BNB (Binance Coin) Weekly Update: Fermi Upgrade, Token Burn and $900–$950 Price Range Jan 17, 2026

BNB is starting the second half of January on a firmer footing, grinding higher while holding above the key $900 level. This BNB (Binance Coin) weekly update walks through the latest price action, the impact of the Fermi upgrade, the 34th quarterly token burn, and what traders and long-term holders should really be watching.

If you just need the snapshot: BNB is trading around $942, up roughly +4.9% over 7 days, with a weekly range between about $897 and $950.

The move has been supported by the Fermi upgrade on BNB Smart Chain (cutting block times to ~0.45s) and the 34th quarterly BNB token burn, alongside ongoing strength in network usage.

Short-term, $900 is the key support area, while $950–$1,000 remains the main resistance zone as BNB trades around 30% below its October 2025 all-time high near $1,370.

Key Data Snapshot

Data as of

17 January 2026, 13:14 UTC (prices may have moved since).

Current price: ≈ $942.3

24h change: +0.9%

7d change: +4.9%

7d high / low: ≈ $949.65 – $897.89

Market cap: ≈ $128.5B

24h volume: ≈ $1.06B (CoinGecko)

Main sources this week

Binance, CoinGecko, BNB Chain Blog, CoinDesk, MEXC, CryptoPotato, TokenTerminal.

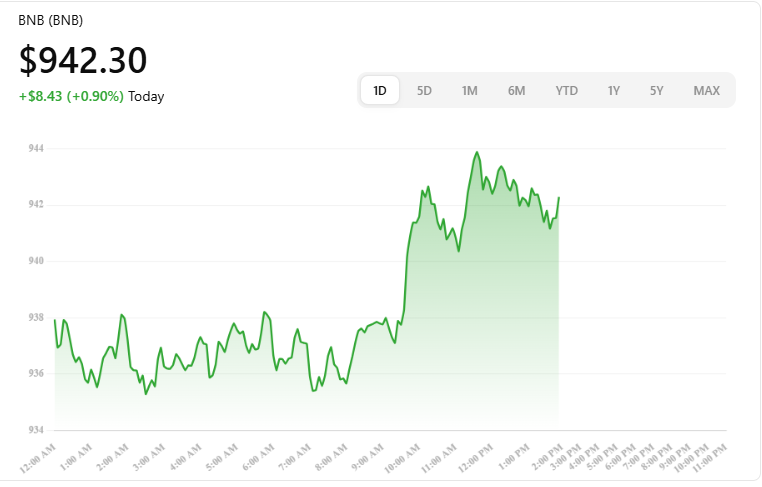

Live Market Snapshot for BNB (BNB)

BNB is a crypto asset in the CRYPTO market.

The price is $942.3 USD, a change of $8.43 (about 0.01%) from the previous close.

Today’s intraday high is $943.93 USD and the intraday low is $924.2 USD.

This Week in BNB Quick Summary

BNB’s price action this week shows a steady grind higher, with the coin up around 5% over the last 7 days, trading near $942 and holding above the psychologically important $900 level.

The story in the background is less about pure speculation and more about network fundamentals: the Fermi hard fork has gone live on BNB Smart Chain, significantly speeding up block times and finality, while BNB Chain kicked off 2026 with its 34th quarterly burn and a strong set of 2025 usage metrics.

BNB still trades roughly 30–31% below its all-time high of around $1,370 set in October 2025, keeping it in a post-ATH consolidation phase but with a constructive bias.

BNB Price Action & Key Levels

Weekly performance

Over the last week, BNB has traded in a 7-day range of about $897.9 to $949.7, finishing the week near the upper end of that band around $942.

On a percentage basis, CoinGecko shows BNB up around +4.9% over 7 days, following a prior week where it closed near $910 after roughly a 3% gain – together suggesting a two-week recovery from late-December consolidation.

Intraday volatility has been moderate, with a 24h range of roughly $925 – $944, reflecting more of an orderly uptrend than a blow-off top.

Short-term technical view

From a structural, non-signal perspective, here’s how the short-term chart looks:

Immediate support

Around $900 – a psychological line in the sand and the area of recent consolidation.

Below that, a more conservative support band sits in the high-$880s to low-$890s, close to the recent 7-day low.

Resistance

$950 roughly aligned with this week’s highs (~$949.7).

Above that, the $1,000 level is the next big psychological barrier many traders monitor.

BNB’s current position near the top of its recent weekly range, but still well below its ATH around $1,370, fits a mildly bullish, post-rally consolidation rather than a euphoric melt-up.

News & Narratives That Moved BNB This Week

Fermi upgrade goes live – block times down to ~0.45s

On 14 January 2026, the Fermi hard fork activated on BNB Smart Chain, cutting block times from around 0.75s to roughly 0.45s and pushing transaction finality towards about 1 second.

This positions BNB Chain as one of the fastest EVM-compatible networks and strengthens the narrative around high-throughput DeFi, gaming and payments on BNB.

34th quarterly BNB token burn completed

BNB Chain also completed the 34th quarterly BNB burn (and first burn of 2026), continuing its long-running deflationary mechanism and permanently removing more BNB from circulation.

Burns don’t guarantee price increases, but they reduce long-term supply and remain a key pillar of the BNB investment thesis that many holders track closely.

2025 network report: 700M+ addresses, rising TVL

BNB Chain’s year-end report for 2025 highlighted.

700M+ unique addresses

Daily transactions averaging ~10.8 million, with peaks above 30 million

TVL up ~40.5% in 2025, supported by liquid staking, stablecoins and real-world assets (RWAs)

All of this reinforces the idea that BNB Chain is still one of the largest and busiest networks in crypto.

Weekly ecosystem data shows strong DAUs and volume

The BNB Chain Weekly Ecosystem Report (Jan 1–7) points to.

Around 2.5M daily active users on BSC

Around 1.8M daily active users on opBNB

Nearly 99M transactions over the week

About $43.8B in trading volume

That combination of users and throughput suggests on-chain activity stayed high into the start of 2026.

Market commentary: holding above $900, struggling at resistance

Market commentary from venues like MEXC and CoinDesk this week highlights BNB holding above $900 with modest gains but struggling to break and hold cleanly above resistance, even as the Fermi upgrade and token burn improve underlying fundamentals.

On-Chain, Derivatives & Sentiment

On the on-chain side, BNB Chain continues to stand out as one of the most used networks in crypto:

TokenTerminal data shows BNB Chain at around 18.4M weekly active addresses, ahead of several major peers such as NEAR and Solana. (Token Terminal)

Official reports and ecosystem posts continue to show millions of daily active wallets and heavy transaction throughput across both BSC and opBNB, consistent with the 2025 scale report and early-2026 snapshots.

From a sentiment perspective, CoinGecko’s community scores lean mildly bearish on BNB, even though price is up over the week the type of “climbing a wall of worry” dynamic traders often watch.

There were no widely reported extreme funding or liquidation events around BNB this week in major public sources, suggesting derivatives positioning is active but not overheated compared with some smaller altcoins.

BNB vs Bitcoin & the Wider Crypto Market

Relative to other majors, BNB’s weekly performance is constructive but not leading:

BNB: ~+4.9% over 7 days

Bitcoin (BTC): ~+5.3% over 7 days

Ethereum (ETH): ~+6.7% over 7 days

The overall crypto market cap sits around $3.32T, roughly flat on the week, with Bitcoin dominance near 57% and Ethereum around 12%. BNB continues to hold a solid top-5 spot by market cap, but it’s not dramatically decoupling from broader market trends.

What This Means for Traders & Long-Term Holders

For short-term traders (context, not signals)

BNB is trading near the top of its 7-day range, so short-term momentum is positive but now running into resistance around $950.

The $900 zone is an important short-term structure; several closes below that level could open the door to a deeper pullback into the high-$800s.

Volatility remains moderate compared with smaller caps, but news-driven spikes are still very possible given the fresh Fermi upgrade and token-burn narrative.

Liquidity is deep across major venues, which is helpful for execution but does not remove price risk.

For longer-term holders and “fundamental” watchers

The mix of ongoing token burns, growing addresses and TVL, and now faster block times supports BNB’s utility and fee-token role on BNB Chain.

Regulatory and centralized-exchange risk around Binance as a company remains a key structural consideration; many institutional investors look at this side-by-side with on-chain growth.

Watching quarterly burn data, DAUs/transactions on BSC + opBNB, and stablecoin/RWA activity on BNB Chain remains crucial for evaluating whether usage and price are moving in sync over time. (BNB Chain)

Risks, Scenarios & Closing Thoughts

BNB’s current setup can be framed in three broad, non-predictive scenarios:

Bullish

Price holds above $900, breaks and sustains above $950–$1,000, on-chain activity continues to grow, and the Fermi upgrade attracts more high-performance DeFi and gaming projects.

Neutral

BNB ranges between roughly $880–$1,000, with price mostly tracking broader crypto sentiment while fundamentals quietly improve in the background.

Bearish

A break and sustained move below the high-$800s, combined with weaker network activity or negative headlines around exchanges or regulation, could put more pressure on BNB.

BNB remains a volatile crypto asset tied both to BNB Chain usage and to broader Binance-ecosystem risk. In this BNB (Binance Coin) weekly update, the overall picture is one of constructive price action backed by solid network data but still very much subject to market and regulatory swings.

This is not financial advice. Always do your own research and consider speaking with a licensed professional before making any investment decisions.

Final Thoughts

BNB’s weekly performance points to cautious strength, with price holding above the key $900 support and grinding toward the $950–$1,000 resistance band. The Fermi upgrade and latest token burn tighten the link between BNB’s value and network usage, while on-chain data shows users, builders and capital remain active across the BNB Chain ecosystem.

For traders and long-term holders, this BNB weekly update boils down to one idea: manage risk first, then look for opportunity. Clear levels, liquidity and fundamentals help, but they never remove volatility or regulatory uncertainty, so stay disciplined with position sizing, track burns and on-chain trends, and back every move with your own research.

FAQs

Q : Why did BNB go up this week?

A : BNB gained about 4–5% over the last 7 days, helped by the Fermi upgrade going live on BNB Smart Chain, which reduces block times and improves finality, and by the 34th quarterly BNB token burn, which reinforces its deflationary tokenomics. Strong network usage metrics from BNB Chain’s 2025 and early-2026 reports also support the idea that the chain is still heavily used.

Q : What are the key BNB support and resistance levels right now?

A : In this week’s BNB price analysis, the $900 area looks like key short-term support, with additional “deeper” support suggested in the high-$800s near the recent weekly lows. On the upside, $950 lines up with recent highs, and $1,000 is the next big psychological resistance many traders watch. These are zones, not guarantees – price can and does move beyond them.

Q : How important is the Fermi upgrade for BNB’s long-term outlook?

A : The Fermi hard fork cuts BSC block times to around 0.45 seconds and improves transaction finality to roughly 1 second, making BNB Chain one of the faster EVM chains. This can improve user experience for DeFi, gaming and payments and may help attract more builders and users over time, which is indirectly positive for BNB’s long-term utility as a gas and ecosystem token.

Q : Is BNB outperforming Bitcoin and Ethereum this week?

A : Not quite. Over the past 7 days, BNB is up around +4.9%, while Bitcoin is up about +5.3% and Ethereum around +6.7% over the same period. That means BNB is moving with the market in a positive direction but slightly underperforming BTC and ETH this week.

Q : Is BNB too risky to hold right now?

A : BNB, like all large-cap crypto assets, carries significant price volatility, and it also has ecosystem-specific risks tied to BNB Chain and the wider Binance brand. On the other hand, it benefits from deep liquidity, ongoing token burns and high on-chain activity. Whether that risk/reward balance works for you depends on your own strategy, time horizon and local regulation – it’s essential to size positions carefully and do your own research.