BNB Tops $1.2K in 4% Rally as Chain Activity and Institutional Demand Accelerate

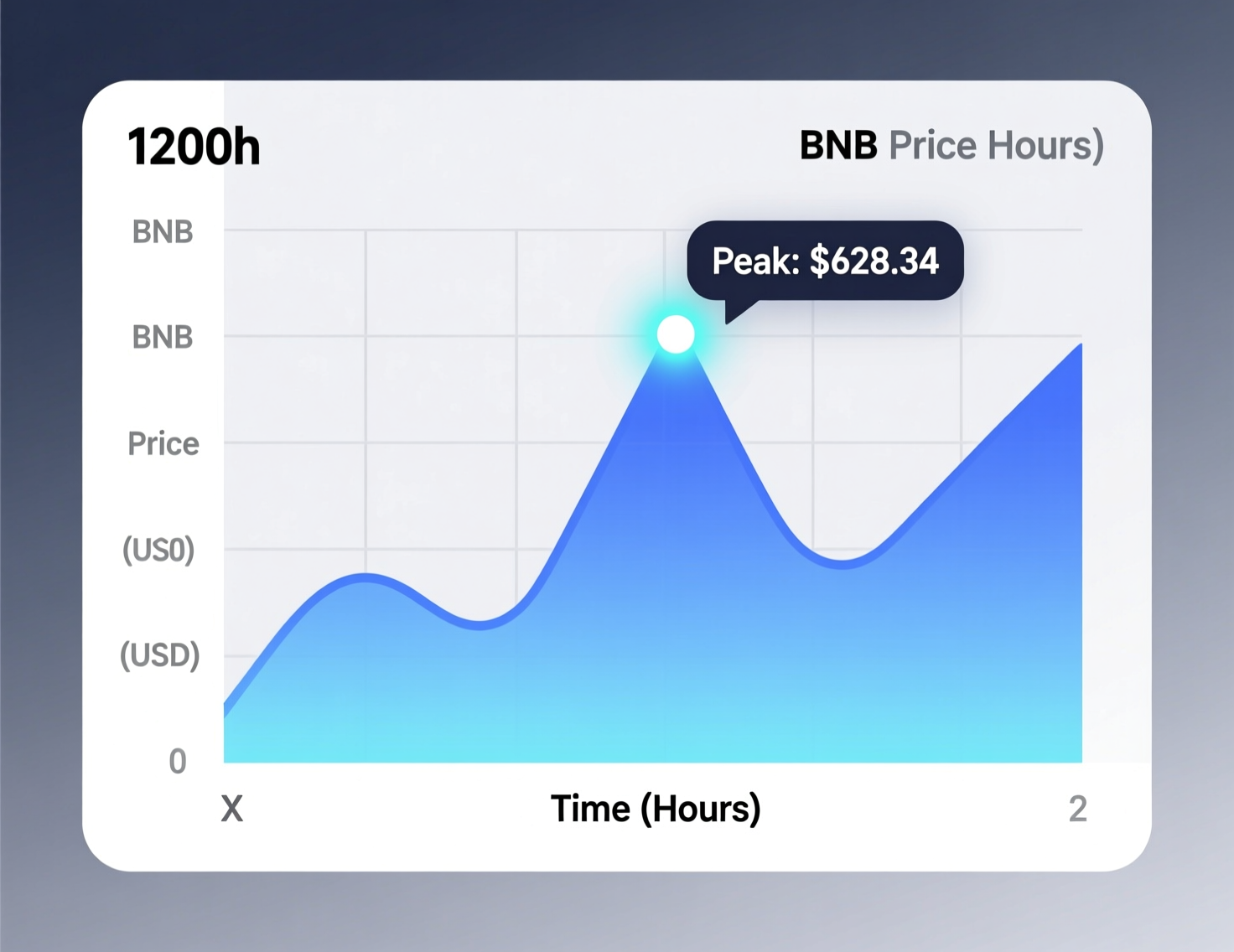

BNB extended its rally with a nearly 4% daily surge, breaking above the $1,200 mark and reaching an intraday high of around $1,223. The uptick followed a rise in on-chain activity and growing institutional interest, signaling renewed momentum in the network’s fundamentals. Traders viewed the move as a sign of strengthening confidence in BNB’s long-term utility and market positioning.

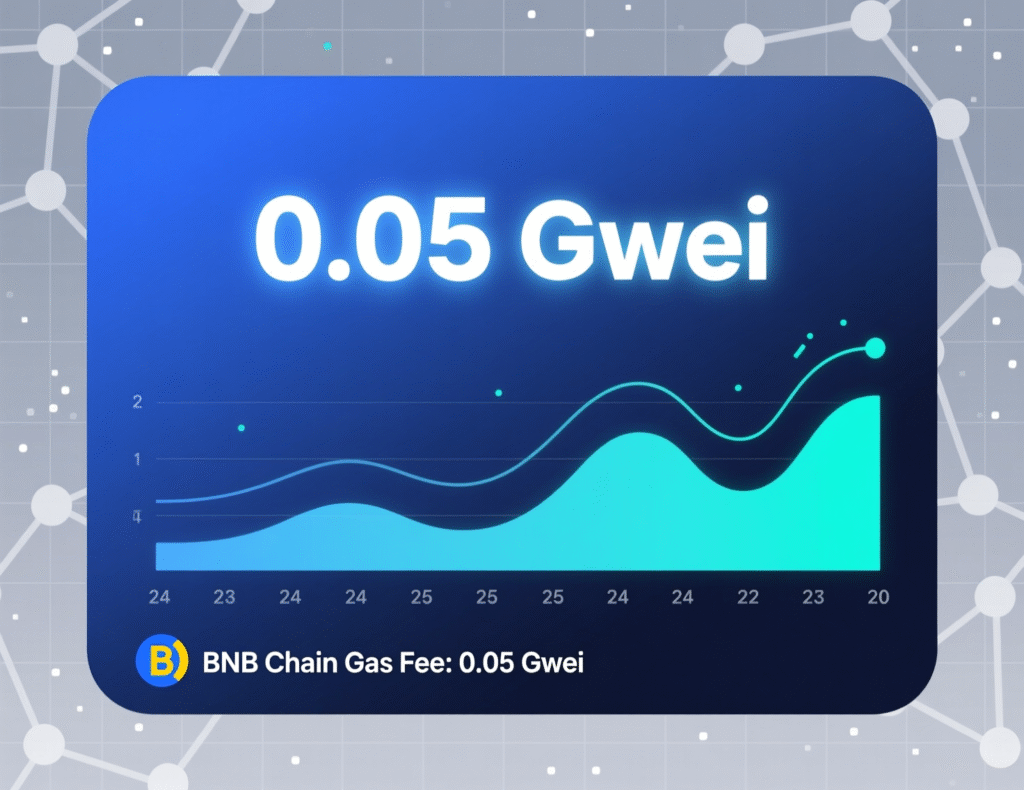

Adding to the optimism, BNB Chain’s decision to lower its minimum gas price to 0.05 Gwei made network transactions cheaper, fueling higher usage. Broader market sentiment also turned positive, as investors anticipated a 25-basis-point rate cut from the U.S. Federal Reserve later this month. These macro tailwinds, combined with stronger network dynamics, helped propel BNB’s price past $1,200 and reinforced its bullish trend.

Drivers behind “BNB price tops 1200”

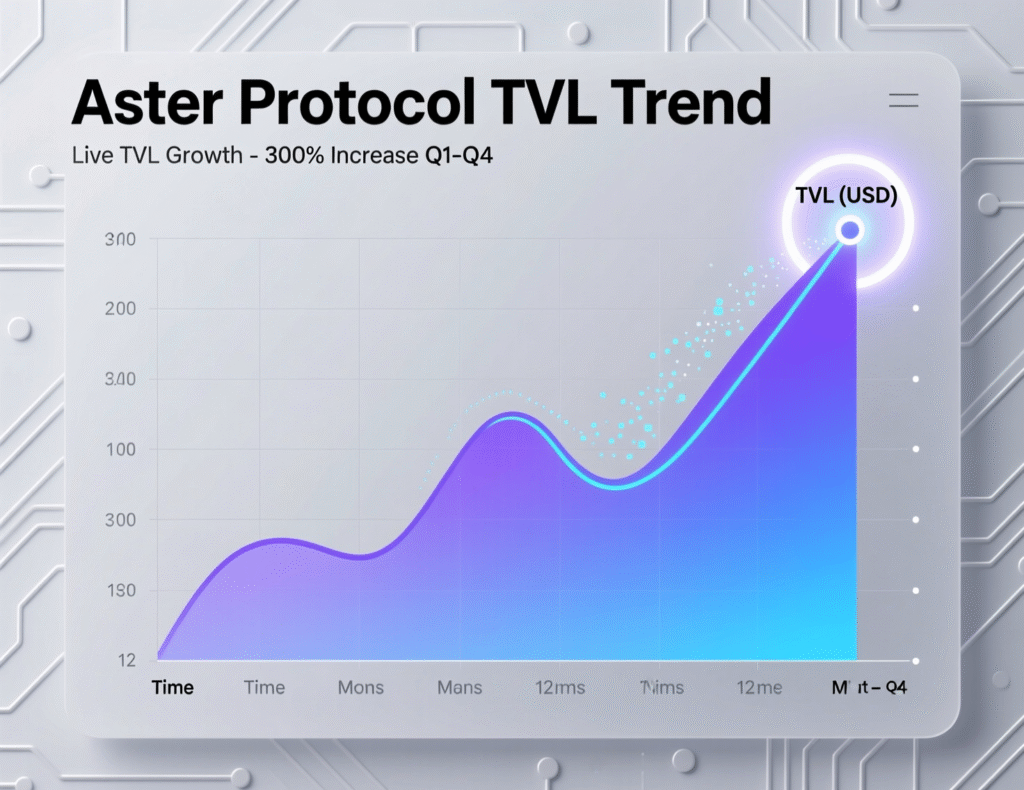

BNB Chain reclaimed the No. 1 spot by monthly active addresses in September (~52.5M, per TokenTerminal data referenced by CoinDesk). Activity has been amplified by decentralized trading and lending on Aster Protocol, whose TVL climbed sharply—CoinDesk cited a 570% jump to $2.34B, while DeFiLlama shows ~$2.47B at press time, reflecting continued inflows. CoinDesk+1

Technicals and key levels: “BNB price tops 1200”

CoinDesk’s model shows BNB traded between ~$1,148 and ~$1,223, closing near $1,201. Support buyers repeatedly emerged at $1,148–$1,158; resistance remains around $1,223. Elevated volume into the high and during late-session pullback points to profit-taking rather than trend reversal.

Cheaper transactions, broader participation

BNB Chain confirmed that all validators and builders have adopted the 0.05 Gwei minimum, bringing typical costs down to fractions of a cent—supportive for retail users and high-frequency DeFi. Lower friction plus visible dApp growth (e.g., Aster) helps explain the address surge and throughput.

Institutional flows and macro backdrop

Kazakhstan’s Alem Crypto Fund, a state-backed vehicle, announced BNB exposure alongside other digital assets. Separately, Jiuzi Holdings flagged a plan for a sizable crypto treasury that includes BNB. Meanwhile, futures pricing suggests high odds of another 25 bps Fed cut in October, an environment that has historically aided crypto beta.

<section id=”howto”> <h3>How to monitor BNB rally drivers in real time</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Track BNB spot price and volume on a reliable market dashboard (e.g., CoinDesk Markets or exchange apps).</li> <li id=”step2″><strong>Step 2:</strong> Check BNB Chain active addresses/transactions via TokenTerminal or BscScan for usage spikes.</li> <li id=”step3″><strong>Step 3:</strong> Watch Aster Protocol’s TVL and volumes on DeFiLlama to gauge DeFi demand.</li> <li id=”step4″><strong>Step 4:</strong> Monitor BNB Chain fee updates (blog/ecosystem reports) to see if gas changes could drive activity.</li> <li id=”step5″><strong>Step 5:</strong> Follow macro signals (Fed rate expectations via Reuters/LSEG data) that may affect crypto flows.</li> </ol> <p><em>Note: Process may vary by data provider and timing. Confirm sources and timestamps before acting.</em></p> </section>

Context & Analysis

With BNB above $1.2K, sustainability hinges on whether on-chain participation persists (addresses, DEX volume) and whether institutional treasury allocations broaden. Lower structural fees (0.05 Gwei) reduce friction for retail and bots alike; quality of activity (not just counts) will matter. Aster’s rapid ascent concentrates a lot of the narrative risk—if that TVL proves sticky and diversified, the thesis strengthens; if not, drawdowns near $1,223 resistance are more likely.

Conclusion

BNB’s recent surge highlights stronger network fundamentals, growing DeFi activity, and favorable macro conditions. The token’s ability to sustain momentum reflects renewed investor confidence and expanding on-chain participation, signaling healthy demand across both retail and institutional segments.

Maintaining support above the $1,200 zone remains key for bulls to retain control, with a confirmed hold above $1,223 likely to extend the current uptrend. However, if prices slip below the $1,158–$1,148 range, a deeper pullback could follow as traders reassess short-term momentum. Overall, BNB’s price action continues to mirror improving fundamentals and a constructive broader market tone.

FAQs

Q : Why did “BNB price tops 1200” today?

A : A mix of higher BNB Chain usage, Aster’s rapid TVL growth, institutional allocations, and cheaper gas drove today’s move.

Q : What are the key support/resistance levels now?

A: Support lies around ~$1,148–$1,158, while resistance is near ~$1,223.

Q : What changed with BNB Chain fees?

A : Validators and builders adopted a 0.05 Gwei minimum gas price, effectively lowering transaction costs across the network.

Q : What is driving on-chain activity?

A : BNB Chain led monthly active addresses in September, with Aster’s DEX and lending platform growth contributing significantly.

Q : Which institutions are linked to BNB demand?

A : Kazakhstan’s state-backed Alem Crypto Fund and China’s Jiuzi Holdings have both referenced BNB in their treasury allocations.

Q : Could macro policy affect BNB next?

A : Yes, markets are expecting a 25 bps Fed rate cut in October, which typically supports risk assets like BNB.