a consolidation phase while Bitcoin hovers near $90,000.

On the narrative side, the market is looking ahead to BNB Chain’s Fermi upgrade in mid-January, the longer-term roadmap targeting up to 20,000 TPS, and the possibility of a future Coinbase listing. Together, these feed into a “high-throughput L1 + institutional adoption” story for BNB heading into 2026.

BNB Price Action & Key Levels

Weekly performance

Over the last 7 days, BNB has:

Gained ~4.1% on a weekly basis (CoinGecko 7-day performance)

Traded in a 7-day range of $838.51–$886.29, staying below its October all-time high near $1,370.

Maintained a market cap around $120B, keeping it solidly inside the top-5 cryptocurrencies by size.

Price has bounced from the high-$830s several times, suggesting buyers are stepping in on dips. So far, though, the $885–$900 band continues to act as a near-term ceiling.

Short-term technical view

Non-signal overview (not financial advice)

Trend.

Short-term price structure is slightly bullish, but still within a broader consolidation below the all-time-high zone.

Key support zones.

First support: $840–$860

Deeper support: $818–$835, an area frequently cited by technical analysts as a potential retest zone.

Key resistance zones.

Immediate resistance: $885–$900

Above that: $920–$950, where many traders are watching for a possible January breakout if momentum strengthens.

Volatility

Weekly volatility is moderate enough movement to interest active traders, but calmer than the spikes seen around the October ATH and the late-2025 macro sell-off.

News & Narratives That Moved BNB This Week

Fermi Upgrade Countdown (mid-Jan 2026)

BNB Chain is preparing the Fermi hard fork, designed to reduce block times, improve finality, and support more parallel execution. The roadmap is targeting throughput up to 20,000 TPS later in 2026, reinforcing BNB’s place in the “high-speed L1” narrative versus other smart-contract platforms.

Roadmap & Coinbase Listing Talk

CMC AI and ecosystem commentary highlight a dual-client architecture (Rust + Geth) and keep alive the potential Coinbase listing narrative after Coinbase added BNB to its asset roadmap in late 2025.This supports the idea of growing institutional interest, although it comes with the usual regulatory caveats.

Post-2025 Macro Hangover

Broader sentiment is still working through a >30% Bitcoin drawdown from 2025 highs and more than $1T wiped from total crypto market cap, which has dampened risk appetite but left majors like BNB in consolidation rather than free-fall.

Market Consolidation in Early 2026

Bitcoin and Ethereum hovering near $90K and $3,100 respectively frame a market that is stabilizing after year-end turbulence. Altcoins such as BNB are largely moving in sympathy with these majors, layered with their own catalysts like Fermi and roadmap updates.

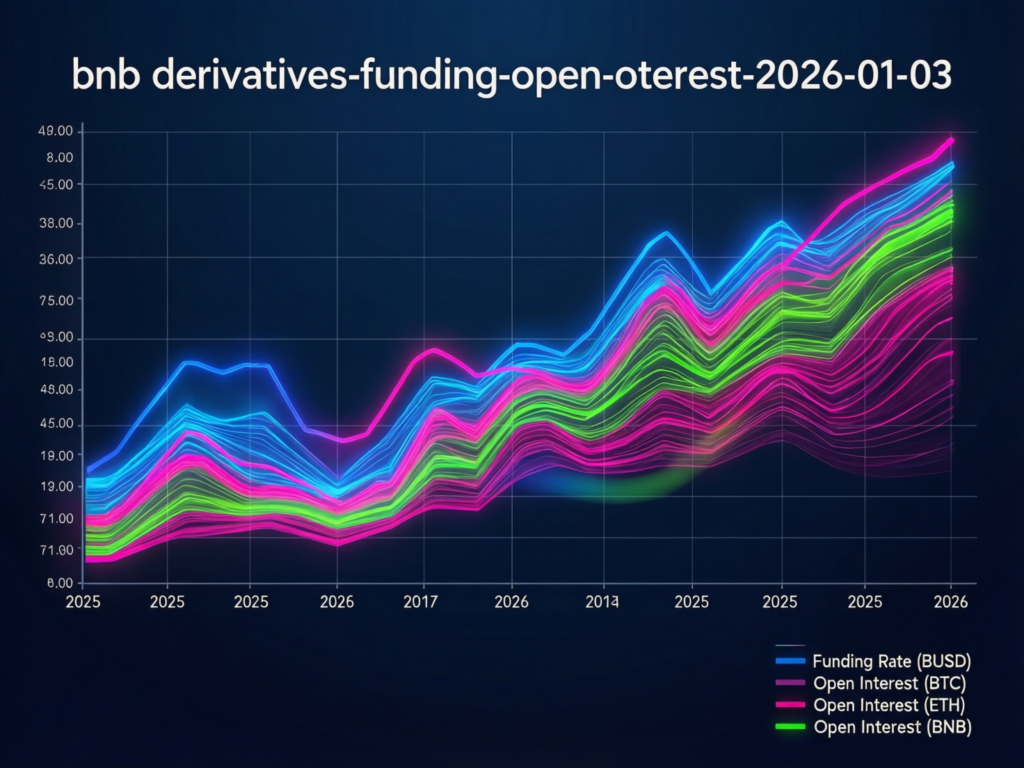

On-Chain, Derivatives & Sentiment

Derivatives positioning

According to CMC AI, BNB open interest is down ~7–8% week-on-week while funding rates remain positive.That combination often signals moderate long positioning without extreme leverage or euphoria.

Community sentiment

CoinGecko currently shows a slight bearish tilt (more “bearish” than “bullish” votes), despite solid fundamentals and upcoming upgrades.That kind of cautious sentiment alongside constructive price action is often read as “climbing a wall of worry” rather than outright hype.

Roadmap-driven on-chain outlook:

Fermi and future upgrades aim to further cut block times and improve throughput, which is structurally bullish for usage-driven demand (gas fees, dApp activity) if execution stays on track.The more the chain is actually used, the more relevant these efficiency gains become.

BNB vs Bitcoin & the Wider Crypto Market

Relative performance: With BNB up ~4.1% on the week, it’s roughly in line with or slightly ahead of Bitcoin’s low single-digit weekly gains, as BTC grinds higher from the high-$80Ks toward and above $90K.

Market share: BNB remains a top-5 asset by market cap in a total crypto market estimated around $3.0–3.2T, maintaining its role as the leading exchange-linked L1 token.

What This Means for Traders & Long-Term Holders

For short-term traders (non-advice)

Keep an eye on $840–$860 as the near-term support band and $885–$900 as immediate resistance.

A sustained move above $900 would place the $920–$950 zone firmly in play, where many short-term technical targets cluster.

Derivatives data suggests positioning is active but not overheated, reducing immediate blow-off risk without ruling out sharp moves either.

Expect headline-driven volatility around the Fermi upgrade window, especially if there are surprises in timing, performance, or post-fork stability.

For longer-term holders

The core thesis remains BNB as the primary asset of a high-throughput L1 + centralized exchange (CEX) ecosystem, with ongoing token burns and frequent scalability upgrades.

2026 priorities including Fermi, the 20k TPS roadmap, AI-oriented workloads, and potential Coinbase access – are geared toward enterprise and institutional-grade use cases.

Macro risk is still very real: the late-2025 sell-off showed how quickly sentiment can flip even when project-level fundamentals appear strong.

Regulatory overhang around large exchanges and centralized infrastructure remains a medium-term risk factor and should be part of any long-term allocation decision.

Risks, Scenarios & Closing Thoughts

Bullish scenario

The Fermi upgrade rolls out smoothly, UX and throughput see tangible improvements, risk assets stabilize, and BNB pushes through $950, opening the door to a retest of the $1,000+ psychological area over the coming months.

Neutral scenario

BNB continues ranging between $830 and $950, largely tracking Bitcoin while the market waits for clearer macro or regulatory catalysts and more data on chain-level usage.

Bearish scenario

A renewed risk-off move or any hiccups around upcoming upgrades could send BNB back to retest or break below the $818–$835 support region, with deeper corrections possible if broader crypto sentiment deteriorates.

BNB begins 2026 from a position of structural strength but under a still-cautious market mood. As always, this is not financial advice crypto assets remain high-risk. Do your own research and consult a licensed professional before making any investment decisions.

Outlook

BNB starts 2026 from a position of structural strength but still under the shadow of a cautious crypto market. This BNB weekly update highlights a mildly bullish range, with buyers defending the $840–$860 area while sellers remain active into $885–$900. So far, price action signals accumulation rather than euphoric breakout.

Looking ahead, much depends on how smoothly the Fermi upgrade rolls out, how Bitcoin behaves around $90K, and whether new listings or regulations shift sentiment. As always, treat BNB as a high-risk asset, size positions conservatively, diversify across the market, and combine on-chain data with your own research before making any decision.

FAQs

Q : Why did Binance Coin (BNB) move this week?

A : BNB’s roughly 4% gain this week reflects a mix of factors: a stabilizing broader crypto market, Bitcoin grinding back toward $90K, and growing attention on BNB Chain’s upcoming Fermi upgrade and the 2026 scalability roadmap.Together, these themes support a mildly bullish bias after the 2025 slump.

Q : What are the most important BNB price levels to watch right now?

A : In the short term, traders are watching $840–$860 as key support and $885–$900 as immediate resistance, with a larger resistance band around $920–$950 if momentum continues.A clean break and hold above $900 would be the first sign of a more decisive move higher, while a loss of $840 increases the risk of a test of the $818–$835 area.

Q : Is BNB considered risky in the current crypto environment?

A : Yes. Like all major cryptocurrencies, BNB remains a high-risk asset, especially given the lingering effects of the 2025 downturn and ongoing regulatory scrutiny of big exchanges.Even with strong fundamentals and a clear technical roadmap, BNB can still see sharp drawdowns if macro conditions or sentiment turn negative.

Q : How is BNB performing compared to Bitcoin and other large caps this week?

A : With a weekly move of around +4.1%, BNB is roughly in line with or slightly ahead of Bitcoin’s low single-digit gains.This comes during a period when total crypto market cap hovers around the $3T+ mark and majors are consolidating near recent highs.

Q : Is BNB a good long-term hold after the 2025 crypto slump?

A : That depends on your risk tolerance and thesis. Structurally, BNB still benefits from its role at the center of the BNB Chain + Binance ecosystem, continuous burn mechanisms, and a roadmap focused on speed and institutional-grade performance.But the 2025 drawdown showed that even strong projects are vulnerable to macro shocks and regulatory shifts, so any long-term position should be sized cautiously and diversified.